Government Programs for SME Business Loans in the Philippines

Key takeaways:

- In the Philippines, you can take zero or low-interest SME loans for business purposes.

- There are several governmental organizations that offer business loans in the Philippines: Small Business Corporation, Agriculture Council, Department of Labor and Employment, and government-owned banks.

- You must provide an ID, business registration, financial reports, and proof of business activity to apply for a governmental loan.

- If you are not eligible for a governmental loan in the Philippines or need more funds, source for an online loan from Digido.

Table of Contents

According to a recent survey by Statista (1), half of the small Filipino businesses do not last longer than 1 to 5 years. Meanwhile, MSMEs (Micro-, Small, and Medium-sized enterprises) make up 99,6% of all the country’s businesses and provide locals with almost five million working spaces — almost 65% of total employment.

One of the biggest challenges of Filipino SMEs is the lack of funds. Sometimes, loans become the only way for many entrepreneurs to avoid going bankrupt. However, their lending practices often result in the endless circle of borrowing tiny sums, repaying high-interest rates (more than 20% per year), and reborrowing again. This usually happens because small businesses find themselves eligible for only the most unprofitable loans due to a lack of stable cash flow.

To fight this issue and support SMEs, governmental organizations release special loan offers with profitable repayment terms. In this article, we will consider government loans for small businesses in the Philippines available today and share the details of each.

- Fast approval in 5 minutes

- First loan with 0% interest rate

- Only 1 Valid ID needed to Apply

Benefits of Governmental MSME and SME loans in the Philippines

How else do you benefit from borrowing from the government — besides the fact you are definitely dealing with someone reliable?

Here is a quick list of advantages of an average governmental MSME/SME loan in the Philippines:

- Affordable interest rates. Sometimes, you pay no interest at all.

- Fair conditions. You sign a contract with transparent loan terms.

- Extra support. Some programs offer you consultancy services and organizational help.

- Grace periods. Some governmental SME loans in the Philippines don’t require immediate repayments.

Pondo sa Pagbabago at Pag-Asenso (P3)

For existing businesses from 1 year old that need help

Pondo sa Pagbabago at Pag-Asenso P3 (2) is an SME business loan program for micro-entrepreneurs with loans of 2.5% monthly interest rates. This initiative aims to protect business owners from digging themselves into a financial hole caused by informal lending.

Many Filipino entrepreneurs tend to borrow small sums with excessively high interest rates — from 20% for the whole period — from so-called 5-6 lenders (you borrow 5 pesos and return 6). Such loans are considered illegal but still remain popular.

The P3 program is supposed to solve this issue and provide businesses with loans of larger amounts and reasonable repayment terms.

| Who can apply? | Existing MSMEs operating for no less than one year, with an asset size of no more than ₱3,000,000 |

| What industries are eligible? | Most micro-entrepreneurs, including retail and wholesale merchants and sari-sari store/stall owners |

| How much can I borrow? | From ₱5,000 to ₱200,000, depending on the business size and the financial situation |

| Repayment terms | 2.5% monthly interest rate, maximum loan period of 24 months, quarterly repayments |

| Collateral | No |

Required documents:

- A filled-in application form

- A valid government-issued photo ID

- Business Registration

- Registration of the Business Name

- Barangay clearance for the past three months

- Proof of your company’s activity for at least one year

How to apply for a Pondo sa Pagbabago at Pag-Asenso P3:

Small Business Corporation (Sb Corp), the project’s owner, collaborates with chain and local microfinance institutions (MFIs). To apply, you need to visit one of these MFIs enlisted on the Sb Corp website.

Note: as a potential borrower, you might be interested in checking out case studies that Sb Corp regularly publishes on its YouTube Channel (3).

RISE UP Loan Program

For existing businesses in any industry

RISE UP Loan program (4) by Small Business Corporation includes several types of SME loans in the Philippines. The main features of these programs are low-interest loans with significant grace periods and convenient repayment terms. At the moment, they are available exclusively for existing businesses from 1 to 3 years old. As per the latest news (5), there will soon be introduced a similar program for startups.

RISE UP Micro Loan

This program is suitable for most small businesses as it doesn’t set too many specific requirements.

| Who can apply? | Existing micro and small businesses operating for no less than one year, with an asset size of no more than ₱3,000,000 |

| What industries are eligible? | Any |

| How much can I borrow? | Up to 20% of the asset size; the maximum amount is ₱300,000 |

| Repayment terms | 12% annual interest rate; the maximum loan period is five years, and the grace period is 12 months |

| Collateral | No |

Required documents:

- A valid government-issued photo ID

- Barangay Certification (if you borrow less than ₱100,000)

- BMBE Certificate (if you borrow more than ₱100,000)

- Photo and video evidence of assets and business operations

- Proof of your micro-enterprise activity for at least one year

RISE UP First Timers Loan

This loan program offers considerably large funding for small businesses who can prove their financial stability.

| Who can apply? | SMEs operating for no less than 3 years |

| What industries are eligible? | Any |

| How much can I borrow? | Up to ₱2,000,000 |

| Repayment terms | 12% annual interest rate; the maximum loan period is three years, and the grace period is 12 months for loans up to P300,000 |

| Collateral | No |

Required documents:

- A valid government-issued photo ID

- BMBE Certificate or Mayor’s Permit (if you borrow more than ₱100,000)

- Photo and video evidence of assets and business operations

- BIR-filed Financial Statement for the previous year with positive net earnings

Learn How to Get

Business Loans in the Philippines: A Comprehensive Guide to StartUp Loans

RISE UP Suki Loan

This program is for current participants of RISE UP or other Small Business Corporation programs. Within the program, borrowers can get an extra loan if they pay out the existing credit accurately and have a good standing.

| Who can apply? | Existing borrowers with a good credit reputation at Small Business Corporation |

| What industries are eligible? | Any |

| How much can I borrow? | Up to ₱5,000,000 for a non-collateral loan; up to ₱10,000,000 for a secured loan |

| Repayment terms | 12% annual interest rate; the maximum loan period is five years |

| Collateral | Requested for loan amounts higher than ₱5,000,000 |

Required documents:

- Proof of Sales

- Proof of Asset Value

- Financial Statement

- BIR-filed financial reports (if you borrow more than ₱3,000,000)

- Ownership and government valuation documents of your real estate (for collateral loans)

How to apply:

To apply to any of the three RISE UP programs, send your request via the official website, email communicationsteam@sbcorp.gov.ph, or Facebook group (6).

Get your first loan with 0% interest rate.

Calculate your pre-approved loan amount with Digido calculator:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

DOLE Integrated Livelihood/Kabuhayan Program

For people willing to start their business

The Kabuhayan government loan program for small business (7) is the initiative of the Department of Labor and Employment. It provides people with the initial investment into their startup projects. This way, the government gives citizens in need the opportunity to go into business, which will, in turn, lead to more working spaces.

The program does not imply getting an MSME loan. Instead, it provides eligible beneficiaries with grants that they won’t need to repay.

In return, a business owner will need to share 20% of their stock with the government. Another pitfall is that there has to be an approved business plan so it is not just a quick and simple money request.

Besides, the Kabuhayan program might also support existing businesses that need a financial boost as beginners or suffer from natural disasters.

| Who can apply? | Marginalized, disabled, seasonal workers, elderly people, women and youth, indigenous people, rebel returnees, displaced workers, and people with low wages |

| What industries are eligible? | Priority is given to agribusiness, health, and wellness, ecotourism, manufacturing, small transport, trade, sari-sari store/stall owners, and industries that make a difference for a particular local development |

| How much can I borrow? | Up to ₱20,000 as an individual and up to ₱1,000,000 as a group project with more than 50 members |

| Repayment terms | No repayment is implied |

| Collateral | No |

Note: you can’t enroll in the program if your project is related to micro-lending and construction works, or requires a purchase of motor vehicles.

Required documents:

- Application letter

- Confirmation that you are NOT a part of the 4Ps program

- Detailed project plan

- Your profile with a photo

However, you might need extra documents if you apply as a group or if the office where you apply requests them. See the detailed description of the process and a list of documents you might need.

How to apply:

You must visit the nearest DOLE office in your area.

Agricultural Credit Policy Council (ACPC) Loan Programs — KAYA and ANYO

For businesses or young entrepreneurs in the agriculture industry

ACPC (8) developed two whopping government loan programs in the Philippines. The point of both is to release loans with no interest or collateral for farming-related businesses.

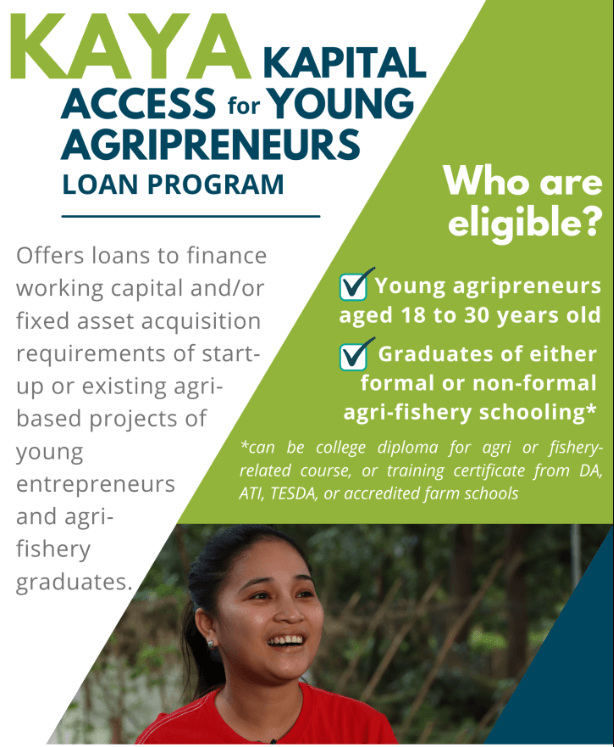

KAYA (Kapital Access for Young Agripreneurs)

KAYA is a zero-interest loan for young entrepreneurs from 18 to 30 years who already own a business or plan to create a startup in the agri-fishery industry.

| Who can apply? | 18 to 30 years old graduates of agriculture or fishery-related degrees, farm schools, courses, etc. who want to start their business or support the existing one |

| What industries are eligible? | Farming and agriculture |

| How much can I borrow? | Up to ₱500,000 |

| Repayment terms | 0% interest rate, but a lending partner can charge a one-time fee of 3.5% of the loan amount. The maximum loan period is 5 years. |

| Collateral | No |

Required documents:

- A valid government issued photo ID

- Basic Business Plan

- A certificate in training on Agri-Fishery

How to apply:

You need to visit one of the partner lending conduits; the list is available on the Agricultural Council’s website.

ANYO (Agri-Negosyo Loan Program)

ANYO is a loan for small farmers and fishers with registered enterprises.

| Who can apply? | Individual small farmers and fishers, registered agricultural businesses, and overseas Filipino workers |

| What industries are eligible? | Farming and agriculture |

| How much can I borrow? | Up to ₱300,000 as an individual and from ₱300,000 up to ₱15,000,000 as an enterprise |

| Repayment terms | 0% interest rate, but a lending partner can charge a one-time fee of 3.5% of the loan amount. The maximum loan period is 5 years. |

| Collateral | No |

Required documents:

The documents pack depends on your status as an entrepreneur.

For individuals:

- A valid government issued photo ID

- 1X1 photo taken no earlier than three months ago

- Registration/enrollment in the RSBSA (the Registry System for the Basic Sectors in Agriculture)(9)

For enterprises:

- Project Proposal

- Board Resolution

- Copy of registration documents

- Copy of the latest Audited Financial Statements

- DA Endorsement

- Registration/ enrollment with FFEDIS (Farmers and Fisherfolks Enterprise Development Information System) (10)

How to apply:

You need to visit one of the partner lending conduits — the list is available on the Agricultural Council’s website.

Livelihood Seeding Program/Negosyo Serbisyo sa Barangay

For all MSMEs, but mainly for those suffering from calamities

LSP-NSB (11) is not just about funding. The main goal of this program is to provide informational and organizational support for beginner entrepreneurs or existing businesses in need. Applicants can count on help with business registration, professional counseling, and helpful trading contacts.

The program also provides businesses with special aid kits.

| Who can apply? | All MSMEs, with priority given to those who suffered from natural disasters |

| What industries are eligible? | Any |

| How much can I borrow? | Up to ₱5,000 — ₱8,000 (in the form of an aid kit) |

| Repayment terms | No repayment is implied |

| Collateral | No |

Required documents:

- Business Name Registration or Barangay Permit

- Action plan

- Pledge of Commitment

Additionally, you have to visit business sessions organized within the program.

How to apply:

You need to address a Barangay SME Counselor or visit your local Negosyo center — the list is available on the Negosyo official website.

SWINE Lending Program from Landbank

For entrepreneurs in the swine industry

Government-owned banks can also offer some favorable programs; one of them is the SWINE by Landbank (12). As the name suggests, the program aims at the swine industry and is willing to support SMEs as well as large enterprises.

| Who can apply? | Businesses involved in the swine industry |

| What industries are eligible? | Pig breeding and meat production |

| How much can I borrow? | Up to 80% of the project cost |

| Repayment terms | 3% annual interest rate. The maximum loan period is three years. Grace period might be available upon request |

| Collateral | Real-estate or chattel mortgage |

Required documents:

- Project plan

- Certifications from BAI, DA RFO TWG, and LGU

- Other documents might be required depending on a particular organization — the full list is available at the bank’s website.

Lending Program for Former Rebels

For ex-rebels and their family members who want to start a business

Another Landback program (13) was designed especially for ex-members of the Communist Party and other revolutionary organizations.

| Who can apply? | Former rebels with no pending legal cases and their family members as co-borrowers |

| What industries are eligible? | Bakery, Barbershop/parlor, furniture making, repair shops, sari-sari stores, tailoring, welding, and agriculture |

| How much can I borrow? | From ₱25,000 to ₱100,000, but no more than 90% of the project cost |

| Repayment terms | 6% annual interest rate, monthly or quarterly repayments. The loan period may vary from 1 to 5 years. Grace period is 1 to 5 years |

| Collateral | Real-estate or chattel mortgage |

Required documents:

- A valid government issued photo ID

- Certificate Joint AFP-PNP

- Project Plan

How to apply:

You need to visit the LandBank’s department in your area; check out the list of offices.

Government Loan Program vs Private Loans: What To Choose?

Governmental support might be extremely helpful. However, there can be pitfalls you need to know about:

- Long wait. It might take up to several months until you receive an update regarding your application, let alone getting the actual funds.

- Limited amounts. Governmental funding is always limited and might not suffice for a particular project.

- Strict requirements towards businesses. Not every startup or existing business can obtain a loan: they must meet particular criteria.

- Plenty of paperwork. Sometimes, a list of documents you need to submit is overwhelmingly long.

It doesn’t mean that you shouldn’t try to apply for a business loan from the government. However, getting extra support from a reliable private lender can be reasonable as well. One such lender is Digido. Digido can provide you with a loan for business purposes on very affordable terms. If you are a first-time borrower, you can quickly receive up to P25,000 with 0% interest.

To Sum Up

Government loans in the Philippines are a perfect way to get help and avoid borrowing from fast-and-loose lenders. If necessary, they can be combined with loans from a trustworthy private organization and become a significant contribution to your business’s development.

FAQ

-

What type of businesses qualify for the loan?Generally, the eligible borrowers are MSMEs and SMEs, located in the Philippines and owned by Filipinos.

-

What risks are involved in taking a Philippine government loan?When you request a government loan in the Philippines, you are running a risk of a long period of approval, failing to qualify for a loan, or losing your property as collateral.

-

What documents are required for small business loan government programs in the Philippines?The list may vary depending on the program, but most require a personal ID, business registration, and the project plan.

-

Is there a 0% SME business loan from the government?Some programs offer zero interest-rates, for example, KAYA and ANYO.

-

How much can I borrow from the Philippines government?The amount depends on a particular government loan program and may reach up to ₱15,000,000 (ANYO program).

-

What advantages do governmental loans offer?The perks of receiving a state-funded loan are affordable interest rates, grace periods, fair conditions, extra management and education support.

Articles sources

- 1. Asia Business Tenure of Small Businesses by Country and Length

- 2. Pondo sa Pagbabago at Pag-asenso (P3)

- 3. YouTube Channel

- 4. BRS Small Business Corporation

- 5. SBCorp Unveils Start-up Loan at Tribune's AIF

- 6. Small Business Corporation on Facebook

- 7. Document on Scribd

- 8. ACPC Access

- 9. Finder RSBSA

- 10. FFEDIS

- 11. DTI LSP-NSB

- 12. Landbank Swine Lending Program

- 13. Landbank Lending Program for Former Rebels

Authors

Digido Reviews

-

AndresDigido came to my rescue when I needed financial assistance for my SME business loan after being rejected by banks. Their online loan application process was incredibly simple, and I received the funds on my bank card within just 10 minutes..5

-

MarkAwesome! I got my loan so fast and easy using only one id document. I got my loan with no problems, they don't cheat or hide the interest. 5 stars for the easy application 😊👍5

-

BayaniGovernment loan programs require a lot of documents, so I couldn't believe how easy it was to get funds here! With just one ID and a few other documents, I got approved for a loan with 0%. Getting a loan on my smartphone is super convenient. Big thumbs up!5

-

LuzWhen you need SME loans in the Philippines, and it's not a substantial amount, you can quickly obtain it through this app. I received the money instantly into my account with Digido. The fees are reasonable, and initially, it's interest-free - just make sure to pay on time!4