Quick Cash Loan in Manila, Philippines

Key takeaways:

- Quick loans are very popular in Manila, but online loans are especially in demand today

- Digido is a registered lending company in Manila with low interest rates

- You can get your first loan with no interest at all

- With Digido you can get up to 25,000 pesos without office visit

- Digido is the go-to platform for those looking to borrow in Manila

A loan is a common part of life. We do not really know when we will face emergencies, and it is a good thing that there are financial institutions in Manila and the rest of the Philippines that can lend a helping hand in times of need. Today, we will take a look at the loan situation in Manila and the rest of the country. By the end of this loan tutorial, you should have a clear perspective about loans and be ready with your documents.

- First loan with 0% interest rate

- Loans without any collateral and guarantors

Quick Cash Loans in Manila

A quick cash loan in Manila is a kind of loan where you do not have to go through a long process. These loans typically do not require a collateral, and you can get approved or denied in as short as 10 minutes. While many Philippine banks offer personal loans, we still cannot categorize them as quick cash loans. Many banks offer personal loans, but these loans take at least a week to get approved. Besides, the application may require detailed information, and the way you answer these questions will affect how they decide about your loan application.

So, what is the alternative? The alternatives are the following:

- Lending corporations. It’s a good solution for people who need urgent money. But the interest here can be higher than at the bank.

- Peer to peer lending companies online. The disadvantage of this type of credit is that there are many illegal companies that are not regulated by the government. You can get the money successfully, or you can get problems.

- Pawnshops. It’s a good way out for people who have bail things out. But if you don’t return the loan, you’re going to lose those things.

We will take a look at some of these alternatives, and we hope that you get enlightened which one of them is the best.

👉 Find out How to Get

Lowest Interest Personal Loan in the Philippines

Digido Lending in Manila: Quick Loans

Digido is a easy loan lending in Manila, known for its fully automated lending system. This unique approach ensures that loans are granted at any time of the day, eliminating the human factor and guaranteeing objective decision-making. The funds are transferred instantly upon approval. Digido is a Philippine company that is duly registered in the Philippines, being a state-licensed and legitimate lender, Digido adheres strictly to all lending rules and regulations.

But why use it?

Benefits of Digido loans in Manila

Digido offers financing loan options in metro Manila tailored to meet individual needs. With minimal documentation requirements, a high loan approval rate, and immediate fund availability, even for those with less-than-perfect credit histories, Digido has made online loans a preferred choice for many Filipinos. In the bustling streets of Manila, Digido stands out as an “easy loan lending in Manila” solution, providing financial relief when it’s most needed.

Here are some of the advantages of Digido easy loan lending in Manila:

- Receive up to PHP 25,000 within 5 minutes

- Fast loans with a 0% interest rate for first-time borrowers

- Apply and receive loans online at any time and from any location via website or mobile app

- Only 1 ID required, with additional documents to enhance approval chances

- A solution for those rejected by conventional banks

- Loans available even without bank accounts; receive the loan directly to your Cebuana Cash Pick-up or a G-cash account or in cash

- No collateral or guarantors needed

- Over 95% of applications get approved

Digido Personal loan in Manila: Terms and Requirements

Now, let us take a look at the terms of the loan if you apply at Digido. We will also try to compare these loans against other financial institutions.

- Loan terms:

If you are the first borrower, you can take a short loan up to PHP 10,000 with 0% interest rate. You will get approved in as short as 5 minutes. Digido need to verify your identity — the company will do a background check. If you are a repeat borrower, you can choose any loan term up to 180 days with loan amount up to PHP 25,000. - Loan amount:

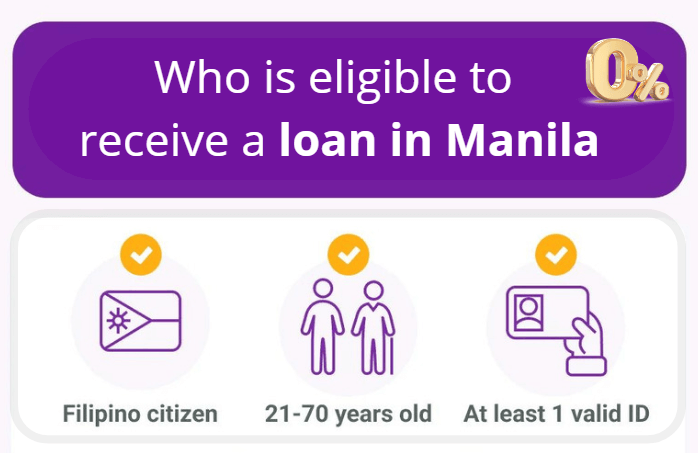

If you are a first-time borrower, you can take a loan from ₱1,000 to ₱10,000 with 0% inetrest. Digido currently offers an interest-free loan to its first borrowers. If you are a second time borrower, you can loan a maximum of ₱25,000. Depending on your performance, the company may consider you for a higher loan amount. - Borrower requirements:

You must be a Filipino citizen between the ages of 21 and 70, and have a steady income. If you plan to loan, you need to prepare the following documents: - We accept government ID’s:

This can be your SSS ID, driver’s license, or passport. This must be an ID issued by the government that bears your photo. See the complete updated list of acceptable Valid ID’s for Digido Loan Application.

Supporting documents. We require only one valid government-issued ID. However, providing supporting documents such as payslips, COE, ITR, company ID, or DTI (for those self-employed or with a business) can be beneficial. If you have already paid back your first loan and you want to loan the second time around, you no longer need to present these documents. Just go on the website and apply for a new loan. Repeat borrowers may receive automatic approval.

What are the Features of Digido financing loan in metro Manila?

👉 Fully automated

Digido is a company that takes advantage of online technology. There is no need to appear in person. All you have to do is to register for an account online from the website, and then apply for a loan. Since it is fully automated, you just need to submit photocopies of your documents, and they will process the loan for you.

👉 High approval rate

Digido has a high-approval rate. This is because before you get approved for a loan, you need to submit proof of your identity and proof of your income. They are willing to take the risk to give you a loan even if you do not have a collateral.

👉 Online application

As mentioned earlier, the whole process of the loan application is online. Whether you are using a desktop or a phone, you can access the company’s website and go from there. Banks in the Philippines do not let you do this — you need to go to the bank, queue with other customers, and then sign some documents.

Calculate your pre-approved loan amount with Digido calculator:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.