Business Loans in the Philippines: A Comprehensive Guide to Startup Loans

Key takeaways:

- Business loans are important for the economy so that entrepreneurs who have great ideas can start businesses.

- You can get a business loan from a bank, a legit private lender or through a government program.

- You can borrow money from Digido right now and spend it for any purpose, such as growing your business.

- Read on for tips on the basic requirements for a borrower, choosing the best business loan and presenting your business plan.

A business loan is money that you borrow from an institution for commercial purposes. In many cases, business owners borrow to add funds for their newly established business, to put up a new branch, or do some renovations.

There are many types of small start-up loans, not all of them come in the form of direct financing. In the Philippines, the most common source of the loans is banks. Aside from the bank, there are other sources of loans. These loans, like other types, have an interest. The interest rate varies between banks and the amount of your loan.

- First loan with 0% interest rate

- Get up to PHP 25,000 in just 4 minutes!

What is the Difference Between a Business Loan and Personal Loan?

👉 A business loan, as the name suggests, is tailored to meet the financial requirements of a business. Whether it’s to fund an expansion, meet daily operational costs, or jumpstart a new entrepreneurial endeavor, a business loan becomes the driving force. Due to the substantial nature of the funding typically needed to nurture or grow a business, the amount offered in business loans often surpasses personal loan amounts. Moreover, the lending institution or bank requires a more extensive set of documentation for a loan for start up business in the Philippines, ensuring that the investment in the business is a calculated risk.

Lenders meticulously scrutinize a company’s financial health, business model, market standing, and future projections. Given these rigorous checks, lenders often feel more assured about the borrower’s ability to repay, which results in lower interest rates and longer repayment tenures.

👉 On the flip side, a personal loan emerges as a more general-purpose financial tool. It encompasses various subcategories, such as consumer loans, housing loans, and auto loans. Individuals can avail these loans either to purchase personal goods, avail services, or refinance existing debts. In essence, it’s centered on individual needs rather than business requirements.

Personal loans usually carry higher interest rates in comparison to business loans in the Pilippines. The rationale behind this is the perceived higher risk associated with personal loans. Since they often don’t require collateral and are disbursed based on an individual’s credit score and earning capacity, lenders view them as a more significant risk.

Learn How to Start

A milk tea business at home in the Philippines in 2024

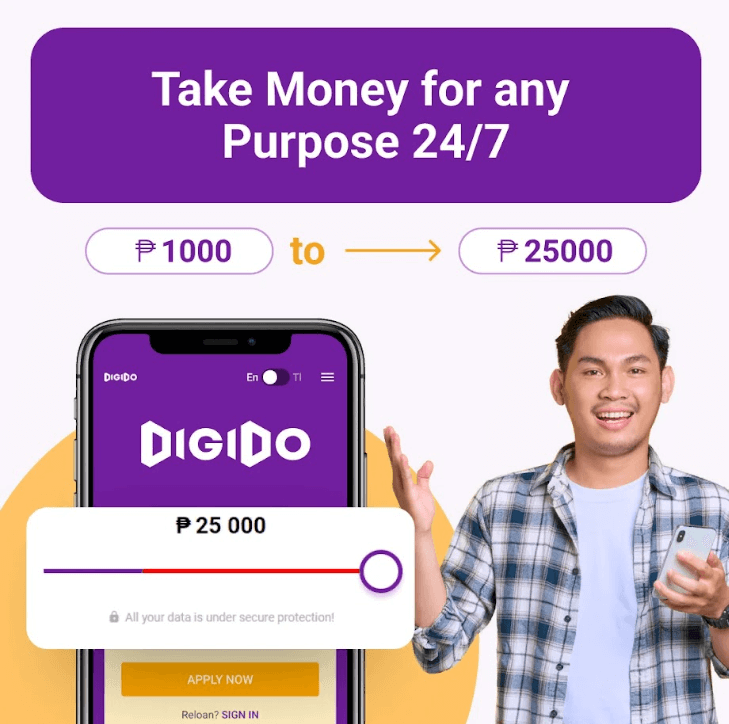

Can I Take a Small Business Loan at Digido?

Digido is an SEC-certified and reputable lender in the Philippines, offering a quick and accessible financial financial solution for individuals and small business owners. Digido offers small business loans in the Philippines and short-term loans that feature quick access and minimal borrower documentation requirements – only a valid ID is required to get a loan. With its user-friendly online application process and prompt disbursement of funds, Digido offers a reliable avenue for addressing immediate financial needs.

The best thing about Digido, it offers loans for any type of reason whenever you need it. Digido is online and does not require you to leave your home. Simply complete the application and get up to PHP 25,000 in just 4 minutes! You can use this money to pay for your groceries, buy some materials, settle Meralco BIlls and so much more.

To be able to get an online business loan for working capital from Digido, you have to be:

- Filipino citizen;

- 21-70 years of age;

- Have a valid government ID;

- Have a working mobile phone for registration;

Here are some Advantages of Digido Quick Online Business Loans:

- Online Application Process. Everything is online so you do not have to fall in line for the application process. It is quick and easy to apply through the Website and mobile App!

- Quick Disbursement of Funds. You can get money to your bank account in as little as 20 minutes.

- No Specific Business Loan Requirements. We only require 1 government valid ID

- Flexible Usage of Loan Amount. You can use this money for any urgent needs. Useful for immediate, short-term business needs.

- Minimal Documentation Required. You can apply for financial assistance when you have been rejected by banks

- First Loan with 0% Interest Rate. For first-time borrowers there is a special offer with interest-free loan

- A loan approval rate of more than 95%

Calculate your pre-approved loan amount with Digido calculator:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

Learn about

Top 6 Small Business Ideas in Manila, Philippines

Online Business Ideas in the Philippines

Where Can I Get a Business Loan in the Philippines?

There are 3 main methods you can try if you need money to get a startup in the Philippines. These are banks, government business credit and private lender loans.

1. Bank Loans for Business

Many commercial banks in the Philippines have specialized loan products for enterprises to cater to their specific needs. These loans can be either secured or unsecured (we will take a closer look at two of these types of bank loans below). They might offer flexible payment terms, higher loan amounts, and competitive interest rates.

However, you need to be employed or your business should already be established. In some cases, banks will approve your credit provided that you already own at least 20% of your target capital. With banks, you will have to choose your payment terms, and you need to pay the interest. The average interest rate is 15% per year.

2. Government Loans for Business in the Philippines

Various government agencies in the Philippines have financial programs to support startups and SMEs (Small and Medium Enterprises).

One government department where you can borrow money is the Department of Trade and Industry or DTI. Such loans are regulated by the Bangko Sentral ng Pilipinas. The Department of Trade and Industry (DTI), through its attached agencies, offers various loan programs like the Pondo sa Pagbabago at Pag-asenso (P3) program, which provides affordable loans for entrepreneurs.

Annually, DTI sets aside a budget of ₱1 billion or more for loans. These are given to micro businesses only. The owner of the company may issue a business capital small loan. It means that the asset amount must be less than ₱3 million. The interest is only 0.5%. To be able to apply for this loan, your startup must have already existed for at least one year by the time of your application.

Learn about

Top 7 Government Loans for Small Business in the Philippines

3. Legit Private Lenders for Non-Collateral Business Loan in the Philippines

Apart from traditional banks, there are many private financial institutions and lending companies in the Philippines that offer loans tailored for startups. They offer small-scale financial services, mainly to low-income entrepreneurs and those without access to traditional banking services.

These lenders might offer faster approval times compared to traditional banks, but they might also have higher interest rates. The application process is often digital, making it more convenient for startups.

These loans typically are uncecured and have lower amounts, shorter loan terms, and are designed to cater to micro-businesses or individuals looking to start a business.

Benefits of Private Lenders for online Business Loan

Legit private lenders can offer a host of benefits for non-collateral business loans in the Philippines, especially for SMEs and startups. Here are some of the advantages:

- Ease of Application: Private lenders often have simplified application processes compared to traditional banks. They may offer online applications, reducing the amount of paperwork and time required.

- Flexible Eligibility Criteria: They may have more lenient eligibility criteria, making it easier for newer or smaller businesses to qualify for business loan non collateral.

- Quick Approval and Disbursement: Private lenders can often process loan applications faster, providing quick approvals and disbursements which can be crucial for businesses in need of immediate funding.

- No Collateral Required: As the name suggests, non-collateral business loans do not require the borrower to provide assets as security, which can be beneficial for startups or small businesses that might not have significant assets.

- Competitive Interest Rates: Some private lenders might offer competitive interest rates, especially if they operate online and have lower overhead costs.

- Credit Building: By providing financing to businesses that might not qualify for traditional bank loans, private lenders help these enterprises build a credit history which can be beneficial for obtaining additional financing in the future.

- Support for Underserved Markets: Private lenders often fill gaps left by traditional banks, providing crucial funding to underserved markets.

These benefits can make private lenders an attractive option for non-collateral business loans in the Philippines, aiding in the growth and sustainability of SMEs and startups in the region.

Business Loan Application Process

Navigating through the loan application journey in the Philippines can be a meticulous task, yet the rewards of Banks and financial institutions support for your startup are invaluable. The following segments elucidate the key steps involved in this process.

Eligibility for Bank Business loans in the Philippines

Qualifying for business loans in the Philippines entails meeting certain criteria set forth by banks and financial institutions. While these criteria may vary slightly among different lenders, the following are typically required:

✅ Nationality and Age:

Being a Filipino citizen aged 21 or above, but below 65 at the time the business loan matures, is usually a fundamental requirement.

✅ Business Registration:

Your business should be registered either with the Securities and Exchange Commission (SEC) or the Department of Trade and Industry (DTI). This registration serves as a legal proof of your business’s existence and legitimacy.

✅ Operational History:

A track record of at least three years of profitable business operations is often required. This history demonstrates the viability and sustainability of your business model.

✅ Minimum Annual Gross Sales:

Lenders often require that your business meet a specified minimum amount in annual gross sales. This requirement ensures that your business has a stable and sufficient income to repay the loan.

✅ Creditworthiness:

A good credit standing is crucial as it reflects your financial responsibility and repayment capability. Lenders will review both your business and personal credit histories.

Additionally, you may also need to provide various documents during the loan application process, such as financial statements, business permits, and other relevant documents that substantiate your business’s operational and financial history.

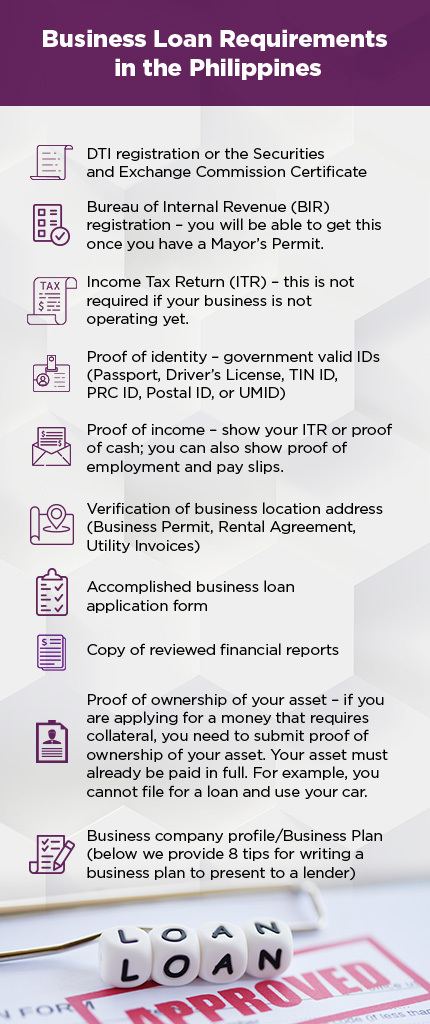

Business Loan Requirements in the Philippines

Here are the general requirements for filing a loan for both banks and government credits for small businesses in the Philippines.

- DTI registration or the Securities and Exchange Commission Certificate

- Bureau of Internal Revenue (BIR) registration – you will be able to get this once you have a Mayor’s Permit.

- Income Tax Return (ITR) – this is not required if your business is not operating yet.

- Proof of identity – government valid IDs (Passport, Driver’s License, TIN ID, PRC ID, Postal ID, or UMID)

- Proof of income – show your ITR or proof of cash; you can also show proof of employment and pay slips.

- Verification of business location address (Business Permit, Rental Agreement, Utility Invoices)

- Accomplished busoness loan application form

- Copy of reviewed financial reports

- Proof of ownership of your asset – if you are applying for a money that requires collateral, you need to submit proof of ownership of your asset. Your asset must already be paid in full. For example, you cannot file for a loan and use your car.

- Business company profile/Business Plan (below we provide 8 tips for writing a business plan to present to a lender)

8 Tips on How to Preparing a Solid Business Plan

Accurate financial projections are crucial as they provide a snapshot of your startup’s future financial health. Lenders scrutinize these projections to assess the viability and profitability of your business. A well-prepared business plan demonstrates a profound understanding of the market dynamics and instills confidence in the lenders regarding the potential success of your startup.

- Executive Summary.

Summarize your business idea, goals, and the unique value proposition that distinguishes your startup. - Market Analysis: Delve into the market dynamics, identifying your target audience, competitors, and the market trends.

- Organization and Management.

Outline your business structure, roles, and responsibilities of the team members. - Product or Service Line.

Describe your offerings in detail, elucidating the benefits they bring to your customers. - Marketing and Sales.

Outline your robust marketing strategy to propel your brand into the market, alongside a sales strategy to drive revenue. - Funding Request.

Specify the amount of funding required, its uses, and the terms under which you seek the loan. - Financial Projections.

Provide a forecast of your financial performance over the next five years. - Aditional information.

Include any additional information, charts, graphs, or other materials that support your business plan.

Secured and Unsecured Business Loans

Secured and unsecured business loans serve as pivotal financial resources for entrepreneurs, each with distinct features catering to different business needs. Understanding the nuances between these loan types is crucial for making an informed decision tailored to your business’s financial landscape.

Find out How to Starting

a small money lending business in the Philippines

What is a Secured Business Loan?

A secured business loan is fundamentally rooted in the concept of collateral. Essentially, it’s a loan where the borrower pledges an asset—like company-owned properties, equipment, or even inventory—as a guarantee to the lender. In the unfortunate event of a default, the lender has the right to seize and liquidate the collateral to recoup their losses.

The presence of collateral often acts as a safety net for lenders, making these loans less risky from their perspective. Consequently, secured business loans are typically accompanied by more favorable interest rates, extended repayment schedules, and generous borrowing limits. This makes them a particularly appealing choice for startups and emerging businesses that are just finding their footing in the market.

However, it’s noteworthy that lenders might impose collateral-specific charges, including but not limited to, valuation fees or registration costs. And while many financial institutions globally offer these loans, their conditions and stipulations can differ widely.

What is an Unsecured Business Loan?

Venturing into the terrain of unsecured business loans, these are extended to borrowers without the requirement of collateral. This absence of a safety cushion naturally raises the stakes for lenders, making these loans harder to secure, especially for businesses with a less-than-stellar credit record.

The inherent risk of unsecured loans often translates into higher interest rates, more stringent repayment terms, and lower borrowing ceilings when compared to their secured counterparts. Though these loans might seem less attractive at first glance, they do offer businesses the advantage of not risking their assets.

Given the risk associated with unsecured loans, traditional banking giants might be wary of offering them. Instead, these loans are often the domain of specialized private lenders. While they may not yet command the same market presence as established banks, their approval processes are usually more agile, and depending on the borrower’s creditworthiness, their rates can be competitive.

Start up Вusiness Loans Without Collateral in the Philippines

Below is a table detailing the various unsecured business loans from popular lenders and banks:

| Unsecured Business Loan | Loan Amount | Loan Term | Interest Rate |

|---|---|---|---|

| BPI & DTI Urgent Unsecured Loans | Contact BPI for loan details (via phone at 02 7918-2000 or email at bbclientservices@bpi.com.ph) | Contact BPI | Contact BPI |

| SME Express Loan | ₱500,000–₱5 million | 12, 18, 24, or 36 months | Monthly 1.30% to 1.75% depending on loan term |

| DTI Pondo sa Pagbabago and Pag-Asenso (P3) Program | ₱5,000-₱200,000 | For more details, call the SB Corporation hotline at (02) 8651-3333 | 2.5% monthly |

| Esquire Financing Inc. | Up to ₱10 million | Contact Esquire at (02) 8811-8888 for more details | Contact Esquire for details |

| Zenith Capital SME Loan | ₱500,000–₱20 million | Up to 12 months | Contact Zenith Capital at (02) 8636-5458 |

| Welcome Bank Business Loan | ₱50,000–₱3 million | Up to 3 years | Starting from 1.39% |

| UnionBank Business Loan | ₱50,000–₱1 million | Up to 3 years | 3% monthly interest |

| Blend PH Business Loan | ₱500,000–₱2 million | Up to 3 years | Depends on creditworthiness |

Learn All about

Starting a food business in the Philippines

The Distinction Between Term Loans and Credit Lines for Business loan

Understanding Term Loans

When businesses seek funds to invest in their growth or expansion, they often consider term loans. Think of a term loan as a commitment: the lender provides a lump sum of money upfront, and the borrower repays it over a specified period, in fixed installments.

Why Should Businesses Opt for Term Loans?

- This might include machinery, tech, or vehicles to boost operational efficiency.

- Expanding the physical footprint, be it through renovations or new constructions.

- For scenarios requiring a predictable and stable amount of cash.

Financial Specifics of Term Loans

Amount: Typically, loan figures oscillate between ₱100,000 and ₱20 million. The sanctioned amount is transferred as a one-time lump sum to the borrower’s account.

Duration: While short-term loans wrap up within a year, longer ones might stretch over 5 to 15 years.

Payment Structure: Regular monthly payments, encompassing both the principal and the accrued interest.

List of Term Loans for Startup Business loan in the Philippines

- BPI SME Term Loan

- Loan Amount: Minimum of ₱300,000

- Loan Term: Up to 5 years

- Interest Rate: Prevailing market interest rates

- Metrobank SME Term Loan

- Loan Amount: ₱1 million-₱20 million

- Loan Term: Short-term: Up to 360 days and Long-term: 2-7 years

- Interest Rate: “At competitive interest rates”

- Security Bank SME Business Mortgage Loan

- Loan Amount: Up to ₱30 million

- Loan Term: Up to 20 years (depending on Security Bank’s valuation)

- Interest Rate: 9.50% – 11.25% (depending on loan amount and fixing period)

- SSS Business Development Loan Facility

- Loan Amount: The lowest of the following: Requested loan amount, Total project cost, Loan value of the collateral, ₱500,000

- Loan Term: Up to 15 years

- Interest Rate: Prevailing SSS rates

- SSS ASENSO

- Loan Amount: Maximum of ₱5 million

- Loan Term: Short-term: 1 year and Long-term: Up to 5 years

- Interest Rate: Prevailing SSS rates

- LANDBANK Term Loan Facility for General/Small & Medium Enterprises

- Loan Amount: Inquire at the nearest LANDBANK Lending Center nationwide or call customer service hotline at (02) 8-405-7000 or at PLDT Domestic Toll Free 1-800-10-405-7000.

- Loan Term: Contact LANDBANK for info.

- Interest Rate: Contact LANDBANK for info.

- PNB Small Business Loan Program

- Loan Amount: ₱1 million-₱10 million

- Loan Term: 1-5 years

- Interest Rate: Contact PNB for info.

- HSBC Term Loan

- Loan Amount: Inquire at the nearest HSBC branch.

- Loan Term: Contact HSBC for info.

- Interest Rate: Contact HSBC for info.

Learn more information about

Online Business in the Philippines

Credit Lines for Startup Business loan in the Philippines

Imagine having a reservoir of funds, ready to tap into whenever required, without going through the loan application every single time. That’s essentially a credit line for you. It’s like having a safety net; you’re only charged interest on what you use.

When is a Credit Line the Right Choice?

- Seasonal Demands. Useful for replenishing stock or acquiring additional resources to cater to fluctuating demands.

- Operational Expenses. A perfect solution for day-to-day business costs.

- Addressing the gaps in cash flow due to delayed receivables.

- Project-based Financing. Especially when contracts are time-bound.

Financial Nuances of Credit Lines

Amount: Entrepreneurs typically have a bracket of ₱500,000 to ₱20 million to draw from. Once approved, the amount is funneled into a business checking account, making funds accessible via checks. Unlike term loans, credit lines have a more fluid repayment mode. Interest is tackled monthly, but the principal can be addressed as per the borrower’s convenience within the tenure.

Validity: A year is the standard duration, but yearly renewals are possible, contingent on the lending institution’s discretion.

List of Credit Line Options for Startup Business loan in the Philippines

- BPI SME Credit Line

- Loan Amount: Minimum of ₱300,000

- Loan Term: 1 year, renewable

- Interest Rate: Prevailing market interest rates

- Metrobank SME Credit Line

- Loan Amount: ₱1 million-₱20 million

- Loan Term: 1 year, renewable yearly (subject to the bank’s approval)

- Interest Rate: “At competitive interest rates”

- PSBank SME Business Credit Line

- Loan Amount:Minimum of ₱2 million (with real estate property as collateral) and ₱500,000 (with bank deposit as collateral)

- Loan Term: 1 year, renewable yearly

- Interest Rate: “At competitive SME Business Credit Line rates”

- First Circle Revolving Credit Line

- Loan Amount: Up to ₱5 million

- Loan Term: Up to 6 months

- Interest Rate: Starts at 1.39%

- Robinsons Bank Go! Small Biz

- Loan Amount: ₱500,000-₱20 million

- Loan Term: 1-year credit line

- Interest Rate: Prevailing Robinsons Bank rates

- Maybank Retail SME Loan

- Loan Amount: ₱500,000-₱50 million

- Loan Term: Up to 90 days PN term

- Interest Rate: Prevailing market rates

- PNB Revolving Credit Line

- Loan Amount: Inquire at the nearest PNB branch nationwide or call the customer service hotline at (+632) 8573 8888.

- Loan Term: Up to 365 days PN term

- Interest Rate: Contact PNB for info

- CBS SmallBiz Revolving Promissory Note Line

- Loan Amount: Up to ₱10 million

- Loan Term: Contact CBS for info.

- Interest Rate: Contact CBS for info.

To sum it up, while both instruments offer financial relief, the choice boils down to the business’s specific needs and its financial agility.

Opting for legit private lenders such as Digido over traditional banks for small business loans often proves advantageous due to a less stringent approval process, personalized service, and quicker fund disbursement.

Private lenders, on the other hand, typically have a better understanding of local market conditions and can provide more tailored solutions.

The expedited approval process with private lenders ensures that small businesses get the financial support they need in a timely manner, which can be crucial for capitalizing on market opportunities.

Benefits of Digido Lender:

Why do you need a Business Loan?

What are the reasons for getting an online loan in the Philippines? Why not just save money and then start your company once you have the capital?

The main purpose of borrowing money is time. It is better to start a business now when the prices of goods are still low. Here are the other reasons why entrepreneurs need a small business capital loan in the Philippines:

- To expand the business – if your company is earning, it is going to take some time to be able to save money to build a new branch. Business owners who are confident of their performance need a business credit so they can establish a new branch. It is in this case a small commercial capital loan will help you.

- To improve cash flow – some companies are strapped for cash, especially those whose success is seasonal.

- To invest in better marketing strategies – some firms need to invest in advertising. If they do not have enough funds to do this, they need money.

- To prepare your start-up for a large wholesale order.

- To finance daily commercial expenses, such as wages, rent and operating expenses during periods of low demand, reduced sales or lockdown.

Different businesses have different reasons to borrow money. Whatever the reason is, the financial institution will approve you if you have a good financial record.

Learn about

Top 15 Street Food Business Ideas in the Philippines

FAQ

-

Can I get a loan to start a business?Yes, it is possible, but most often with collateral or a guarantor. If you are just starting a business, getting a no-collateral loan in the first year of your company is very difficult. Lenders need a guarantee that the loan will be paid back.

-

How can I get a business loan in BDO?Yes it is possible if you meet the terms of the loan.

-

Is a business loan a good idea?It's a good option to get more opportunities for your business and expand your reach.

Digido Reviews

-

PaoAs a small business owner, I was in need of extra funds to grow my business and I researched business loan requirements in the Philippines. Digido service came in handy! I got the funds I really required for my business, and I couldn't be more pleased with the service.5

-

AnnaWhen my online shop hit a rough patch, I turned to Digido for an online business loan in the Philippines. The process was smooth, and in no time, I had the funds to restock. Highly recommend Digido for quick financial help!5

-

S. MarkoIf you need a loan with minimal application requirements, you can try Digido. It's a very simple application, and I was able to get cash I needed to invest in my business without any problems4

-

Junjun11So fast! The application process was quick and easy, and I got 10000 in my account within hours. Highly recommended!👍5

-

AntonyDigido assisted me when I lacked funds to cover bills and expenses for my small business. The application process for a non collateral business loan in the Philippines was quick and easy with Digido. Got my funds fast! Great service!5