Online Loan No Requirements in the Philippines: with Minimum Documents

Key takeaways:

- No Requirements loan in the Philippines is a good option for Filipinos seeking financial support

- Basic documents for getting loans is government ID and proof of income

- Online lenders must be registered with the SEC and have a physical office in the Philippines to operate legally

- Digido is a registered reputable lender that offers loans with no requirements, no additional documents or guarantors

What is Personal Loan No Requirements

It is commonly known that many borrowers in the Philippines do not qualify for traditional loans because they cannot provide the required documentation. Typically, when applying for a loan, there are certain requirements that must be met, such as a good

- credit score;

- proof of income;

- and a minimum age requirement.

However, borrowers still have the option to apply for a loan with minimum requirements, also known as a “No Requirements Loan”. Although this term may not be widely used in the financial industry, it can be used to describe loans with minimal documentation and qualifications. Only basic documents such as a government ID and proof of income are required for this type of loan, and it can usually be completed online.

- Just one valid government ID required

- Enjoy a loan approval rate of over 95%

- Loans without any collateral and guarantors

A loan with minimum requirements is designed to have a simplified application process and can be a good option for borrowers who do not meet the strict requirements of traditional loans. However, it’s important to note that these loans often come with shorter repayment terms and higher interest rates than traditional loans.

In the Philippines, the No Requirements Loan is a popular option for borrowers. Common examples of loans with minimum requirements include:

- Payday loans: These are short-term, high-interest loans intended to be paid back by your next payday.

- Personal loans: These are loans that may not require collateral and can be used for many purposes, from home repairs to debt consolidation.

- Title loans (with collateral): These are short-term loans that use the borrower’s property, such as a car as collateral.

- Pawnshop loans (with collateral): These are loans where you “pawn” an item in exchange for cash and can get the item back after repaying the loan and interest.

It’s important to choose such loans carefully and understand their advantages before making a decision. And today, we will learn how to choose the right kind of loan and understand its advantages.

Pros and Cons of Loan No Requirements

So is it worth choosing this type of loan? Let’s take a closer look at the advantages and disadvantages of loans without requirements.

Advantages of No Requirements Personal Loan

✔️ Opportunity for people with low credit scores or no collateral: No requirements loans offer a great advantage for people who may not have a high credit score or any collateral to secure a traditional loan. These loans provide access to funds without the need for a credit check or collateral, making them an accessible option for individuals who may otherwise struggle to secure financing.

✔️ Quick and easy application process: No requirements loans typically have a simple and straightforward application process. Borrowers can apply online or in-person, and the application process usually takes just a few minutes to complete. This ease of access allows borrowers to quickly and easily obtain the funds they need.

How to Get

Fast Loan in 15 Minutes in the Philippines

✔️ Possibility of obtaining a loan for people with bad credit history: No requirements loans offer a chance for individuals who may not have a credit history or have a bad credit history to obtain financing. This can be especially important for those who are just starting out or trying to rebuild their credit.

✔️ Minimal documens Requirements: No requirements loans usually have minimal documentation requirements, making the application process easier and faster. Borrowers may only need to provide basic information such as proof of income and identification.

✔️ Fast loan approval: With minimal documentation requirements, no requirements loans often offer a fast loan decision. This can allow borrowers to quickly know whether they have been approved for a loan, allowing them to move forward with their financial plans.

✔️ Borrowers can apply for a loan to pay for a debt, pay school tuition, and many other purposes: No requirements loans can be used for a variety of purposes, including paying off debt, covering unexpected expenses, and paying for school tuition. This flexibility makes them a valuable tool for borrowers who need access to funds quickly and for a wide range of purposes.

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

Disadvantages of Loan with minimum Requirements

As you see, no requirements loans have many advantages that make them a popular option for those in need of quick financing. However, it’s important to keep in mind that there are also several significant disadvantages to these types of loans.

Higher interest rates: No requirements loans often come with higher interest rates compared to traditional loans. It is important to take the borrowing process seriously and choose the right lender.

Shorter repayment terms: While no requirements loans offer flexible repayment terms, they often come with shorter repayment terms than traditional loans.

Limited loan amounts: No requirements loans may offer smaller loan amounts than traditional loans, which may not be sufficient for borrowers who need to finance larger purchases or expenses.

Risk of predatory lending: Borrowers should be cautious of lenders who offer loans with high interest rates, hidden fees, and other unfavorable terms. It is crucial for borrowers to approach only those lenders who are SEC-certified in the Philippines and have a good reputation.

Learn about

Personal Online Loan up to PHP 25,000 in the Philippines

Where to Get Online Loan no Requirement in the Philippines

When it comes to borrowing money, it is important to be a smart borrower and examine your options before choosing a particular lender. Since there are many lenders in the Philippines, choosing one can be a daunting task. To help you navigate through the plethora of lenders available, here are a few options for loans with minimum requirements and low documetation that you may want to check out.

Table 1. Comparison of interest rates and terms of loans without requirements

| Loan amount PHP | Loan term | Interest Rate | Approval time | |

|---|---|---|---|---|

| Digido | 1000 – 25. 000 | 7-180 days | 0% per day for 7 days | within 4 minutes |

| UnaCash | 2,000-50,000 | up to 6 months | 0% to 6% | within 5 minutes |

| MoneyCat | 1,000-20,000 | up to 180 days | first loan free | in 5 minutes |

| Finbro.ph | 1,000-50,000 | 1 to 12 months | 1.25- 15% p.m. | up to 12 hours |

| OnlineLoans Pilipinas | 2,000-10,000 | 10- 30 days | new clients 0% | in minutes |

| Tala | 1,000-25,000 | up to 61 days | 15% (p.a.) | in minutes |

Note: The information presented in the tables is subject to change and borrowers are advised to contact their chosen financial entity directly for the updated information

Learn How to Get

24-hour payday loan in the Philippines

Benefits of Digido Personal Loans 🔥

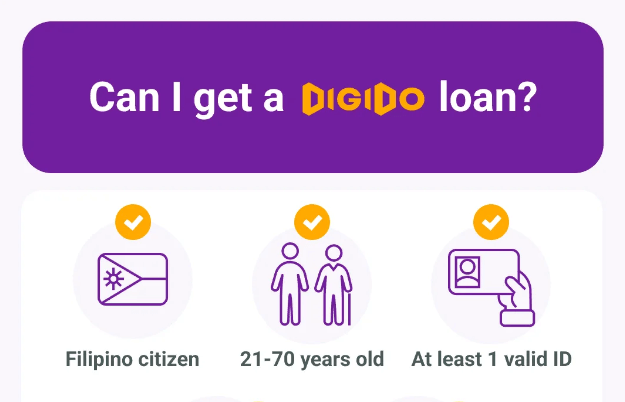

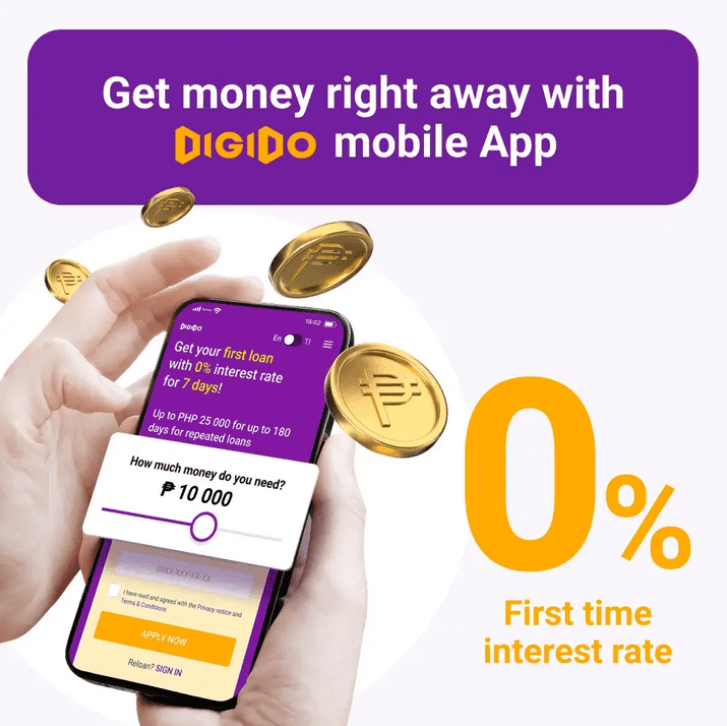

Digido is a fully automated online portal with highly innovative, customer-friendly financial solutions. This lending facility gives you a generic loan, which means you can use it for any purpose. Digido is a certified and reputable lender in the Philippines, having obtained certification from the SEC. As a borrower, it is essential to work with a lender that is trustworthy and reliable, and Digido meets those standards. You can verify their SEC (1)registration number easily, giving you peace of mind when applying for a loan with them.

The main advantage of Digido is that the entire process can be completed online, so there is no need to leave your home. Just fill out the application and get your money within 15 minutes. If you want to get a loan quickly and without paperwork, with Digido you only need one valid ID.

Digido offers so many features that are advantageous to borrowers:

- Digido is a fully legal company, it has SEC Registration and Certificate of Authority

- Digido is open 24/7, you can contact them anytime and anywhere in the Philippines

- You can get your first loan with a 0% interest

- Easy loan application process with immediate decisions online

- Digido’s automated loan lending system makes independent decisions based on each application and transfers money within a few hours

- There are no hidden charges, upfront fees, or commissions

- No collateral loans and guarantors are not needed

- More than 95% loan approval rate

- Multiple Loan Repayment Options which include bank transfer, remittance center, DragonPay, offline branches, and 7-Eleven