Quick Cash Loans in Pasig City, Philippines

Key takeaways:

- Fast loans are very popular in Pasig City, but online loans are especially in demand right now

- Digido offers a quick cash loan for new customers with 0% interest rate in Pasig city

- You can get up to 25,000 pesos without going to the office

- Digido loans can be used for a variety of purposes such as paying bills, holidays or medical expenses

Also known as Green City, it’s the best place for one to live in the Philippines. The environs are breathtaking which makes it a perfect holiday destination. However, you need to have cash to travel or do your business here. Considering most Filipinos are entrepreneurs they depend on their business to feed their families. This is why the Pasig loan is a viable option to promote your business. The lending companies in Pasig offer you affordable microloans for business or even personal use.

- Up to PHP 25,000 In only 4 minutes

- First loan with 0% interest rate

- Only 1 Valid ID to Apply

What Financial Services Are in Pasig City?

There are various financial services in Pasig City. One can opt for any of the firms when seeking microloans.

- Banks: Banks are one of the cash agencies where you can get access to short-term loans in Pasig City. Though the banks take about 5 days before the loan is approved, you can request both long-term and short-term loans. This is why we recommend online loans if you need cash assistance urgently. The funds will be approved within hours to take care of the issues at hand.

- Pawnshops: These are brokers who exchange cash for a valuable asset. Most of the pawnshops deal with jewelry or even gadgets. The item you hand to the broker is used as collateral in case one fails to repay the debt on time. The good thing about a pawnshop is that you receive the cash instantly without any delay. However, before seeking this financial service, you should know they’re not regulated. You might be subjected to a high-interest rate depending on the demand and supply in the market.

- Online lenders: Online lenders are the best financial providers in the city. One of the best online platforms is Digido. The firm offers you an instant loan within hours. There is no collateral needed and they are regulated by the financial authorities.

Also read all about

Banks in the Philippines that Offers Personal Loan

What’s the Best Express Loan in Pasig City?

Are you searching for an express loan in the Philippines’ Pasig City? If so, Digido is the perfect firm for the job to be done. The platform offers affordable and sustainable loans. Their loans attract a low-interest rate depending on the loan amount.

That’s not all. It has a loan tenure of 7 to 30 days. This gives you ample time to settle the debt according to terms and conditions. What makes Digido the best lending company in Pasig is that it offers first-timers a loan up to PHP 10,000. And for the second applicants, they qualify for a loan up to PHP 25,000. Here are some of the benefits of getting a loan at Digido:

Digido is a legit lending company in Pasig City

Digido is a fully legal company, it has SEC Registration No.: 202003056, and Certificate of Authority No. 1272. Any client can check this information on the state website in the list of financial companies.

Digido features include the following:

- Digido offers loan for amounts from 1,000 to 25,000 pesos. First loan at 0% per annum. This means you pay back the same amount you borrowed without interest;

- The service uses an automated system to evaluate your loan application. This eliminates human errors and biases;

- The loans are generic hence you can use it for any purpose;

- Digido offers unsecured loans with minimal documentation. Plus your credit score is not needed to determine if you are qualified for the funds;

- The company provides a 24/7 service, hence one can acquire a loan when on the move or during ungodly hours;

- The loan application is done online through an app or the website and the cash is disbursed within half an hour;

- You can get a loan via Bank account, E-wallet, GCash or in cash even without a bank account in remittance centers (for repeat borrowers).

🔥 Calculate your loan cost and click ‘Apply Now’, 95% of applications get approved!

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

Digido Loan Requirements

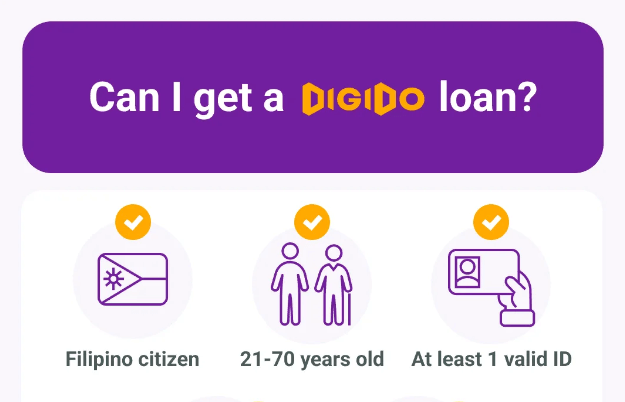

To be qualified for an online loan from the company, you need to meet the following requirements:

- The applicant must be a Filipino citizen;

- You should be between the ages of 21-70 years to be considered eligible;

- At least one government ID must be uploaded before submitting the loan application forms;

- A valid mobile number is needed;

- You must be either employed or self-employed.