24/7 Payday Loans Online in the Philippines

Key takeaways:

- A payday loan is a small loan issued by a financial institution over the Internet.

- The need for a payday loan in the Philippines usually comes due to low wages or in case of an emergency.

- We recommend a quick short-term loan from Digido for between 7 and 30 days.

- Always keep repayment deadlines in mind to pay back your debt on time.

What is Payday Loan?

An online payday loan is issued by a private lender through the Internet. These are typically unsecured, are short-term, and can be granted quickly. These do not require collateral, but interest rates can be low or high depending on the lender. Payday loans are supposed to be repaid upon the next payday.

Therefore, in most cases, you must have a stable source of income. People turn to these sources of credit when their salaries are not enough to cover expenses or if their salaries are delayed. These loans are designed for those who need quick funds for any urgencies. Some situations in which quick 24/7 payday loans online can apply include:

- Medical expenses and hospitalizations;

- Home repairs;

- School expenses;

- Rent and utilities;

- Appliance purchase;

- Quick travels;

- Debt refinancin;

- Food and others.

Hence, these loans are available 24/7 online through apps or websites. However, it cannot be used to cover mortgages, nor be used as capital for starting a business.

When a payday loan is taken out, the expectation from the lender is that it will be paid on the next date when the borrower’s salary is available. The borrower will pay the principal amount plus whatever interest rate was added to the principal amount.

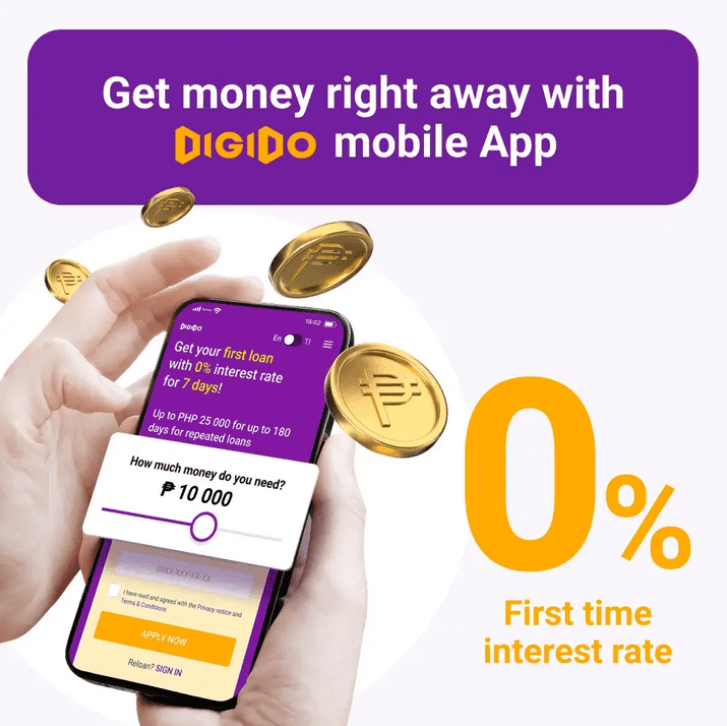

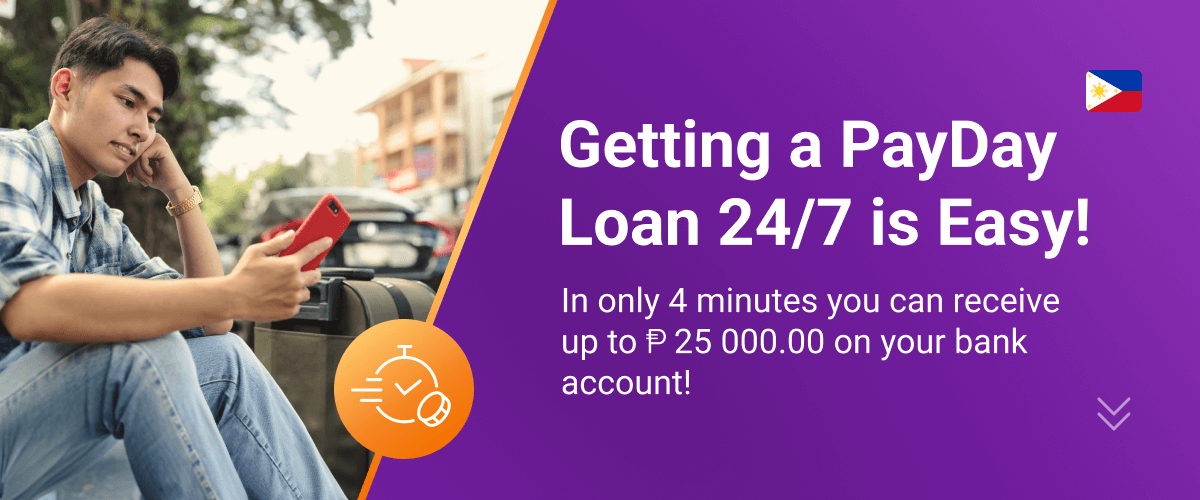

- In only 4 minutes you can receive up to PHP 25,000

- First loan with 0% interest rate

Payday Loans Online in Digido, Philippines

Digido is an online money lender, established, licensed, and operating legally. Many financial organizations offer unemployment loans, but not every one offers such loyal conditions as Digido. Digido is an automated credit system that issues loans quickly and hassle-free with minimal interests and favorable terms.

If you need cash immediately for the purchase of equipment, vacation, celebration, surgery or payment of utilities – do not waste time on banks, sign up for a Digido account now!

Advantages of Digido 24 hour Payday Loans Online

1. Fully Automated

Since Digido Philipppines issues 24/7 cash loans online, the borrower can expect the money to be there like an instant payday. Borrowers don’t have to fall in line for hours too, the transaction is also more accurate, being that all the financial transactions are calculated on computers which are really overpowered.

2. High Approval Rate

These loans can be disbursed within minutes, which is helpful if you need money urgently. With Digido, potential borrowers can be assured that they will receive their payday credit with ease and with little hassle.

3. Online Application

You just need to prepare 1 valid ID and proof of employment. No proof of income is required. But if you have proof of billing, payslips, etc. it will give you a chance to get approved faster.

Borrowers don’t have to go to the bank! Application can be done and completed from the comfort of your own home using your preferred gadget.

4. Open for Everybody

Anyone who has reached the age of majority and is a citizen of the Philippines can apply for a fast and easy online loan 24/7. Your marital status nor your salary will not affect your probability of getting accepted.

5. Possibility of Cashing in an Offline Point

Also an undoubted advantage is the ability to cash out funds in the offline point. The borrower receives the 24/7 loan approval of the application on the web-site, and then cashes out a loan in one of our offices. Such points are located throughout the Philippines.

6. Easy steps to Getting Money

You can process the loan in 24 hours and less and it is quite simple. Here are the simple steps:

- Choose the loan amount;

- Enter your phone number for fast registration;

- Then fill in a short form with your ID data.

The application is sent for consideration. Within a few minutes, the borrower receives a reply from the company to which the electronic contract is attached. It is necessary to read the points of the contract and confirm the financial deal with a single click of the mouse. Money will be available within half an hour.

Just click “Apply Now” button to get started and the money will be in your account in half an hour.

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

Digido Payday Online Loan with 0% Interest Rate

👉 Payday Loan Amount

First-time borrowers can take up to PHP 10,000 with 0% interest rate for the first time. Then the first loan has been paid, the borrower can borrow a higher amount. Succeeding amounts can go as high as PHP 25,000.00 which should be enough for most simple emergency situations.

👉 Loan Terms

The terms set by Digido are pretty straight forward: those who are going to borrow for the first time are allowed 15 days to pay back whatever amount is owed. This is just about the same length of time between paychecks.

For those who will be borrowing for their second time or more, they can take out a loan with a term anywhere between 5 and 30 days.

👉 Borrower Requirements

The requirements necessary for borrowing a payday 24/7 loan from Digido is minimal. All customers are expected to have 1 government valid ID and a working mobile phone.

- Additionally, the following documents can be provided to improve your chances of getting a loan: a copy of their payslips or employee ID or a Certificate of Employment (COE).

- For the self-employed like those who are running a business, can present their Department of Trade and Industry (1) or Bureau of Internal Revenue (2) certificates.

Digido is a financial system that does not require the provision of supporting documentation, except the passport. You will not have to experience:

❌ waste time on standing in queues at banks;

❌ waste time on waiting for an approving result;

❌ need to collect a package of documents;

❌ extra overpayments, commissions and other cash deductions.