BDO Credit Card Guide: Types of Credit Cards and Application Requirements

Key takeaways:

- BDO cards provide seamless transactions, easy applications, and immediate account management for diverse spending needs.

- The card is versatile for shopping, traveling, and bill payments.

- Eligibility may be limited by age, income, or other factors.

- If denied, a Digido loan can facilitate online purchases remotely.

Table of Contents

BDO is one of the biggest publicly-held banks in the Philippines. It is owned by the same group that also has one of the biggest chains of malls and real estate companies in the country. Today, we will focus our attention on BDO credit cards. You will learn the different card types offered, how you can check your balance, and how you can process your BDO credit card application.

- 0% interest for first loan

- Fast approval in 5 minutes

- Only 1 Valid ID needed to Apply

BDO Credit Cards Types

BDO Unibank offers a variety of credit cards tailored to different needs and lifestyles. These include cards that focus on rewards, cashback, travel benefits, and low interest rates. Some cards are co-branded with airlines and retail partners, offering specific advantages like lounge access and special discounts. They also provide premium cards that come with exclusive privileges and higher credit limits for more affluent customers.

There are nine types of BDO credit cards (1) that you can choose from.

1. BDO Installment Card

This is a card where you can get a cash advance limit of 100% of your credit limit. You do not have to pay what you borrow in full as there are installment plans. This card is particularly useful for buying high-ticket items such as electronics, furniture, and appliances.

Advantages of the BDO Installment Card

- You can convert up to 100% of your assigned credit limit into cash, with the flexibility to repay in easy monthly installments.

- Offers the option to repay cash availments in light installment terms ranging from 3 to 36 months, making it easier to manage large expenses.

- The credit limit is automatically replenished with each payment made, allowing for repeated cash availments up to the available limit.

- The card features a low annual membership fee of only Php1,000, making it cost-effective for regular use.

- No collateral or co-borrower is required to apply, streamlining the process and reducing the paperwork typically involved.

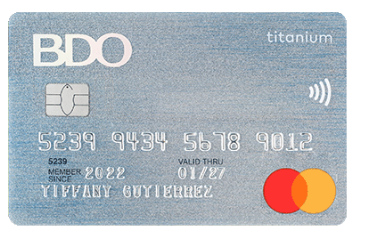

2. BDO Titanium Mastercard

This is a high-end card where you get one point for every Php40 spent or $1. You can use this card internationally, plus you have free travel insurance coverage. You can even choose a dollar billing option and not peso if you want.

The BDO Titanium Mastercard offers several benefits :

- Enjoy the freedom to spend on your own terms with a high credit limit that facilitates access to funds globally, providing convenience for international transactions.

- Dual Currency Billing Option. This feature allows you to have the flexibility to pay in either Philippine Peso or US Dollar, making it ideal for those who travel frequently or make purchases in different currencies, all on one card.

- The BDO Titanium Mastercard eliminates the worry about annual membership fees, as it offers free membership for life, reducing the overall cost of holding a credit card.

- Installment Programs. Tailor your financing according to your needs with various installment options that enable easier and more manageable payments for large purchases.

- Bills Payment: Streamline your monthly bill payments with features like Charge on Demand and Auto Charge, which provide fast and convenient ways to manage recurring payments.

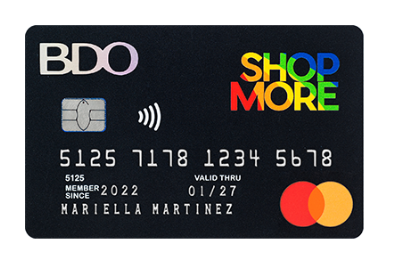

3. BDO ShopMore Mastercard

A kind of card where you receive points if you use the credit card for shopping. If you use it with establishments partnered with SM Advantage, you will earn more points. As you accumulate more points, you can avail of discounts and free stuff from the bank. For every Php200 you spend, you get Php0.50 peso points.

Main advantages:

- Free Membership Fee: The first year’s membership fee is waived, and subsequent years feature a low monthly membership fee of Php150 starting from the 13th month, making it cost-effective for long-term use.

- Earn Peso Points Anywhere: This card rewards your everyday purchases by offering 2x Peso Points on all transactions. These points can be converted into cash credit or transferred to any BDO Rewards account, providing flexible options for redeeming your rewards.Enjoy the Credit Card Peso Points earned from your everyday, everywhere purchases!1 Credit Card Peso Point equals Php1 Cash Credit or 1 BDO Rewards Peso Point

- Buy Now, Pay Later: Cardholders can enjoy 0% interest on purchases with extended payment terms at over 20,000 in-store and online partners nationwide.

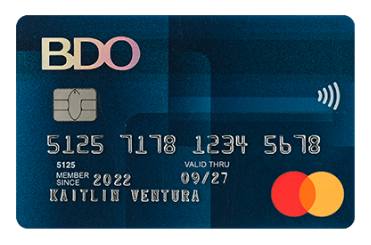

4. BDO Standard Mastercard

This one is a standard card where you get one point for every Php50 spent. You can exchange the points you accumulated from the BDO redemption catalogue. You can also use this card shopping online, and it is one of the best cards to use for installment purchases.

The BDO Standard Mastercard provides several attractive benefits:

- Free membership fee for the first year, and starting from the 13th month, a fee of Php150 per month applies.

- 0% interest rate on purchases with extended payment terms at over 20,000 stores and online partners nationwide.

- This card offers different installment plans for different financial situations, allowing you to spread your purchases over time to ease the impact on your budget.

- With the Standard Mastercard, every purchase earns you 2x peso points.

- Provides a safe and convenient online shopping experience, backed by significant discounts from the best partner apps.

5. Bench Mastercard

The BDO Bench Mastercard offers a suite of benefits that are especially appealing to those who frequently shop at Bench and its partner global brand stores:

- Stylish Mondays: Cardholders can enjoy significant discounts of up to Php1,000 off every Monday when shopping at Bench and its affiliated global brand stores.

- Mastercard Priceless Specials: This program enhances shopping experiences by providing exclusive offers and deals, adding value and providing unique opportunities just for being a cardholder.

- Up to 4x Peso Points: For every Php1,000 spent at Bench and partner stores, cardholders earn 4x Peso Points. These points can be accumulated and redeemed for rewards, making every purchase more rewarding.

- Free Membership Fee for Life for the First Supplementary Cardholder: This is an exceptional benefit where the first supplementary cardholder enjoys a free membership fee for life.

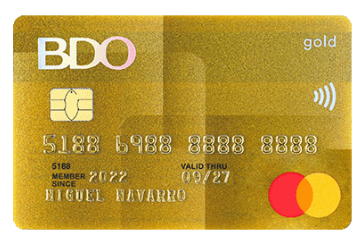

6. BDO Gold Credit Card

This is an all-around card that is issued to most of the credit cardholders. It is a typical card that you can use for everything and offers a variety of benefits tailored to enhance both everyday spending and travel experiences:

- Free Membership for the First Year: The first year’s membership fee is waived, allowing new cardholders to enjoy the benefits of the card without any initial cost, reducing the barrier to entry.

- Up to Php5 Million Travel Insurance Coverage: When you charge your travel expenses to your BDO Gold Credit Card, you receive comprehensive travel insurance coverage up to Php5 million.

- BNPL: Enjoy 0% interest on purchases with extended payment terms at over 20,000 in-store and online partners nationwide.

- Installment: Offers a variety of installment options to suit different financial needs.

- Earn Peso Points Anywhere: Earn 2x Peso Points on every purchase, which can be converted to cash credit or transferred to any BDO Rewards account.

7. World Elite Mastercard

The BDO World Elite Mastercard offers a suite of premium benefits designed for discerning cardholders who value luxury, security, and convenience:

- Credit Card Peso Rewards: Earn Peso Points on everyday purchases, anywhere you shop.

- Travel and Lifestyle Services: Access a curated collection of exceptional travel, dining, and entertainment experiences. This includes perks and privileges that elevate the standard of your journeys and leisure activities, making every outing more enjoyable and special.

- Priceless Experience Program: Eligible for an all-expense-paid, bespoke travel experience, offering unique, once-in-a-lifetime trips that are tailored to the personal tastes and preferences of the cardholder.

- Purchase Protection Insurance: Shop with confidence knowing that your purchases are protected by insurance coverage of up to $3,000. This benefit provides peace of mind when buying high-value items, guarding against theft or accidental damage.

- Safety and Security Features: The card is equipped with advanced safety and security measures to protect your information. Multiple layers of security ensure that your personal details and financial transactions are kept safe from unauthorized access.

8. BDO Platinum Mastercard

It is also a high-end card, but you can enjoy more perks and have a higher credit limit.

The Dual Currency Billing Option on this card allows flexible payment in either Philippine Peso or US Dollar, simplifying currency management for frequent travelers or international businesspersons, while the Free Membership for Life eliminates annual fees, offering substantial long-term savings and minimizing ongoing expenses.

The most sophisticated of all cards that are reserved for VIPs. You will get exclusive offers at the hotels and resorts if you are a cardholder.

If you do not want a Mastercard, you have an option to tell BDO what kind of card you want. You can choose from JCB, UnionPay, Diners Club, VISA, and you can also ask the bank to give you a BDO AMEX credit card.

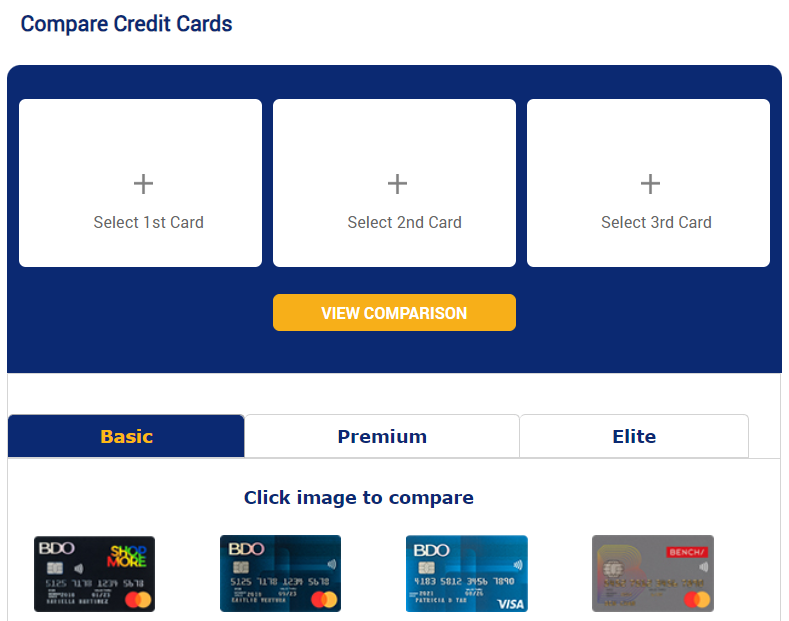

If you still haven’t chosen a credit card that suits you, you can use the BDO credit card comparison service (2). Simply select 2 or 3 cards and click View Comparison. The service will give you the information in tabular form.

Learn more:

✦ How to Get Quick Online Cash Loan for blacklisted

✦ How to Get Fast and Easy Loan in the Philippines

✦ How to take Personal Loans For Poor Credit Score

Need money you can get quickly? Apply for an easyDigido loan right now with just one any valid ID and a cell phone number. Calculate your pre-approved loan amount:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

BDO Credit Card Requirements

Before you apply, you have to prepare some documents. There are also eligibility requirements that you have to meet before you even bother applying:

✅ You have to be between 21 and 90 years of age;

✅ You must be a Filipino citizen;

✅ You must live or work near a BDO branch;

✅ You have to be employed or must have a business that you can prove:

- You must be a permanent employee or self-employed with an active business for at least 2 years;

- Minimum Gross Fixed Income Requirement Php400,000 for Self-Employed/Professional;

✅ You must earn a month’s salary:

- Php15,000 for Bench, ShopMore, Standard Mastercard and Installment Card

- Php33,000 for Gold Mastercard, Visa Gold, JCB Gold, Gold UnionPay.

✅ You must also have a landline phone that the bank can call if they need to contact you. If you have no landline, you will not be approved.

If you meet these conditions, you have to be ready to supply proof. You have to submit the following documents:

- Application form;

- Valid government ID;

- Income Tax Return documents;

- Payslips if you are employed;

- Registration permit if you are a business.

✅ Accepted ID’s:

Driver’s Licens, Passport, Philippine Postal ID, Professional Regulations Commission, (PRC) ID, New Social Security System (SSS) ID, TIN ID, UMID ID, Voter’s ID, PhilID and ePhilID

✅ Accepted income documents:

Income Tax Return (ITR), Certificate of Employment (COE), Latest 3 months payslips, Latest Credit Card Statement For Self-employed, Audited Financial Statements (2 years), Certificate of Registration of Business Names issued by DTI, Certificate of Registration issued by SEC, Latest Credit Card Statement

Once everything is ready, you have to prepare photocopies and scanned copies. You must also prepare 2×2 or 1×1 pictures in case they ask for it.

BDO Credit Card Fees and Charges

BDO has several fees and charges, and you can see them all at the table (3) of fees on the BDO official site.

The most important you need to know include:

Principal Card Membership Fee:

- Php150 / month – Standard / Classic / Lucky Cat / ShopMore Mastercard

- Php200 / month – Bench Mastercard / Gold Cards

- Php250 / month – Diners Club International

Additional fees:

- Cash advance fee – Php200 or $4, whichever is higher

- Monthly Interest Rate – 3.00%

- Late payment charge – Php850 / US$20 or unpaid minimum amount due, whichever is lower

- Lost Card Replacement Fee – Php400 for each card

- Overseas Card Delivery Fee – Php2,500

Our recommendation is that when you borrow, make sure you have the funds to pay what you owe. You should also learn how to pay a BDO credit card in advance to avoid late fees.

How Can I Avail of a BDO Credit Card?

There are only three ways you can avail of a BDO credit card:

- Apply in person and provide the documents you need;

- Apply online and wait for further instructions.

The third way is if you are a BDO depositor. Sometimes, the bank automatically sends you a credit card even if you did not apply. This usually happens to depositors who have a lot of money in the bank.

5 Steps to Apply for a BDO Credit Card

Here are the five simple steps on how to apply for a BDO credit card:

- Step 1: choose the right card for you;

- Step 2: check if you are eligible;

- Step 3: prepare your documents;

- Step 4: apply online or in-person;

- Step 5: follow up on your application status.

We have discussed the requirements earlier, so you have to prepare them. Collect physical copies and scan them, too. To fill out the application form, you can either do this on the bank’s website or go to a branch. Once you are approved and you got your card, follow the BDO credit card activation instructions that came with the mail. You cannot use the card unless it is activated. The mail also has instructions for:

- How to pay BDO credit card;

- BDO credit card inquiry.

The card itself and the mail both have the BDO credit card hotline (02) 8631-8000 to call if you have a problem.

Learn more:

✦ All about Gadget Loan Requirements in the Philippines

✦ How to Get Cash loans in 1 hour with fast approval

How to increase BDO credit card limit?

For a credit limit increase on your BDO credit card, please consider the following steps and requirements:

- You can request a credit limit increase at least six months after your card has been issued. This allows time for your account history to establish your credit behavior.

- Ensure that your card is in good credit standing, which means maintaining a history of timely payments and responsible credit usage.

- To initiate a credit limit increase, call the BDO Customer Contact Center at (02) 8631-8000. This is the direct line for handling such requests.

- Be aware that your request for a credit limit increase is subject to evaluation. BDO may review your current credit status and overall financial health.

- BDO may require additional financial documents to process your request. These could include recent pay slips, income tax returns, or other proofs of income.

It’s always a good idea to maintain a healthy credit history and demonstrate financial responsibility to increase the likelihood of approval for a higher credit limit.

Why is My BDO Credit Card Application Not Approved?

Here are some possible reasons why your BDO credit card status or application was denied:

- You are under 21 or over 70 years old – all banks in the Philippines have age requirements. Your age somehow determines your capacity to pay.

- You do not meet the employment requirements of the borrower – you have to be employed, and be able to prove your employment plus citizenship if you want to apply for a credit card in the Philippines. This is a guarantee that you can pay.

- You are unable to provide work references – banks will investigate and ask people if what you are saying is true. You have to be able to submit names and numbers of people who can vouch for who you are.

- You do not have a landline phone – landlines are guarantees that you live where you say you do.

- Your annual income is less than 180,000 pesos – banks want to make sure that you do have the capacity to pay. Credit cards give you an opportunity to borrow money, so they have to be sure you can afford to pay what you borrow.

If your application was declined after processing a BDO online credit card, do not despair because there is an alternative.

BDO Credit Card Alternatives

If you do not get approved, you have to look for an alternative. What we can recommend is Digido, an online loan facility in the Philippines.

Here are the benefits of applying for a loan from Digido:

- Easy to apply – everything is done online;

- No collateral – this is a loan where you do not need to pawn items; you just have to present documents to prove your income;

- Hassle-free – you do not have to go to a financial institution to get a loan; the money will be deposited to your bank account.

Digido is a great alternative if you cannot be approved for a credit card. In some cases, it is better to get a loan if you just want to purchase a big-ticket item once. Credit cards have annual fees, so you also have to consider that expense.

Learn more:

✦ How to Renew Business Permit in the Philippines

✦ In-Demand Jobs in the Philippines

In Conclusion: How to use BDO credit card?

Using a BDO credit card is straightforward, but there are several key points to keep in mind to ensure smooth and secure usage:

1. Activating the Card

- Before you can use your new BDO credit card, you’ll need to activate it. This can typically be done via BDO’s online banking portal, mobile app, or by calling their customer service hotline.

2. Setting Up Online Banking

- Register for BDO Online Banking to manage your credit card account conveniently. Through online banking, you can check your balance, view transactions, pay your credit card bill, and more.

3. Understanding Your Card’s Features

- Familiarize yourself with your credit card’s benefits such as reward programs, installment options, interest rates, fees, and the billing cycle. This information is often provided in your card’s welcome kit or available on BDO’s website.

4. Making Purchases

- You can use your BDO credit card for both online and in-store purchases. For online purchases, you’ll typically need to provide your card number, expiration date, and CVV code. For in-store purchases, you can swipe, insert the chip, or use contactless payment methods if available.

5. Paying Your Bill

- Ensure you pay at least the minimum payment due each month before the due date to avoid penalties and interest charges. You can pay your credit card bill through BDO online banking, BDO branches, ATMs, or through other authorized payment channels like SM and other banks.

6. Monitoring Transactions

- Regularly check your account statements or online banking account to monitor your transactions and identify any unauthorized or suspicious activity early.

7. Utilizing Security Features

- Take advantage of security features such as SMS notifications, email alerts, and setting up a PIN for your credit card to enhance security, especially for transactions abroad or online.

8. Handling Rewards and Benefits

- If your card has rewards or cashback features, understand how to earn and redeem these benefits. Keep track of any points you accumulate and use them before they expire.

9. Understanding Fees and Charges

- Be aware of any annual fees, transaction fees (for foreign transactions), late payment fees, and over-limit fees. Understanding these can help you manage your card more effectively and avoid unnecessary expenses.

10. Knowing Customer Service Options

- Keep the customer service number handy for any inquiries or issues you may encounter. BDO provides 24/7 customer support for emergencies like lost or stolen cards.

FAQ

-

How to increase BDO credit card limit?If you feel that your current BDO credit limit is not sufficient, you can contact Customer Support at (02) 8631-8000 to apply for a higher BDO credit limit.

-

Is the BDO installment card a credit card?Yes, it is a credit card with more benefits than usual options on the market.

-

How do you withdraw cash from a BDO credit card?You can withdraw money from the ATM where your credit card is accepted. To withdraw money above the limit on your credit card, contact BDO bank.

-

How Can I Check My BDO Credit Card Balance?To check your BDO credit card balance, the most convenient method is to utilize the online platform or the mobile application provided by the bank. You can either call the BDO hotline (02) 8631-8000 as well or do it online on the official BDO website in your personal profile. In the latter case, you must sign in with your login and password and select "My Statement".

Authors

Digido Reviews

-

DerickThis loan app is very convenient to use, easy to borrow cash especially during Petsa de peligro or anytime you need money. Easy to repay with low interest rate.4

-

MarkA very reliable loan app. You can have the approved amount transferred to your account in less than 3 minutes. Highly recommended to those who need immediate cash☺5

-

RonnahGetting a loan was always a challenge. I was unable to meet the BDO credit card requirements and the requirements for other credit cards. But with Digido App, i was able to get a loan quickly with just one document! Good online cashloan!4

-

JessicaDigido you saved my husband life. When i need the money the most, for hospital. Thank you.5

-

DanicaSuperb App. It is very easy and fast approval. it's my second loan since the last time. Very happy to apply for this app. Highly recommended.5

-

EdcelDigido is superb to the point of acing clients or customer needs for loan. The free choose of how many days you can pay and the payment extension is beyond compare. Although the interest is quite high but it will really compensate fast-pacing response. The agent were very responding and accomodating! I love Digido, Happy Chinese New Year ❤️4

-

CatherineFast and easy app! I can apply for a loan from home and get the money into G-cash within minutes. Even when my BDO credit card limit was exhausted, I could still enjoy online shopping, thanks to Digido's hassle-free fast funding. ❤️ Thank you!5