The Ins and Outs of Home Equity Loans Philippines

Key takeaways:

- An equity loan is where you use your property as collateral

- These loans are secured by the property, which can result in lower interest rates compared to unsecured loans

- Home equity loans can be used for a variety of purposes, including home improvements, debt consolidation, and business expenses

- The loan amount you can borrow depends on the value of your home and the lender’s loan-to-value ratio

- Loan terms typically range from one to twenty years, with repayment schedules varying by lender

Do you want to borrow money and use your house as collateral? After all, a house is one of the most important assets you can have, and it has a value that you can offer to loaners. Before you apply for a loan, it just makes sense to understand what home equity means, what it entails, and how you can take advantage of it – we will show you everything you need to know about Philippine home equity loans today!

- Over a 95% loan approval rate!

- Get your first loan with 0% interest rate

- Receive up to PHP 25,000 in a swift 4 minutes!

Definition of Home Equity Loan Philippines

A home equity loan is a kind of loan where you offer your house as collateral. The bank checks the value of your house in the current market. From this value, they may agree to approve your loan.

You must pay this loan as agreed. Otherwise, the bank will take your property as payment. You can use your house as collateral for many reasons.

Here are the most common examples:

- Medical emergencies

- Payment for tuition

- Payment for going abroad

- Purchase of equipment

- Debt consolidation

There are so many reasons why people would loan money. However, there are some purposes that the bank may not approve, which only they, the bank, can tell. Typically, you cannot get approved for a home equity loan if you will use the money to put up a business.

The most common reason for getting a home equity loan is refinancing or home repair. Home refinancing means a new bank will loan you money, so you can use that money to pay off your debt from the original bank that loaned you the house.

Learn all about

Debt Consolidation Loan Philippines: Managing Debt with a Single Loan/a>

What is the Purpose of Home Equity Loan

Most of the time, people borrow money using equity loans to pay off outstanding debts. If a person has no means of income, a bank is not likely to approve a personal loan, especially if the amount he is borrowing is a huge sum.

However, if he has a property, he can use this property to borrow money. The bank will lend him the money according to the market value of the house or what the bank thinks the house is worth.

How much can you Borrow with an Home Equity Loan

The equity is equal to your property’s worth minus your existing mortgage if you have an existing loan for that house. However, this definition is just basic. Different banks have different rules when it comes to the maximum amount of money you can borrow.

There is no single answer as to how much you can borrow. Your home equity loan really depends on the value of your house or what the bank thinks is its current value. Of course, they also have to think about the profit they would make in case they took your house and sold it.

The Advantages and Downside of Home Equity Loans

Here are the advantages of equity loans:

✓ You have the option to pay a fixed interest rate

✓ You have long terms or repayment period

✓ The rates are lower compared to other loans

Now, here are the disadvantages of a home equity loan:

✖ You can lose your house if you do not pay your loan

✖ You may not get the money you desire

✖ You are paying money that is not exactly worth your house

As you can see, a home equity loan is a fast way to get money for an emergency. However, as far as payment and interest are concerned, you may be paying more than the value of what you borrowed. In addition, you may lose your house.

Who is Eligible to Apply for a Home Equity Loan Philippines

The first qualification is that you must own a house. It is alright if this house is still under a mortgage. What matters is that the house and lot are in your name.

Here are the eligibility requirements:

✔️ 21 to 65 years once the loan has matured

✔️ You must have a monthly income of at least ₱50,000

✔️ You must be a practicing professional or a permanent employee

✔️ You can also be an OFW or a business owner

For the age of 65, it does not mean that you can apply if you are 65 years old. It means that y the time the loan has matured, your age should not be more than 65.

Use our online calculator to gauge your instant personal loan cost:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

Learn how to

Renovate Your Home with Ease: Get a House Loan for Renovation

Home Equity Loan Requirements

Before you apply for a loan, you should prepare what the banks would require of you. In this section, we will show you the most common requirements.

Here are the things you need to prepare:

- Completely signed loan application form

- Government ID

- If married, present your CENOMAR

- Proof of employment, such as business documents or pay slip

If you are operating a business, you must present your:

- Business registration

- A business permit from the mayor

- Audited financial statements for the last two years

- Company profile or background

- Income tax return documents

Now, if you are an OFW, you must present your contract of employment. You must also present your employment certificate. In addition to this, you need a special power of attorney document, which you can get from the bank.

Finally, you need to present documents for your collateral. Here are the ones you need to prepare.

- Copy of Tax Declaration for your lot and its improvement

- Copy of Transfer Certificate of Title or what we call CTC as proof that you own the property

If you have a condominium unit, you must also present the CCT and a copy of the Master Deed of Declaration and Restriction Copy of Tax Declaration.

If you are applying for a loan for home construction, you must present the building plan and the bill of materials from your engineer or construction company. These are merely basic requirements. Some banks may ask you for more documents.

Where can you Apply for an Home Equity Loans in the Philippines

There are many places where you can borrow money for a home equity loan, but most of these are banks. Here are the most common places or companies that offer home equity loans in the Philippines

| Company | Loanable Amount | Repayment Period |

|---|---|---|

| BPI | At least 500,000 PHP or up to 70% of the value of your house | Choose from one to ten years |

| BDO | 1 to 20 million pesos | From one year to three years if short-term |

| Maybank | Half a million to 30 million pesos | Choose from one year to 20 years |

| Landbank of the Philippines | ₱300,000 to 2 million pesos | One to five years |

| CTBC | Half a million to 50 million pesos | 180 days to ten years |

Note: The information about banks presented in the table is subject to change and borrowers are advised to contact their chosen bank directly for the most updated information.

Learn about

What is Multi-Purpose Loans (MPL) in the Philippines

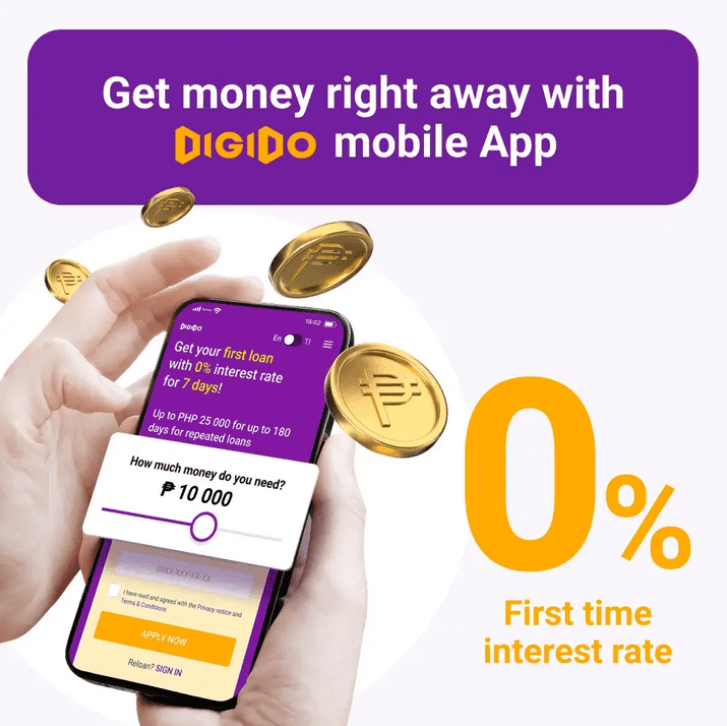

Experience the Benefits of Digido’s Urgent Loans

In times of urgent financial need, you can rely on Digido – a certified financial company that provides quick and convenient loans. With Digido, you can get approval for your loan in as short as 5 minutes, allowing you to meet your urgent financial requirements without any delay.

What Digido Loans offers is not a home equity loan. Digido offer fast online loans with immediate approval, with 0% interest on your loan at the first time. The processes are quick and easy – you only need one government ID. Repeat borrowers can also be automatically approved.

But that’s not all. Digido offers a range of other benefits, such as competitive interest rates and a streamlined application process that can be completed entirely online. Our loans are designed to cater to your specific needs, ensuring that you get the financial support you need, when you need it.

The main benefits of Digido are the following:

- No need to queue physically

- All processes are online

- No need for a lot of documents

- Easy and fast approval system

- Online disbursement of your loan

So, why wait? Get in touch with Digido today and experience the convenience of our urgent loans firsthand!