The Best Ipon Challenges in 2024

Key takeaways:

- Taking Ipon Challenges becomes part of Filipino life and enables them to achieve

financial discipline in a time-bound way. - To start an Ipon Challenge, all you need is a goal, and an Ipon Challenge calendar

to track the progress. - Once the period is over, you will have the money to fulfill your goals.

- If you do not have enough money, you can get a loan from Digido.

Table of Contents

The Philippine term “Ipon” means “Saving for the future.”

Everyone has different financial goals at various life stages, such as college tuition fees, owning a car, or spending a foreign country vacation. The majority of the Filipinos live on a shoestring budget with a small amount left for saving. So the conventional pattern of savings through a bank account will not work here.

The saving system should be simple, goal-oriented, time-bound, and workable for the population. In that sense, Ipon Challenges 2022 and then Ipon Challenges 2024 keep on scoring brownie points and has become the most popular saving option for the Filipinos.

What is the IPON Challenge?

The Ipon Challenges are different from conventional saving schemes due to their simplicity and efficiency. To start an Ipon Challenge, all you need is a goal, container or piggy bank and an Ipon Challenge calendar to track the progress.

In Ipon Challenges, the user breaks down the goal amount to achievable savings at regular intervals. For each contribution, the owner will make a corresponding mark on the template. The customer can tabulate the entries anytime and can have a clear idea of his or her current savings.

Once the period is over, you will have the money to fulfill your goals.

The completion of the first challenge is a life-changing experience for the participants. They become achievers on a beautiful morning. It makes them confident to dream big and in taking up new challenges with higher financial goals.

Slowly, taking new Ipon Challenges becomes part of their life and enables them to achieve financial discipline in a time-bound way.

Also learn more about

Dragonpay Philippines

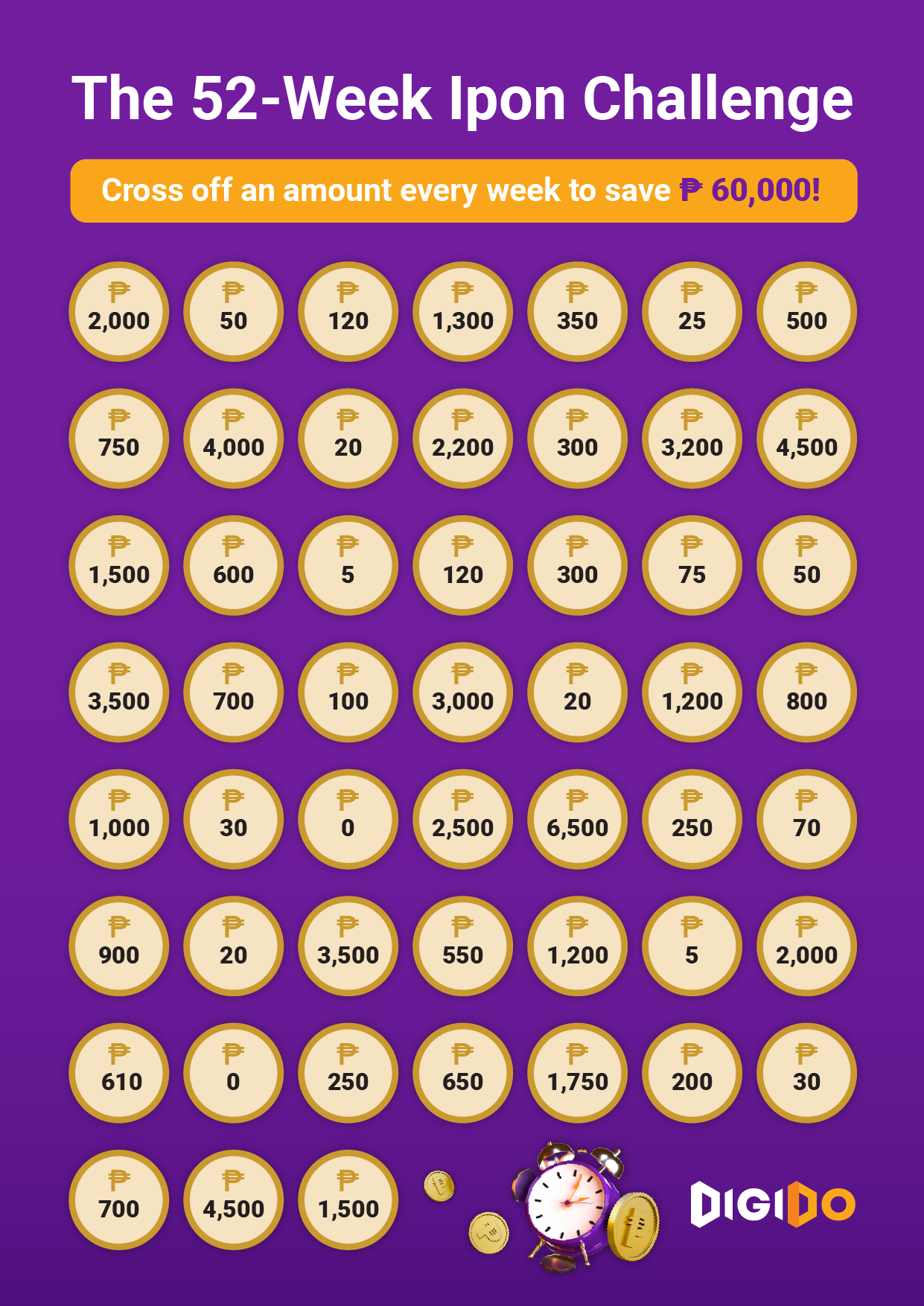

The 52-Week Ipon Challenge

The 52-Week Ipon Challenge

The 52 Week Ipon Challenge is a systemic saving scheme with a one-year time frame.

It’s quite simple. You earmark a particular amount as saving for each week. As time progresses, you increase the savings as multiples of the weeks since the start of the challenge.

For instance, if you set PHP 50 as your saving amount, you will put PHP 50 as your savings for the first week. Your saving will be PHP 100 (first-week saving + basic saving) in the second week. For the third week, you need to save Php 150, i.e., PHP 100 + PHP 50. The significant advantage is that you can decide on the basic saving amount depending on your financial status. You can even start saving money as low as PHP 20, 10, or PHP 2.

Tracking the investments for the 52-week duration is a hectic affair. Custom-made templates for each denomination are readily available for sale, or one can develop his or her custom ipon challenge printable template for efficient tracking of the savings.

Even though the 52-week Ipon Challenge is a great option to achieve your financial goals, some find it challenging to stay motivated throughout the entire year. Also, a miscalculation in setting the basic saving amount can be disastrous. By the end of the challenge, you have to save a substantial amount as your weekly savings. Getting money during festival months such as December might not be easy for many Filipinos.

Download 52-week Ipon Challenge chart free printable PDF template for 2024 here.

Still, the 52-week Ipon Challenge is an excellent new year resolution for achieving financial independence. You can save up to 60,000 PHP a year, which is why some participants call it the 60k Ipon Challenge.

- Up to PHP 25,000 In only 4 minutes

- We only require 1 government valid ID

- Simple online application via mobile app

All about-

how to apply bank loan for motorcycle

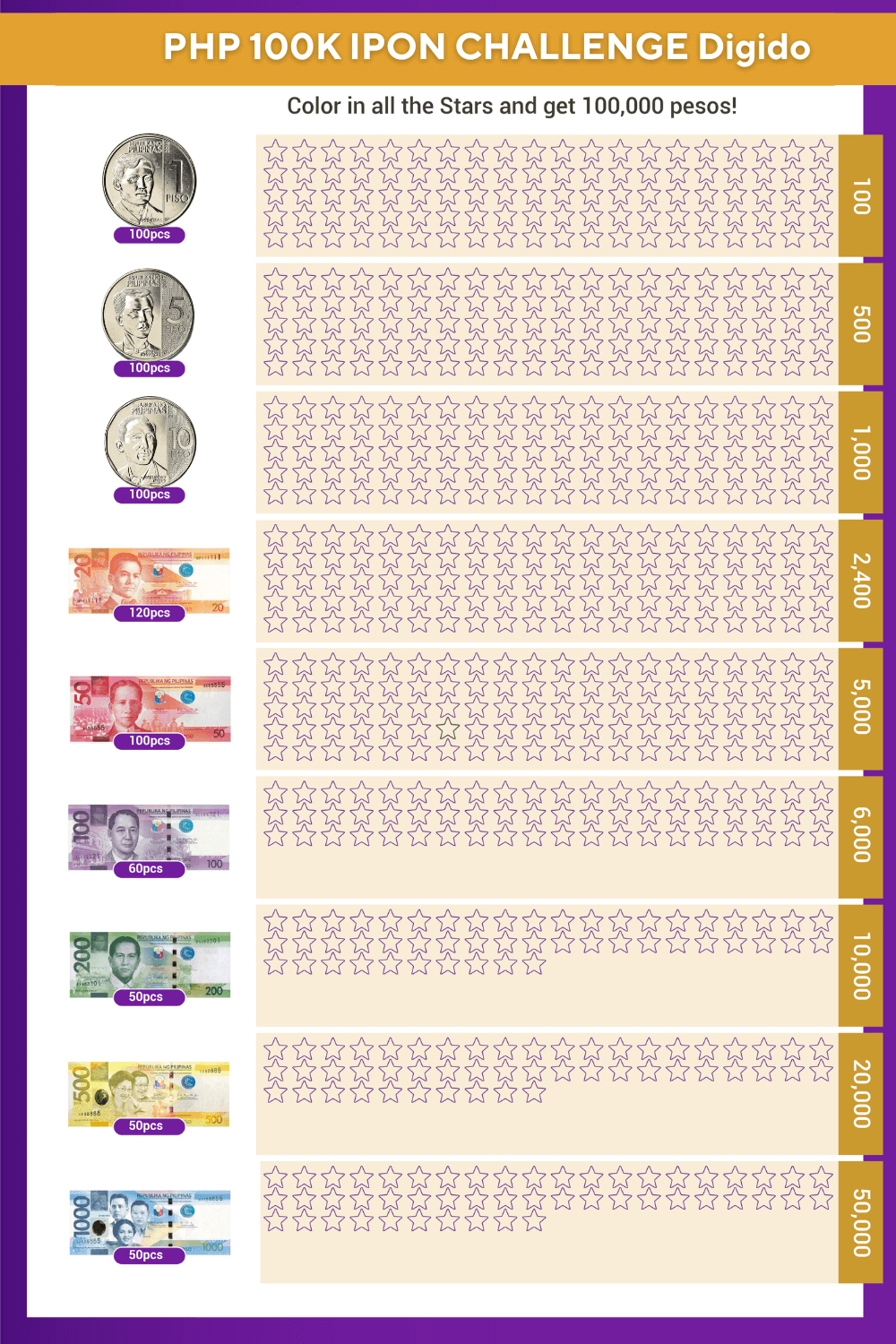

100k ipon challenge

The PHP 100K Ipon Challenge is a unique savings challenge in the Philippines aimed at helping individuals save up to PHP 100,000. This challenge is designed to be flexible and accommodating to the participant’s financial capabilities. The idea is to give oneself a “star” for every amount saved, similar to receiving a star for good performance in childhood. Participants use a tracker, which can be printed or copied, to monitor their savings progress. The challenge emphasizes starting savings habits, even with small amounts, and gradually building up to the goal of PHP 100,000.

The challenge encourages various methods to achieve this savings goal, such as reducing unnecessary expenses, allocating portions of bonuses to the savings challenge, generating extra income or side hustles, and setting aside money from regular income or business profits.

Download 100k Ipon Challenge printable template PDF here.

365 Days Ipon Challenge Total

The 365 days ipon challenge is a simple budgeting activity with having extra money after a certain period as the end goal. Compared to simple saving, the ipon challenge is not only saving money within a set period of time but saving deliberately and strategically. If you are someone who wants to do challenges to encourage you to reach your objectives, then 365 days ipon may be for you.

Decide How Much You Want To Save

How much can you afford to set aside per day? The amount can be as little as Php 10 to Php 20 per day or as much as you are able to afford or want to challenge yourself. You must also consider your income or where you get the ipon challenge money, especially if the amount is a bit bigger.

Who or What is the Ipon Money To Be Used For?

The amount you want to save per day also depends on what it is used for. If it is for a gift, know the amount of the item and divide it into 365 days, and give allowance in case of the price increases at the time of purchase. Likewise, with bigger projects, do an estimate so you will be aware if you can afford it or not and adjust your saving challenge accordingly.

The 365 days ipon challenge money total is Php 3,650 for a Php 10 money challenge, while a Php 20 will yield Php 7,300. If you are one who does not want to bother tracking or computing to save money, this 365 days ipon challenge fits you well. Just set a reminder on your phone to make sure you don’t forget, or mark it on your physical calendar on the wall if you have one.

Learn about

How to Renew Business Permit

50 Pesos Ipon Challenge

The 50 pesos ipon challenge is one of the more interesting ways of saving money. You save each and every 50 peso bill that you receive. Every time you receive a 50 peso bill as a change, you keep it and place it in your alkansiya or other safe containers in your house and forget about it. There may be times when you don’t receive any 50 peso bill change, like when you stay at home on the weekends. At the most, you can save several pieces of 50 peso bill each week. At any time you can deposit in your bank account and when the specific time frame arrives, you can use it to fund whatever you want. On the other hand, why not leave it in your account or invest it, then start another 50 pesos ipon challenge?

Make the 50 Pesos Ipon Challenge Fun

Saving money should not be a chore or burden to you. Look forward to the rewards you are getting out of this challenge. You might even use it for a loved one. Whenever you are expecting change for your money, ask the cashier to give you 50 peso bill/s in newer and crispier bills. It does feel nice counting new money, unlike the overused ones.

If you commit to at least saving five 50 peso bills per week, you can save up to Php 6,000 for six months or Php 12,000 for one year. You will be amazed that you saved something without struggling. Now, you can start another ipon challenge with a higher amount.

You can easily find and download a 50 pesos ipon challenge printable online or get creative and design your own custom template. It can be a wonderful source of motivation for your savings journey. Additionally, these templates make fantastic Christmas gifts!

Couple Ipon Challenge

If you tried to save on your own and faltered along the way, maybe it’s time to do a couple ipon challenge. You could feel more challenged to save if you partner with somebody who shares the same goals as you. It can also be enjoyable as well. You can make it a friendly competition as long as you are supportive of each other thereby strengthening your relationship. For the ipon challenge to be successful, couples must have a single savings goal. That is to save money together for a specific period of time.

Plan how you go about the ipon challenge. Discuss the following: How much will each of you contribute, what is the timeframe, the purpose of the savings, where to place the money (deposit it in an account or place it in a piggy bank), put money daily or weekly, and other rules you want to include like reminders.

If the couple sticks to the challenge and saves every week, they can save as much as Php 10,400 at the end of the year if they contribute a set amount of Php 100 each week (ipon challenge 100 pesos). It might be small for some, but it’s just the start. They can start to do the 52-week ipon challenge with Php 100 each on the first week and then increase by Php 100 (Php 50 each) on each of the consecutive weeks. By the time they arrive at the end of the year, they have saved a whopping amount of Php 107,800.

Read Useful Information

Where to pay Digido loan

12-Month Saving Challenge

Even with regular income, unexpected financial expenses can topple our saving scheme for the particular month. When we follow a scheme like the 52-Week Ipon Challenge, the increasing monthly saving towards the end creates a significant roadblock for its successful completion.

Since the fixed saving schemes do not consider the fund availability for the month, sticking to the challenge becomes practically impossible for people with low or irregular income.

As an alternative, personal finance coach Alvin Tabañag has introduced an income-based money-saving challenge known as the 12-Month Saving Challenge.

Instead of fixed saving patterns, the system tries to save a portion of your income every month along with a basic fixed saving amount. If you cannot save money for every month, you can mark your base amount as zero. Then add a percentage of your monthly income to the base amount, beginning with 1% on the starting month and reaching 12% at the final month.

The formula to calculate your monthly saving is the following:

Monthly Savings= Base Saving + [Monthly % * Monthly Income]

Let’s assume that Mr. A. earns PHP 20,000 per month. He starts a 12-Month Ipon Challenge in January, and his base saving is 0.

Now his savings on each month will be as follows:

January = 0+(1% x 20,000) = 0+200 = PHP 200.

February = 0 +(2% x 20,000) = 0+400 = PHP 400.

By the time it reaches December, the monthly saving will be PHP 2,400.

The primary advantage here is that you can be flexible about your base saving. Since the saving amount depends on your monthly income, it won’t affect your financial freedom. You can also improve base saving when you have additional income as well. This challenge is becoming popular with its flexibility and efficiency in achieving long-term goals without imposing too much strain on your financial liberties.

Read about

OFW Cash Loan

Peso Sense Ipon Challenge

Not everyone can stick to a saving challenge that demands continuous involvement. For such people, a saving challenge that gives flexibility while not compromising its saving aspects can be a blessing.

The Peso Sense Ipon Challenge is such a challenge. It’s gaining overwhelming acceptance among Filipinos due to its flexibility and saving potential. Here, you prepare or purchase an ipon challenge template according to your financial goal. There will be bubbles against each denomination of Peso. Whenever you put a bill or currency into the box, you shade one of the corresponding bubbles.

There is no strict regime to follow. You can put money in the box whenever you have it, making this challenge the most suitable option to save money for students or people with irregular income. However, this flexibility is a bane as well. Unless you are super disciplined and have a strong desire, sticking with the Peso Sense Ipon Challenge is an arduous task. So it is always better to club Peso Sense Ipon Challenge with any other challenges so that you continue with the saving spree without any compromises.

No Spend Day Challenge

No Spend Day Challenge

For many working people, the weekend blast is the most anticipating event during the workdays. Naturally, people prefer spending their weekends in a fun-filled way to unwind the stress of a week’s work and rejuvenate their spirit. But the impulsive spending significantly damages their financial stability.

No Spend Day Challenge aims at the participant to avoid out-of-the pocket expenditure on a particular day. On workdays, not all can avoid spending. So weekends are the best choice for observing the No Spend Day Challenge.

Instead of hanging out with friends or shopping, you spend your time at your home with your family. It improves your quality time with your dearest ones and makes the atmosphere in the family charming. The primary drawback of this type of challenge is that there is no guarantee about the returns. But it gives excellent returns by improving relationships.

Ipon challenge for Students

The key to a successful ipon challenge is setting realistic goals and being consistent with your savings efforts. Students should choose a challenge that suits their financial situation and income level. It’s also essential to track their progress regularly to stay motivated and ensure they are on track to meet their savings goals.

The best ipon challenge for students in the Philippines would depend on their financial goals, resources, and preferences. Here are a few ipon challenges that students can consider:

Ipon Challenge Chart for Students

- Monthly Ipon Challenge: This challenge is suitable for students because it allows them to save consistently and align their savings with their monthly income and expenses. It’s a practical approach that doesn’t require significant upfront investments, making it accessible for students with varying financial situations. For example, setting aside PHP 1,000 per month can be manageable for many students and can add up over time.

- No-Spend Challenge: The No-Spend Challenge is particularly beneficial for students as it teaches them valuable financial discipline and encourages responsible spending habits. Students often face tight budgets, and this challenge helps them cut unnecessary expenses for a defined period, improving their financial management skills. It’s a great way to save money without a significant impact on their essential needs like food and transportation.

- Savings Jar Challenge: The Savings Jar Challenge is an excellent option for students because it’s a simple and flexible way to save money. Students can start with small amounts, such as spare change, which they can easily collect over time. This approach doesn’t strain their budgets and provides a visual representation of their progress. Whether using a physical jar or a digital app, it’s a convenient method for students to save without feeling overwhelmed.

The Best Free Ipon Challenge Apps

There are various mobile apps available to make Ipon Saving Challenges a comfortable experience. Some of the popular apps are the following:

My Ipon Challenge: Piggy Bank & Savings App

In this app, you only need to specify your target amount. The app will list the possible challenges, and you can set your preferences accordingly.

It enables you to have different challenges for your varying financial needs and track them efficiently. The app gives a pictorial representation of the challenges. It helps the user make proper allocation of his or her resources in the most efficient way.

Ipon: 52-Weeks Money Challenge App

There are multiple apps available for the 52-Week Ipon Challenge. The most striking feature of this app is the visual representation of your current savings using various stats and ipon challenge charts.

It keeps the motivation levels high and helps you continue with the process. It also gives you timely notifications about your payments and enables you to design various challenges for different purposes.

My Money Challenge: Money Saving App & Piggy Bank

The significant difference between this app from other apps is that it splits your money into dollar denominations. It helps the OFWs make saving much more efficiently than checking the exchange rates every morning.

Many Ipon apps are available on the Internet, and you can choose one that suits your requirements.But whatever be the Ipon challenge formats, the participants financial discipline and determination to complete the challenge alone can make it a success.

Learn about

Fast Loan in 15 Minutes

Why are Ipon Challenges so Popular in the Philippines?

The Philippines is a growing economy. We have people living across the globe, and their exposure has significantly changed the perceptions of money and wealth. The improvements in education levels have dramatically enhanced job opportunities and future growth possibilities of the younger generation.

People try to give their kids better opportunities through proper education, and for that systematic saving is essential. Besides, Ipon Challenges go in hand with the life of the Filipinos. So they can quickly adopt them without the fear of losing money or reputation.

Learn about

Quick loans for the Unemployed at Digido

Where to Get Money Urgently if You Have No Savings?

Many Filipinos realize the requirement for savings only when they are in urgent need for money. Naturally, you can’t start saving and get the emergency funds required at the same time.

Getting a loan either from banks or private lenders is the only possible option during emergencies. Bank’s red-tapism makes them unsuitable for emergency financial support, and the private lenders can be expensive.

However, legit lenders like Digido that operate with state licenses can be a great help here.

Need money that you can get quickly? Calculate your pre-approved loan amount and apply now with using just 1 government valid ID:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

Ipon challenge chart and ideas for 2024

The ipon Challenge chart 2024 in the Philippines offers a variety of savings challenges tailored to different people and income levels. Here are some of the main challenges:

| Savings Challenge | Description | Savings Frequency | Savings Increment | |

|---|---|---|---|---|

| 1 | 52-Week Ipon Challenge | Offers various versions to suit different savings goals, such as starting with a large amount and decreasing, saving random amounts, or using dice to decide. The amount saved varies depending on the weekly increment chosen. | Weekly ipon challenge | Variable |

| 2 | 12-Month Ipon Challenge | Designed for salaried employees, taking into account their fixed monthly income, making savings more realistic and practical. | Monthly ipon challenge | Fixed (Monthly) |

| 3 | Bi-Monthly Ipon Challenge | Ideal for those receiving salaries twice a month, allowing savings in line with salary receipts. Savings increase every two weeks by a base amount. | Bi-Monthly | Variable (Bi-Weekly) |

| 4 | 365-Days Money Challenge | A simple daily savings plan, where a fixed amount is set aside each day. | Daily | Fixed (Daily) |

| 5 | Invisible Money Challenge | Involves designating certain money as “invisible” and saving it immediately. It encourages saving from spare change or specific bill serial numbers. | Ongoing | Variable |

| 6 | Loose Change Ipon Challenge | Saving all loose change at the end of each day, suitable for those preferring to save smaller amounts. | Daily | Variable |

| 7 | Envelope Savings Challenge | Involves saving a designated number of bills in shuffled envelopes each week, with the amount depending on the chosen denomination. | Weekly ipon challenge | Variable |

| 8 | Holiday Savings Challenge | Aimed at preparing for holiday expenses, encouraging consistent saving to avoid overspending during holidays. | Weekly or Monthly | Variable |

| 9 | Bisyo Savings Challenge | Targets saving money while trying to quit a bad habit by setting aside a penalty fee each time the habit is indulged. | Ongoing (Triggered) | Variable |

| 10 | 200-Day Ipon Challenge | Involves saving a specific amount for 200 days, chosen randomly from a jar containing numbers 1 to 200 written on pieces of paper. | Daily | Variable (Random) |

FAQ

-

How much money do you save with the 52 week challenge?The most common way to complete the 52-week challenge is to save Php 20 in the first week and increase what you save by Php 20 each week. If you save 20 pesos the first week, and then you save Php 40 in week two, Php 60 in week three, all the way to Php 1,040 in week 52. Your total savings at the end of 52 weeks will be Php 27,560

-

What is the money challenge?It is a way of saving money by saving according to a certain scheme.

-

What is a no spend challenge?A no-spend challenge is where you go for a set period of time without spending any money.

-

What is the best ipon and simple Ipon challenge?The 365 Daily Challenge will suit you. It is easy to follow, just save a certain amount daily. You don’t need to calculate any increases or keep track of your savings.

-

What is the major disadvantage of the 52-week Ipon Challenge?The main disadvantage of the 52-week Ipon Challenge is that the last several weeks before the end of the challenge may be too much for some. If your source of income is sporadic or you are at the minimum wage level, you might have difficulty saving the weekly amount as it involves increasing or doubling the amount of savings per week.

-

What is 5 pesos ipon challenge in the Philippines?At the beginning of the challenge, you save 5 pesos. You can use any available container or piggy bank to collect your savings. Every day, you increase the amount you save by 5 pesos. So, on the second day, you save 10 pesos, on the third day, you save 15 pesos, and so on. The goal is to continue this pattern for a full year, which means by the end of the year, you'll be saving 1,825 pesos in a single day.

-

What is 10 pesos ipon challenge in the Philippines?The 10 Pesos Ipon Challenge is another popular savings challenge in the Philippines, similar in concept to the 5 Pesos Ipon Challenge but with a slightly higher starting amount. At the beginning of the challenge, you save 10 pesos. Like the 5 Pesos Ipon Challenge, you can use any available container or piggy bank to collect your savings. Every day, you increase the amount you save by 10 pesos. So, on the second day, you save 20 pesos, on the third day, you save 30 pesos, and so on. The goal is to continue this pattern for a full year, which means by the end of the year, you'll be saving 3,650 pesos in a single day. You can save more, like 20 pesos a day, сreate the iipon challenge 20 pesos chart graphic with your own hands or download the app!

-

The "20k Ipon Challenge" or the "10k Ipon Challenge"?The "20k Ipon Challenge" and the "10k Ipon Challenge" are both popular savings challenges in the Philippines, but they differ in their savings targets.

- 20k Ipon Challenge: This challenge aims for participants to save 20,000 Pesos. It's designed for those who are able to set aside a larger amount of money consistently. The timeframe for this challenge is typically one year, although it can be adjusted based on personal financial situations. Participants save a fixed amount daily, weekly, or monthly to reach the 20,000 goal.

- 10k Ipon Challenge: This challenge has a goal of saving 10,000 Pesos. It's more accessible for those who might find the 20k challenge too steep or for those who are just starting with personal savings habits. Like the 20k challenge, it often runs over a year, with participants setting aside money on a regular schedule to meet the 10,000 target.

Authors

Digido Reviews

-

JohnDigido is the best! I just claimed 4000k on my first loan with zero interest, 7 days term! Claimed through Cebuana, Wow! I am now officially Recommending Digido App.5

-

RosveEasy to apply and they disburse loan amount instantly. Online staff are very accomodating and respectful thank you.4

-

MarkA very reliable loan app. You can have the approved amount transferred to your account in less than 3 minutes. Highly recommended to those who need immediate cash☺5

-

SamI loved Digido not just the app but for the whole experienced that I had in applying for a loan. Hassle free and loan disbursement is as quick counting 1-2-3.5

-

FredericoOne of the best Loan App, reliable, quick cash disbursement and they also give you alternative plan option to settle your debt, so far I'm satisfied with it 😊👍5