Everything You Need to Know on Getting Laptop Loan Philippines

Key takeaways:

- Laptop loans can provide an affordable way to purchase a new computer in the Philippines

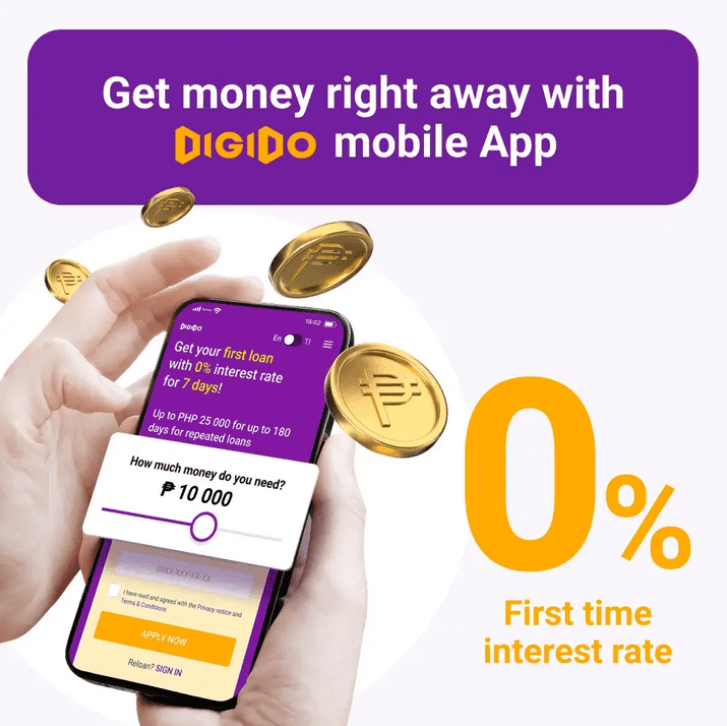

- You can secure a loan for freelancers and self-employed at Digido with 0% for first loan

- Take a quick loan from Digido and use it to buy a laptop – the whole process takes no more than 15 minutes

Are you in need of a new laptop but struggling to come up with the cash to purchase one? Fortunately, there are several options for obtaining a laptop loan in the Philippines.

Whether you’re a student, freelancer, or small business owner, getting a loan for a laptop can be a wise investment in your productivity and success.

So, let’s dive in and explore how you can get the laptop you need to achieve your goals!

- First loan with 0% interest rate

- Loans without any collateral and guarantors

Why Are Personal Laptop Loans Becoming Increasingly Popular in the Philippines?

Personal laptop loans are a type of loan that allows individuals to borrow money specifically to purchase a laptop. These loans can be obtained from banks, lending institutions, or online lending platforms and can typically be repaid over several months to a few years.

Personal laptop loans are becoming increasingly popular in the Philippines for several reasons. For instance, the COVID-19 pandemic has forced many individuals to work or study from home, making a laptop a necessity rather than a luxury. That has created a significant demand for laptops, but many people may not have the financial means to purchase one outright. On top of that, the rising cost of laptops has made it difficult for many Filipinos to afford them without some form of financing.

Personal loan for laptop provide an affordable way for individuals to obtain a laptop without paying for it all at once.

The ease and convenience of obtaining personal loans have also contributed to their popularity. Many lenders now offer online application processes, making it easy for individuals to apply for and receive a loan from the comfort of their own homes.

Read all about

Gadget Loan Requirements Philippines

Perks of Using Loan for Laptop

Several benefits are associated with getting a computer loan instead of buying one outright. Here are some of the key advantages:

✔️Cost Savings

One of the most significant benefits of a laptop loan is its cost savings. Rather than paying for the entire laptop upfront, borrowers can spread the cost over several months or years, making the payments more manageable and affordable.

✔️Full Financing

Laptop loans typically offer 100% financing, meaning borrowers can borrow the laptop’s total cost without providing a down payment or collateral.

✔️Affordability

Laptop loans often come with lower interest rates than credit cards or personal loans, making them a more affordable financing option. Borrowers can also choose a repayment plan that fits within their budget, which can further reduce the financial burden.

✔️Uncomplicated Requirements

Loans for gadgets typically have uncomplicated eligibility requirements, which makes them accessible to a wide range of borrowers.

✔️Quick Disbursement

Loans for gadgets can often be disbursed quickly, allowing borrowers to immediately obtain and use their laptops. This can be especially helpful for students or remote workers who need a laptop for their studies or work.

Types of Loans for Computer in the Philippines

Laptops have become an essential device for many individuals in the Philippines, whether for personal or professional use. However, not everyone has the means to purchase a laptop upfront. Thankfully, there are various types of loans available in the Philippines that can help individuals acquire a laptop.

Here are some of the common types of loans for laptops:

| Loan Type | Description |

|---|---|

| Personal Loans | Borrow a lump sum from a bank or financial institution to purchase a laptop. Repay the loan in installments over a specific period. |

| Buy Now Pay Later | Individuals can purchase a laptop and pay for it over a certain period. This loan type allows individuals to spread out their payments, making it more manageable for them. |

| Manufacturing Financing | Laptop manufacturers offer financing options for individuals to purchase their products. Buy a laptop and pay for it in installments directly to the manufacturer. |

| Credit Card Installment | Pay for your laptop in monthly installments using a credit card installment plan. This option is available to those with a credit card and sufficient credit limit. |

| In-House Financing | Purchase a laptop from a store and pay for it in installments directly to the store through their in-house financing option. |

| Salary Loans | Employers in the Philippines offer salary loans for purchasing a laptop. The loan amount is deducted from your salary over a specific period. |

Read How to get

Get the Latest Appliances with an Appliances Loan in the Philippines

Where to Get Computer Loan

In the Philippines, there are various organizations that provide loans for laptops.

Some of these organizations:

📌Digido – Digido is a digital lending platform that offers personal loans, including loans for any purposes such as buying laptops. The loan application process is quick and easy, and individuals can apply through their website or mobile app.

📌BDO Unibank – BDO Unibank is one of the largest banks in the Philippines, and they offer personal loans, including loans for laptops. The bank offers flexible payment terms and competitive interest rates.

📌Abenson – Abenson is an appliance store that offers financing options, including loans for laptops. The loan application process is simple, and individuals can apply through their website or visit any of their physical stores.

📌Landbank I-STUDY – Laptop loan for students Philippines – LANDBANK has introduced an improved version of the I-STUDY Lending Program that allows students to apply for a loan of up to PHP 50,000. This loan can be used to purchase learning gadgets like laptops, desktops, or tablets. The amount can be included in the maximum loanable amount of PHP 150,000 per student or PHP 300,000 per parent-borrower, which covers the payment for tuition or enrollment-related fees.

How to get ⏰

Fast Loan in 15 Minutes in the Philippines

Why people choose Digido for Quick Loans

Do you need a new laptop but don’t have enough money to buy the model you want? Look no further than t he robot service Digido Fast Loans. With Digido you can secure your laptop purchase and get the financing you need to upgrade your tech or for other purposes.

Digido is a financial technology company that provides an online lending platform in the Philippines. They offer a range of loan products, including personal loans. Digido uses advanced algorithms and big data analysis to evaluate loan applications and provide fast loan approvals.

The platform offers a range of benefits, such as:

- The whole process is online. You can register and fill out the form without leaving your computer.

- New customers who have not borrowed from Digido before are eligible for a 0% interest rate on their loan

- Digido provides loans with a minimum loan amount of PHP 1,000 and a maximum loan of PHP 25,000

- Getting approved is easy and fast, with a 5-minute approval process that doesn’t require any paperwork.

- Repeat borrowers can take advantage of our installment loan.

Upgrade your tech and secure your laptop purchase with Digido Personal Loans today. Click “Apply Now” to get started and experience the ease and convenience of Digido for yourself!

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

Requirements for Digido loans

In terms of requirements for laptop loans in the Philippines, lenders will typically require proof of income, government-issued identification, and a good credit score. Some lenders may also require collateral or a co-signer to secure the loan.

In contrast, Digido loans have uncomplicated eligibility requirements, making them accessible to a wide range of borrowers.

Unlike traditional loans that require a high credit score or lengthy application process, Digido loans can be obtained with minimal paperwork and eligibility requirements.

How can I get a Digido loan?

You can get a loan if:

- A Filipino citizen, 21-70 years old

- Has a valid government-issued ID

- A working mobile phone number