Certificate of Employment Guide: Writing Tips and Ready-to-Use Templates

Key takeaways:

- The COE contains detailed employment information

- It can be used as supplemental documentation for banking purposes and visa applications

- It is the right of every Filipino employee to receive one

- You don’t need a COE to apply for a Digido loan, we only require 1 government valid ID

Table of Contents

A certificate of employment is one of the most important documents that you can have in the Philippines. It gives details about the type of work that you’re doing and for how long you have been doing it. It is a required document by banks and foreign embassies, demonstrating that you have a job and can support yourself.

- First loan with 0% interest

- Up to PHP 25,000 In only 5 minutes

- Easy loan application and approval process

What is a COE?

A certificate of employment (COE) is a document that outlines an employee’s experience with a specific employer.

Meaning, it contains the type of work an employee did and the date in which the employee joined and resigned from the company. Some COEs may also contain the amount of compensation an employee got.

Regular employees who have resigned or were terminated can be granted a COE. Present employees can also request and be given a COE, provided that the reason is applicable.

All employees in the Philippines have the right to receive a COE, according to Rule XIV, Book V of the Omnibus Rules Implementing the Labor Code. However, they don’t have the right to dictate the specific contents of a COE.

A COE is also not synonymous with an employment clearance. The former is about the nature and duration of your employment, while the latter clears you of all your responsibilities from your previous employer.

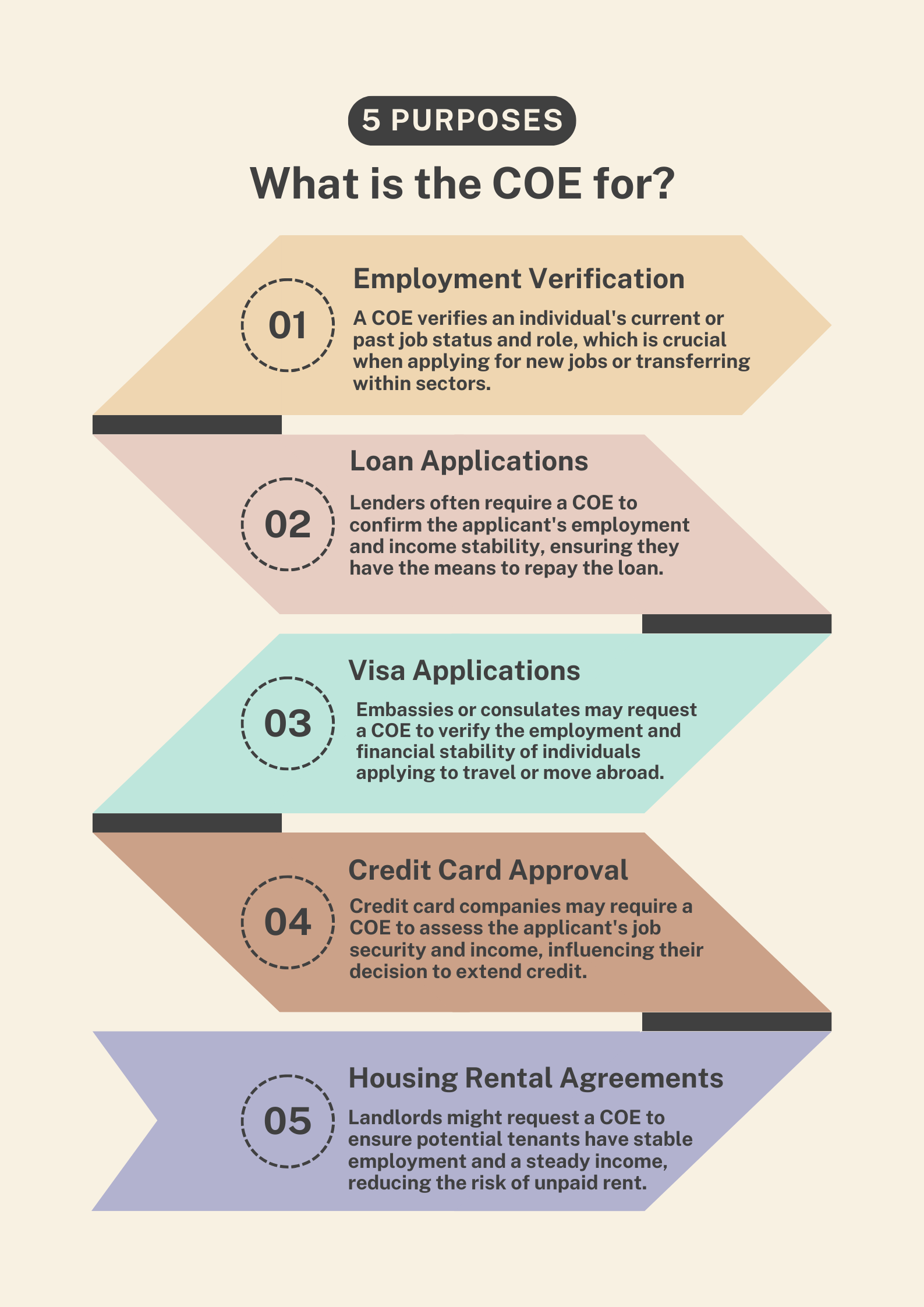

What is the purpose of a COE?

The COE serves as formal evidence that a person is or was employed by a particular company, detailing their role and the duration of their employment. Employees may request a COE from their employers for different reasons. The most common reasons are:

✅ Applying for a new job

When applying for a new job, one of the primary documents that an employee must submit is a COE. Potential employers will refer to an applicant’s COE to assess their employment history and experience as part of the screening process. Hiring managers may use a COE to contact a previous employer and verify everything that is stated in the document.

✅ Loan or credit card purposes

Banks and financing companies will request a COE from clients to verify their employment and to check their capability of paying off their financial obligations. In particular, COEs are important when it comes to loan and credit card applications.

In some cases, these institutions may ask for a COE with a salary or compensation amount up to the present date. They will use this information to verify an applicant’s cash flow and set specific loan or credit card terms.

✅ International travel and visa purposes

In applying for a visa to visit a foreign country, having a COE ready and printed out will increase your chances of getting approved. Why? Foreign countries would like to be assured that you have a stable job in the Philippines and have the financial means to cover travel costs.

In addition, agents of the Bureau of Immigration (BI) will sometimes ask travelers going out of the Philippines to present a COE with signatures from your boss and HR, along with your work ID. This is to make sure that the traveler has a stable job here and is not at risk of human trafficking or financial trouble abroad.

It is not uncommon for BI agents to refuse a traveler from boarding a plane due to not having a COE or because they were unable to prove that they have a job here.

✅ Rental Agreements

Landlords may require a COE from potential tenants to verify their employment status and income to ensure they can meet rental obligations.

How to get a Certificate of Employment?

It’s very easy to get a certificate of employment. Simply notify your boss or HR department that you need a COE, then state the reason for your request.

You can also draft a request letter for a COE if your workplace requires it. In your letter, state your name, your request for an employment certificate, and the reason why you need one. Aside from your boss, you can also ask for a signature for someone from your HR department.

Once your COE is ready, you might need to collect it in person, or it may be sent to you digitally, depending on your company’s policies and you simply download your employment certification and print it out.

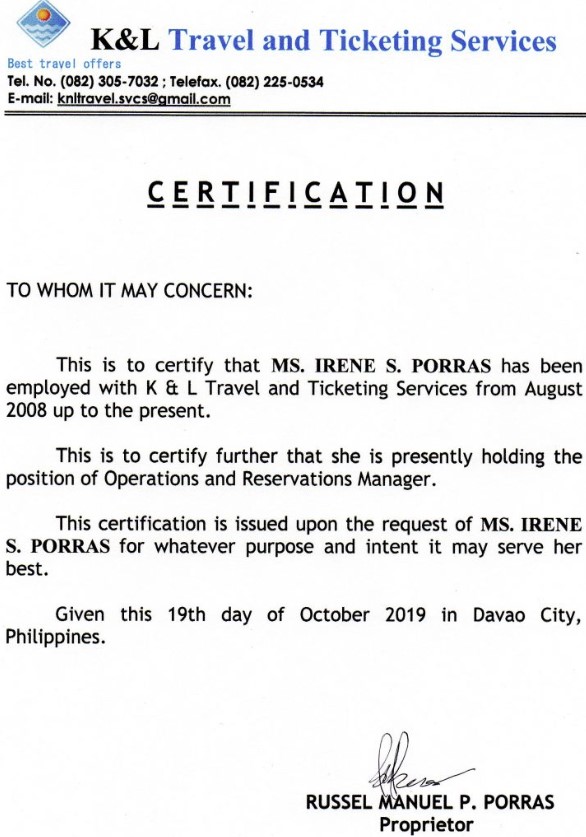

Certificate of Employment Sample

What information should be included in a COE?

According to the guidelines set by the Department of Labor and Employment, a certificate of employment should contain the following:

- Duration of an employee’s engagement

- Date of employment termination

- Type of work done by the employee

As an employee, you have the right to request a COE for whatever purpose it may serve. However, you have no control over the content of your COE.

Employers must release a COE within three days from the date of request. That means it cannot be released at the same time as the final pay. The DOLE mandates employers to release the final pay within 30 days from the date of employee separation or termination.

If you are having problems with your employer regarding your COE, you can file an issue or dispute at the nearest DOLE regional/provincial/field office which has jurisdiction over your workplace. Here is a COE example:

Here is a COE sample certificate of employment courtesy of Digido. If you are an employer, you are free to copy this template anytime an employee asks for a COE.

[Company Letterhead]

[Date]

CERTIFICATE OF EMPLOYMENT

To whom it may concern:

This is to certify that [name of employee] has been employed with [name of employer/company] as [employee position] for [duration of employment] from ____ to ____.

This certificate is being issued at his/her request for whatever purpose it may serve.

[Employer’s signature]

[Employer’s name]

Certificate of Employment with Compensation Sample

A Certificate of Employment with Compensation is a document issued by an employer that not only verifies an employee’s job status and tenure but also includes information about the employee’s compensation. This typically encompasses salary details along with any benefits or allowances that the employee receives as part of their employment package.

Here is a COE sample with salary:

[Company Letterhead]

Date: [Current Date]

To Whom It May Concern:

This is to certify that [Employee’s Name], residing at [Employee’s Address], has been employed with [Company’s Name] since [Start Date] and is currently holding the position of [Job Title].

As part of [his/her/their] employment, [Employee’s Name] is compensated with a gross monthly salary of [Amount in local currency], which includes base salary, annual bonus and other allowances.

This certificate is being issued upon the employee’s request for [specify the purpose, e.g., “personal loan application purposes”] and should not be used for any other purpose.

Please contact our human resources department at [Contact Information] should you require any further information.

Sincerely,

[Signature]

Certificate of Employment for travel purposes Sample

A Certificate of Employment (COE) for travel purposes serves as an official document to verify an individual’s employment status, primarily when they are applying for a travel visa. This document can be crucial for several reasons:

- Visa Applications: Many countries require proof of employment to issue a visa. This helps the consulate or embassy assess the applicant’s ties to their home country, suggesting that they have a reason to return after their travel.

- Evidence of Financial Stability: A COE can demonstrate to visa officers that the applicant has a steady job and regular income, which supports their ability to fund their trip and return home.

- Verification of Leave Approval: In some cases, the COE may also mention that the applicant has been granted leave for the duration of the travel, which reassures the visa processing authorities that the traveler has the intention and obligation to return to work, and thus, to their home country.

- Reducing Risk of Visa Denial: By showing that the applicant is gainfully employed and not likely to overstay their visa for economic reasons, a COE can reduce the chances of visa denial.

Here is an example of certificate of employment for travel purposes:

[Company Letterhead]

Date: [Date]

To Whom It May Concern,

This certificate is to confirm that [Employee’s Name], holding the position of [Employee’s Position], has been employed with us at [Company’s Name] since [Start Date of Employment]. [He/She/They] is currently working on a [full-time/part-time] basis.

We acknowledge that [Employee’s Name] has been granted leave from [start date] to [end date] for travel purposes.

Please feel free to contact us at [contact information] should you require further information.

Sincerely,

[Your Name]

Request Letter for Certificate of Employment

If you are wondering how to draft a proper COE request letter, below are certificate of employment templates you can use. Feel free to adjust the details and the tone of the letter to match your specific needs and the norms of your industry. Remember to always be polite in your requests; it’s important to clearly ask for everything you need.

Dear [Recipient’s Name],

I am writing to formally request a Certificate of Employment (COE) from [Company’s Name]. I was employed as [Your Job Title] from [Start Date] to [End Date], and I require the COE for personal record and future employment purposes.

Please include the following details in the certificate:

- My employment start and end date

- Position held

- Brief description of duties (if applicable)

I would appreciate if the COE could be provided by [desired date of receipt], as it is required for [mention the purpose, e.g., a loan application, new job application, etc.].

Thank you for your attention to this matter. Should you need any additional information, please do not hesitate to contact me at [Your Phone Number] or [Your Email Address].

Yours sincerely,

[Your Signature]

Here is also a sample request letter for certificate of employment for loan. This letter keeps the request straightforward and polite, with clear details about what is needed and why.

Dear [HR Manager’s Name],

I am writing to request a Certificate of Employment. I am currently employed as [Your Job Title] at [Company’s Name], and I require this certificate to support a loan application.

Please include details such as my employment status, position, salary, and dates of employment. I would appreciate if the certificate can be provided by [desired date of receipt], to meet the loan application deadline.

Thank you for your attention to this matter. Please let me know if you require any further information.

Sincerely,

[Your Name]

Learn more about fast loans:

✦ Easy Cash Loan with fast approval

✦ fast online loan in 15 minutes

✦ Loans For Students in the Philippines

Is COE a valid ID?

While a certificate of employment is not considered a valid ID, banks and financing companies can ask you to provide a copy of this document (along with your work ID) as proof of employment. They will use this document to verify that you have a job and income. This document is a primary requirement, especially if you are applying for a loan or credit card.

However, some online lenders do not require you to submit a COE, only a valid ID. And you’ll be lucky to know that Digido is one of them!

You don’t need a COE to apply for a Digido personal loan. All you need is a valid government-issued ID. We accept the following:

- Driver’s license

- Philippine passport

- UMID

- SSS ID

- TIN ID

If you’re in need of quick cash and you already have one of the IDs listed above, apply for a Digido loan now! You will get a minimum of Php 1,000 and a maximum of Php 25,000 if you are a repeat borrower — all in just 5 minutes!

Calculate your loan cost and get your first loan with 0% interest rate:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

Why Employers Should Provide COEs

Denying an employee’s request for a Certificate of Employment (COE) can have significant repercussions across social, economic, and human aspects. Here’s why it’s important for employers to provide a COE when requested:

- Legal Compliance: In many jurisdictions, the provision of employment documentation upon request is a legal requirement. Non-compliance can lead to legal disputes, financial penalties, and administrative burdens, which could be economically damaging to the organization. Employees have a professional right to access their employment records and validate their work history. A COE is a fundamental document that supports an individual’s career progression and personal planning.

- Trust and Reputation: By issuing a COE, employers maintain trust and uphold their reputation not only among their employees but also within the broader community. Denying a COE can lead to negative perceptions and may suggest that the company does not value the rights and needs of its workforce. Employees frequently require a Certificate of Employment (COE) for important personal tasks such as applying for visas, securing housing, or pursuing educational opportunities. By issuing a COE, employers demonstrate their support and respect for the personal and professional development of their employees.

10 Steps How to make Certificate of Employment

To make a Certificate of Employment, follow these simple steps:

- Use Company Letterhead: Start with your company’s official letterhead for authenticity.

- Include Date: Clearly state the date on which the certificate is issued.

- Address Recipient: Use “To Whom It May Concern” if there is no specific recipient.

- State the Purpose: Briefly mention that the certificate is issued at the request of the employee.

- Employee Details: Include the full name of the employee, job title, department, and employment dates.

- Employment Status: Mention whether the employee is currently employed or was a past employee.

- Compensation Details (if required): Include salary details along with any other compensation the employee receives.

- Closing Statement: Mention that the certificate is issued for a specific purpose, if applicable.

- Signature: End with the signature of the HR Manager or authorized person, their name, position, and contact information.

- Contact Information: Provide a way for the recipient to verify the certificate, if necessary.

Learn more useful information:

✦ Gadget fast Loan Requirements

✦ Personal Loans With Bad Credit Score

✦ Buy Now Pay Later in the Philippines

Certificate of Employment in the Philippines: FAQs

-

What is certificate of employment?A Certificate of Employment (COE) is a document issued by an employer that verifies an employee's current or past job status. It typically includes the employee's name, position, dates of employment, and sometimes, details about salary and responsibilities. This certificate is often required for loan applications, visa applications, or new job applications to prove employment history and financial stability.

-

How long is the COE in valid in the Philippines?In the Philippines, a Certificate of Employment (COE) does not have a specific expiry date. However, the relevance and acceptance of a COE depend on the purpose for which it is being used. For instance, financial institutions or embassies may require a COE that has been issued within the last three to six months to ensure that the information is current.

-

Is COE mandatory in the Philippines?Yes, in the Philippines, issuing a Certificate of Employment (COE) is mandatory when requested by an employee. According to Philippine labor laws, employers are required to provide a COE upon the request of a current or former employee. This legal obligation ensures that employees can access important documentation of their employment history for personal or professional reasons, such as applying for loans, new jobs, or visas. Failure to comply can lead to legal consequences for the employer.

-

Where to get certificate of employment?A Certificate of Employment (COE) is typically obtained from the human resources or personnel department of the company where you are or were employed.

-

Who is entitled for COE?Anybody who was and is an employee of the company CAN request for a COE.

-

When should a Certificate of Employment be issued?A COE is issued after the termination of employment or upon request by an employee.

-

How can I request for an employee certificate?You can request for a COE simply by informing your employer. You can submit a request letter for a COE for a more formal process. Include the reason for your request as well as the timeline for your COE.

-

When should my employer release my COE?Your employer should release your COE within three days from the date of request.

-

Is the COE the same as clearance?No, the COE and employee clearance are not the same. Employment Clearance is a form or document that an employee receives upon leaving a company, indicating that they have fulfilled all their responsibilities, returned all company property, and cleared any outstanding obligations. It's essentially a clearance form stating that the employee has no pending issues with the company.

-

Is the COE the same as an employee contract?No, the COE is not the same as an employee contract. Employment Contract is a formal agreement between an employer and an employee that outlines the terms and conditions of employment. It includes details such as the nature of the job, salary, benefits, work hours, job responsibilities, and conditions related to the termination of employment. An employment contract is agreed upon and signed when an employee starts working at a company and is binding as long as the employment relationship exists.

-

When can my employer legally refuse to provide me with a COE?In general, employers in the Philippines are legally obligated to provide a Certificate of Employment (COE) upon the request of an employee or former employee. However, there might be specific scenarios where an employer might delay or question providing a COE, such as:

- Pending Settlements: If an employee has pending financial or other obligations that need to be settled with the company, the employer might delay issuing the COE until those are resolved.

- Administrative Delays: There might be administrative or bureaucratic delays within the company, such as slow processing times during peak periods or transitions within the HR department.

Authors

Digido Reviews

-

EdcelDigido is superb to the point of acing clients or customer needs for loan. The free choose of how many days you can pay and the payment extension is beyond compare. Although the interest is quite high but it will really compensate fast-pacing response. The agent were very responding and accomodating! I love Digido, Happy Chinese New Year ❤️5

-

JohnDigido is the best! I just claimed 4000k on my first loan with zero interest, 7 days term! Claimed through Cebuana, Wow! I am now officially Recommending Digido App.5

-

SamI loved Digido not just the app but for the whole experienced that I had in applying for a loan. Hassle free and loan disbursement is as quick counting 1-2-3.5

-

FredericoOne of the best Loan App, reliable, quick cash disbursement and they also give you alternative plan option to settle your debt, so far I'm satisfied with it 😊👍4

-

RosveEasy to apply and they disburse loan amount instantly. Online staff are very accomodating and respectful thank you.4