Obtaining a UMID Card in 2024: Steps in the UMID Application Process

Key takeaways:

- UMID cards are the most affordable, free and valid ID cards in the Philippines

- Since it is a biometric ID card, you can use it for most transactions

- To get a UMID ID card you should visit your GSIS or SSS office

- Digido recognizes the UMID card as a legitimate form of identification, offering the process of borrowing money with a single ID

Who can get a Digido loan?

Table of Contents

The Filipino government’s initiative to streamline various social security programs into a single card led to introducing the UMID ID card in 2010. This initiative aimed to implement a unified multipurpose ID incorporating advanced biometric data and enhanced security measures for personal details, which would simplify the access to governmental institutions and be a convenient identification document for Filipinos.

This article provides in-depth information helping to understand what a UMID ID card is, how it can be used, who is eligible to receive this card, and what are the steps to obtain it.

What is a UMID ID?

The UMID ID card, which stands for Unified Multi-Purpose Identification card, functions as an all-encompassing identification card recognized by the most significant Filipino government entities (1). The list of such entities includes:

- the Social Security System (SSS) – a state-controlled social insurance program for the citizens working in the private, professional and informal sectors

- the Government Service Insurance System (GSIS) – a program providing social security services to workers in the public sector

- the Philippine Health Insurance Corporation (PhilHealth) – a tax-exempt and government-owned corporation that delivers universal health insurance coverage for all citizens

- the Home Development Mutual Fund (Pag-IBIG Fund), which is a governmental establishment in the Philippines committed to helping members secure decent and affordable housing

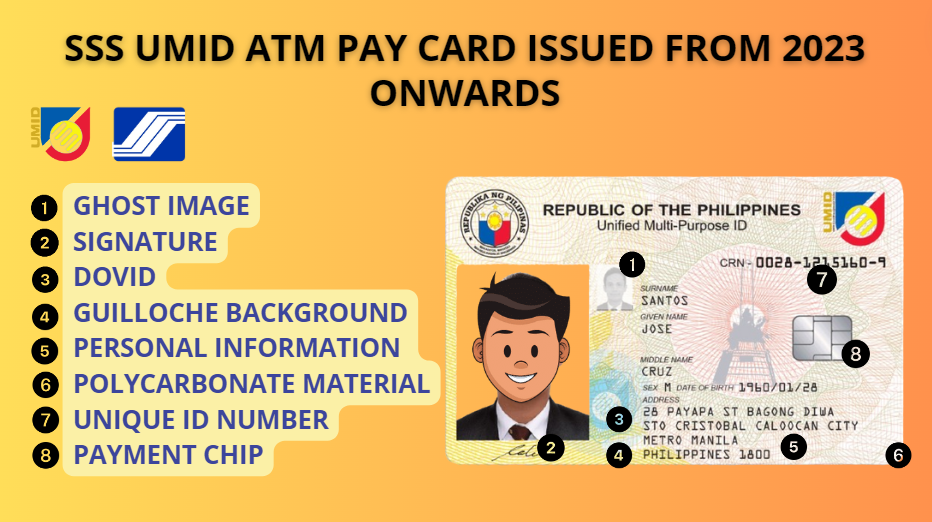

Incorporating the personalized Common Reference Number (CRN), which functions as the ID number, the UMID card is also equipped with embedded security features, such as a magnetic stripe and a contactless chip, both ensuring the secure storage of the cardholder’s personal data. On the card, there is the cardholder’s photo, their signature, and personal details such as the name, address, and birthdate.

Since recently, all the UMID ID cards that SSS and GSIS members can opt for include ATM features. UMID-ATM cards enable users to access funds from loans and social security benefits across the country. It also facilitates electronic payments and cashless transactions, allowing cardholders to settle bills, transfer funds, and manage financial operations digitally.

- Get up to PHP 25,000 in just 5 minutes

- Only 1 Valid ID needed to Apply

Why Do You Need a UMID Card

Serving as an all-in-one card, UMID ID offers its owner the following essential benefits:

- ID’s consolidation. The card integrates the identification systems of key agencies, including the SSS, GSIS, PhilHealth, and Pag-IBIG Fund.

- Access to social security benefits. Members of SSS and GSIS can use the UMID card to access their social security rights. It is an essential document for transactions related to pension claims, loans, and other SSS or GSIS services.

- Efficient operations. Instead of presenting separate IDs for SSS, GSIS, PhilHealth, and Pag-IBIG, individuals can use the UMID card for various services, making processes more efficient.

- Incorporation of biometric security. The UMID card is equipped with fingerprint and facial recognition functionalities, enhancing its security and reducing the potential of fraud and leak of identity details.

- Financial transactions. UMID-ATM cards can be used for financial transactions such as withdrawing money from loan values and social security benefits nationwide.

Learn more about

7-Eleven Payment Services Guide

Who Is Eligible to Receive a UMID ID Card

Prior to starting your UMID ID application, it’s crucial to determine your eligibility. You are eligible to apply for the UMID only if you meet at least one of the following criteria:

- You are enrolled with the SSS and possess an active SSS number.

- A minimum of one SSS contribution is recorded under your name. (2)

- You are a current member of GSIS (including those with permanent, elected, special, coterminous, appointed, casual, confidential, contractual, emergency, lumpsum, provisional or substitute employment, mandated by law to remit regular monthly installments).

- You are a GSIS pensioner (comprising old age, loss of breadwinner, and disability beneficiaries).

- You are an indigent Filipino or other PhilHealth member, but not a beneficiary under GSIS or SSS.

- You are required to update your card due to a name change and correction of personal information.

- You have misplaced or damaged your UMID card.

- You are an active GSS member and Pensioners (elderly, survivors, and disabled).

To be eligible to obtain a UMID ID card, make sure your details, including your name and birthdate, are accurate and up-to-date in the SSS database.

Learn How to Get

24 Hour Payday Loan in the Philippines: Step by Step Procedure

What Are the UMID ID Requirements in 2024

In order to get a UMID ID, all applicants must provide either one primary valid ID or, in case if unavailable, two secondary valid IDs. Please note, that as per UMID ID requirements primary and secondary IDs must be in their original form, not photocopies.

Among the primary documents you can find (non-exhaustive list): (3, 4)

- Passport

- Social Security card

- Unified Multi-Purpose ID card

- National Bureau of Investigation Clearance

- Vehicle License

- Alien Certificate of Registration

- Voter identity card

- Seaman’s Book

In case If you don’t have a primary ID, you can submit any two secondary identification documents. Both of them must have signatures of the applicant, and at least one should have a photo.

Secondary documents (non-exhaustive list): (5)

- Birth Certificate

- Senior Citizen document

- Identification Number of a Taxpayer member ID

- Сertificate of clean criminal record

- Marriage Settlement

- Pag-IBIG Member’s Data Form (MDF)

- School ID

- Seaman’s book

- Health or Medical card

Need Quick Cash? Apply for a Quick and Easy loan today with just 1 government valid ID. Calculate your pre-approved loan amount:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

Where to Apply for a UMID Card

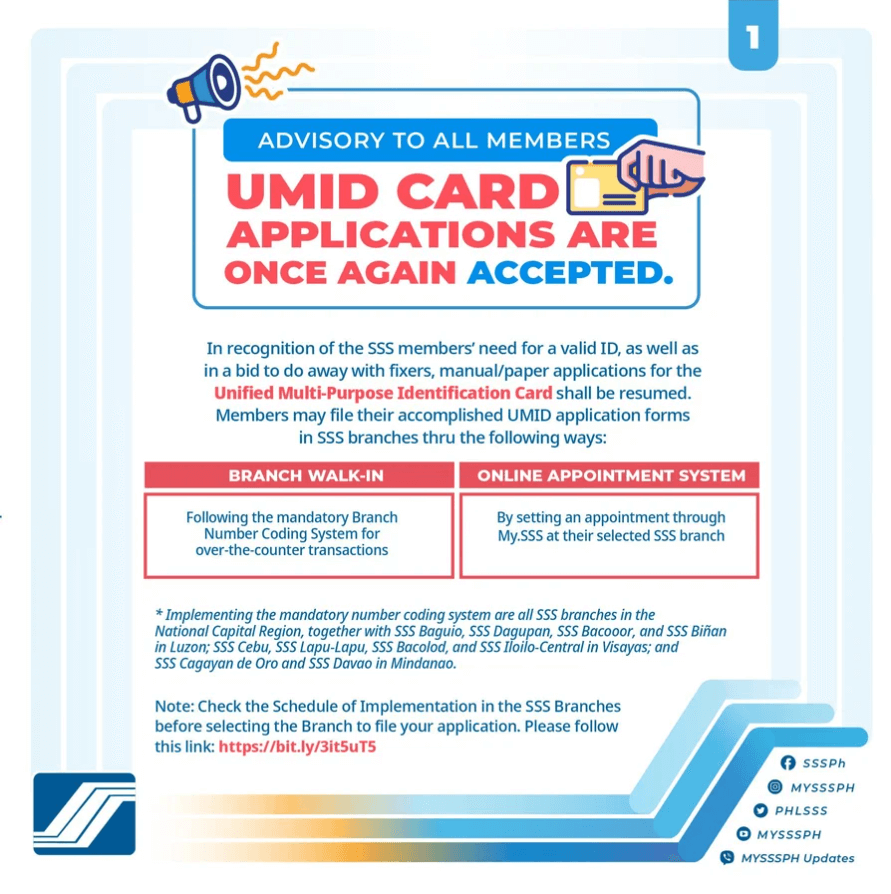

While the SSS and the GSIS are the main agencies in charge of the UMID implementation, other agencies take an active part in enhancing and streamlining the process for greater efficiency. Here you can find some guidelines on how to get the UMID ID via the SSS and the GSIS. If you are a member of the Social Security System, you have two option available to apply for the UMID ID card:

- Offline via an SSS branch that has a UMID enrollment facility

- UMID ID Online Appointment via your My.SSS account with a physical appointment to check your biometric data at the preferred SSS branch.

👉 How to get a UMID Appointment via SSS Branch Office

For face-to-face transactions, you have to comply with the prescribed Branch Number Coding System.

The mandatory number coding system is in effect across all the SSS branches in different regions of the Philippines. You can refer to the list of SSS branches currently accepting UMID application forms. (6)

The coding system schedule is based on the tenth digit number of your SSS or Employer ID number. It determines the designated day for your in-person appointment at the SSS division. For instance, if the 10th digit of your SSS number is 4, your visit is limited to Tuesdays.

| Employer ID number | Day for UMID card appointment |

|---|---|

| 1&2 | Monday |

| 3&4 | Tuesday |

| 5&6 | Wednesday |

| 7&8 | Thursday |

| 9&0 | Friday |

Get ready for the walk-in appointment by following these steps:

- Retrieve and print out the UMID Application Form (7)

The staff will check the validity of the information in their database. The SSS number, name, date of birth, and sex in the application form must match the member’s information in the SSS database.

- Prepare the primary or secondary supporting documents and submit a filled out UMID application form

You should also present the original or certified copy of any primary valid IDs such as a passport, driver’s license, PRC ID, or seaman’s book for verification. Also, provide your email address or telephone number so that the SSS employees can contact you or provide updates whenever applicable.

Note: Anyone wishing to change their old SSS ID will have to pay a fee of PHP 200 directly to the SSS office where they will get a UMID card. As for pay the UMID card, if you get it for the first time, it’s free.

- Provide your biometric information in the SSS office

The SSS office will have a biometric capture booth. They will use it to collect your data, such as photos, fingerprints, and digital signatures. After this, you can verify the details by checking the prototype shown on the screen. After submission, you will receive an acknowledgment, and it can be used to track UMID delivery progress.

- Obtain your UMID ID in the SSS branch after receiving an SMS notification

Or wait for the UMID Card Delivery. You can receive the card through PhilPost. The delivery time varies based on your location, but it rarely goes beyond 30 days from your application date.

- How to Activate your UMID Card in SSS

You can activate the UMID card from the SSS branch at the nearby SSS branches with UMID. You can add ATM functionality to your UMID ID cards by converting your UMID card to a UMID-ATM card. One can do this by visiting the kiosks of the UnionBank of the Philippines (UBP) available at most SSS branches. After the conversion, you can withdraw your benefits and loan proceeds from any Bancnet ATMs or Visa-branded ATMs for international transactions.

Learn How to Get

a Loan without a Bank Account in the Philippines

👉 UMID Card Application at GSIS

We will now explain how to apply for a UMID ID card in the Philippines. The steps to get UMID card for GSIS members is almost similar to that of SSS. The steps are the following:

- Go to any GSIS branch: GSIS branches are open from Monday to Friday from 8 a.m. to 5 p.m. without any breaks, including lunch breaks.

- Submit the UMID requirements: You can submit the fully accomplished UMID application along with the photocopies of your ID proofs for the enrollment officer for scrutiny. You can fill in the GSIS eCard customer information record on the official website.

- Undergo ID photo and biometrics capture: The enrollment officer will take your photograph and capture your biometric information. Verify the details and make corrections if necessary. Once everything is complete, you will get a UMID eCard Release form for claim your UMID card.

- Wait for updates: GSIS will update you about the status of your UMID ID through SMS or email. Once you receive the notification, proceed to the GSIS office where you submit the application and claim the card.

- Claim your card: Submit the following documents to the card releasing officer to procure your card: UMID eCard Release Form, Accomplished Bank Customer Information Record (available at the GSIS branch), Original and photocopy of GSIS eCard, passport, SSS ID or two valid government-issued IDs, Check the card for any discrepancies and ensure that the PIN mailer is readable

Activate your new UMID card:

Upon receiving your UMID card, activation is required, which can be done at a GSIS Wireless Activated Processing System kiosk located in various locations such as Robinson’s Malls, municipal halls, city halls, or directly at a GSIS branch. Here are easy steps to Activate your new UMID card:

- Visit the nearest GSIS branch or any facility with the GSIS Wireless Activated Processing System (G-W@PS) kiosk

- Place the UMID card on the e-card reader and perform a fingerprint verification

- Once the verification is complete, you will receive a confirmation message

- The UMID card will become active within 72 hours

The UMID application for Pag-IBIG members is identical to that of SSS members with SSS ID or GSIS members. Here the Pag-IBIG member has to submit his or her member’s data form, which can be downloaded from the website, as an identification document.

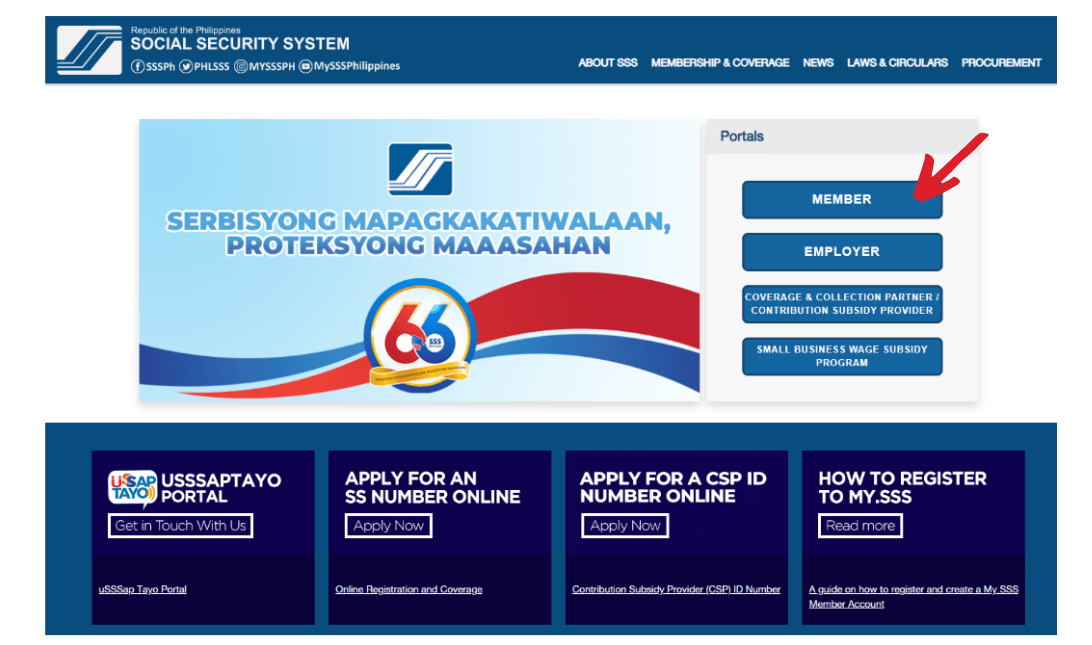

How to Apply for a UMID ID Online via My.SSS

The UMID ID online appointments system is an alternative way to get a UMID ID online through My.SSS account at the selected SSS branch. (8) Then follow the given plan:

- Use your web or mobile browser to access My.SSS account

- Go to the SSS system for an appointment

- Provide all the necessary information. Fill out the UMID ID online application form

- Set appointment time and write your concerns

- Provide the details of your scheduled appointment

- Visit the SSS branch on the assigned date and time

Please Note: As of February 2023, the SSS has discontinued accepting applications for standard UMID cards. Individuals who currently possess UMID cards or have a pending application for a UMID card, are now exclusively provided with the UMID ATM Pay card. (10)

Since January 2023, the SSS has been encouraging eligible members who have submitted an application for a ‘generic’ UMID card and are awaiting card issuance to have a complimentary upgrade to a UMID ATM Pay card that would serve the dual purpose of an identification card and a debit card.

How to Upgrade UMID card to the new UMID Pay Card Account

- Go to the My.SSS Member portal and either log into your existing account or register for a new one. Ensure all your personal details on the SSS database are accurate and current

- Once logged in, go to the “E-Services” section to authorize the sharing of your UMID Application Data with UnionBank

- Install the UnionBank app from the AppStore or PlayStore, then proceed to set up a UMID ATM Pay Card account within the app

- Input the Transaction ID and necessary personal details to initiate the account opening process. It’s important that the details you provide are consistent with those in your My.SSS account

- After completing the setup, the new SSS UMID ATM Pay Card Account will be mailed to you, arriving within 15 banking days if you’re in Metro Manila or 20 banking days for addresses outside Metro Manila

- Upon receiving your card, activate it and create a PIN through the UnionBank Mobile App

Find out here – How to Get

Fast Loan in 15 Minutes in the Philippines

How to Inquire About the Status of the UMID Card Application

If you submitted your application through the SSS, you will receive a notification via a text message from the SSS office as soon as your UMID ID card can be obtained. UMID cards with ATM functionality can be retrieved at the designated bank’s branch within 30 days after the SMS notification being received from the SSS.

You can always reach out to the SSS office by dialing (02) 8920-6401 or via email to sss_id@sss.gov.ph. You can also get the update of your status via My.SSS account:

- Access the logging in page

- Click to the “MEMBER INFO” section in the main menu

- In the dropdown menu you have to opt for the “UMID/SSS ID Details” option

The information about your enrollment date, your application status as well as your serial and transaction numbers is available in your SSS online account.

The GSIS will notify you via text or email regarding the availability of your new UMID card at the servicing branch where you submitted your application. You can also follow up directly with your servicing bank or leave a request for updates at your UMID ID card at https://www.foi.gov.ph.

It is a governmental system that permits Filipino citizens to seek information regarding government transactions and operations, ensuring that such requests do not compromise privacy and national security matters.

Damaged or Lost UMID ID Card Replacement Procedure

In the event that you lose or damage your UMID card issued by the SSS, it is mandatory to have it promptly replaced by following these steps:

- Immediately inform the SSS department your card is lost or stolen to avoid any potential fraud.

- Prepare all the necessary documents for the UMID ID replacement. Prepare your valid identification and a filled out police report or an affidavit of loss for your card.

- Schedule an appointment in the branch where you initially applied for the card and bring the required documents, along with Php 200.00 paid as a replacement fee.

- Once your replacement card is ready, you will be notified through an email or a text message. Collect your replacement card either at the branch where you submitted the application or at a designated location for pick-up.

If you have lost or damaged the card issued by the GSIS, stick to the following plan:

- Immediately get in touch with your Servicing Bank by either making a call or sending an email to report the loss of your UMID card to enable the prompt blocking of your account against unauthorized usage.

- Head to the nearest branch of your servicing bank and where you will fill out the affidavit of loss form and fill out a UMID replacement form.

- You will receive notification through text or email once your new UMID card is prepared for pickup at the branch where you initially submitted your application.

- It is crucial to store your UMID card securely and promptly report any losses or thefts to avoid potential issues with unauthorized use of your card.

Discover the best

Loyalty Cards in the Philippines

What a UMID Applicant Needs to Consider

There are certain points that should be taken into consideration when you are planning to apply for a UMID card:

- Prolonged processing time. It is recommended to plan it in advance as it may take several months to get your UMID ID card done. There is no way to speed up this process and any offers to do that are fraudulent

- Availability limitations. Current UMID cards are intended for public officers, SSS, PhilHealth, and GSIS members

- Security concerns. Even though the UMID ID card has improved its security system, it still may face potential risks of fraud and tampering, prompting concerns about its overall validity and security

- Restricted usage. While recognized as a primary ID for government transactions, the UMID card is not universally accepted in the private sector

Conclusion

The UMID card is crucial for making it easier to identify people, keep information secure, and make it more convenient to access government services. It shows that the government is dedicated to giving citizens a dependable and unified ID system, which ultimately helps individuals and creates a safer and more organized society.

Possessing a UMID card offers numerous advantages. It eliminates the need to carry multiple government IDs. Besides, you can easily access various government benefits from different agencies with just one universal card.

Learn all about

Loan Apps For Unemployed in the Philippines

FAQ

-

Is SSS ID same as UMID?No, they are different. The SSS ID is no longer produced, instead UMID has been used since 2011, which combined SSS, GSIS, Pag-IBIG and National health insurance program.

-

What's the difference between the UMID, SSS ID, and National ID?Before the introduction of the UMID, the SSS used to provide citizens with SSS IDs. However, now the agency exclusively utilizes UMIDs. Philippines National ID and PhySys are intended to cover all Filipino citizens and resident aliens, providing a unique identification number while a UMID ID card is issued to individuals based on their membership in specific government agencies. Not everyone has a UMID card; it depends on their membership with the SSS, GSIS, PhilHealth, and Pag-IBIG.

-

Is SSS ID the same as UMID?No, they differ. The SSS ID is no longer produced, instead UMID has been used since 2011, which combined SSS, GSIS, Pag-IBIG and the National health insurance program.

-

How long does it take to get the UMID ID?Allow around 30 days from the application filing date, and an additional two weeks for the delivery through Philpost. Deliveries outside Metro Manila may experience extended timelines due to security and health preventive measures.

-

How much is the UMID application cost?There is no fee for the first time enrollment and obtaining the new card.

-

Where can I find Umid number?It can be seen on the front side of the Mcard.

-

When does the card expire?The UMID ID card is timeless, with no expiration date, and remains valid for the cardholder’s entire life.

-

How to get a UMID ID online?If you are a member of the Social Security System (SSS) use an online UMID ID registration system. It is available when the number coding system is not applicable, and walk-ins are not available at the selected SSS branch.

-

I misplaced my UMID card. How to replace the lost UMID ID card, is there a fee?In the event of a lost UMID card, you need to apply for a replacement. To accomplish this, you must fill out the UMID card application form and head to your designated SSS branch for an appointment. Furthermore, you are required to file a notarized affidavit of loss and settle the UMID renewal fee of Php 200.00 at an SSS-accredited bank or directly at the SSS local office.

-

Where can I find the UMID ID number?It can be seen on the front side of the MCard.

Authors

Digido Reviews

-

JoelDigido is the very best loan app I had ever applied with. Reliable loan Co. especially in this difficult times. Kudos to the mgt. Keep up the good work and the great service to your clients. Highly recommended. God bless and more power🙏5

-

RyfteBased from my experienced in this loan app, i think its verry good easy to used. It helps for those who need urgent loan you can have longger term of repayment also.5

-

RyanDigido is one of a kind. They are true to their commitment that once u pass d review they will credit the loaned amount right away! In less than 5 mins we got the money transfered to my gf bank account. Amazing! Two thumbs up Digido!!!5

-

AnaMy experience with Digido has always been positive: my applications have been approved quickly and funds via Gcash have been disbursed without delay. Just upload your umid id online in the app and you will be approved in minutes! Go for it!4

-

MaryVery efficient, fast reliable company. Reasonable rates with very friendly and accommodating customer service! I highly recommend it! 👍👍👍4

-

MiguelApplying for a loan with Digido was a breeze, thanks to the simple requirement of just one ID. They accept a unified multipurpose ID as well, so the process has become even more convenient. Approval was fast in just a few minutes, and I had the cash in no time!5

-

FrinaI like Digido loan site the most because they low interest rate within and had a prolongation service incase you can't meet your due, it really helps alot in time of need. In addition their loan process speed and disbursement is by far the fastest.4