Buy Now Pay Later in The Philippines

Key takeaways:

- Buy Now Pay Later in the Philippiens is a type of installment loan for purchases and paying bills

- You pay for your purchase in several equal installments, the first of which is generally settled at checkout paid at checkout and also referred to as “point of sale installment loans”

- Many BNPL do not require a stringent credit check. Applying for the BNPL program won’t damage your credit history, but can help you build a good score

- BNPL can be a useful payment option for those who are able to make their installments on time and in full

Table of Contents

If you wish to order an item but lack the means to do that, there’s no need to give up the idea. Go with a Buy Now Pay Later (BNPL) option.

One of the main advantages of BNPL is that consumers do not need to pay the full amount upfront to make purchases. Being able to use this financial option for everyday purchases lightens the load of spending and allows users to budget and manage finances better.

BNPL has turned extremely popular with buyers, since it minimizes the initial cost of purchase. Recent statistics prove that: the global BNPL market amounted to USD 256.54 billion by the end of 2022, and is forecasted to reach USD 3,892.19 billion by 2031 (1). The rising popularity of this convenient payment solution is also accounted for by the development of mobile banking and ecommerce.

In this article, we’ll discuss how BNPL works in the Philippines, how to apply for it, where you can use it, and what the terms are for this payment option.

- 0% interest for first loan

- 1 valid ID only

- Get fast cash for urgent purchases!

What is BNPL in the Philippines?

Buy Now Pay Later (BNPL) in the Philippines is a kind of installment loan and a great alternative to credit cards, which typically have more restrictive requirements for approval. A lot of BNPL credits allow you to pay for your purchases without using a credit card. However, the principle is similar: you can buy something right away, even if you don’t have enough cash at that moment.

Shop Now Pay Later in the Philippines is typically used to purchase costly items such as appliances or gadgets. However, some consumers also use BNPL to pay for everyday essentials like food, services and utilities such as water, electricity, internet, and phone bills if that service providers are partner merchants of the chosen BNPL program.

Many trading establishments, including offline and online stores, provide the Buy Now Pay Later credit line option. A few of these include popular eCommerce platforms such as Lazada, Atome, Shopee, and digital payment platforms such as SPay Later, retail outlets such as All Home and SM Appliance, and utility providers such as Meralco.

Find out how to

Get a Cash loan in the Philippines Without a Bank Account.

How Does BNPL work in the Philippines?

As a rule, BNPL implies that you can pay for your purchases using no credit card. However, some BNPL programs in the Philippines require the users to hold a Philippine-based bank account for BNPL loans.

The BNPL payment option is also available at certain banks like Metrobank, BDO, and EastWest Bank. These banks offer BNPL services through their websites or mobile banking apps with special discounts for customers who opt to use the installment program.

Buy Now Pay Later programs divide the total purchase cost into multiple payments over a set period (usually up to 12 months). Users must make a “down payment” or an initial deposit and then pay the remaining balance in monthly installments.

These are fixed amounts typically slightly higher than the minimum payments required by credit cards. Customers are free to “shop now and pay later”, often with 0% interest.

In Philippines, BNPL service providers do not usually request information about a user’s credit history or score to determine their eligibility for a BNPL loan. However, customers have to stick to paying their installment in due time to avoid account restrictions, late payment penalties, and sizable cuts in their spending limit.

BNPL providers give clients a set credit limit per month. It starts at a low figure and gradually increases if users make more purchases while complying with their payment schedule.

BNPL Loans vs. Credit Сards

Buy Now Pay Later installment loans are similar to credit card offers. Still, there are also noticeable differences in terms and conditions that users should be aware of before applying for a BNPL.

Let’s go through similarities first. Both BNPL loans and credit cards:

✅ Allow installment payments

The most significant benefit of applying for a Buy Now Pay Later program or a credit card is that you can split high costs of important purchases without depleting your savings account. This leaves more room to save up and pay off your debt over a more extended period of time, or spend on other necessary items and reserve the payment for another time.

✅ Have period-based payment terms

The period for loan amount repayment for BNLP loans and credit cards is usually between 3 and 12 months. Usually, interest-free installments are up to 4 months, and loans for longer payment periods incur interest rates. Therefore, before committing to a loan, users must understand the shop’s installment loan provisions to know what to expect regarding payment terms, interest rates, and late payment fees.

✅ Offer discounts when you pay using a BNPL loan or credit card

Many establishments now offer generous discounts for customers who opt to use their BNPL loan. In some cases, the discounts increase in proportion to the loan amount. That means shorter payment periods incur higher discounts than opting for longer payment terms.

Depending on the payment method and the merchant, a pay-later transaction and a credit card transaction can add up to a sizable discount, especially for home furnishings, appliances, and electronics.

✅ Require a bank account

For most BNPL programs, users must link their debit card to their account to pass the approval process.

However, a few providers do not require a bank account to use the BNPL in the Philippines, such as SPay Later (3) and Lazada BNPL (4). Instead, users must transfer funds into their respective accounts to maintain enough balance to pay for the current outstanding loans. This can be done using financial apps like BillEase or Atome.

✅ Earn reward points

Various online and offline establishments provide special discounts or reward programs when customers shop using their chosen BNPL provider or credit card brand. This is an added benefit to using Buy Now Pay Later options, as customers can save more with these rewards and discounts.

Find out how to

Get a Gadget Loan in the Philippines

However, there are noticeable differences between Shop Now Pay Later programs and credit cards:

🆚 Buy Now Pay Later loans tend to have fewer approval requirements than credit cards

Unlike credit cards, Buy Now Pay Later loans do not oblige a user to prove their salary above the stipulated minimum or a positive credit history. This makes it easier for those with a limited financial background to access installment payments. Applying for a Buy Now Pay Later loan usually only requires the following:

- Personal information, including a full name, address, age, gender, profession, and current work status

- An approved and valid ID or other forms of identification

- A recent bank statement

- Character references (in rare cases)

🆚 BNPL loans in the Philippines incur higher fees than credit cards

Most BNPL loans incur higher interest rates than those of traditional credit cards or personal loans. This is because BNPL is considered a higher risk credit, as it allows consumers to make purchases without having to pay the full amount upfront.

Additionally, a Buy Now Pay Later loan has a stricter policy with regard to those who consistently miss payment deadlines. Such behavior might result in lower allowable purchase amounts and heftier interest rates for succeeding purchases made with the provider.

🆚 Not all providers support the BNPL payment method in the Philippines

While the Buy Now Pay Later programs and apps are becoming more and more popular in the Philippines, the number of merchants, providers, and establishments that accept this payment method is still insufficient. On top of that, each establishment has a preferred BNPL provider.

Users must create multiple BNPL accounts for different providers, depending on which one the merchant accepts. Meanwhile, credit cards are accepted in almost all establishments regardless of which bank they come from.

Need money for urgent purchases or to pay bills? Calculate your pre-approved loan amount with Digido calculator and get the money within a few minutes:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

What is the interest rate on BNPL in the Philippines?

The interest rate for a BNPL account may vary depending on the provider and the terms of the account. Some BNPL providers offer zero-interest installments, while others charge a fee or interest. Clients are normally exempt from interest while using short-payment plans, while long-term BNPL plans of over 4 years might charge over 10% of monthly rate.

It is important for consumers to carefully review terms and conditions of a BNPL provider before signing up, as fees and interest rates can vary significantly between providers. Some BNPL providers may also offer promotional interest rates or special deals for new customers, so it is advisable to shop around and compare offers from different providers.

Top BNPL Loans Services 2024

There are several BNPL providers operating in the Philippines, each with its own unique terms. These are the TOP 9 providers of BNPL in the Philippines:

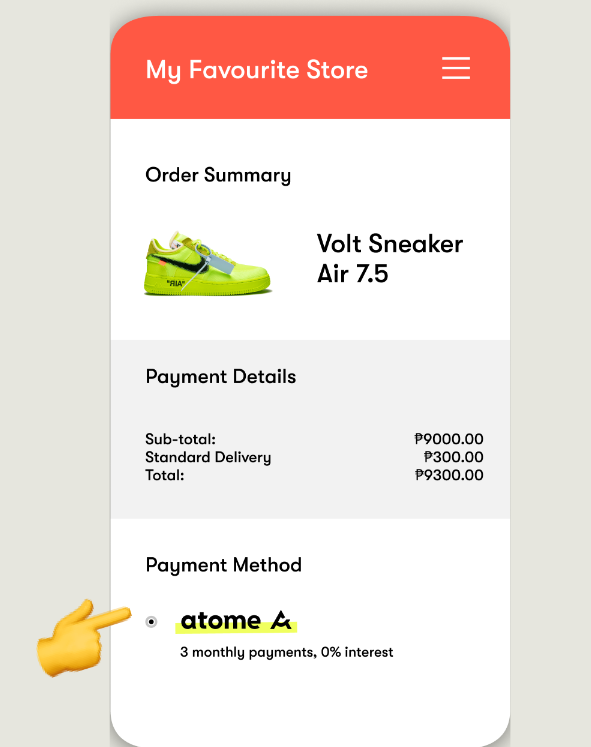

#Atom

Atomе Buy Now Pay Later App (5) is a great choice for your fashion shopping.

This BNPL system grants you a zero-interest loan for forty days, and allows you to split bills for the period from three to six months. But don’t delay your payment, otherwise you will be charged an administrative fee of PHP 300.

Partners: Zalora, Aldo, Garmin, HairMNL, The SM Store, Rustan’s, Boozy, Fitness First, Agoda, and Davines — Atome’s partners come up to 1500 retail outlets nationwide and abroad.

Terms & Rates:

- Loan amount: Starts at PHP 100

- Loan term: 40 days / 3 to 6 months

- Interest rate: 0% / interest fee on any outstanding amount

- Payment Processing Fee: 2.24% of the payment amount including tax but not less than 2.24 PHP

#TendoPay

TendoPay (6) is an app that lets you manage your personal finances and allows you to “shop now and pay later” at popular stores like Lazada, Zalora, 7-Eleven, Vision Express, The Premium Playground Outlet and more. TendoPay installment plan requires neither a bank account nor credit history, and the installments are automatically deducted from your salary.

Terms & Rates:

- Loan amount: PHP 2,000 to 30,000

- Loan term: Depends on the loan amount. For example, you can repay PHP 25,000 in 8 months

- Interest rate: Depends on the loan amount. The interest is included in the monthly payment and disclosed to you before you agree to the transaction.

#Cashalo Pay Later

Cashalo (7) is a fintech platform in the Philippines that grants digital credits to its users. The service includes BNPL installment at 0% with more than 1,000 partners, including Lazada, ShoppePay, GCash, and TouchPay.

Terms & Rates:

- Loan amount: up to PHP 5,000

- Loan term: 90 days

- Annual Percentage Rate (APR): up to 49.68% (8)

- Processing fee: 10%.

As of 2024, Cashalo’s “Fly Now, Pay Later” program, in partnership with Cebu Pacific, is operational and providing services to Filipino travelers. This program allows users to book flights, with a maximum value of PHP 7,000, on Cebu Pacific using Cashalo as a payment alternative. Payments can be made later in installments spread over three or six months, offering a flexible payment option for those who may not have immediate access to funds or a credit card.

This innovative financial solution addresses the needs of Filipinos who wish to travel but may not have the upfront cash or a credit card to make immediate payments.

#GGives by GCash

With GGives (12) you can pay for your purchases at over 100,000 partner stores and branches both online and in-store using a QR code. The program allows you to maintain multiple active loans as long as you meet the eligibility requirements.

Terms & Rates:

- Loan amount: PHP 1,000 to 125,000

- Loan term: 3, 6, 9, 12, 15, 18, or 24 months

- Interest rate: 0% to 5.49% per month

- Late payment fee: 1% of the total loan amount + 0.15% of outstanding balance * number of overdue days.

#LazPay Later

LazPayLater (9) is a Lazada BNPL program with 0% interest rate for a 45-day term for select users. You can get a credit limit of up to ₱ 15,000. You can use your credit limit to buy any products at Lazada except for jewelry and digital items such as mobile devices.

You can also easily use monthly installment payments from accredited Lazada partners such as TendoPay, UnaPay and Cashalo.

The best feature of this Lazada BNPL program is that it does not charge any subscription fees or other charges. However, if you repay the loan within 45 days, you will be charged interest.

Terms & Rates:

- Loan amount:Up to ₱15,000

- Loan term: 45 days / 3, 6, 9, or 12 months. The due date is on the 16th day of every month, with 2-days’ grace period

- Interest rate: 0% for 45-day term / Depends on the monthly installment plan

- Late payment fee: Depends on your loan amount or term. You can get a credit limit of up to ₱ 15,000.

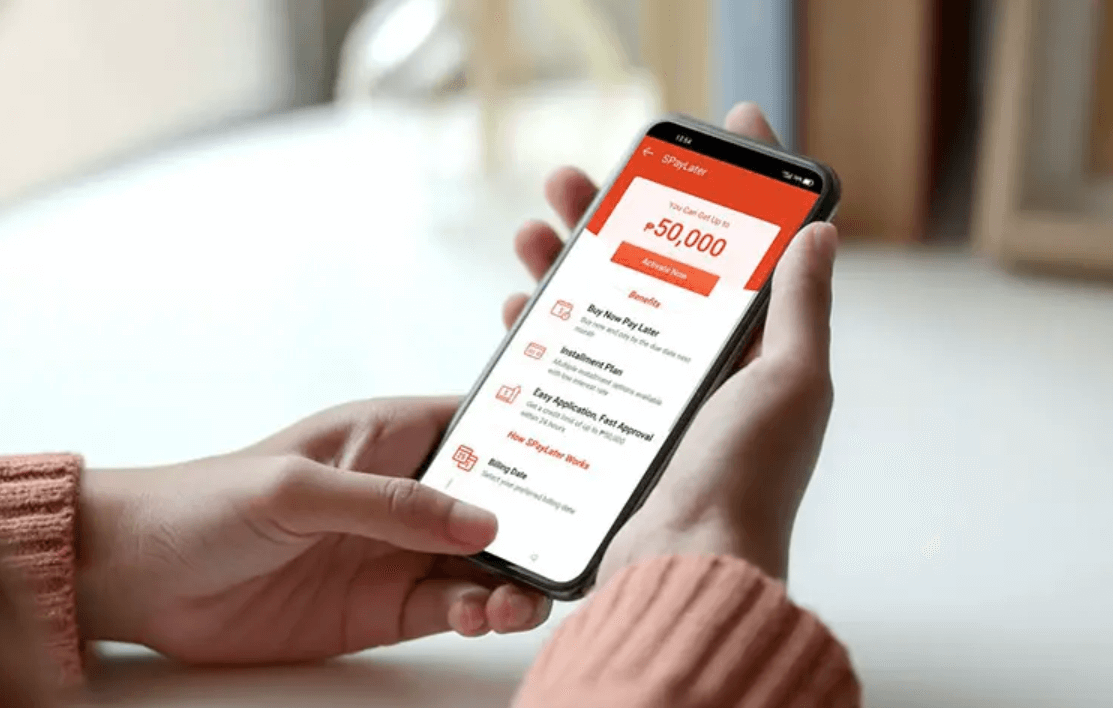

#SPay Later (Shoppee Shop Now Pay Later)

SPay Later is one of Shopee’s payment methods that allows you to pay for purchases later or get an installment credit. As GCash and The SPayLater LazPayLater – SPay Later is only available to selected users.

You can pay SPayLater bills through ShopeePay and other Shopee-supported methods such as e-wallets, online payments, and OTC.

Terms & Rates:

- Loan amount: Depends on the credit limit. According to Reddit users, their SPay Later credit limit varies between PHP 5,000 and 50,000.

- Loan term: Up to 12 months

- Interest rate: 1% to 5% per month

- Processing fee: 0% to 2% of the total amount

- Late payment fee: 2.5% to 5% per month of the unpaid amount.

#BillEase

BillEase (11) is a fintech platform that offers customers to break down their bills onto zero- or low-interest flexible installments. Users can pay back their BNPL by means of direct bank deposits, InstaPay, PESONet, or coins.ph. They can also use Cebuana, 7-Eleven, and MLhuillier retail outlets.

Terms & Rates:

- Loan amount: up to PHP 40,000

- Loan term: 1 to 12 months

- Interest rate: 0% to 3.49% per month

- APR: 0% to 41.88%.

To apply to BNPL BillEase you will need the latest proof of income, proof of billing and one valid government ID to be eligible for the buy now pay later feature.

These are the type of proofs of income accepted:

- Payslips

- Screenshot of bank transaction history

- Upwork certificate of employment

- Paypal transaction history

- Remittance slip

These are the proofs of billing accepted:

- Meralco bill

- Credit card bill

- Water bill

- Cable TV bill

- Postpaid plan bill

#Home Credit Qwarta

Home Credit Qwarta (13) is pre-approved Home Credit’s service exclusive to active bank’s clients. Customers use it to settle bills, pending credit card debts, purchase goods from authorized partners and top up their prepaid mobile number. The program promotes payments via QR codes, so the clients will also enjoy up to PHP 300 of cash back on their QR purchases.

Terms & Rates:

- Loan amount: up to PHP 10,000.

- Loan term: 6 to 24 months

- Interest rate: 0.13% per day

- Late payment fee: 5.00% of the total outstanding amount.

As you can see, the Philippines have a handful of BNPL options to consider based on your spending habits and financial situation. Rate structures for Buy Now Pay Later services in the Philippines vary depending on the provider, but Atome, GGive by GCash, LazPay Later and SPay Later (Shoppee Philippine) generally offer competitive interest rates.

When considering a provider to go with, compare their terms and conditions before signing up. Also, it’s essential to consider the level of security of your chosen provider. Ideally, you should select one accredited by numerous merchants and credit bureaus. Never sign up for unknown BNPL options with low reviews and ratings.

- Up to PHP 25,000

- Loans even without bank accounts

- Only one government-issued ID is required

#Digido Quick Loans

If you want to get a quick loan without interest for a short term you also can pay attention to Digido quick personal loan for your shopping. Digido provides fast loan approval in 5 minutes. You can buy any items at Lazada using Digido loans. Any Filipino within 21-70 years of age with a working mobile connection can apply for a loan. Digido offers unsecured personal loans of up to PHP 25,000. The entire process does not take more than 15 minutes.

Terms & Rates:

- Loan amount: ₱1,000 to ₱25,000

- Loan term: One to six months

- Interest rate: 0% interest rate for 7 days – to 11,7% per month

- Requirements: only require 1 government valid ID

Look at the advantages of Digido loans:

Find Out How to Get

Personal Online Loan up to PHP 25,000

Keep in mind that some BNPL providers only work in the Philippines, but there are a few merchants that accept international providers. One example is using Afterpay in the Philippines. While not many stores allow this as their mode of payment certain merchants allow visitors to pay with this provider.

Which BNPL provider has the best benefits?

Depending on the merchant or platform, each BNPL program has its advantages and disadvantages.

Some factors to consider when evaluating BNPL providers include the fees and interest charges associated with their services, the availability and convenience of their payment options, and any additional benefits or perks that they offer to users.

Suppose you plan on making only one account for BNPL purchases. In that case, it’s best to look at the official website of your chosen provider to see the complete list of partner merchants and providers they work with and weigh the pros can cons of their payment terms, conditions, and rewards programs. Here are some more trusted providers offering BNPL in the Philippines:

- Tonik’s Shop Installment Loan: Offers up to Php100,000 without requiring a credit card or downpayment. The interest rate can be as low as 4.25%, making it suitable for significant purchases.

- Akulaku: A versatile platform offering various installment and loan options for a range of items including gadgets and appliances.

- Flexi: Provides installment options without the need for a credit card, available through partner merchants.

- Plentina: Tightly integrated with partners like Smart and 7-11, allowing cashless purchases and other transactions through the CLIQQ app.

- Grab PayLater: Integrated with Grab’s services, it offers a set credit amount for services like Grab Mart, Taxi, Express, and Food.

- CLiQQ Loans: Provides loans through CLiQQ, usable for purchases at 7-11 stores or CliQQgrocery.com.

Each provider has its unique set of benefits, and the best choice depends on individual needs such as the amount of credit required, interest rates, ease of application, and the type of purchases planned.

The following are the main players in Asia:

Atome, Rely, Tendopay, Fundiin, Hoolah, Finaccel, Latiturepay, Split, Ablr, Ceria, Easygop, Undiin, Wowmelo, Indodana, Gojek, Link ajo, Dana, Traveloka, Fave, Shopback, Shopee, Pine labs, Akulaku, Unapay, Finmas, Cashalo, Billease, Superatom.

How To Apply For Buy Now Pay Later In The Philippines

As mentioned, there are multiple buy now, pay later providers in the Philippines for consumers to choose from. However, the general process of applying for a BNPL credit line in the Philippines is straightforward.

Choose BNPL service and create an account, submit your personal information along with a valid government ID and other requirements . Afterwards, you can easily top up your credits or link your debit card to the BNPL account and start using it.

- Download your chosen App from Google Play or Apple Store

- Input your mobile phone number and wait for the verification code

- Verify your account and provide personal information

- Provide your credit card details

- Add in basic details and a valid Government ID.

Generally, the steps for registering and applying for a BNPL are often similar but may vary depending on the requirements

Pros and Cons of Buy Now Pay Later

| Advantages | Disadvantages |

| An easy and fast approval process. Particularly important for emergency shopping | Higher late payment fees than credit cards |

| No Collateral Required | Restricts payment dates based on provider terms |

| Allows users to spread out payments. Flexible installment plans | They can stimulate impulse spending |

| Offers an accessible alternative to credit cards. Can be used for offline shopping | The program does not include all stores |

| Includes convenient features like auto charging | The interest rate for a BNPL account may be higher than the interest rate for a credit card |

| Interest-free terms if you abide by your repayment agreement. | The temptation to create multiple BNPL accounts, such as creating multiple credit cards |

Summary

One of the main advantages of BNPL in the Philippines is that it allows consumers to plan their finances in advance and afford more expensive purchases without having to pay the full amount right there and then. This can be particularly appealing for those without the access to traditional forms of loans, or those who want to avoid high interest rates imposed by credit cards. BNPL can also be a convenient option for those who want to spread the cost of a purchase over a longer period of time.

However, it’s essential to research and compare various providers before you select one. It’s also a good idea to use these payment methods responsibly and make sure you can afford the repayment plan before signing up for any BNPL loan. Take your time to read all the terms and conditions carefully to know what is expected of you to repay your loan. Additionally, be mindful of the fees that come along with late payments.

Learn About How to Get

Personal Loans even with a Bad Credit Score only in 1 hour

FAQ

-

Does the BNPL affect my credit history?Only some BNPL providers can provide repayment history information to credit bureaus. It often has no effect on your credit history.

-

Do BNPL providers charge interest?You will not pay any interest on the amount borrowed for a short term. However, some providers may charge you a monthly rate for long-term BNPL plans of over 4 years.

-

What happens if I don't pay the BNPL monthly installments on time?If you fail to make timely BNPL payments, the provider might penalize you with lower credit amounts and higher interest rates on your future purchases under the BNPL program.

-

How Does BNPL Work in the Philippines?After you pay a down payment of the entire purchase amount, the remaining amount will be deducted in a series of monthly installments according to the schedule you agree upon.

Articles sources

Authors

Digido Reviews

-

Kristine JoyI enjoy shopping online with Buy now pay later apps Philippines, but the interest charges can be a hassle. With Digido it was able to take the full amount, avoiding the need to stretch out my payments. The process was quick and convenient!5

-

J.PatrickVery easy to use! 😎👍I'll take it again.5

-

LizI prefer buying things outright without paying in installments. It's convenient to pay on payday with no interest. I recommend Digi instant loans to other buyers online4