Don’t Get Bitten by Loan Sharks! How to Safeguard Yourself from Illegal Lending Practices in the Philippines

Key takeaways:

- In the Philippines, borrowing from informal lenders surged from 2019 to 2021.

- Loan sharks offer fast funds with sky-high interest rates and use intimidating collection tactics.

- Transactions with loan sharks without a proper loan agreement result in unclear repayment terms, vulnerability to exploitation, and a lack of legal protection.

- Fight loan shark harassment by documenting transactions, gathering supporting evidence and reporting to authorities.

- There are trusted licensed lenders, such as Digido, who operate within legal boundaries, who will consider approving your loan application, despite a low credit score or income.

Table of Contents

Loan providers exist to offer financial assistance, ensuring that people have access to funds when faced with emergencies, opportunities, or planned investments. However, the perception of high costs and bureaucratic inconveniences associated with borrowing from formal lenders has driven many to explore alternative options. Traditional sources often pose challenges, such as demanding extensive collateral or excessive documentation, pushing individuals to opt for informal borrowing, which has gained popularity as a more accessible and convenient choice for those in need.

According to the 2021 Financial Inclusion Survey of the Bangko Sentral ng Pilipinas (BSP), almost half of Filipino adults had outstanding loans, witnessing a significant increase from 33% in 2019 to 45% in 2021. Borrowing from informal lenders also surged, growing from 10% to 14% within the same period(1).

While informal borrowing may seem appealing, there lurks the menacing threat of illegal lending, in the form of loan sharks. These lenders offer fast funds with sky-high interest rates and employ intimidating debt collection tactics.

With the rising poverty rate and the Filipinos’ increasing reliance on informal credit to meet their spending needs, how do we fight loan shark harassment and the illegal lending practices in the Philippines?

What is a Loan Shark?

Loan sharks are called as such due to the predatory and ruthless nature of their lending practices. The term “shark” is often associated with dangerous predators in the animal kingdom, and it symbolizes how these lenders prey on vulnerable individuals, offering quick access to funds but imposing excessively high-interest rates.Their collection practices are known to be aggressive, involving threats and even acts of violence.

Two of the most notorious forms of loan sharks in the Philippines are Sangla-ATM lenders and 5-6 lenders. In the Sangla-ATM scheme, borrowers hand over their ATM cards as collateral, while in the 5-6 lending scheme, borrowers are charged a staggering 20% interest or 1/5th of the principal loan. It’s also not uncommon to hear loan sharks demanding collateral like jewelry or land titles.

One cannot underestimate the dangers of dealing with loan sharks. Victims of loan sharks suffer the risk of physical harm and damage to reputation, and may face financial devastation.

Philippine laws Against Loan Sharks

The widespread growth of loan sharks in the Philippines and their illegal lending practices pose significant challenges. To effectively tackle these, it is important to get an idea of the legal boundaries surrounding these lending practices.

5-6 Lending Scheme is Illegal

In the Philippines, the 5-6 lending scheme is infamous for its 20% interest rate with unfavorable payment terms. Accurate statistics regarding the exact number of 5-6 lenders are not available. However, industry sources suggest that their total count could be as high as 40,000, possibly equivalent to one lender in every barangay throughout the country(2).

The Supreme Court has declared the 5-6 lending scheme illegal(3) citing Article 1409 of the Civil Code. To put it simply, if an agreement allows for extremely unfair or excessively high interest rates, it goes against what is considered right and fair, therefore considered morally wrong and may not be legally acceptable.

There are no laws prohibiting Sangla-ATM Scheme but…

Sangla-ATM is an informal lending system that utilizes the ATM card as collateral. This arrangement allows the lender to gain possession of the borrower’s ATM or debit card, including the PIN, and deducts the loan payment from the borrower’s salary on each payday until the full amount is repaid.

Although the Bangko Sentral ng Pilipinas (BSP) has previously stated that using an ATM card as a loan collateral is not illegal per se, they have strongly cautioned the public against this scheme as it may lead to further financial trouble such as unauthorized bank withdrawals(4)(5).

Borrower Harassment is Punishable by Law

The Department of Justice (DOJ) has emphasized that engaging in harassment of individuals who have borrowed from lenders, is illegal and punishable by law.

According to the DOJ, certain actions can be considered illegal under different laws. These actions involve accessing a borrower’s contact list to send messages, publicly sharing their personal and sensitive information on social media, threatening them with physical harm or death, and using offensive language through text messages. These actions are typically carried out as a means of shaming borrowers due to failed repayments.

These actions may potentially violate the following laws: Republic Act No. 10175 (Cybercrime Prevention Act of 2012), R.A. No. 10173 (Data Privacy Act of 2012), the Revised Penal Code in relation to Section 6 of R.A. No. 10175, and Securities and Exchange Commission (SEC) Memorandum Circular No. 18, series of 2019(6).

Common Illegal Lending Practices in the Philippines

1. Loans sharks typically impose extremely high interest rates.

Loan sharks entice borrowers with promises of fast cash, exploiting their vulnerable circumstances by imposing exorbitant interest rates that in some cases can go over 100%. These predatory lenders take advantage of desperation, placing borrowers in a cycle of overwhelming financial obligations that become increasingly difficult to escape.

2. Loan sharks may require collateral such as ATM cards and IDs

Loan sharks may demand collateral like ATM cards and government-issued IDs. Handing over an ATM card can give loan sharks unauthorized access to a borrower’s bank account, leading to unauthorized withdrawals or misuse of funds. Similarly, surrendering an ID can result in identity theft or fraudulent activities carried out in the borrower’s name.

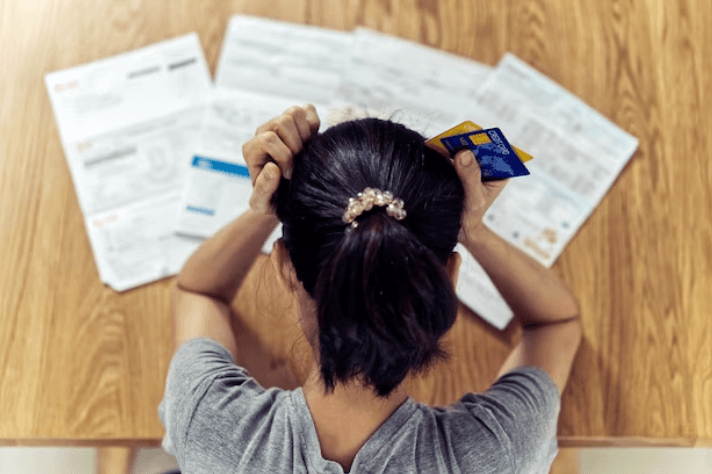

3. Loan sharks operate without formal loan contracts

Loan sharks in the Philippines typically operate without providing a formal lender-borrower contract. The absence of proper and legally binding terms and conditions can result in ambiguous loan repayment terms, increased vulnerability to exploitation, and lack of legal protection. As a consequence, borrowers face limited options for fair conflict resolutions.

4. Loan sharks do not maintain proper documentation of repayments

Loan sharks often do not maintain a proper record of borrowers’ repayment transactions. Without a clear record of repayments, borrowers may find themselves in a dangerous position. They would lack the means to accurately track the amount they have already repaid, the outstanding balance, and any additional charges imposed by the loan sharks.

5. Loan sharks employ unfair debt collection practices

Loan sharks employ offensive language, threats, harassment, and public disclosure of borrowers’ personal information, and even using deceptive means to collect or attempt to collect any debt or to obtain information concerning a borrower.

The Securities and Exchange Commission (SEC) has issued Memorandum Circular No. 18 s.2019 (7) to prevent unfair debt collection practices of lending companies, financing companies and third-party providers. However, most loan sharks in the Philippines do not even have licenses to operate. Without the oversight and regulation, loan sharks remain oblivious, if not ignorant, and are able to continue their exploitative activities with little accountability.

How to Fight Loan Shark Harassment in the Philippines

👉 Stay calm and keep a detailed record of your transactions

When dealing with loan sharks and their harassment, it’s important to maintain thorough documentation of all your transactions. Record every interaction, ask for names, take note of the dates, times, and details of conversations. These details will be valuable when seeking assistance from the authorities.

👉 Gather supporting evidence of the harassment

Collect any supporting evidence, such as photos, screenshots, videos, text messages, emails, or receipts, that can backup your harassment claims against the loan shark to strengthen your case.

👉 Report the loan shark to the relevant authorities

Take action by reporting the loan shark to the relevant authorities, such as the local police or the National Bureau of Investigation (NBI) and submit all the records and evidence you’ve gathered. They can initiate an investigation and take appropriate legal measures against the loan shark.

Where to report loan sharks in the Philippines

To report any threats of violence from loan sharks, contact the local police:

| Philippine National Police | For Emergency Cases:

For Non-Emergency Cases:

|

To report cybercrime or any form of violation of your Data Privacy Rights:

| National Privacy Commission (NPC) | To file a formal complaint with the NPC, please follow these steps:

1. Download form |

| PNP Anti-Cybercrime Group | You may submit your complaint form to the PNP ACG e-Complaint Desk

Hotline: 09666271257 or 09688674302 Email: acg@pnp.gov.ph |

| NBI Cybercrime Division | Direct Line: (02) 8252-6228

Mobile Number: 09296607861 or 09454420773 Email: ccd@nbi.gov.ph |

| Department of Justice – Office of Cybercrime | Hotline: (+632) 8524-8216

Email: cybercrime@doj.gov.ph |

How to prevent falling prey to loan sharks in the Philippines

- Always verify lender credibility. Check if the lender is licensed and authorized by relevant regulatory bodies or government agencies. The SEC maintains a list of registered lending companies(8) available to the public.

- Beware of aggressive tactics! Loan sharks use aggressive tactics or creating urgency to push you into taking a loan. Legitimate lenders provide full information and allow time for your consideration.

- Keep your personal information secure. Avoid sharing your sensitive personal information with unverified lenders to prevent troubles like identity theft.

- Review the loan agreement. Carefully read and understand the terms and conditions, including interest rates, repayment schedule, and fees. Never deal with lenders who fail to provide proper documentation.

- Stay informed about your rights. Awareness is key! Know your borrower rights and lending regulations to recognize and report any unfair or illegal practices.

- Build a strong financial foundation. Establish an emergency fund, manage expenses, and build good credit for better borrowing options from reputable lenders in the future.

- Consider alternative borrowing options. Rejected for a bank loan? There are trusted licensed lenders, operating within legal boundaries, who will consider and fairly evaluate your loan application, even if you have a low credit score or low income.

Speaking of trusted lenders, Digido is a SEC-licensed online lender with a wide branch network across the Philippines. The company offers cutting-edge financial solutions through a fully automated online portal, for utmost convenience. With an efficient lending system, Digido assesses each application and disburses funds within hours or even minutes! This user-friendly loan app provides attractive interest rates, including promotional offers, and extends non-collateral loans of up to Php 25,000

For your financial needs, get a loan from reputable lenders. Explore the Digido app!

Apply nowLearn How to Get

Personal Online Loan up to PHP 25,000 in the Philippines

Final Thoughts:

Loan sharks in the Philippines pose a significant threat to vulnerable individuals seeking financial assistance. The rise of informal borrowing and illegal lending practices in the Philippines highlights the need for consumer protection measures and safer financing options. It is important for borrowers to stay informed, explore reputable lending options, and be cautious of predatory practices to safeguard their financial well-being from the clutches of loan sharks.

Learn How to Get a Secure

Fast Loan Approval with No Credit Check

FAQ

-

Are 5-6 lending and Sangla-ATM schemes illegal?Yes, the Supreme Court has declared the 5-6 lending scheme illegal, citing Article 1409 of the Civil Code. An agreement that allows for excessively high interest rates goes against what is considered right and fair, therefore may not be legally acceptable. As for the Sangla-ATM scheme, it is not illegal per se, but the Bangko Sentral ng Pilipinas strongly advises borrowers against it due to potential implications of fraud and unauthorized withdrawals.

-

What happens if I can’t pay back the loan shark?According to the Philippine Constitution (Article III, Section 20), borrowers cannot be imprisoned for debt since it is not a criminal offense. However, a loan is still an obligation and lenders can pursue repayment through civil action. Nevertheless, loan sharks are not entitled to publicly shame, threaten, or harass borrowers for unpaid debt.

-

What can I do if a loan shark harasses me, my family and friends?If you experience harassment from a loan shark, start by collecting all evidence of your transactions with them and ensure you have documentation of the harassment, whether it's in the form of text messages, emails, photos, or videos. After that, you may file a formal complaint with the local police (PNP) or relevant regulatory agencies, depending on the nature of the violation or harassment you are facing.

Articles sources

- 1. 2021FISToplineReport.pdf (bsp.gov.ph)

- 2. Gov’t campaign vs ‘5-6’ lenders successful | Philstar.com

- 3. Frequently Asked Questions - Securities and Exchange Commission

- 4. Use of ATM card as loan collateral legal – BSP | Inquirer News

- 5. BSP warns public vs use of ATM card as loan collateral | Philstar.com

- 6. DOJ stresses: Cyber harassment, 'debt-shaming' of online debtors illegal | Inquirer News

- 7. MC No. 18 s.2019 - Prohibition on Unfair Debt Collection Practices of Financing Companies(FC), and Lending Companies(LC) - Securities and Exchange Commission

- 8. List of Recorded Online Lending Platforms - Securities and Exchange Commission