All About Holiday Pay Computation in the Philippines

Key takeaways:

- The rules for holiday payment are outlined in the Labor Code of the Philippines

- Holiday pay takes into account when a person is on the job on a regular holiday or a special day off

- All working Filipinos are entitled to vacation pay except for certain groups of citizens

- If an employee is in financial difficulty, he or she can always apply for a loan from Digido

Table of Contents

Sometimes company employees have to work on holidays, such as January 1 or April 1. In the Philippines, staff members are paid more money for this than for usual working days. That makes sense because when other people have a rest and enjoy their holidays, these specialists are working.

Let’s find out how vacation pay is calculated, when and to whom it is paid and what to do if you haven’t received your vacation pay.

What Is Holiday Pay

The payments made to employees to compensate for working on public holidays are called holiday pay.

The right to payments in the Philippines is enshrined in Article 94 of the country’s Labour Code (1) and is an important aspect of the corporate environment. The holiday pay not only rewards employees with additional income but also helps to increase productivity and enhance the well-being of working citizens.

The law states that employers must compensate an employee on certain dates despite their absence from work. It also guides computing holiday pay.

Who Is Entitled to Holiday Pay in the Philippines

The holiday pay is enshrined in the country’s law. It is entitled to all workers, irrespective of their age, period of service, and field of work.

However, there are categories of employees who are not eligible for additional payments:

- managerial employees

- people who personally serve another person or domestic workers (Kasambahays)

- workers of retail and service organizations with fewer than 10 permanent employees

- government employees

- management staff and officials

- members of the employer’s family who receive financial support from the employer

- employees who work on commission or contract

- Only 1 Valid ID needed to Apply

- Get up to PHP 25,000 in just 5 minutes

- Cash Loan Online Easy and Fast Approval

Special Employee Groups

There are specific groups of employees to whom the holiday pay rules apply differently than to others.

For every day that an employee is paid on a price-rate basis, they receive holiday pay by the average daily wage for the seven working days prior to the regular holiday. Payments may not be less than the minimum wage as defined by the law of the country of employment.

University and college teachers, as well as public school teachers, do not receive holiday pay during the semester holidays. But they are entitled to payments during the regular holidays that fall on Christmas Day.

Finally, holiday pay is paid to employees who work without regular holidays.

Holiday Pay Rules in the Philippines

In compliance with the Department of Labour and Employment (DOLE) (2), there are two sets of rules on how holiday payment is figured: one for regular holidays and the other for special non-working days.

📎 Types of Holiday Pay

For each type of holiday, the method of computing holiday pay is different. In the Philippines, there are two types of non-working days:

- regular (known also as legal) holidays;

- special non-working holidays.

The difference between the two types is significant. Regular holidays or legal holidays are the days on which specialists receive 100% of the daily rate despite being absent from work, provided they were not away on the working day preceding the holiday.

Conversely, on special holidays, employees are not paid if they do not work, but if they go to work, they are entitled to 130% of their normal daily rate.

In the Philippines, Proclamation No. 368 provides for ten regular holidays in 2024: (3)

| Date | Holiday |

|---|---|

| January 1st | New Year |

| March 28th | Maundy Thursday (Holy Thursday) |

| March 29th | Good Friday |

| April 9th | Araw ng Kagitingan (Day of Valor) |

| May 1st | Labor Day |

| June 12th | Independence Day |

| August 26th | National Heroes Day |

| November 30th | Bonifacio Day |

| December 25th | Christmas Day |

| December 30th | Rizal Day |

In 2024, the citizens will have eight special non-working holidays:

| Date | Holiday |

|---|---|

| February 10th | Chinese New Year |

| March 30th | Black Saturday |

| August 21st | Ninoy Aquino Day |

| November 1st | All Saints’ Day |

| November 2nd | All Souls’ Day |

| December 8th | Feast of the Immaculate Conception |

| December 24th | Christmas Eve |

| December 31st | Last Day of the Year |

Since there are two types of holidays, the amount of holiday pay and the way it is calculated are different. We will focus on this below.

📎 General Rule

According to the Labour Code, an employee is entitled to an additional 100% payment of their daily salary for working on a legal holiday. This means that since the same amount is added to the employee’s regular salary, the employee is entitled to double their daily salary. Put another way, they get a 200% payment.

The special working holiday pay in the Philippines is 30% of the daily rate in addition to the daily wages. In other words, the employee receives 130% of the daily wage for one day.

📎 Overtime on Holidays

People who work more than eight hours on a public holiday are entitled to overtime pay. Employees are paid 30% of their hourly rate for each additional hour worked. It makes no difference whether it is a regular holiday, when the worker is entitled to double pay, or a special holiday when 130% of the daily wage is paid.

📎 Extra Pay for Work on a Rest Day

An hourly employee receives 260% of their daily rate of pay if they worked on a legal holiday that coincided with a rest day.

An hour worked on a special non-working day that coincides with a public holiday is paid at 150% of the employee’s daily rate.

Weekend overtime is also paid at 30% of the hourly rate, regardless of whether the weekend is a regular or a special holiday.

📎 What to Do If You Haven’t Received Holiday Pay

If employees discover that they have not been paid for a holiday they have worked, they should contact the HR department or the accounting division of their company.

The worker should do the same in the case when the vacation pay has been incorrectly calculated.

What should I do if I don’t have enough money for urgent needs?

There are a lot of ways to get financial assistance, such as online cash loans. Digido provides financial relief to many Filipino employees who struggle with their finances. You can borrow from PHP 1,000 to PHP 25,000. Additionally, the loan application is very easy. You can apply anytime and anywhere through the Digido website or mobile app.

Calculate your pre-approved loan amount with Digido calculator and Get your loan with 0% interest:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

Learn all about

Holiday overtime pay in the Philippines: How to calculate it

How to Compute Holiday Pay in the Philippines

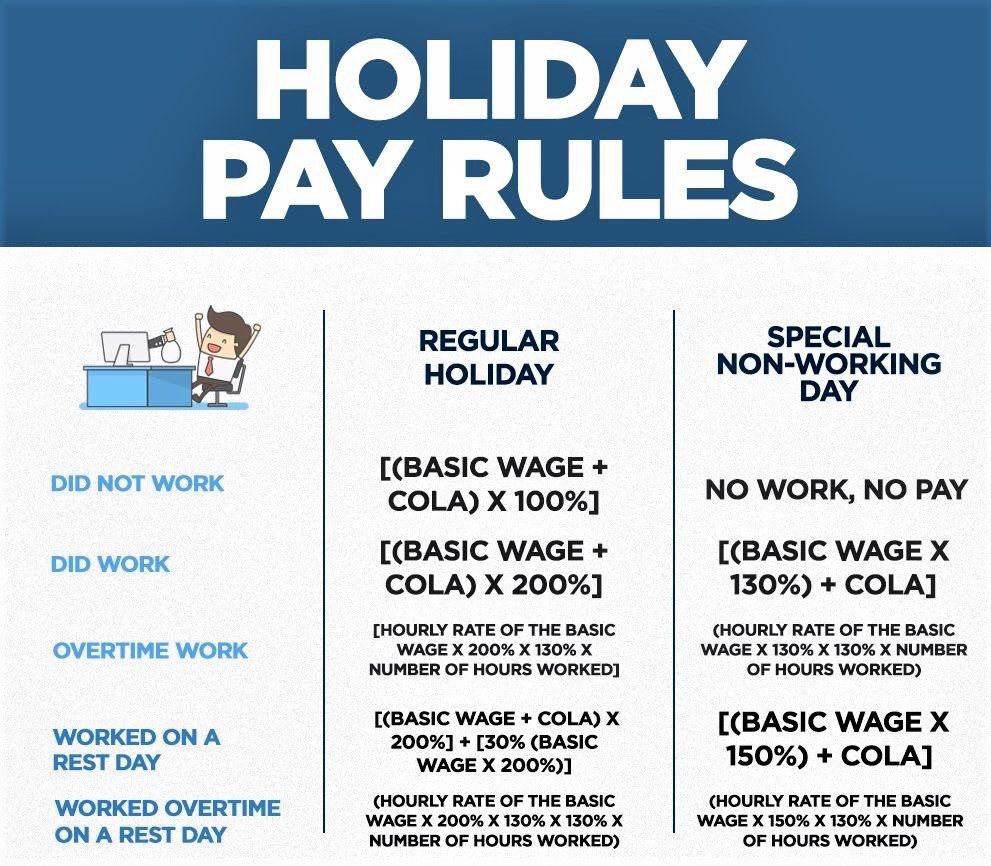

To see more clearly how holiday pay is calculated, we have gathered all the formulas into a table.

Note that the calculation refers to the COLA (Cost-of-Living Allowance).

It is an extra payment added to an employee’s salary to help compensate for the effects of inflation on necessary living expenses like food, housing, clothing, and transportation.

This adjustment is typically determined by changes in the Consumer Price Index, which measures changes in the cost of goods and services over some time. It’s important to remember that not all companies include a COLA in their compensation plans.

| Conditions | Regular holiday pay computation | Special holiday pay computation |

|---|---|---|

| The specialist did not work | Basic pay + COLA (Cost of Living Allowance) х 100% | No payment, unless stated otherwise in the employee’s contract or Collective Labor Contract |

| The specialist worked | (Basic pay + COLA) x 200% | (Basic pay x 130%) + COLA |

| The specialist worked overtime | Basic per-hour rate x 200% x 130% x amount of hours worked | Basic per-hour rate x 130% x 130% x amount of hours worked |

| The specialist worked on a rest day | (Basic pay + COLA) x 200% + [(Basic pay x 200%) x 30%] | (Basic pay × 150%) + COLA |

| The specialist worked overtime on a rest day | Basic per-hour rate x 200% x 130% x 130% x amount of hours worked | Basic per-hour rate x 150% x 130% x amount of hours worked |

Examples of Holiday Pay Computation

To better understand how holiday pay is rated in the Philippines, let’s look at some examples.

📎 Computation of Regular Holiday Pay

If you don’t come to work on a legal holiday, you will still be paid a full day’s payment (100% of your salary). For example, if your daily rate is Php 900.00, that’s what you’ll receive.

You will be paid a double sum if you work on a regular public holiday, for example, April 9. In this case, the first eight hours will be paid at 200%.

📌 The calculation formula for a regular public holiday: (Basic Pay + COLA) x 200%.

If your daily rate is Php 900.00, multiply this figure by 200%. The result is Php 1,800.00.

If you work more than eight hours on a regular public holiday, you will be paid an additional 30% of your per-hour wage for each additional hour worked.

📌 The calculation formula for more than eight hours on a regular public holiday: Basic time wage x 200% x 130% x amount of hours worked.

Let’s say you worked three hours of overtime at an hourly rate of Php 150.00, for a total of 11 hours of overtime). Calculate using the formula: 150 x 2 x 1.3 x 11. This comes to Php 4,290.00.

You should receive 30% of your 200% salary plus your 200% salary if you worked on a legal holiday that was also a weekend day (such as Saturday or Sunday).

📌 The calculation formula for a regular holiday that fell on a weekend day: (Basic salary + COLA) x 200% + [(Basic salary x 200%) x 30%].

So, for a daily rate of Php 900.00, the calculation would be (Php 900 x 2) + [(Php 900 x 2) x 0.30]. This comes to Php 1,800.00 + Php 540.00 = Php 2,340.00.

You will be paid an additional 30% of your per-hour rate if you work more than eight hours on a legal public holiday that coincides with your day off.

📌 The calculation formula for a regular public holiday that falls on a day off: Basic time wage x 200% x 130% x 130% x amount of hours worked.

If you worked an extra three hours (i. e. 11 hours in total), at an hourly rate of Php 150.00, we calculate it as 150.00 x 2 x 1.3 x 1.3 x 11. This comes to Php 5,577.00.

📎 Computation of Special Non-Working Holiday Pay

For those who don’t work on a special holiday, there is a “no work, no pay” policy. The exception is if the employee and employer have a collective bargaining agreement (CBA) that provides for payment on a regular holiday.

If you have worked eight hours on a special holiday, an additional 30% must be added to your regular daily rate.

📌 Special working holiday pay rules: (Basic pay x 130%) + COLA.

For example, if your daily rate is Php 800.00, your holiday pay would be Php 1,040.00 (Php 800.00 x 1.3).

An additional 30% of your basic time wage is paid for working more than eight hours on a special day.

📌 The calculation formula for working more than eight hours on a special day: Basic time wage x 130% x 130% x amount of hours worked.

So if you worked two hours overtime, your total work time is 10 hours. Knowing that one hour of work costs Php 100.00, calculate your holiday pay: 100 x 1.3 x 1.3 x 10 = Php 1,690.00.

For the first eight hours of work on a special non-working day, which is also your day off, you are entitled to an additional 50% payment of your basic rate.

📌 The calculation formula for a special non-working day that coincides with a day off: (Basic salary × 150%) + COLA.

For a basic salary of Php 800.00, your holiday pay is calculated as follows Php 800.00 x 1.5 = Php 1,200.00.

You will receive an additional 30% of your hourly rate of pay for each hour worked if you have worked more than eight hours on a special non-working day which falls on your rest day.

📌 The calculation formula for each hour worked beyond the standard eight hours on a special non-working day that falls on a rest day: Basic time wage x 150% x 130% x amount of hours worked.

If you have worked two extra hours (10 hours in total) at the hourly rate of Php 100.00, your pay will be calculated as follows: Php 100.00 x 1.5 x 1.3 x 10 hours = Php 1,950.00.

Conclusion

The holiday pay rules protect the rights of employees who are entitled to compensation for working on holidays. The computation for a special working holiday is different from the one for a special non-working day. As for legal holidays, they also have a different payment scheme.

There are also certain before and after holiday pay rules in the Philippines. Knowing how payments are calculated, each specialist can compute their entitlement. If it does not match the size of the payment, the employee may contact the accounting or human resources department.

FAQ

-

Are all employees eligible to receive vacation pay?Yes, this payment is entitled to all working citizens of the Philippines. The only exceptions are government and managerial employees, domestic workers (Kasambahays), etc.

-

Do employees have a duty to work on holidays?Yes, a hirer may ask an employee to work on a public holiday under Article 94(b) of the Labour Code of the Philippines.

-

Are temporary workers entitled to holiday pay?Yes, they are, but only if they are not on the list of those who are not eligible for additional payments.

-

How much will an employee be paid if their shift starts on a regular holiday and ends on a workday?Under the Labour Code, extra pay is only payable for hours worked on a regular public holiday.

-

If an employee is off before a holiday but comes to work on the holiday, will they be paid?Yes, the employee will receive all payments for working on a holiday, even if they did not work before the holiday.

-

How to compute special holiday pay?An employee receives 30% of the daily rate in addition to the daily wages, i. e. the payment is 130% of the daily wage for one day.

-

How to compute regular holiday pay?In case of a regular day off, the worker’s daily payment is doubled, i. e. they get 200% of their daily wage.

-

Are employees entitled to holiday pay if they are on probation?Yes, probationers are subject to the same rules as other employees.

-

Is vacation pay taxable?Yes, only those who earn the minimum wage amount are exempt from tax.

Authors

Digido Reviews

-

IanThank you Digido. This app is very helpful in times of emergency needs. Easy to apply and disbursed in my account. God bless you.5

-

DanicaSuperb App. It is very easy and fast approval. it's my second loan since the last time. Very happy to apply for this app. Highly recommended.5

-

MariaEven with the extra cash from my special holiday pay, I found myself in a tight spot this month. Thankfully, this app always in my phone to help. The loan was approved and disbursed within minutes, ensuring I didn't fall behind on my bills.4

-

EllaVery fast! Its really for emergency purposes!5

-

ElenaI was worried that my special working holiday pay in the Philippines wouldn't cover an emergency expense and that's when I tried applying for a loan on this site. It was easy to fill short form and i got money quickly, without the need for extensive documentation! Very nice!5

-

DerickThis loan app is very convenient to use, easy to borrow cash especially during Petsa de peligro or anytime you need money. Easy to repay with low interest rate.4

-

RicardoI've relied on Digido for years for their financial services. Recently, I needed info on special working holiday pay rules for our accountants and found it right on their site. Their finance experts and authors always deliver valuable content.5

-

CharieAmazing! So easy to loan and approval is very fast only a minute. That's why I rate this with 5 stars.5