SSS Maternity Benefits Computation in the Philippines 2024

Key takeaways:

- Pregnant women can always rely on SSS and PhilHealth for financial aid

- The new maternity benefits law expands maternity leave from 60 days to 105 days

- You must be a paying member or contributor to avail of either SSS or PhilHealth benefits

- You can always rely on Digido for financial support if what the government provides is inadequat. Digido credit will help you cover your expenses right away

Who can get a Digido loan?

Table of Contents

Whether you are pregnant or managing employees, you need to know a pregnant person’s rights when it comes to maternity benefits. You are not just entitled to 105 days of maternity leave — there are many other benefits you can enjoy.

You must know what your SSS maternity benefits are so you can claim them. Otherwise, an employer might take advantage of your ignorance. In this article, you will learn everything there is about your SSS maternity benefits, including SSS maternity computation, SSS maternity benefits requirements, and how to compute maternity benefits.

- Get up to PHP 25,000 in just 5 minutes

- Only 1 Valid ID needed to Apply

- Simple Application Process online

What are SSS Maternity Benefits in Philippines

SSS maternity benefits are a set of benefits that you get if you are pregnant in the Philippines. These are rights, not privileges that you can demand from your employer based on the provisions of the Department of Labor and Employment.

The SSS Maternity Benefit (1) is the daily cash allowance of SSS female members upon instance of pregnancy who are unable to work due to:

- childbirth

- miscarriage

- emergency termination of pregnancy, including stillbirth

The Expanded Maternity Leave of SSS is eligible to female members regardless of:

- civil and employment status

- child legitimacy

- frequency of pregnancy

The following is a list of the main benefits which we’ll tell you more about:

✅ 105 days of paid leave

You are entitled to this leave regardless of the outcome of the pregnancy or the process. What it means is that you are entitled to 105 days of maternity leave if you had a caesarian section or natural. However, if you had a miscarriage, you can only avail up to 60 days of leave with pay.

✅ Full Pay

During your leave, you shall receive full pay. The company you work for must also provide you with other health care benefits during your pregnancy. In addition to this, the employer must also provide you with benefits during the period postpartum or after you give birth. This salary is based on your basic pay only, which means the employer will not pay the cost of allowance and all other remunerations outside of your basic pay.

✅ Right to Work

Once the leave is over, the employer should take you back as an employee. It is illegal for an employer to fire you simply because you got pregnant, or you were out during your maternity. As such, you have a guarantee that you have a job to support you and your baby after recovering from birth.

✅ Welcoming Environment for Pregnant Employees

One thing that people overlook when they get pregnant or after they give birth is that they have a right to a conducive environment. What it means is that the employer must give you access to a supportive environment as regards your pregnancy.

- This may include providing ergonomic furniture, ensuring proper ventilation, and making accommodations for physical limitations.

- Some examples are the availability of breastfeeding rooms or facilities to accommodate your pregnancy needs.

However, this may not be available in many Philippine companies, especially if you work in places like low-economic businesses such as “canteens.” In situations like that, what matters is that the employer is willing to accommodate your needs. For example, if you are not feeling well, it should be easy to ask for a leave of absence if you need to see your doctor.

Your employer must also be within reach to speak to you about your benefits and answer other questions you may have.

Granted benefits included in this law are:

- Full pay, consisting not only of the SSS Maternity Benefits but also the salary differential paid by the employer.

- An option to extend another 30 days duration but without pay for childbirth, providing the employer with due notice.

- Female National Athletes are also eligible for the benefits.

- Health care services courtesy of National Health Insurance, under its existing rules and regulations.

- Unlimited childbirth claims, including miscarriage.

- Maximum benefit claim of PHP 70,000 for both normal and cesarean delivery.

SSS Maternity Computation in 2024

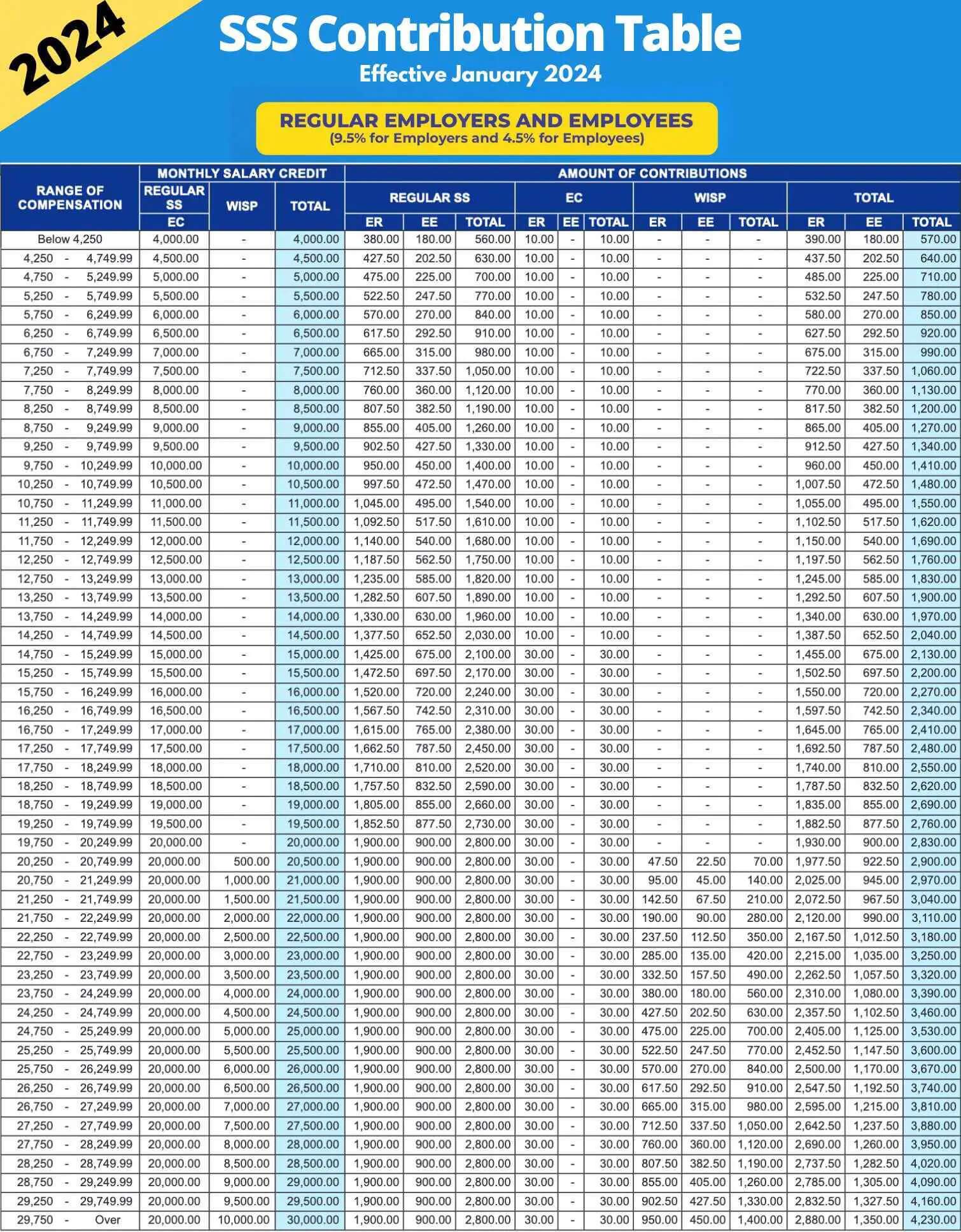

In this section, we will take a closer look at what you can earn if you avail of your maternity leave pay or how to compute SSS maternity benefit. The first step is to take a look at the SSS Contribution Table for 2024. There are five types:

- Employer and Employee

- Household Employer and Kasambahay

- Land-based OFW

- Self-Employed

- Voluntary Member

👉 Also Learn How to Apply

for SSS Educational Loan in the Philippines

How to Compute SSS Maternity Benefits for Employers

For this example, we will use the EMPLOYER and EMPLOYEE table. For the rest, you can visit the SSS website for an updated table.

Here is the table:

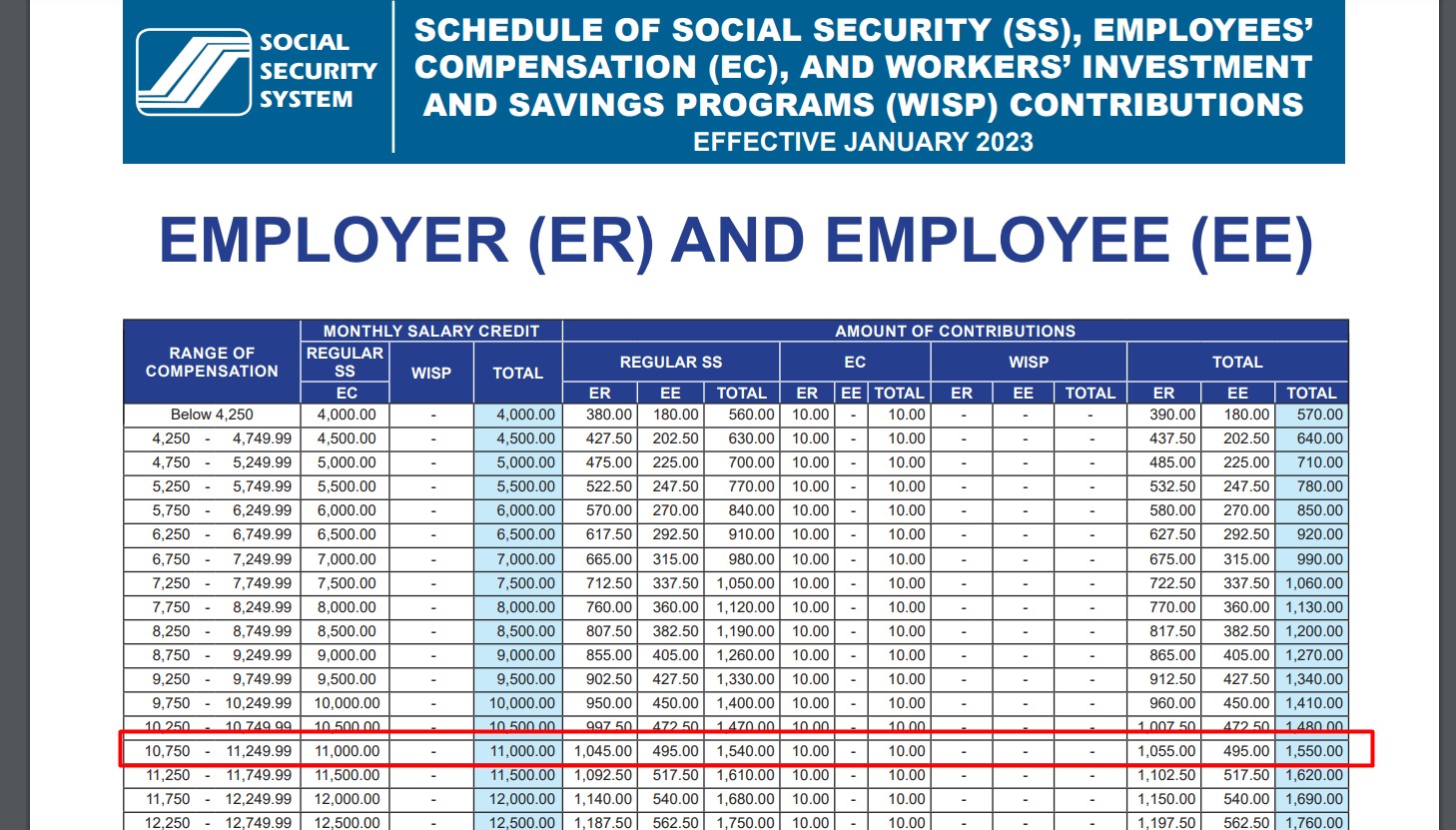

The first column, Range of Compensation, refers to your monthly salary. If your range of compensation is ₱11,000 monthly for your basic pay, then you belong to the ₱10,750 – ₱11,249.99 range (highlighted in red).

How Much is the Maternity Benefit in SSS for 2024

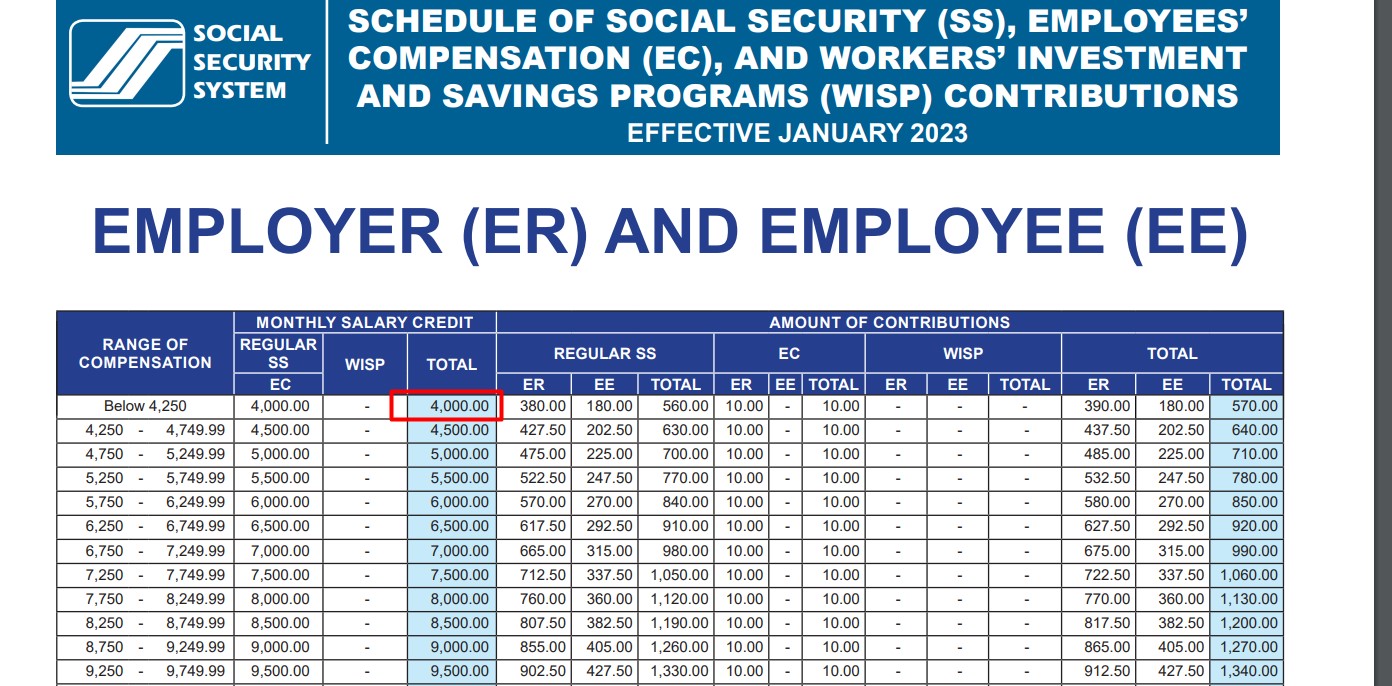

Now, let us calculate the SSS maternity reimbursement for you. The first thing you need to understand is that there is a thing called MSC or Monthly Salary Credit, shown below:

This MSC will help you determine your maximum SSS maternity benefit. So, in our example where your salary is ₱11,000 monthly, your MSC is 11,000 (see first table highlighted in red).

The formula for how to compute maternity benefits is this: 100% of your average daily salary credit X 105 days. Below you will find the steps on how to compute the SSS maternity benefit.

- Step 1: From the date of birth, exclude the past 6 months of what we call the Semester of Contingency. This Semester of Contingency is six consecutive months BEFORE the birth.

- Step 2: count 12 months from the month BEFORE the Semester of Contingency

- Step 3: Look for the highest MSC within this period of 12 months.

- Step 4: Add the SIX HIGHEST MSC to get the total monthly salary credit

- Step 5: Divide this number by 180 days, and you will get the AVERAGE SAILY SALARY CREDIT.

- Step 6: Multiply this number by 105; this is your SS Benefits

👉 Learn all about

What are the SSS WISP Benefits in the Philippines

Sample SSS Maternity Benefit Computation

For this demonstration, we made a table that is easy to understand. Let us say that your monthly salary is ₱11,000.

Here is a table of events:

| YEAR | MONTH | MONTHLY SALARY CREDIT | SITUATION |

|---|---|---|---|

| 2023 | Jan | 10,000 | – |

| 2023 | Feb | 10,000 | – |

| 2023 | Mar | 10,000 | – |

| 2023 | Apr | 10,000 | – |

| 2023 | May | 10,000 | – |

| 2023 | Jun | 11,000 | – |

| 2023 | Jul | 11,000 | – |

| 2023 | Aug | 11,000 | – |

| 2023 | Sep | 11,000 | – |

| 2023 | Oct | 11,000 | – |

| 2023 | Nov | 11,000 | – |

| 2023 | Dec | 11,000 | – |

| 2024 | Jan | 11,000 | – |

| 2024 | Feb | 11,000 | – |

| 2024 | Mar | 11,000 | – |

| 2024 | Apr | 11,000 | – |

| 2024 | May | 11,000 | – |

| 2024 | Jun | 11,000 | YOU GAVE BIRTH THIS MONTH |

So, for step 1, we will count back six months from Jun 2024. This will take us to December 2023.

| YEAR | MONTH | MONTHLY SALARY CREDIT | SITUATION |

|---|---|---|---|

| 2023 | Jan | 10,000 | – |

| 2023 | Feb | 10,000 | – |

| 2023 | Mar | 10,000 | – |

| 2023 | Apr | 10,000 | – |

| 2023 | May | 10,000 | – |

| 2023 | Jun | 11,000 | – |

| 2023 | Jul | 11,000 | – |

| 2023 | Aug | 11,000 | – |

| 2023 | Sep | 11,000 | – |

| 2023 | Oct | 11,000 | – |

| 2023 | Nov | 11,000 | – |

| 2023 | Dec | 11,000 | SEMESTER OF CONTINGENCY |

| 2024 | Jan | 11,000 | – |

| 2024 | Feb | 11,000 | – |

| 2024 | Mar | 11,000 | – |

| 2024 | Apr | 11,000 | – |

| 2024 | May | 11,000 | – |

| 2024 | Jun | 11,000 | YOU GAVE BIRTH THIS MONTH |

Now, we will count 12 months from December 2023. This will take us as far back as December 2022.

| YEAR | MONTH | MONTHLY SALARY CREDIT | SITUATION |

|---|---|---|---|

| 2022 | Dec | 10,000 | 12 MONTHS BEFORE SEMESTER OF CONTINGENCY |

| 2023 | Jan | 10,000 | |

| 2023 | Feb | 10,000 | |

| 2023 | Mar | 10,000 | |

| 2023 | Apr | 10,000 | |

| 2023 | May | 11,000 | |

| 2023 | Jun | 11,000 | |

| 2023 | Jul | 11,000 | |

| 2023 | Aug | 11,000 | |

| 2023 | Sep | 11,000 | |

| 2023 | Oct | 11,000 | |

| 2023 | Nov | 11,000 |

So, how to compute sss maternity benefits?

The highest MSC for these 12 months is 11,000. The SIX HIGHEST MSC for the last 12 months is also 11,000 each.

So, we will add 11,000 six times, and we get 66,000. After this, we divide 66,000 by 180 days, and we get 366.67.

Finally, we can now multiply 366.67 by 105 days and we get a final value of: ₱38,500.

If you need extra money, but you don’t qualify for an SSS maternity loan, Digido can help! Calculate your pre-approved loan amount with Digido calculator:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

SSS Maternity Benefits for Voluntary Members

The process of availing maternity benefits as a voluntary member of SSS is different from that of those members who have employers. As soon as you have a copy of your first ultrasound, you can notify SSS about your pregnancy.

You can apply for maternity benefits by filing a Maternity Notification Form (Mat1). This SSS Maternity leave form is available in the SSS branch and downloadable from the SSS official website.

Submit the following requirements to the SSS branch:

- Filled out Mat1

- Ultrasound

- 2 valid IDs

After that, they will return to you your Mat1 with another form attached to it. This form contains the list of additional requirements you need when claiming the benefit. These are:

- Bank Account Details (affiliated by SSS)

- Certified True Copy of Operating Room Record (for Caesarean delivery)

- Baby’s Birth Certificate (certified true copy)

- Maternity Reimbursement Form (Mat2 for SSS maternity reimbursement computation)

- Valid ID

- Authorization letter (if a representative will submit the requirements).

The Mat2 can also be obtained from the SSS branch. You can fill this out and submit it together with the other additional requirements. Wait for SSS notification within 2-3 weeks.

How to Compute Maternity Benefits for Voluntary Members?

You might be asking, how much is the SSS maternity benefit for voluntary members?

The computation of the maternity benefits for voluntary members is similar to the above calculation. Get your monthly salary credits based on your paid monthly contribution first.

Then, get your average daily salary credit. And again, multiply your average daily salary credit by the approved number of days. The result is your total maternity benefit.

👉 Learn here How to Get

Easy Cash Loan in the Philippines

SSS Maternity Benefits: Requirements for Application

To apply for SSS Maternity Benefits in the Philippines, a female member must submit the following requirements:

- Maternity Notification

Submitted through the My.SSS Portal on the SSS website, via the SSS Mobile App, or through the employer for employed members.

- Maternity Benefit Application Form (MBA)

For employed members, this is submitted through the employer.

For voluntary, self-employed, and OFW members, this is submitted directly to SSS.

- Proof of Pregnancy

This can include ultrasound reports, pregnancy test results, or a medical certificate from a doctor.

- Child’s Birth Certificate

If the maternity benefit is claimed after childbirth, the birth certificate issued by the Philippine Statistics Authority (PSA) or a duly certified copy must be provided. For cases of miscarriage or emergency termination of pregnancy, a fetal death certificate and obstetrical history stating the number of pregnancies must be submitted.

- SSS ID or any two valid IDs

Both IDs should have a photo and signature of the member, and at least one should show the member’s date of birth.

For employed members, it’s important to notify the employer of the pregnancy and the expected date of delivery as soon as possible. The employer is then responsible for notifying SSS.

It’s crucial to submit the Maternity Notification before the childbirth or miscarriage. The SSS allows the submission of notification before the delivery but has specific time frames depending on the type of delivery (normal or cesarean section) or in case of miscarriage.

How to Avail SSS Maternity Benefits

You can get your SSS Maternity benefit from your employer. However, this only applies if you are regularly employed. At the end of the day, everyone claims the SSS maternity reimbursement from the SSS itself.

So, how many days to claim maternity benefits? Ideally, you should file a maternity leave 30 days before your expected delivery date.

How to File a Maternity Benefit Claim with SSS?

Now, let us discuss the maternity claim SSS process. If you have an employer, you must discuss this with them or the HR department. If not, you must go to your nearest SSS office to file for the maternity benefit.

Here are the SSS maternity benefits requirements and process on how to avail of SSS maternity benefits:

- Accomplished application form; this is the MATERNITY BENEFIT APPLICATION form

- Medical certificate from your obstetrician indicating your projected delivery

- Solo Parent ID if you are a solo parent (you will get an extra 15 days for your maternity leave)

Your HR will guide you through the entire process for maternity claim SSS. If you are not employed, you can go to SSS or ask somebody to do it for you.

After submitting your application form, the next thing to do is to wait. An SSS personnel will send you an email notifying you of your payment. The SSS will send the money to our nominated bank account.

If you are employed, the employer will pay you the money the same way they pay your salary. Then, it is the employer who will seek the disbursement for what they paid you in advance.

SSS Maternity Benefit Online Application

Can you apply for SSS maternity benefits online? Yes, you can. The SSS rolled out this program in 2021 (2). Below are the requirements and other qualifying items:

- You are a paying member

- You want to correct the application (from normal to caesarian or miscarriage)

- The SSS computation of your maternity benefit is higher than what your employer gave you

- Correction in the number of days you must be compensated

To start the application, go to My.SSS and look for the appropriate tab or button to apply. The SSS may also ask you for some supporting documents to prove your online application, so prepare the basic docs that we mentioned earlier, like a medical document from your obstetrician.

Here are the steps:

- Log on to your My.SSS account at https://member.sss.gov.ph/. If you don’t have an account, you can sign up for free.

- Under the E-services tab, click the “Submit Maternity Benefit Application” option.

- Read and understand the reminders then click Proceed.

- Key in the required information then click Proceed in order for it to be validated. You must also confirm your eligibility for SSS maternity benefits.

- Give your Type of Claim and Disbursement Account then Proceed.

- Upload the supporting documents. Once done, read the certification statement then press Certify and Submit.

- Keep the general transaction details.

- Check your email for a notification regarding your SSS maternity benefit application

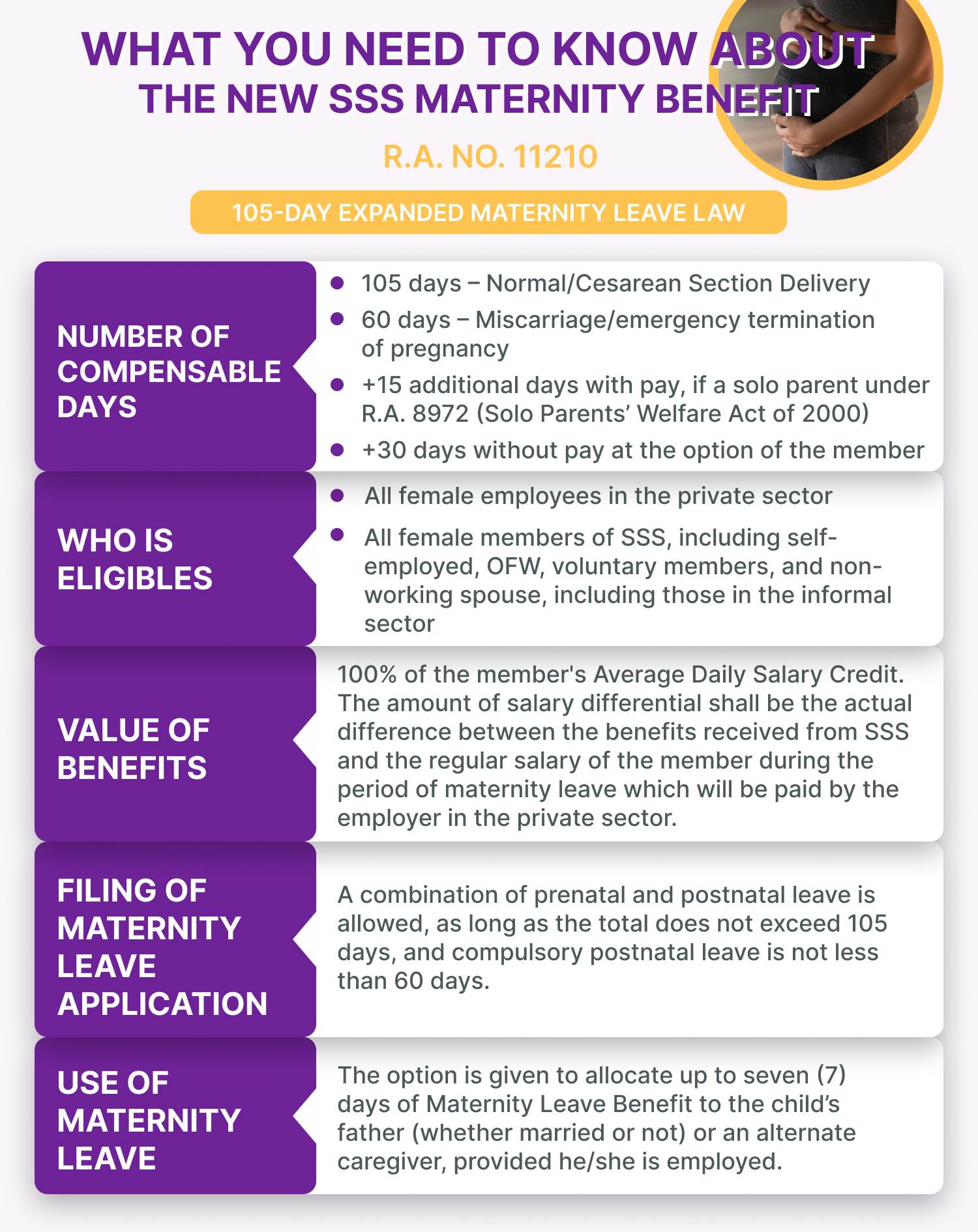

The Expanded Maternity Leave Law

Recently, there have been talks about expanded maternity leave. Also called Republic Act No. 11210 (3), the government now allows 105 days for maternity leave instead of the traditional 60 days. This is the number we used in our calculation earlier.

The document for this is long and legal to read. To help you, we summarized the key points about this law below.

- Women are entitled to Maternity Leave (ML) Benefits regardless of Civil Status

- You can avail of ML even after you got recently terminated from work for as long as it has not been 15 days between your delivery or miscarriage and the date of your employment termination.

- The minimum leave is 60 days and the maximum is 105 days

- If you are not paying SSS, PhilHealth will cover your maternity leave

- There is security of tenure for your employment if you avail of the maternity leave

Earlier, we covered the Paid SSS Maternity Leave and its calculation. The revised law for maternity leave also has a provision for Optional Maternity Leave Extension. This only means that instead of 60 days, you have the choice to expand it to 105 days.

Not all mothers want to spend their 105 days on leave. As you may know by now, some mothers want to get to work as fast as they can because if they come to work, they get paid more.

Think of our example earlier.

If your monthly salary is ₱11,000, and then you have an allowance of another ₱5,000, your total earnings per day (at a 22-word day period) is ₱727 per day.

If you multiply that by 105 days, you get ₱76,363. With the SSS pay, you only get ₱38,500 for 105 days. As you can see, you are earning more if you go to work. Because of this, some mothers opt to only get 60 days of maternity and then come back to work.

👉 Read all about

SSS Salary Loan Online Application 2024 in the Philippines

What are the Liability and Penalty of Employers

Your employers have legal liabilities if they do not comply with the law. Based on Section 18 of the new maternity law, the penalty is not less than ₱20,000 and not more than ₱200,000. In addition, an employer can go to jail for not less than six years but not more than 12 years.

It is either the judge penalizes the employer in cash or imprisonment, or worse, both. What if the people guilty of this are a corporation? In this case, it is the directors and managing heads who will be held accountable. In the worst-case scenario, the employer may not be able to renew his business license.

The employer’s responsibility is to pay the maternity leave benefit of the employee and allow her to take her leave. From here, the employer will have to go to the SSS office and process the reimbursement.

It is also the responsibility of the employer to ensure that the office has a safe provision for the employees who are pregnant or those who have birth.

👉 Learn How to Claim

Paternity Benefits in the Philippines: What is the Paternity Leave Law

What Are the PhilHealth Benefits for Maternity

Now that we have thoroughly discussed SSS maternity, let us move on and talk about PhilHealth maternity benefits.

What is the PhilHealth Maternity? By Universal Health Care Act (4), all women who are about to deliver their babies are entitled to coverage of social health insurance. The thing is that you have to be a member of PhilHealth to be able to avail of this program. In addition, you should be a regular contributor to qualify for the PhilHealth maternity benefit.

How to Qualify for PhilHealth Maternity Benefits?

The most important qualification is that you should be a member of PhilHealth and that you are an active contributor. You must meet these qualifications:

- You should have paid at least three months of contributions before your availment and these three months shall have been made within the last six months before your delivery date

- If you are not an employee, or you are a self-employed member, you must have paid at least 9 months of contributions in the last 12 months

Some OFWs are sponsored, and they are a special case. For as long as the date of the availment is within the validity period, they can enjoy the benefits of a PhilHealth Maternity Benefit. There are several packages or amounts you can get, and we will describe them below.

🍼 Antenatal Care Package

In this package, you will be able to get services that include pre-natal check-ups, check-ups for detection of pregnancy problems, management of complications, nutrition for the mother, immunization, counseling, lifestyle counseling, family planning, and breastfeeding guidelines.

🍼 Maternity Care Package

This is the financial package that ranges between ₱6,500 and ₱8,000 if you have availed the PhilHealth, but only if you gave birth in accredited hospitals or clinics. The Maternity Care Package also referred to as MCP, also covers the antenatal period and normal delivery.

Mothers can also avail of this package during the post-partum period. The financial support of ₱6,500 is for accredited hospitals, while the benefit of ₱8,000 is for people who gave birth in maternity clinics or what we call birthing clinics.

🍼 Normal Spontaneous Delivery Package

This type of package refers to the common way of giving birth or the normal birth. Also called NSD, the mother could get a package worth ₱5,000 if the mother gave birth in a hospital. If the birth happened in a birthing home, the mother could get as much as ₱6,500.

🍼 Maternity Benefits for Other Types of Childbirth

Other types of childbirth, like Caesarian delivery, or those who have had complications, can still avail of the PhilHealth maternity benefit. The amount that you can get varies according to your condition.

🍼 Newborn Care Package

Finally, there is a package for the newborn baby of up to ₱1,750. This package includes newborn screening, tests for hearing, and other standard provisions for newborn babies.

🍼 Z Benefits for Premature and Small Newborns

There are several packages that mothers can get for this situation. The Z Benefit Package has the intent to capture preventive approaches for patients. Women who are pregnant for 24 to 36 weeks and are at risk can avail of this package.

Here are the benefits:

- For the prevention of preterm birth, the package is between ₱600 and ₱4,000

- For preterm and newborns, the package is between ₱35,000 and ₱135,000

- For preterm and newborns between 32 weeks but less than 37 weeks, the package is between ₱24,000 and ₱71,000

You can only avail of the Z package if the baby is premature. As such, you can only get this if you deliver between 24 and 37 weeks. Also, the baby must be between 500 to 2,499 grams.

How to File PhilHealth Maternity Benefit

In this section, we will discuss the PhilHealth Maternity Benefit requirements.

Accredited hospitals and surgical clinics have dedicated PhilHealth desks to assist with registration. It’s advisable to prepare all required documents beforehand to expedite the process and prevent delays upon discharge.

Employed members should ensure they have the following PhilHealth maternity requirements for 2023:

- A valid ID or PhilHealth ID

- A copy of your latest PhilHealth Member Data Record

- PhilHealth CF1 (Claim Form) and CSF (Claim Signature Form), available through employers or their authorized representatives

- Additionally, a certification of contribution or proof of payment may be requested. This information allows PhilHealth representatives to verify your records online and process your maternity benefit claim efficiently.

For members under 4Ps (Pantawid Pamilyang Pilipino Program) and indigent individuals, coordination with local government units or social welfare offices is necessary to obtain certification for PhilHealth enrollment or maternity benefit eligibility.

If married, PhilHealth will ask you to submit a copy of your marriage certificate. As a reminder, you must submit these documents for application to the PhilHealth office within 60 days after your discharge from the hospital.

How Much Can You Receive in PhilHealth?

You can receive anywhere from ₱600 to ₱71,000. It all depends on your condition.

👉 Learn How to

How to Claim SSS Unemployment Benefits in the Philippines

Maternity Benefits in National Health Insurance

National Health Insurance offers maternity benefits that are health packages that expectant mothers can avail of to help them during their pregnancy. Every member that is about to give birth is immediately eligible for these benefits, regardless of number of contributions.

There are two maternity benefit packages: Maternity Care Package (MCP) and Expanded Newborn Care Package (NCP). The MCP has two packages, namely Antenatal Care Package and Normal Spontaneous Delivery Package. Members can avail of the MCP for prenatal checkups, normal delivery, and postpartum care. MCP coverage is Php 6,500 for accredited hospitals, and Php 8,000 for accredited birthing homes, lying-in or maternity clinics.

Meanwhile, the Expanded NCP has a coverage of Php 2,950 and covers essential newborn care, newborn screening tests, and newborn hearing tests.

To avail of National Health Insurance maternity benefits, you must prepare and secure your member’s data record (MDR), Claim Form (CF1, if employed), CSF form (if employed), proof of premium payments, National Health Insurance ID and valid IDs, and CF2 from your healthcare provider.

GSIS maternity Benefits

Unfortunately, unlike the SSS, the GSIS does not offer maternity benefits to its members.

However, government agencies are mandated to grant maternity benefit claims to its employees as stipulated in the RA 11210. That means women government employees can still avail of the 105-day maternity leave.

While the GSIS does not offer maternity benefits, members can still avail of its retirement and life insurance benefits that can help first-time parents and established families alike. Alternatively, they can apply for maternity benefits from National Health Insurance, which we will show you in the next section below.

Digido Loan Will Help in an Emergency Case

Even if you have completed all the requirements of claiming your maternity benefit, this does not guarantee immediate encashment. You need to wait for a couple of weeks before you can enjoy your SSS benefit, or your total monthly salary may not be enough to cover all of the expenses related to your pregnancy and childbirth. Having readily available cash is necessary, especially during emergencies such as:

- sudden childbirth delivery before the due date, or premature delivery

- contingency like miscarriage

Advantages of Digido fast emergency loan:

In case of emergency, time matters most. With Digido, you can get an instant cash loan for a sum of up to PHP 25,000. Additionally, you do not have to worry about the tedious filing or submitting of loan requirements.

Digido only requires one valid government ID. But for faster approval, you can also present your payslip (if employed) or DTI registration (if business owner).

When you complete the loan application to Digido, you will receive the money instantly after confirming the contract. You can expect it to be reflected on your bank account during banking hours.

Apply now👉 Find out How to Get

Personal Loans With Bad Credit in the Philippines

Conclusion

Both SSS and PhilHealth maternity benefits are helpful when it comes to the financial plight and rights of a woman. However, you may find yourself still strapped for cash, considering that hospitals and birthing clinics raise their prices, but the government does not raise the financial benefits. In this case, you can always rely on Digido to help support you financially.

Learn How to Get

24-hour payday personal loans in the Philippines

FAQ

-

What is the expanded maternity leave?The expanded maternity leave law increases the daily maternity leave benefit from the initial 60 days for normal delivery, or 72 days for caesarian delivery, to 105 days, regardless of the type of delivery. In case of a miscarriage or an emergency termination of pregnancy, the entitlement is 60 days of paid maternity leave.

-

Should I have a married status to apply for my SSS maternity benefits this 2024?No, you do not have to be married. All women are entitled to maternity benefits.

-

How is the SSS maternity benefit for 2024 calculated?The calculation of the SSS maternity benefit for 2024 in the Philippines is based on the Average Daily Salary Credit (ADSC). First, calculate the average monthly salary credit (MSC) by referring to the SSS contribution table. Then, divide the total MSC by 180 days to find the ADSC. For normal or cesarean delivery, multiply the ADSC by 105 days. In case of miscarriage or emergency termination of pregnancy, the benefit covers 60 days.

-

How much is the SSS maternity benefit for voluntary members?If you are a voluntary SSS member, your maternity benefit will still depend on the number of contributions that you have made.

-

What are the SSS miscarriage benefit requirements?You can avail of SSS maternity benefits even if you had a miscarriage. The requirements are the same as applying for SSS maternity benefits, or you can coordinate with your HR on what to do.

-

How much is maximum sss maternity benefit in SSS 2024?Female members with expected delivery date on January 2024 onwards, may receive a maximum maternity benefit of P70,000, given that they are paying their contributions under the new maximum monthly salary credit of P20,000

-

How to Avail of 70k SSS Maternity Benefits?Note that the PHP 70,000 SSS Maternity Benefits is the maximum amount to avail. Hence, to get this amount, your posted contribution to SSS must be at a maximum amount as well, with 105 days duration. It will determine your monthly salary credit indicated in the SSS contribution table. The updated SSS contribution table is available on the SSS official website.

-

How is the SSS maternity online application?Applying for SSS maternity benefits online is easy! Just go to the My.SSS website, log in your account, go to E-Services then click Submit Maternity Benefit Application, then follow the instructions from there.

-

How long do I have to confirm that I have received my SSS maternity benefit?You can do this within 7 working days from the date they sent you the email.

-

What is going to happen if I don't receive confirm the payment of my SSS maternity benefit?The request for your maternity leave benefit will be rejected.

-

How long does it take for the SSS maternity benefits money to be credited?Your employer must pay you in advance within 30 days of you filing your SSS maternity benefits.

-

Can my employer fire me after my leave of 105 days?No, an employer cannot do that. Based on the law, it is illegal for an employer to fire an employee merely because of pregnancy.

-

Can I use my husband’s National Health Insurance account for maternity benefits?Yes, you and your baby can avail of maternity benefits if you are your husband’s dependent.

-

How many contributions do I need to qualify for the PhilHealth maternity?You need to have at least 3 months in the last 6 months if you are employed. If not, you must have a contribution of at least 9 months in at least the last 12 months if you are a voluntary member or if you are unemployed.

-

I'm a single mother; am I qualified for PhilHealth maternity benefits?Yes, you are qualified for it. Like the SSS benefit, you do not have to have a married status to avail of the PhilHealth maternity benefit. Anyone pregnant is qualified.

-

Is my second or third baby covered by PhilHealth as far as maternity goes?Yes, the PhilHealth packages cover you even if it is your second pregnancy. There is no limit to the number of babies covered by the PhilHealth maternity benefits.

-

Are miscarriages covered?Yes, PhilHealth covers miscarriage as SSS does.

-

Is it possible to convert the PhilHealth maternity to cash?No, you can no longer convert this to cash. You can only file for reimbursement of expenses you had or discounts in a hospital or birthing clinic.

Authors

Digido Reviews

-

AzenVery fast and reliable source of money. Easy payment option also :)5

-

DanicaSuperb App. It is very easy and fast approval. it's my second loan since the last time. Very happy to apply for this app. Highly recommended.5

-

MarcA very reliable loan app. You can have the approved amount transferred to your account in less than 3 minutes. Highly recommended to those who need immediate cash☺5

-

MelissaI highly recommend this App. Convinient and user-friendly. This App is amazing! So easy to loan and approval is very fast just a few minutes. Disbursement is super fast. The Staff are very accomodating, polite, respectful, courteous and friendly. Digido is is very reliable, costumer service is awesome. I love the flexibility it gives to their clients and I can definitly reccomend it to anyone who needs finacial assistance. To the management and staff, thank you very much for the helping hands!5

-

NonaOne of the Best Loan App. Reliable. Affordable Fees. Thanks, Digido.4