Coins Payments Guide in the Philippines

Key takeaways:

- Coins.ph is a convenient way to make a payment online in the Philippines.

- You can use Coins.ph to pay your Digido loan.

- You will find detailed instructions in this article.

Coins.ph is a platform where you could buy coins like Bitcoin, Ethereum, and many other types of coins. Over some time, it has evolved and now it is also a payment processing system for paying your bills in the Philippines. Today, we will talk about the Coins.ph bills payment and show you what different sorts of bills you can pay with this online platform.

→ Also learn more about Dragon Loans App

How to Pay a Digido Loan Using Coins.ph

Digido offers Filipino citizens innovative financial solutions that help them get a quick loan at any time of day or night. Digido is a legal, government-licensed lender that gives loans 24/7.

Digido is a fully automated lender. You can apply for a personal loan up to PHP 25,000 at any time through our website. Our loan approval rates are as high as 95% and the loan is disbursed within a few hours. We offer a wide range of repayment options. For example, you can make repayments using Coins.ph.

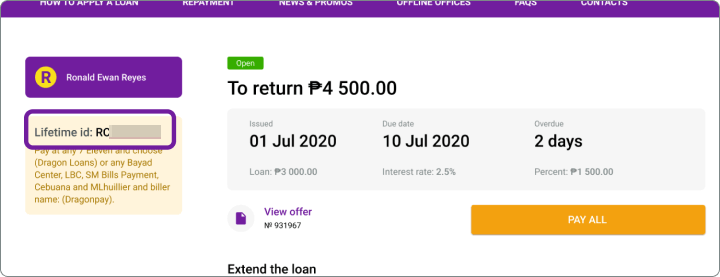

To understand how to pay a Digido loan at Coins.ph you need to know your Lifetime ID.

Everyone who has ever borrowed from Digido has this. You will see your Lifetime ID in your personal profile on the Digido website. It consists of three letters and five numbers.

1. Login to Coins.ph app and click “Pay Bills”.

2. Then select “Loans”.

3. Then enter all the required information.

4. Then press “Confirm”. You will also receive an SMS confirmation with your Coins.ph invoice receipt.

Congratulations! Now you know the answer to the question “Can I pay my Digido loan via Coins.ph”. It turns out to be very simple.

→ Learn about Fast Loan in 15 Minutes

Coins.ph is like any other online payment processing system. But even if you can buy coins, it is not exactly a trading platform.

To start, you go to the website and sign up for an account. From there, you can buy coins from the system. Once you buy a coin, the next thing you want to do is to wait until the coin price surges.

For the payment system, however, you need to add funds to your Coins.ph account. You can do this in several ways.

Here are a few examples:

- Palawan Pawnshop;

- Western Union;

- M Lhuillier.

For these payment systems, you have to go to a physical establishment and hand over your cash. You will have to sign a form to let them know that you are funding your Coins.ph account.

The other methods you can use are online bank account or transfer, over-the-counter banking, and e-wallets such as PayMaya and GCash. You cannot add funds to your Coins.ph account via PayPal as of now.

Once you have added funds, your money will reflect in our Coins.ph account in peso. Your account has several balances in it, and the different balances are the following:

- PHP – Philippine peso;

- Coins such as BTC, Ethereum, XRP, BCH.

You can move these balances from one kind of coin to another, or even from coin to peso. However, you have to know that the price you pay depends on the money you get. Moving one balance to another has a fee. Also, there is a trade difference that you have to account for.

Need Quick Cash? Apply now with just 1 government valid ID! Calculate your pre-approved loan amount with Digido calculator:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

→ Read about 7-Eleven bills payment charges

What Bills Can I Pay with Coins.ph?

There are many Coins.ph bills payment businesses that you can choose from. We will not list all of them here, but give you several examples:

- Electric bill – you can pay Meralco, Davao Light, Cotabato Light, and some more;

- Broadband – accepts payments for Globe, Converge, Sky, and Smart;

- Cable channels – accept payments from Cignal, Verdant W-Tribe, etc.;

- Donations – use this if you want to help charitable organizations like Caritas Manila, Gawad Kalinga, and many more;

- Exchange – this is the payment system if you want to buy coins from the platform;

- Government – pay our NBI clearance, PAG-IBIG, and NSO documents;

- SSS Contributions.

There are many more choices like Home Credit, Insurance, Stocks and Securities, Telecom, and Water utilities. You can also pay our credit card bills from here if you want to.

The ones mentioned above are the major categories. There are many different companies under each category. You have to create an account to be able to see all the various types of business establishments that you can pay for.

Take note that not all Philippine businesses can be paid through this system. Only those that partner with the company will accept payments through it. If your biller is not in the Coins.ph system, then, unfortunately, you cannot pay them via this platform – you have to check out other systems like Bayad Center if your biller takes payment from them.

→ Learn more about Easy Loan For Unemployed

→ Do you know how to get easy loan online with no bank account?

How to Pay Bills Online with Coins.ph?

- The first step that you have to do is to sign up for an account and then fund that account. Earlier, we have already discussed several methods by which you can add funds.

- From there, just go to your dashboard and then click on “Pay Bills”.

- From here, you will see a list of the billers. The first step is to choose the type of bill you want to pay from a drop-down called “Bill Type”. This is where you will choose the categories such as electric utilities, credit card, broadband services and more.

- The next step is to go to the drop-down called “Company Name”. It is here that you will choose the actual name of the company that you want to pay. Then, type the amount of what you want to pay. This is expressed in peso, not in coins.

- The next step is to type your account number. This number depends on how your biller recognizes accounts. For phone bills, the system will ask you for your phone number and your account number.

- Once all inputs are done, you can now click on the button that says “Pay Bill”. If something is wrong, you will receive a warning, and then you’ll have to re-type the info on the screen.

Take note that the Coins.ph bills payment charges vary from one company that you pay to another. Some may cost you only ₱10, and some can reach ₱50 or higher.

→ Useful information about 24 hour emergency payday loans

Coins.ph Payment Charges and Rebates

There is a current promotion called Coins.ph Bills Payment Rebate. In this process, you will receive a 10% rebate for your first ₱2,000 payment for a load. From there, you will receive only 5% for your phone loads.

For bills, the company offers ₱5 for every unique bill that you pay. On top of that, you will also get ₱100 if you pay 5 unique bills on a weekly basis.

- Enjoy 0% interest on your first loan

- We approve 95% of loan applications

→ Learn about Loyalty Cards in the Philippines

FAQ

-

Where can I deposit coins in the Philippines?You can cash in to your Coins.ph Wallet in 7-Eleven, TouchPay, Globe GCash, M Lhuillier ePay, Palawan Express Pera Padala,Cebuana Lhuillier and Bayad Center.

-

Is Coins PH safe and legit?Yes, Coins.ph is safe and trusted and regulated by the Bangko Sentral ng Pilipinas (BSP) as a licensed Virtual Currency Exchange, Electronic Money Issuer (EMI), and Remittance and Transfer Agent (RA).

-

Can I use coins PH without Internet?Internet is required to use Coins.ph.

Authors

Digido Reviews

-

StephenFast and easy to use. Only for emergency for me5

-

AldrinI really recommended this site of fast loan and 0% interest and low processing fee, not the other.4

-

EdHighly recommended. App is easy to use. Good customer service, fast result, easy to pay & fair to their charges.4

-

LannieDigido so excellent, I really love it. It helps me in times of my emergency needs, disbursement in just a minute. Thank you so much Digido i really like your apps. Now i can borrow up to 7k for 30days long term. I highly recommended this loan apps. So much help for me.5

-

CarmelaOne of the best loan app ever, less interest and fast approval. Thank you Digido, more blessings.4