How to use Lazada Wallet: Simple Steps for Activation and Verification

Key takeaways:

- Lazada e-wallet has become one of the best digital payment platforms Filipinos are using.

- The site is convenient and reliable to shop and pay for the bill. It comes with a loaning feature that enables the Philippines to request a soft loan when shopping.

- But if you are refused a loan, Digido can always help.

- The Digido loan requested is approved instantly, to allow you to continue shopping till you drop.

Lazada is a prominent e-commerce platform in the Philippines, known for its wide array of products and significant market presence. In April 2024, Lazada, alongside Shopee, generated substantial sales in the Philippines, amounting to approximately USD 630 million. Lazada itself accounted for about USD 224 million of this revenue, showcasing its popularity and extensive use in the region (TMO Group) (1).

Lazada (2) is renowned for its customer-centric approach, providing various value-added services such as LazPayLater, which allows customers to buy now and pay later in installments, and Lazada Wallet, a digital wallet for easier transactions.

Let’s dive in and learn what Lazada wallet is and how it works.

What is Lazada Wallet?

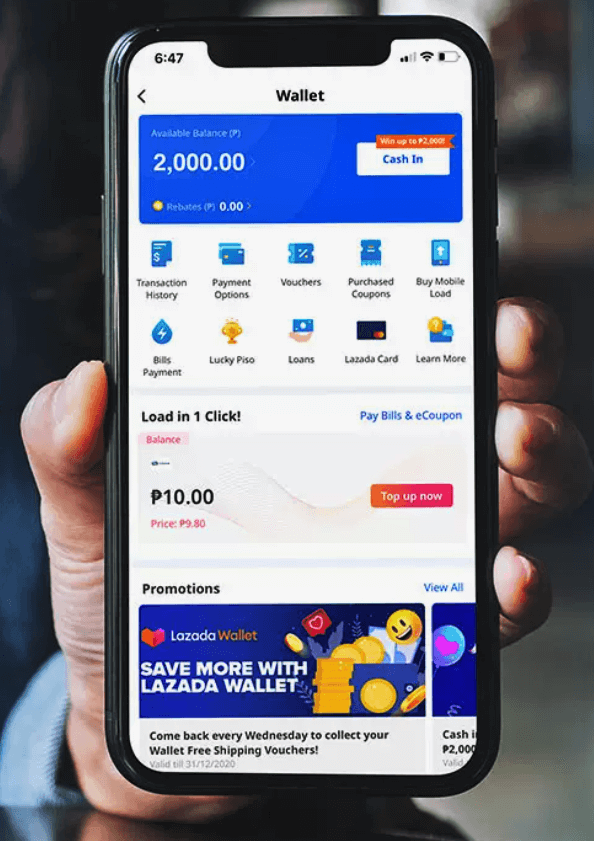

How does Lazada Wallet work? That’s the question when you hear about the digital wallet. Well, it’s an online prepaid account that allows you to purchase products and services from Lazada digital shops.

The Lazada wallets come with amazing features which you will find very useful as an online shopper. The one-click check-out procedure comes in handy to avoid the extra charges. This is a fee that is incurred once the product has been delivered on a cash-on-delivery basis.

In case you have insufficient funds in the account, you can top-up your online wallet via credit card, or online banks and get an amazing shopping experience. You are allowed to deposit a minimum amount of PHP 20 and a maximum of PHP 100,000 on your wallet. That said, the platform is safe and secure as all the transactions are protected by Lazada’s Payment Protection.

How to Activate Your Lazada Wallet

Activating your Lazada account is a simple process as well. Once you’ve finished, your account will be up and running. Below is a 7 step guide on how to make the Lazada wallet.

- Download the Lazada App: Ensure you have the Lazada app installed on your mobile device. It is available for download on both iOS (App Store) and Android (Google Play Store). If you do not have a Lazada account, register by providing your email address, phone number, and other required details. If you already have an account, log in using your credentials.

- Access the Wallet: Tap on the “Account” icon located at the bottom right corner of the app. In the Account section, find and select “Lazada Wallet”

- Activate Wallet: You will see an option to activate your Lazada Wallet. Tap on “Activate Now”.

- Verify Identity: You may need to verify your identity. This typically involves providing additional information such as your full name, date of birth, and possibly a government-issued ID. Follow the on-screen instructions to complete the verification process.

- Set a PIN: For security purposes, you will be prompted to set a 6-digit PIN. This PIN will be used to authorize payments and manage your wallet. Optionally, you can enable two-factor authentication (2FA) for added security.

- Verify Mobile Number: The next step is typing your mobile number in the empty field. Once this is done, you’ll receive a code. The verification code shall be sent to you via SMS. Enter the code in the corresponding field. Click on the “Verify Mobile Number” icon and proceed to the next field.

- Agree to Terms and Conditions: The next task is checking the Terms and Policy box. This shows that you have agreed on the firm’s regulations.

Lastly, when the verification procedure is finished, a page that displays your balance and details will show. Plus, the features you stand to enjoy shall also be displayed on this page. So now you know how to register for Lazada Wallet. Read Lazada terms and conditions carefully before use.

How to verify lazada Wallet: 5 Steps with Screenshots

Some features of Lazada Wallet, such as certain payment methods, cashback offers, and promotions, might only be available to fully verified users. If Lazada offers any loan or credit services through third-party partners, these services typically require a fully verified account to ensure eligibility. Verified users may receive priority assistance from customer support for any issues or disputes related to their wallet or transactions.

Here’s a comprehensive guide to help you through the process:

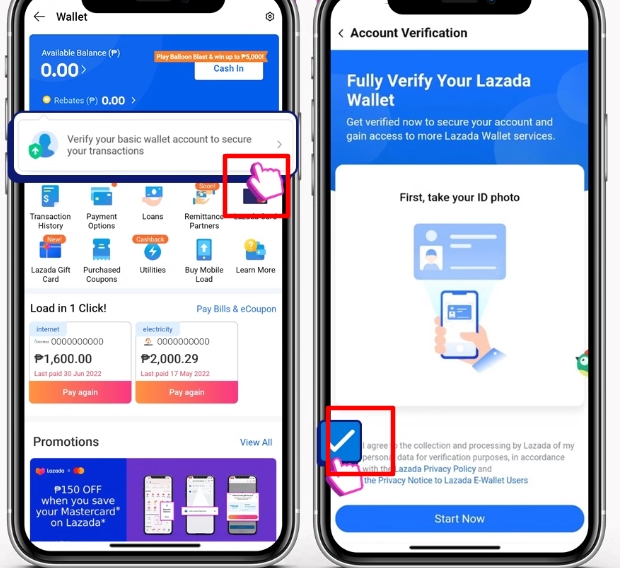

Step 1: Open the Lazada app then Tap the “Account” icon. Select “Lazada Wallet”.

Step 2: In Lazada Wallet, tap “Verify your basic wallet” to begin the process. Review the term and conditions and click checkbox to accept, then click “Start now”.

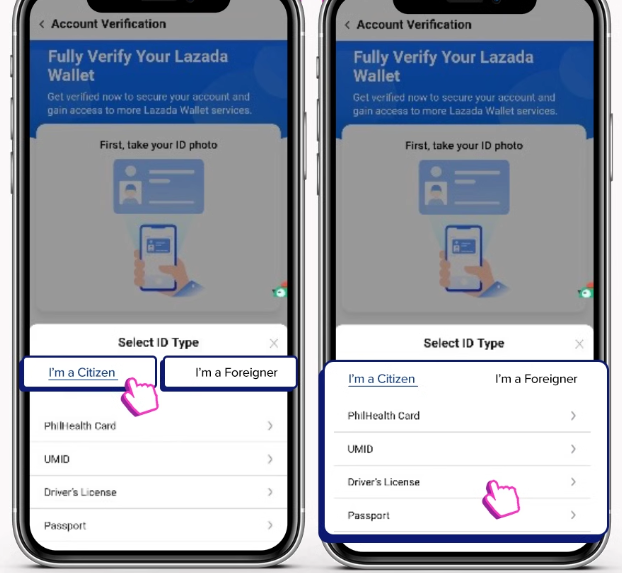

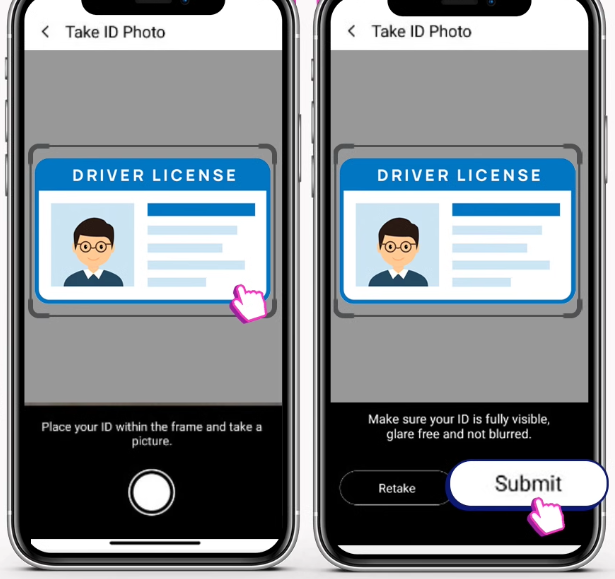

Step 3: Take a clear photo of your chosen ID. Lazada currently accepts the following IDs for full verification:

- PhilHealth

- UMID (Unified Multi-Purpose ID)

- Driver’s License

- Passport

Step 4: Take a selfie to match your ID. Ensure that your face is clearly visible and the photo is not blurry. Upload both the ID photo and the selfie through the app.

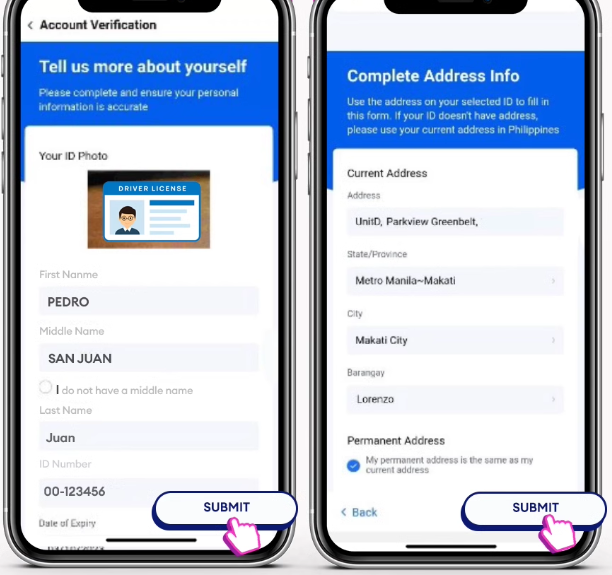

Step 5: Enter your full name, date of birth, and other required information exactly as it appears on your ID

After uploading the necessary documents and filling in the required information, submit your application for verification. Lazada typically takes 24-48 hours to process verification requests.

Take note: Your verification may have failed due to several possible reasons:

- If you have registered more than one account, this could cause the verification process to fail.

- The photos you provide must be clear and legible. Blurry or obscured images will not be accepted.

- Ensure that all the information you submit exactly matches the details on your ID. Discrepancies will lead to verification failure.

- The ID you provide must be current and valid. Expired IDs are not accepted for verification purposes.

If your verification status is pending for more than 48 hours or if your verification fails, contact Lazada’s Customer Care Specialists for assistance.

Learn How to Get

Online loan with no job verification in the Philippines

How to Top Up your Lazada Wallet

Topping up your Lazada Wallet is straightforward and can be done through various methods. Follow these steps to add funds to your Lazada Wallet:

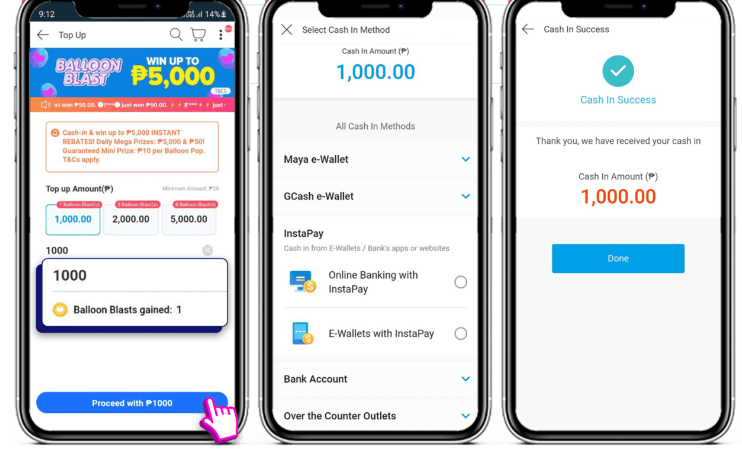

Step 1. In the Lazada Wallet section, tap on “Cash in”

Step 2. Enter the amount you wish to add to your wallet or select from the predefined options.

Step 3. You can choose from several payment methods such as:

- Credit/Debit Card: Enter your card details and confirm the transaction.

- Online Banking: Choose your bank, log in to your online banking account, and authorize the transaction.

- GCash or Maya: Select GCash, log in to your GCash account, and confirm the payment.

- Over-the-Counter (OTC): Select the OTC option, and you will receive a subscriber number or reference code via SMS or email. Use this code to complete the transaction at a physical payment center such as 7-Eleven or a bank.

Step 4. Follow the on-screen instructions to complete the payment process. Depending on your chosen method, you might need to enter an OTP (One-Time Password) sent to your registered mobile number.

Remember that to cash in using online banking or OTC you will need a subscriber number or reference. It is sent to you via SMS or email. The code is what you fill in the field specified and then click the “Done” tab.

Step 5. Once the transaction is completed, you will receive a confirmation message via SMS and email. Your Lazada Wallet balance will be updated accordingly.

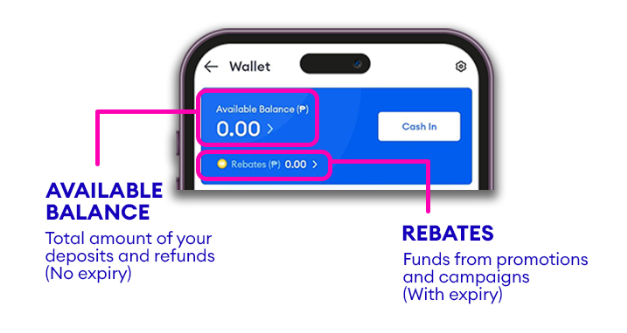

For fully verified Lazada Wallet accounts, the maximum balance you can maintain is PHP 100,000. This limit encompasses funds from top-ups, rebates, and refunds. This ensures users can manage substantial amounts securely and efficiently.

How to Cash Out Lazada Wallet

So, how to transfer Lazada wallet to bank account? Unfortunately, you can’t withdraw the balance from your wallet. The deposits can be used to make other purchases instead. Hence, we always advocate for depositing the exact amount needed for the purchase.

Also check the amount twice before topping up to avoid this. On a positive note, the balances and refunds don’t have expiration dates. Thus, your

Shopping and Paying Bills with Lazada Wallet

Shopping and payment of bills have been made easier, thanks to the Lazada wallet. The wallet gives you a chance to facilitate financial transactions without having to move a muscle. All it takes is just a click of a button and your bills are paid instantly.

The amazing thing is the site comes with a Lazada wallet voucher. The voucher gives you a chance to purchase a product or service at a reduced price. They come with codes that can be used in making purchases. Therefore, be on the lookout for the wallet vouchers since they are usually given at the end of the month or during the holiday season.

How to pay using Lazada wallet? Below are steps on how to use Lazada wallet to pay orders.

- During checkout select the online wallet as the default method of payment.

- However, if the wallet is not listed as one of the suggested payment methods, click on the more options buttons. This shall give you a drop-down list of the online payment methods present. Scroll down and look for the Lazada wallet and then select it as the checkout option.

- On the other hand, if you don’t have enough cash in your online wallet to cover the expense we recommend topping up. Click “Cash In and Pay” to deposit cash in your account. Though we recommend making the deposit 48 hours before the purchase. This ensures the cash reflects in your Lazada e-wallet on time. In the section below we’ll discuss how to top-up your wallet in depth.

Need money that you can get in 5 minutes? Borrow up to PHP 25,000 with just 1 government valid ID in Digido App. Calculate your pre-approved loan amount:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

Learn How to Get

Loan with no bank account in the Philippines

Pros and Cons of Lazada Wallet

Just like any other product in the market the E-Wallet has its ups and downs.

Pros

- You gain access to exclusive discounts when using the wallet, hence you can save some money.

- When using the wallet to make purchases you earn rewards that can be used in various forms. That includes promo codes, discount vouchers, etc.

- The platform also gives you a chance to apply for Lazada loans. The firm has partnered with various online loan providers to ensure this is possible. If you lack cash, you can request a soft loan from the providers.

- Another advantage is when you are not satisfied with the purchase, you’ll receive your refund instantly. Just make the request and the cash shall be availed into your e-wallet account.

Cons

- The platform doesn’t allow one to withdraw their balance.

- 0% interest for first loan

- Fast approval in 4 minutes

- Only 1 Valid ID needed to Apply

Can I Repay a Digido Loan with Lazada?

Unfortunately, Digido loans can’t be repaid using the platform. Though there are other payment methods you can use to settle your loan on time. The avenues for this include the following:

- 7-Eleven

The 7-Eleven is a well-known store in the Philippines. It acts as a social and business center where Filipinos meet to grab a quick lunch, shop, or even socialize. At the center, you’ll find the CliQQ Kiosk Machines. The machines give you a chance to make Digido loan repayments. They have a user-friendly interface that is easy to use and operate.

Once the payment is made, remember to take the payment print-out receipt to the cashier. But before handing it in check the details to ensure you have the right amount printed out. The cashier will then scan your payment code to approve the transaction. Keep the receipts safe since you might require them in the future for reference.

Learn more:

How to pay your water bills in 7/11

- Cebuana or Bayad Center

The center is located in malls such as Robinsons and SM. Basically, in any customer service mall, you shall find the center. Hence you can visit the stations and make your loan payments. On the other hand, there is the Bayad Center Online Payment app.

This has made it easier for one to service their Digido loans with a click of a button. All you have to do is to download and install the app on your smartphone.

- Via Union Bank

Union Bank is one of the trusted institutions which work with Digido. You can step into any Union Bank branch and make your Digido loan repayment over the counter. Alternatively, you can use the online Union Banking site or app to loan payments as well.

The site is easy to use and takes a few minutes. All you have to do is create an account with the Union Bank, that’s if you lack one. But if you do have one, login and make the repayment.

Learn about:

DragonPay option for loan repayments

What is a Lazada Loan

The Lazada loan is a buy-now, pay-later scheme of Lazada, one of the biggest online marketplaces in The Philippines. Lazada launched it in September 2019. It is not a loan where you can get cash. It is not a Lazada cash loan application.

Lazada does not loan the money for paying the items bought on the marketplace. Instead, they partnered with third-party lenders.

If you do not have a credit card, your best bet is to avail of the Lazada installment without a credit card. To do that, you need to have an account on any of the following:

• BillEase

• InvestEd

• Paylater

• TendoPay

• Cashalo

• UnaPay

• JuanHand

To apply with BillEase , you have to go to Lazada and then click on the application link. The Lazada loan amount is between ₱2,000 and ₱30,000.

In the application, choose your preferred installment term. Unfortunately, you can only choose between one and three months. After filling out all the required information, click on the “apply” button and wait for further instructions.

The default lender for Lazada installment plans is BillEase. If you want to borrow from other lenders, you need to sign up for an account in their apps.

You need to submit your personal details and then wait at least one banking day for results. If approved, you will see your loan amount in your Lazada wallet. It is why people also call it the Lazada wallet loan.

If you are a repeat borrower, you can extend your loan term to six months, 12 months, and 24 months.

The application for Lazada loan installment with other lenders is the same. First, you need to visit the Lazada loan without a credit card page. From there, you will see the various companies and their application links.

Is there a Lazada installment using GCash?

No, there is no installment option for Lazada purchases with GCash. However, you can pay your installment due in BillEase with GCash.

To do this, you must locate your BillEase Loan ID from your BillEase account. Then, you have to use that ID when paying bills on your GCash app.

How Much is the Interest for Lazada Installment online?

The interest you pay varies from one company to another. Below is an example calculation from BillEase.

• Amount borrowed: ₱40,000

• Term: Six Months

• Total to pay: ₱45,390

In this case, the total interest is ₱5,390, or 13.48% of what you borrowed. You will pay ₱7,565 per month.

Learn all about:

Buy Now Pay Later in the Philippines

How to Pay Loan in Lazada

Payments vary from one lender to another. For example, Cashalo’s accepted payment methods are different from others.

Here are some of the ways you could pay your installment on Lazada if you borrowed from Cashalo:

• Pay over the counter in stores or malls; examples of these are 7-11, Robinsons, and BDO

• You can pay in remittance centers like Dragonpay, Bayad Center, and some selected pawnshops

• Robinsons Bank online system

As you may have observed, it does not offer GCash. However, some lenders offer GCash as a payment method.

Learn How to Get

Fast and Easy online Payday loans in the Philippines

What Are the Advantages of Lazada Loan

- Loan Huge Amounts – you can loan up to ₱40,000. This amount is huge and should be enough to buy an excellent computer or laptop.

- Easy, and Secure – there is no need to stand in line in any physical institution. All you need to do is to go online and apply. The best thing here is that you do not even need a computer. Download the lender’s app, and you should be able to apply for a loan.

- Fast Processing – it takes only one business or banking day to get approved. Of course, you must submit all the requirements to get approved.

If you have no money now, but you need to buy something in Lazada, like a computer that your child can use for online education, you can avail of the Lazada loan so you can purchase it now.

Just make sure that you pay your loans on time. If you don’t pay on time, you may incur fees, and the lender may not lend money to you again in the future.

What Are the Disadvantages of Lazada Loan?

All loans come with disadvantages. For one, there are fees. In the example earlier, you are paying 13% in total interest in a span of six months.

If you could, perhaps you can wait it out a little longer. The 13% interest you paid could be used for other things.

Another issue is behavioral development, wherein are spending money you do not have for shopping. There may come a time when this becomes a habit, and it would be difficult for you to kick it off. If possible, you must only loan for emergency reasons. Shopping, of course, is not an emergency.

What is Lazada Seller Loan

The Lazada Seller loan is for sellers who need financing. You can loan between ₱30,000 and ₱150,000. These loans have low processing fees and interest. Like the Lazada loan, the lender is not Lazada but some partners like SB Finance, Esquire, SeekCorp, and Kayamo.

So, some Lazada loans review claim that it is Lazada that offers money. This information is not correct. Lazada does not loan because it is not a financial company.

One trick on how to do installment in Lazada is to pick the best offer. The best Lazada loan is the one that you can afford. Since the partners have different interest rates, you must study the differences. Pick one that has the lowest interest so you can save money.

Learn more:

In-Demand Jobs in the Philippines

FAQ

-

Is Lazada Wallet safe?Pay securely, seamlessly and enjoy hassle-free shopping through the use of this cashless payment method. All Wallet Transactions are covered by Lazada's Payment Protection.

-

Does Lazada wallet expire?Your Lazada Wallet Top-Up funds don't expire. Now you can withdraw your credit limit to your e-wallet anytime you want and wait for a sale. Or you can combine and save your funds to purchase something of higher value in the future!

-

Is Lazada wallet cash on delivery?To minimize this, COD is not available for high-value orders. You may use various payment methods such as Lazada Wallet and various credit cards for completing your order.

-

Can I use Paypal for Lazada?You can pay for orders at Lazada using Paypal if you don't have a credit card.

-

How to use Lazada wallet voucher?This is a coupon that gives you a discount on an item or on Lazada shipping.

-

Where to find Lazada wallet account number?Lazada Wallet does not have a traditional account number like a bank account. Instead, your Lazada Wallet is linked to your Lazada account. Tap on the "Account" icon located at the bottom right corner of the app. In the Account tab, tap on the settings icon located at the top right corner next to your profile. In the settings menu, select "Account Information". Under Account Information, locate the mobile number linked to your Lazada account. This mobile number acts as your Lazada Wallet account number.

-

How to activate Lazada wallet without phone number?As of now, activating your Lazada Wallet typically requires a mobile phone number for verification purposes. The phone number is used to receive a verification code via SMS, which is necessary to complete the activation process. There currently isn't an option to activate the Lazada Wallet without a phone number. However, here are a few alternatives and additional steps you might consider: Use an Alternative Phone Number | Contact Lazada Customer Service | Consider a Virtual Phone Number

-

How to send money using Lazada wallet?Currently, Lazada Wallet does not support sending money directly to other users or transferring funds outside the Lazada platform. Lazada Wallet is designed primarily for making purchases on the Lazada app, receiving refunds, and participating in promotions within the Lazada ecosystem.

-

How to Load Lazada Wallet?In the Lazada Wallet section, tap on “Top-Up” or “Cash In”. Enter the amount you want to add to your wallet or select one of the preset options. choose from several payment methods and follow instructions

Authors

Digido Reviews

-

JoanaI give this 5 stars rate but I think it is worth for more than 5 stars rate. I was really amazed by this app loan lender, it really fit its name to it. Just a second! Imagine how fast the approval and the disbursement of the loan. I am totally shook! worth recommended to all! 👍👍👍👍5

-

JamelynThe best app that i have tried so far easy to apply and real time disbursement . low interest,and the 1st loan has 0% interest.4

-

FiaGreat app. Kinda low interest. Easy to apply, Fast and no hassle. Thank you Digido.5

-

Marilyn MasaltaThis is reliable app for emergency needs with zero interest within 7days super unique and rare just to pay on time no problem at all.Thumbs up 100%4

-

RosalieFor now,it's 5 stars. I already got the money in just seconds . No calls for first timers and that's what I like the most...5