Quick Loan in Makati, Philippines

Key takeaways:

- Fast online loans are very popular in Makati, Philippines

- Digido is a lending company in Makati where you can get a quick online loan

- We recommend Digido loans with 0% interest rate for first time borrowers

- You can get up to PHP 25,000 even without having a bank account

A loan is an important aspect of anybody’s financial life. This is most especially so if you live in Makati — a premier city in the Philippines. Today, we will take a look at the different types of credits in Makati and where you can avail them.

- Up to PHP 25,000 In only 4 minutes

- First loan with 0% interest rate

- 95% loan approval

Types of Lending Companies in Makati

- Banks. The most common credit institusion is a bank. The main advantage of bank credits is that you can borrow a large amount of money for a long time. However, they may need collateral from you, and such a loan is difficult to approve.

- Pawnshops. These refer to loan types where you need to provide a collateral. You can apply for this in different financial institutions or banks. It is easy to get approved if you have an asset, but they will seize your asset if you fail to pay your loan on time.

- Private lenders. These are independent firms or even individuals. Their requirements vary, but they usually offer small credits for emergencies and small businesses. They are everywhere in the country, but they do not always work in accordance with the law. In addition, they charge high interest rates.

- Fast Lending Companies. These are mostly online companies that offer fast approval — as fast as 24 hours. Here you can get a quick loan for any purpose, although the interest will be higher than in the bank. One of the best companies that offer this is Digido, which we will discuss in detail below.

Lending Company in Makati, Philippines

Digido is a certified and reputable lender in the Philippines, holding certification from the SEC. When seeking a trustworthy and dependable lender as a borrower, Digido aligns perfectly with those criteria. This lending service provides you with a versatile loan that can be used for any purpose.

The primary benefit of Digido is that it is online and does not require you to leave your home. Simply complete the application, and your funds will be in your hands within 30 minutes. If you want to get a loan quickly and without unnecessary paperwork, Digido requires only a valid ID.

Advantages of Digido Loans in Makati

Let us dig a bit deeper about Digido and see why you need to consider this as your credit provider. You can choose the best loan in Makati for your needs.

- Fully automated. All the processes here are automatic, which means you just need to submit your application and they will take care of it from the back end; you no longer need to go to a physical establishment to pay your loan or get it.

- High approval rate. The Digido team only requires that you submit a few documents, especially your proof of identity and income, to get approved. You do not need to present a collateral.

- Online application. You can process your application online. Just go to the website and fill out the application form. You will be notified what next steps to take.

- Minimal documents. Only 1 government-issued ID is required to apply for a loan. The entire process is done online.

- No Collateral. Digido extends loans without the need for collateral or guarantors.

- Full Legal Compliance. Digido is a fully compliant company, possessing both SEC Registration and a Certificate of Authority.

- Versatile Repayment Options: Choose from a variety of repayment options, including bank transfers, remittance centers, DragonPay, and 7-Eleven.

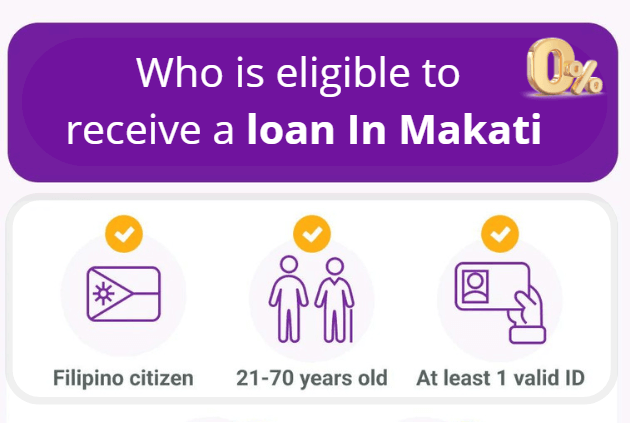

Digido Loan Terms and Borrower Requirements

Here are the terms that you need to know about Digido before you apply.

✅ Loan terms. You can get a credit for the period from 7 to 30 days. When you borrow cash, you need to pay it and interest back in 30 days. Get your first loan with 0% interest rate – offer valid for all first time borrowers!

✅ Loan amount. As a fast lending firm in Makati, Digido offers between ₱ 1,000 and ₱ 25,000. The amount of money you can borrow depends on your status as a borrower. Receipt of funds to the account within 30 minutes

✅ Borrower requirements. You only need to present your identity documents. You have to send a digital copy of a valid government ID. You also need to send your proof of address and proof of income to get approved.

If you’re looking for a forum about Digido to read reviews, check out Digido Facebook page or read reviews of the Digido mobile app. It is highly rated and very popular among Filipinos.

Learn More

🔎 About Best Personal Loan

Calculate your pre-approved loan amount with Digido calculator:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

Other Types of Quick Loans in Makati, Philippines

Let us take a look at the different kinds of loans you can avail in the Philippines.

- Seaman’s loan – a kind of credit to seafaring employees; you need to prove that you are employed by a shipping company.

- OFW loan – this type is for people who work overseas. To qualify, you must present an ID from the government proving that you are an OFW.

- Salary loan – The amount of money you can borrow depends on your status as a borrower.s granted to local employees; these are small amounts that are based on how much you earn.

These credits are not available in the Digido system. In Digido, you can avail of personal and emergency loans.

How to Choose a Lending Company in Makati?

Now, you have to be careful before asking for money. The Philippines has strict regulations on financial institutions to protect borrowers and their assets.

Here are some things you need to check about a lending company in Makati City.

- Select a lender carefully. The lender must have a physical office. You should also read the terms and conditions. A good lender must be able to offer a fair lain arrangement. Avoid lending companies that charge an arm and a leg for loan interests.

- View customer reviews. Always visit online forum and check what people have to say. You need to have knack for reading between the lines of reviews because they can be faked. Only go to credible review sites like Trust Pilot. Also, if the review site has thousands of comments from users, it is an indication that the reviews are legit.

- Check with the state registry. The lenders in Makati must be duly registered in the Securities and Exchange Commission. To check this, you need to go to the SEC website, and then search for the its name. There is a list of lending companies in Makati and other Philippine cities. If it is not registered, stay away. This lender may be a loan shark that will force you to give up your property if you fail to pay the debt.

- Compare conditions with other firms. Get a pen and paper or use a spreadsheet to compare loan companies. List down how much you can borrow, what the interest rate is, how long you can take to pay, and how fast you can get an approval. Carefully review the aspects of the credit that matter to you, such as interest rates. Pick the best loan company Makati based on these priorities.

Why do People Take Online Loans in Philippines?

Usually, people take credits when the out of the pocket expenses exceed their regular savings.

These are the most common reasons for the Filipinos to arrange a Salary loan:

1. Medical Emergencies

Health problems always come at the wrong time, and it’s impossible to prepare for them. If you don’t have savings, you can cover medical expenses with a loan for medical treatment. For example, buy expensive medications or pay for a nurse’s care.

2. Wedding Expenses

A wedding is one of the most important events in a person’s life! But it is also one of the most expensive. You can borrow for your wedding to pay for the banquet, food, wedding clothes, and honeymoon with a wedding loan.

3. Vacation Expenses

Go on the vacation of your dreams! Choose a beautiful place and relax in a luxury hotel. A vacation credit will allow you to rest properly and start work with fresh energy.

4. Home improvements and renovation

Finance your quality of life! Make improvements, and renovate your home, because you can use a Home credit cash loan or Digido loan to do so.

5. Appliance purchases

Allow yourself the appliances you’ve always dreamed of! You can get a phone or a TV loan, buy the best refrigerator, air conditioner, or tablet. Upgrade your gadgets and devices!

Whatever the reasons are, if you default the credit card payment, it will reduce your credit scores. A low credit score and a blemished credit history will make you ineligible for any other credits.

Pag-Ibig housing loan in Makati city

If you are a low- or middle-income Makati resident, you too can afford to own a home. The Pag-IBIG housing fund, gives its members the opportunity to finance the purchase of a house in Makati at a lower rate than banks. In order to qualify for a Pag-Ibig housing loan in Makati , the following requirements must be met.

- active Pag-IBIG member with a minimum contribution of 24 months;

- Not older than 65 years at the time of application and 70 years at the time of repayment.

- no outstanding Pag-IBIG loans or any other loan debts.

The Pag-IBIG home loan is good because it can be used not only to finance the purchase and construction of your house and plot, but even to improve your home.

Conclusion: Loans in Makati, Philippines

A loan is a financial necessity for many Filipino citizens. Even if you have to pay interest, there really comes a time when you have avail quick cash loan in Makati. You will never know when an emergency will crop up. In any case, you need to get a list of loan companies and compare them now. When the time comes that you need a money, you will at least have a list of options that you can try.

Digido is the best lending company in Makati, and one of the best in the Philippines. It services the entire nation, and you can expect to get approved in as short as 24 hours. If there are some issues in your documents, the approval may take up to 15 days to complete.

Everything is automated in Digido — you will even get your cash in your bank account. You no longer need to go to a physical office to get the cash and carry it around. It will be transferred to your bank and you can withdraw it from an ATM.

FAQ

-

Where can I borrow money easily Philippines?You can choose any of the official lending companies, the most important thing is to make sure that it is under the control of the state. We recommend Digido Lending Company.

-

What is the best loan in Makati that can be taken online?We recommend Digido because it offers a fully automated and user-friendly online platform for personal loans in the Philippines. It is a certified and trustworthy lender with a 95%+ loan approval rate. Digido provides quick and convenient loan processing, no collateral requirements, transparent terms, and various repayment options, making it a reliable choice for borrowers.

-

Which type of loan in Makati is cheapest?Generally, secured loans are more advantageous than unsecured loans. However, quick loans without collateral and guarantors are much more affordable for Filipinos.

-

Can I get a loan in Makati with a low credit rating?Yes, you have that chance. Some lending companies may approve your loan for a small amount.

Authors

Digido Reviews

-

AnnaI faced a medical emergency and required immediate funds. Digido came to my aid and approved my loan in Makati, even though I was unemployed at the time. The required funds were swiftly deposited into my bank account. Thank you, Digido!5

-

MariaCandidly, I was in a tough spot when unexpected expenses hit. Searching for a solution, I came across Digido, and it turned out to be the best loan Makati had to offer. They truly help those with bad credit histories! I couldn't be more grateful to Digido for their reliable assistance.5

-

EfrenI give 5 star in this app. Nice app, very fast approval and they are very professional and the agent is very good. I recommend this app to my friend and family.4

-

ErnestThe app is efficient and user-friendly. It generates results in just a few minutes. Not only the system is laudable ,the staff and its workers are polite ,respectful and courteous. They really know how to treat their clients well and find ways how to ease the situation that this pandemic brings. Congratulations to this company! You deserve a five star commendation!5

-

RosaI can't thank Digido enough! When banks turned me away, but Digido didn't. To my surprise, I got approved within minutes, and the funds were in my account within the hour. With just one ID and a straightforward online application, I secured the best loan in Makati to kickstart my business.5

-

ErwinThe service is very fast once you renew your loan as long as you are a good payor and on time always to pay your loan.Small interest for shorter days to pay your loan. Recommended to everyone.5

-

LuzI would definitely give a five (5) star rating to Digido because for so many times since I started using it last October 30, 2020, it saved me from immediate financial needs. The interest is just right depending on the loan term you choose. This is one of my favorite loan apps so far, it has a much lower interest than other loan apps I've tried. The agents are professional and respectful unlike other loan apps.5

-

NeamDigido is one of the nicest online loan apps around. Professional and allows realistic extension options. Thank you.4