Best Loyalty Discount and Reward Card for Filipinos 2024

Key takeaways:

- Loyalty cards are another popular way to earn rewards and benefits in the Philippines.

- Different loyalty cards offer various rewards and benefits, so it’s important to choose one that suits your spending habits.

- If you’re in a physical location, simply ask a staff member about the loyalty card program.

Table of Contents

For shopgoers, owning more than one loyalty and reward card is not uncommon. From grocery, clothing, or other essential stores, they will surely have a card ready for swiping to avail of various fancy rewards. Of course, who doesn’t want discounts and freebies?

But have you ever wondered why these shops give their customers rewards and loyalty discount cards? What are they for, anyway? But most importantly, which cards are the best to keep or have in your wallet?

What are Reward, Membership, and Loyalty Cards in the Philippines?

Reward, membership, and loyalty cards are popular marketing tools used by businesses in the Philippines. These cards give incentives to customers so they will make repeat purchases.

These cards may offer a variety of benefits such as special promotions, exclusive discounts, and reward points for frequent purchases. Some businesses in the Philippines use physical cards offered to their customers. While others use digital loyalty programs accessible through mobile apps or online platforms.

- Get up to PHP 25,000 in just 4 minutes!

- Only 1 Valid ID needed to Apply

- First loan with 0% interest rate

Best Loyalty Card Philippines in 2024

Here are the best and most popular loyalty cards in the Philippines that you can avail of in 2024:

SM Advantage Card (SMAC)

Offered by SM Supermalls, SMAC works with all participating SM Retail stores, including:

- SM Supermarkets

- SM Hypermarkets

- SM Savemore

- SM Retail-owned stores

How do they work?

For every PHP 200 spent using the card, cardholders will earn 1 reward point.

You can earn points at the following stores:

The SM Store, Toy Kingdom, Ace Hardware, Uniqlo, Pet Express, Sports Central, Innisfree, The Body Shop, Forever 21, Simply Shoes, W Department Store, Adidas, Nike (inside SM Supermalls), New Balance (SM Aura Premier), Under Armour, Sfera, Crocs, Bata, In Good Company, Kultura, SM Cinema, IMAX Theatre, SM Bowling & Leisure Center, SM Skating SM Storyland

And you can earn 1 point for every 400 PHP spend at these stores:

SM Supermarket, SM Hypermarket, Savemore Market, Alfamart, Waltermart, SM Appliance Center Watsons, Our Home, Surplus, Mindpro Supermarket, Baby Company, Crate & Barrel, Levi’s (inside SM Supermalls), Miniso

The card also allows you to earn points for every PHP 200 spent at the gas station or when you buy goods at Shell Select and by making reservations at a certain partner hotel. You also earn points when you bill for PLDT Home services.

| Cardholders will earn 1 reward point for every: | |||

|---|---|---|---|

| Entertainment | P200 spent | ||

| Hotels | P200 spent | ||

| SM Store and other retail partners | P250 spent | ||

| SM Markets and selected retail partners | P500 spent | ||

SMAC members can be eligible for a SMAC Prestige membership if the following criteria are met:

- A SMAC active member

- Has spent a cumulative of at least P150,000 within the current calendar year at The SM Store and other SM Retail Partners

Higher tier cards SMAC Prestige (1) offer more exclusive benefits such as exclusive discounts, priority lanes and checkouts, and access to the SM Prestige Lounge.

How to apply:

Apply in-store at any participating SM Retail stores. You can also apply online through the SM Advantage website (2). Basic personal and contact information should be provided. A 5-year membership costs only 200 pesos.

Benefits and features:

- Earn rewards points for every purchase made at over 1,000 participating SM Retail Inc. establishments

- Redeem rewards points for a variety of products, discounts, and more

- Access to exclusive promotions and discounts

- No expiry date for rewards points

- The card also serves as an identification card, allowing cardholders to access special events and promos.

Mercury Drug Suki Card

Mercury Drug Corporation, the largest chain of drugstores in the Philippines, also offers a loyalty card to its customers – the Suki Card. This card can only be used at Mercury Drug stores in the country.

How do they work?

For every P200 spent using the card, cardholders will earn 1 reward point.

How to apply:

To avail of a Suki Card, you must be 18 years old or above. You can apply online through the Mercury Drug website. Wait for 3 working days, then you can pick up your card at your preferred Mercury Drug store. Upon claiming, present a cumulative or single Mercury Drug receipt worth P1,000.

Benefits and features:

- Suki Card is transferable – it can be used by another person.

- Cardholders may earn Suki Extra Points on selected products from time to time

- You can also redeem rewards points for a variety of products, discounts, and more, and have an access to exclusive promotions and discounts

- The card is free.

Need Quick Cash? Apply now with just 1 Government valid ID. Calculate your Pre-Approved loan cost and click ‘Apply Now’:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

Learn about

Senior Citizen Discount and Benefits

Robinsons Go Rewards Card

Robinsons Go Rewards card also allows customers to earn points for every purchase made at any participating Robinsons stores and Robinsons’ over 2,000 partners, including:

- Shopwise

- Handyman

- Daiso Japan

- Toys R Us

How do they work?

The conversion rate varies per Earn Partner. Some examples are:

- Handyman – 1 reward point for every P200 spent

- Robinsons Supermarket – 1 reward point for every P400 spent

- The Marketplace – reward point for every P250 spent

How to apply:

You can avail of a card at any Robinsons Retail Group Store at the Point of Sale (POS) Terminal. Just present your valid ID, and pay a minimal fee of P100.

Benefits and features:

- You can earn rewards points and redeem the points for vouchers, gift certificates, discount codes, freebies, coupons, and more

- Go Rewards Card can be linked to the Go Rewards app for easy tracking of points, and for regular updates on the latest promos

- You can also use your points to pay for your transaction at any participating Robinsons stores and Redemption Partners

Jollibee HappyPlus Card

Jollibee HappyPlus Card can be used exclusively at Jollibee and other Jollibee-owned restaurants, including:

- Chowking

- Greenwich

- Red Ribbon

- Mang Inasal

How do they work?

For every P50 spent using the card, cardholders will earn 1 reward point.

Conversion: 1 HappyPoint = PHP 1

How to apply?

Customers can purchase a Jollibee HappyPlus Card “Welcome Kit” at any participating Jollibee or Jollibee-owned restaurant nationwide for only P100. Then, they can register online or via SMS. For details, please visit the HappyPlus website.

Register your card in 2 ways:

- Jollibee website (3)

- SMS registration

Visit any participating store nationwid and ask to load your card. Touch your card to the card reader. Wait for your confirmation slip. The minimum download amount is 100 PHP, the maximum is 10,000 PHP. You can now place your order and then pay with a happyload.

Find out which

The Best Ipon Challenges in 2024

- You can earn rewards points for every purchase made at Jollibee and other Jollibee-owned restaurants, and redeem your points for a variety of food items, drinks, discounts, and more.

- You can access exclusive promotions and discounts at participating Jollibee and Jollibee-owned restaurants.

- You get the convenience of cashless payment at all participating stores.

- The card is valid for 3 years.

7-Eleven CLiQQ Card

7-Eleven CLiQQ Card (4) can only be used at 7-Eleven stores in the Philippines.

How do they work?

For every P50 worth of physical goods purchased using the CLiQQ wallet credits, you will earn 1 reward point. But if you pay in cash, P100 spent equals 1 reward point. Payments for services like Bills Payment do not apply to the points-earning system.

How to apply?

You can get a 7-Eleven CLiQQ Card by visiting a 7-Eleven store and completing the necessary registration process . The card is free of charge and can be used right away after your registration.

Benefits and features:

- You can earn rewards points for every purchase made at 7-Eleven stores and redeem the points for a variety of products, discounts, and more.

- You can have an access to exclusive promotions and discounts

- No expiry date for rewards points as well.

- You can also use their 7-Eleven CLiQQ Card to pay for purchases at 7-Eleven stores, so you don’t need to carry cash.

- You can send points to your friends so that they can receive rewards. You can also give and receive rewards as gifts.

Petron’s Value Card

Petron, one of the largest oil refining and marketing companies in the Philippines, also offers a loyalty program, the Value Card

This card can only be used at Petron service stations and select partner establishments in the country. You can find a complete list of partners on the Petron website (5).

How do they work?

Earn points every time you buy Petron fuel, lubricants.

Get 1 point for purchasing 5 liters of Petron Xtra Advance, Petron XCS and Petron Diesel Max and get 1.5 points for each purchase of 5 liters of Turbo Diesel or Blaze 100.

Earning points vary if you buy Petron Fuel, Lubricants, or Gasul/LPG.

- 1 point for every 5-liter purchase of Xtra Advance, XCS and Diesel Max

- 10 points for every 1-liter purchase of Premium lube products

- 10 points for every 11-kg purchase of Gasul Elite and Gasul LPG product

Value of 1 Point = Php 1.00

How to apply:

You can get a Petron Value card for only 100 pesos at any Petron gas station nationwide. Get a Petron Value Card by visiting a Petron service station and completing the registration process.

Benefits and features:

- Earn rewards points for every fuel purchase made at Petron service stations and redeem these for a variety of products, discounts, and more.

- You can access exclusive promotions and discounts at Petron service stations and select partner establishments.

- Free Towing and Roadside Assistance (subject to the terms

- Year-round Personal Accident Insurance (subject to the terms

- You can also use Petron Value Card to pay for your fuel purchases at Petron service stations.

- The card can also be linked to your Petron credit card, allowing you to earn rewards points for your credit card purchases.

Loyalty Programs for Bank cardholders

Many corporations that provide banking and financial services also offer rewards programs. First, you must have a bank credit card. Check if your bank has a rewards system. Some bank cardholders can activate their membership online through the company’s website.

For example, Citibank, a multinational banking and financial services corporation, offers the Citi Rewards Card. This card also earns points on purchases made with Citi partners, including Cathay Pacific, Adidas, CASIO, Swarovski, Bulgari and other luxury brands

Benefits and features:

You can earn rewards points for every purchase made at over 8,000 partner brands, and redeem them for a variety of products, discounts, and more

You can also have an access to exclusive promotions and discounts

Use your points to earn cash credits, merchandise, gadgets and more including travel, shopping, dining, and entertainment experiences.

The card is linked to a Citibank credit card, allowing you to earn rewards points for your credit card purchases. Earn points for every spend anywhere, including online shopping and food delivery. For every PHP 30 spent using the card, cardholders will earn 1 reward point.

The Rewards Card is also available from BDO Bank. If you have a BDO Credit Card you can activate your membership by visiting the BDO Rewards website or calling the BDO Customer Service Hotline.

The BDO Rewards Card offers points for purchases made at BDO partners such as: Alfamart, SM Supermarket, Our House, Miniso and Watsons. For every 200 PHP spent with the card, cardholders get 1 bonus point.

You can redeem bonus points for a variety of products, discounts and more, and have access to exclusive promotions and discounts.

Learn more about

BDO Credit Card guide

Top 3 Best Loyalty App in the Philippines

If you are looking for the best loyalty card apps, here are the top 3 cards apps that you can download to your Smartphone:

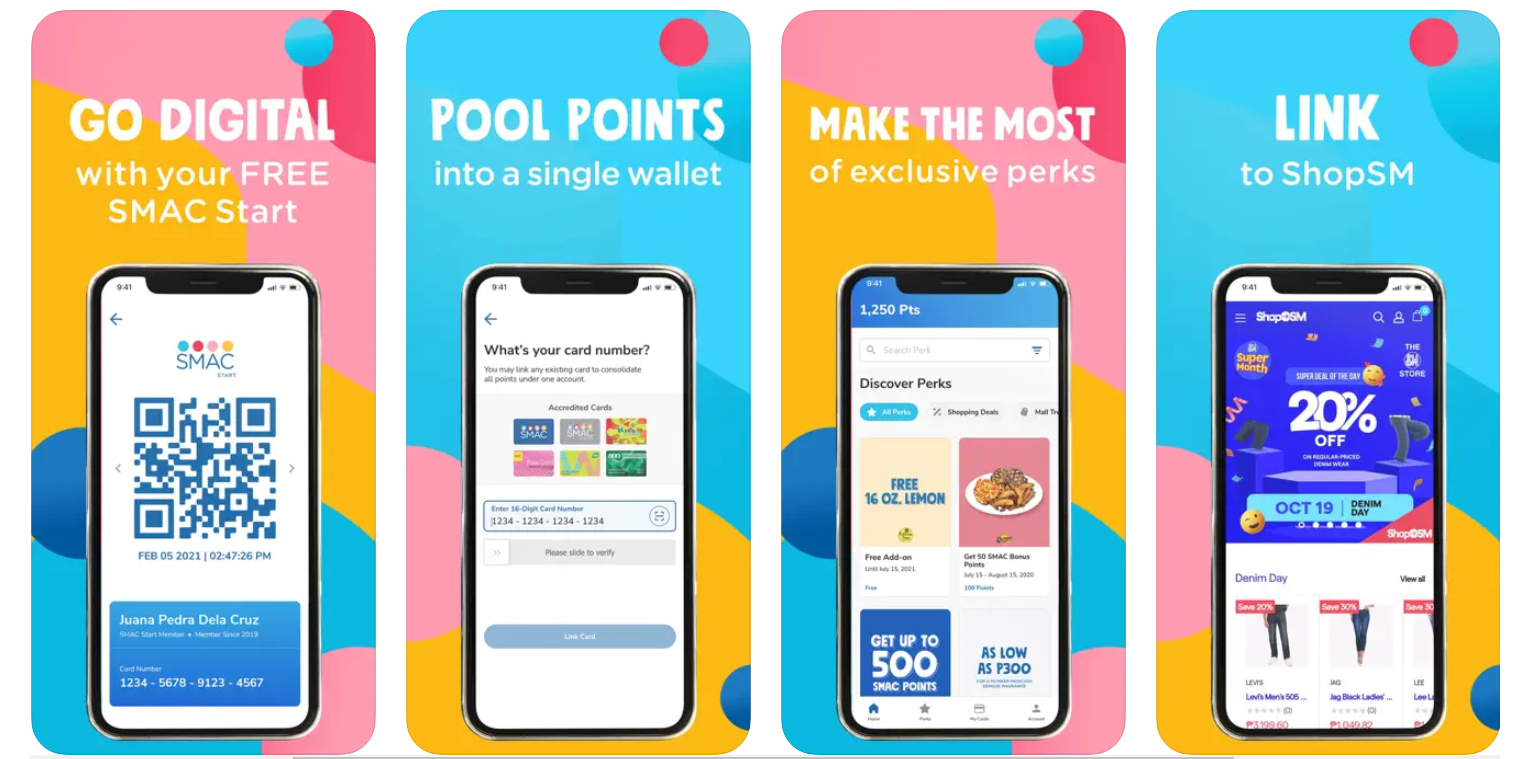

1. SMAC PH

SM Advantage app users can view and track their reward points, exclusive discounts, and freebies that can be redeemed from shopping at SM Malls.

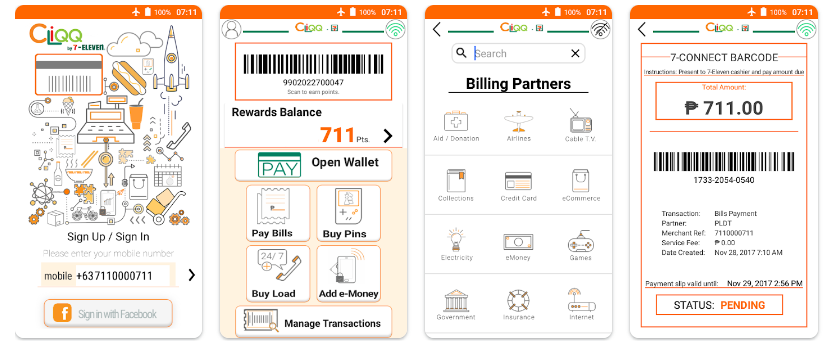

2. CLiQQ by 7-Eleven

Users of CLiQQ app can view and track their reward points. They can also use the app for payment purchases. It also features games and contests that they can participate in to earn additional rewards and have fun at the same time.

Learn more Information about

7-Eleven Payment Services Guide

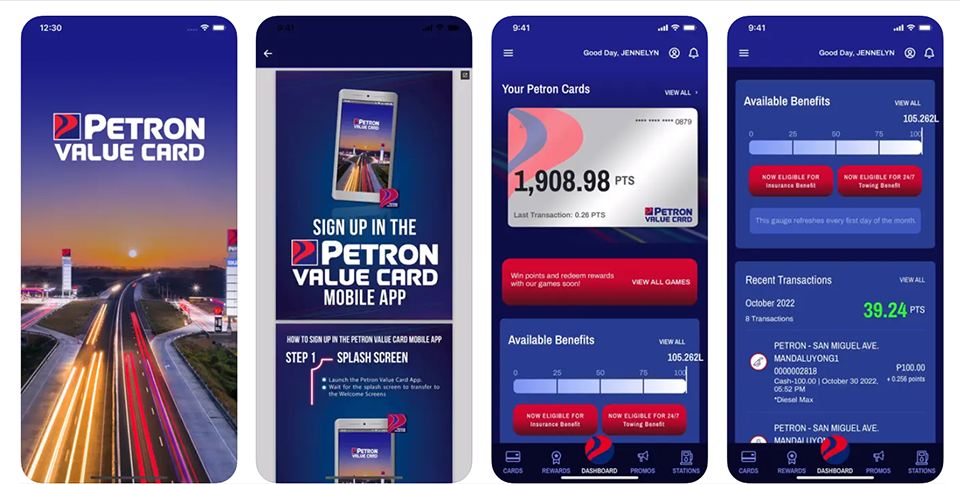

3. PETRON Value Card

Users can avail of fuel exclusive discounts in the app, track their earned points with real-time updates, and have a payment option for their fuel purchase. They can also use such app tools as a station finder and fuel mileage calculator. Members also get specialized access to personalized offers and rewards, and can even use their points to pay for tickets on 3 major airlines – Philippine Airlines, AirAsia and Cebu Pacific.

How can I get rewards fast?

Use your loyalty card regularly, and make it a habit of using it for eligible purchases. Look for bonus offers such as referring friends or signing up.

If you are using a credit card with the loyalty program, use your credit card when paying for your purchases instead of paying in cash to earn more points quickly.

If the reward points of the loyalty program have an expiration, make sure to use your points regularly so they won’t go to waste.

Summary

Choosing a loyalty card depends on your needs and preferences. Before availing of the loyalty program, check first the rewards structure of the program, the redeeming process, the partner merchants, fees, and the user experience.

Loyalty cards in Philippines may give you exciting rewards and discounts, but you don’t have to get everything and stuff them in your wallet. You can just get the ones where you always shop so you can maximize the benefits of having a loyalty card.

FAQ

-

How does the loyalty Card Work?Once you have your loyalty card, you can start using it every time you make a purchase. You will typically earn rewards points for each purchase, which can be redeemed for discounts, free proucts, or other benefits.

-

How to Get the loyalty Card?Visit the business in person. Ask the staff about the loyalty card program. Most businesses have a physical location where you can sign up for the loyalty card program. If the business has a website, you may be able to sign up for the program online.

-

What is loyality Card?A loyalty card is a rewards program offered by a business to incentivize repeat purchases. It could be a grocery store, gas station, coffee shop, or any other type of business you frequent.