All About Union Bank Personal Loans in the Philippines

Key takeaways:

- Union Bank offers loans with favorable interest rates for bank customers

- With Union Bank you can take a loan of up to PHP 5 million

- To apply for a loan, you must meet their requirements such as annual income

- You can pay your Digido loan with Union Bank

- You can get a fast loan for your urgent needs in Digido with just only 1 valid ID

Union Bank of the Philippines, Inc, founded in 1968 and initially known as Union Savings Mortgage Bank, became a commercial bank in 1982 and a universal bank in 1992. It is now among the top 10 universal banks in the country, noted for its high profitability, solvency, liquidity, and robust online banking services.

Union Bank is among the lender in the Philippines offering affordable loans. It is also the best bank for car loans in the Philippines. You can request UnionBank loan with an attractive interest rate and excellent service. Let’s dive in and learn more about the firm’s loan.

- Apply with only 1 valid ID

- Fast approval in 5 minutes

- Simple application via mobile app

Types of Union Bank Loans

Union Bank understands your needs, and for this reason, they offer different types of personal quick loans. Each of these loan purposes is designed to help individuals achieve their personal and financial goals by providing them with the necessary funds in a timely and flexible manner. That’s not all. They present you with a flexible loan repayment plan, and you can request funds between PHP 1000 – PHP 2000,000.

Here’s a list of available loan offers from Union Bank in 2024:

✅ Quick Loans: These small personal loans are designed for fast processing and disbursement, ideal for urgent financial needs without the requirement for collateral.

✅ Personal Loans: These loans offer larger amounts and longer repayment terms. They are suited for bigger financial commitments, such as major purchases or consolidating debts.

✅ Home Loans: Aimed at helping customers purchase or renovate their homes, these loans offer structured repayment plans over extended periods.

✅ Auto Loans: These loans are available for purchasing new or used vehicles, with options for flexible payment terms to accommodate different budgetary needs.

Here is a breakdown of the various personal loans Union Bank offers in the Philippines. Each product package comes with its terms and conditions. Let’s see how each loan works.

Union Bank Personal Loan

Union Bank personal loans cater to a variety of financial needs associated with major life milestones or can be used as a quick emergency loan. Here’s a more detailed look at these purposes:

- Significant Life Events: These loans provide swift financial support for significant life events or big projects that you’ve been dreaming about. Whether it’s starting a new business, celebrating a major personal event, or making a large purchase, the loan can be instrumental in bridging the gap between your aspirations and your current financial capacity.

- Home Renovation: If you’re looking to enhance the comfort, functionality, or aesthetic appeal of your home, UnionBank personal loans can help. This funding can be used for various home improvement projects like remodeling kitchens, updating bathrooms, or even expanding living spaces, making your home better suited to your needs and increasing its value.

- Learning and Self-Development: These loans also support personal advancement through education. Whether it’s funding tuition fees for yourself or family members, covering expenses for professional certifications, or even consolidating educational debts, Union Bank provides the financial resources necessary to invest in personal and professional development.

- Debt Payment: If you are burdened by outstanding debts and are in good standing with your previous loan providers, you can use a Union Bank Personal Loan to consolidate and settle your existing debts.

- Emergency Expenses: Life can present unforeseen challenges, and during such times, having quick access to funds is crucial. Whether it’s a medical emergency or an unexpected major expense, a Union Bank quick loan can provide the necessary financial support to navigate these emergencies.

Union Bank’s Quick Loans are designed to offer financial solutions that are both swift and accessible, aligning with the needs of modern consumers who require prompt financial assistance. These loans are easily accessible, with a quick approval process that facilitates rapid disbursement of funds, essential for urgent financial situations.

Union Bank offers personal loans with several attractive features:

- These loans can be approved very quickly, sometimes in as little as five minutes (it depends on the amount of the loan and the borrower’s status).

- Applicants can borrow substantial amounts, up to PHP 2 million, without needing to provide any collateral or guarantors.

- Additionally, the repayment terms are flexible, ranging from one to five years, allowing borrowers to choose a schedule that best fits their financial situation.

Union Bank Personal loan Interest Rates

What about the cost of repaying the loan? The annual interest rate on Union Bank personal loans is set at 26.9% APR. Let’s take a look at the loan repayment table and monthly interest payments if you borrow PHP 500,000 from the bank:

| Loan Term | Monthly Installment | Interest Rate |

|---|---|---|

| 60 months | PHP 15,237.79 | 26.9% |

| 48 months | PHP 17,112.80 | 26.9% |

| 36 months | PHP 20,385.79 | 26.9% |

| 24 months | PHP 27,164.77 | 26.9% |

| 12 months | PHP 47,984.31 | 26.9% |

For PHP 100,000:

| Loan Term | Monthly Installment | Interest Rate |

|---|---|---|

| 60 months | PHP 3,047.56 | 26.9% |

| 48 months | PHP 3,422.56 | 26.9% |

| 36 months | PHP 4,077.16 | 26.9% |

| 24 months | PHP 5,432.95 | 26.9% |

| 12 months | PHP 9,596.86 | 26.9% |

Additional costs include a Documentary Stamp Tax, which is charged at ₱1.50 for every ₱200 borrowed. A disbursement fee of ₱1,750 is applied when the loan amount is issued. If payments are late, a fee of ₱500 or 6% of the missed payment amount, whichever is higher, is charged.

Union Bank Personal loan Requirements

To qualify for the Union Bank personal loan, applicants must meet several criteria. They should be aged between 21 and 65 and either Filipino citizens or foreign residents with a valid local address in the Philippines. Additionally, they must have a Taxpayer’s Identification Number (TIN) and be a primary holder of a credit card. A minimum gross annual income of PHP 250,000 is also required to be eligible for the loan.

To apply for a personal loan, you need a valid government-issued ID that includes both your photo and signature. You will also need to attach the following documents and certificates:

For Employed Individuals:

- Recent pay slips from the last two months.

- A recent Certificate of Employment detailing salary, issued in the last two months.

- The most recent Income Tax Return (ITR) with an official BIR stamp.

For Self-Employed Individuals:

- The latest business Income Tax Return (Form 1701), including all pages.

- The most recent Audited Financial Statements, complete with an independent auditor’s report.

Union bank Quick Loan Requirements

To apply for a Union Bank Quick Loan, the requirements are relatively straightforward, focusing on accessibility for existing customers. Here are the key requisites:

- Existing UnionBank Account: You must have a savings account with UnionBank to be eligible for a Quick Loan. If you do not have one, you can easily open an account online.

- Application Process: The application process involves completing a loan application form, which can likely be found on UnionBank’s website or through their online banking portal.

For more detailed information on the application process or to start your application, you can visit the UnionBank Quick Loans online page here.

Take note: The interest rates for Union Bank’s Quick Loans are not explicitly listed on their website. Generally, the interest rates for such loans are competitive and designed to meet the needs of customers looking for rapid financial solutions.

5 Steps to Apply for a Union Bank Personal loan

To obtain a personal loan from UnionBank, follow these steps for a streamlined process:

- Submit Your Application: Start by ensuring all required documents are complete and submit them to UnionBank. This can significantly speed up the processing time, potentially taking as little as 24 hours.

- Loan Approval and Notification: Once your loan is approved, UnionBank will call you to arrange how you would like to receive the funds.

- Choose Your Disbursement Method: You can opt to have the loan amount credited directly to a bank account of your choice or receive a manager’s check delivered to your billing address.

- Sign Necessary Agreements: Review and sign the Loan Disclosure Statement. You will also need to agree to an Auto-Debit Agreement, which allows loan repayments to be automatically deducted from your UnionBank deposit account.

- Receive Your Loan: Following your consent to the agreements and the setup of the repayment method, the loan proceeds will be released to you.

That’s it!

After your UnionBank Personal Loan is approved, you’ll begin paying interest with the next statement and start monthly payments the following month. For example, if approved in April, interest starts in May and payments in June.

Need money you can get quickly? Apply for a quick and easy online loan at Digido with 1 valid ID. Approval in 5 minutes and no paperwork! Calculate your pre-approved loan amount:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

Union Bank Auto loan

Have you thought of purchasing a car and luck with the funds to do so? Well, the answer to this is Union bank auto loan. The loan covers the expense of purchasing a brand new or second hand with ease.

UnionBank offers auto loans with a minimum down payment of 20% for new vehicles and 30% for used ones. Loan amounts can go up to 80% of the vehicle’s selling price. The loans feature flexible repayment options ranging from 12 to 48 months or individuals planning to purchase new cars have the option to spread their payments over a period of up to 60 months. Borrowers can choose from various payment modes like over-the-counter, post-dated checks, or Auto Debit Arrangement.

The Union bank auto loan rates are spread equitably to make it sustainable. One can request an auto loan from PHP 200,000 to 80% of the cars’ sales price. The loan is approved within 24 hours without any delays.

Union bank Auto loan Requirements and Interest Rate

Before the auto loan is approved, certain parameters need to be met. The union bank car loan requirements include:

- One must be employed or self-employed and for a period of 1 and 2 years respectively.

- You have to be between the ages of 21 to 65 to qualify.

- The customer must be 65 years old at the time of repayment of the loan.

To apply for a personal loan, you need two valid government-issued IDs with signatures, proof of billing address and you must also attach the following documents:

For Employed Applicants:

- Certificate of Employment with salary details.

- Payslips for the last three months.

- Latest Income Tax Return (ITR), unless the loan amount is less than PHP 3,000,000.

For Self-Employed Applicants:

- Business Registration documents (from DTI, SEC if applicable).

- Two years of audited financial statements and ITR.

- Trade references.

Interest Rates:

Union bank auto loan interest rates have been distributed effectively. Here are the rates and how they have been spread:

| Auto loan Term | Standard Interest Rate | with One Month Advance |

|---|---|---|

| 12 | 6.56% | 5.68% |

| 18 | 9.19% | 8.29% |

| 24 | 12.14% | 11.19% |

| 36 | 18.18% | 17.16% |

| 48 | 24.72% | 23.61% |

| 60 | 31.76% | 30.57% |

Union bank Home loan

Union bank housing loan in the Philippines is the best option if you’re looking for mortgage financing. The bank approves a minimum loan amount from PHP 200,000, and maximum loan amount can be up to 60% of the property’s appraised value or 90% of the contract price from the bank’s approved real estate developers. Allowing a down payment range from 10% to 99% provides significant flexibility for buyers in managing their initial financial outlay. That’s a sweet deal you can’t miss out on when looking for a house to purchase in the Philippines.

Additionally, one has a loan tenure up to 20 years for condominiums and 25 years for houses and lots. Once your home loan request has been approved, you’ll receive the funds within 5 business working days.

Interest Rates

Union bank home loan rates are 6%-11% annually, making the loan sustainable. Though, the loan tenure depends on the value of the property financed. We recommend using an online loan calculator to find the interest charged on principle.

Union bank home loan Requirements

Application Requirements:

- Completed application form

- Valid government-issued ID

- Marriage certificate for married applicants or a certificate of no marriage for single applicants

For Employed Applicants:

- Most recent Certificate of Employment that includes compensation details

- Pay slips from the last three months

- Latest Income Tax Return stamped by the BIR or Form 2316

For Self-Employed Applicants:

- Business Permit

- SEC Registration

- DTI Registration for sole proprietorships

- Articles of Incorporation, By-Laws, and General Information Sheet for corporations

- Certificate of Incorporation for corporations

- Most recent BIR-stamped ITR or Form 1701 with Audited Financial Statements

- Trade Reference

Property or Collateral Documents:

For Accredited Real Estate Developer:

- Contract to Sell

- Reservation Agreement

- Statement of Account

For Non-Accredited Real Estate Developer:

- Photocopy of the Transfer Certificate of Title (TCT)

- Latest Tax Declaration

- Location Map

- Seller’s government-issued ID (and spouse’s if married)

- Authorization for property appraisal, including contact details and location

- Appraisal fee payment

Union bank Online loan Application

Union bank is one of the financial institutions that have embraced digital banking. Instead of heading to the bank to request a Union bank quick loan, you visit the official site. Here is the application procedure.

- Step 1

The first step is vesting the officials site. Though you can download the online app for your Android or iOS device and continue with the loan application. - Step 2

Once at the site, go to the home page and click the button “You qualify for a loan” The button then takes you to the online forms. Ensure you key invalid information to increase the chance of your loan approval. Plus, remember to attach and the relevant documents as well before submitting it. - Step 3

The loan application will be evaluated by the firm, to ensure you meet all the requirements before it is approved. If the firm finds you eligible, the funds shall be sent to the respective account.

Alternatives to Union Bank Quick Loan

If your loan request at the bank has been declined, there no need to worry. There is an alternative way to get an instant cash loan. One of the platforms that offer instant loans is Digido. The firm has been a renowned financial institution in the Philippines and offers the online loan. Hence, you can request the funds anytime through your SmartPhone.

Filipinos love the platform because they offer a minimum loan of PHP 1,000 and a maximum amount of PHP 25,000 and the interest rate on the first loan is free!

Benefits of Digido

- Quick loans without any collateral and guarantors

- Get your first loan with 0% interest rate with Fast approval in 5 minutes

- Only one government-issued ID is required and your credit score is not needed.

- The funds are generic and can be used for any purposes.

- The company provides a 24/7 service; thus, one can request a loan during ungodly hours or move.

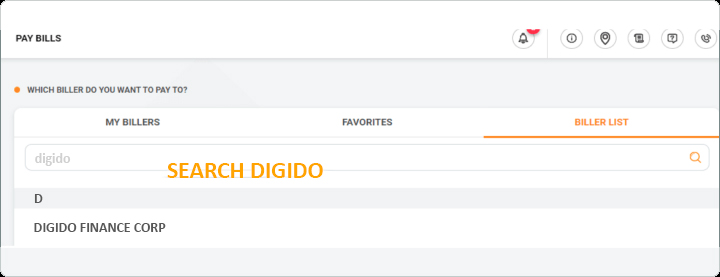

How to pay Digido loan via Union Bank

There are 2 ways to pay the Digido Loan via Union Bank:

Mode 1: Online banking of Union Bank

If you have an account with Union Bank, and wish to pay via Debit-To-Account, fill-out the Account Number field in the upper right-hand portion of the form.

Step 1: Log in to your UnionBank Online Banking account at online.unionbankph.com or downloading the APP. Follow this link to start Login

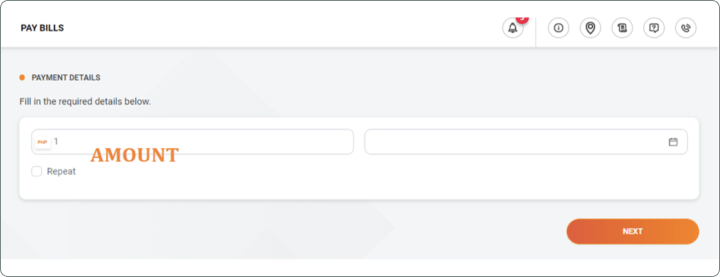

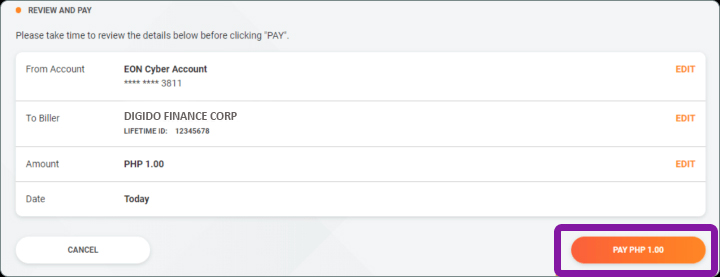

Step 2: In the main menu, click Pay Bills and then click on the Select Biller button.

Step 3: In the Biller List tab, search and select Digido.

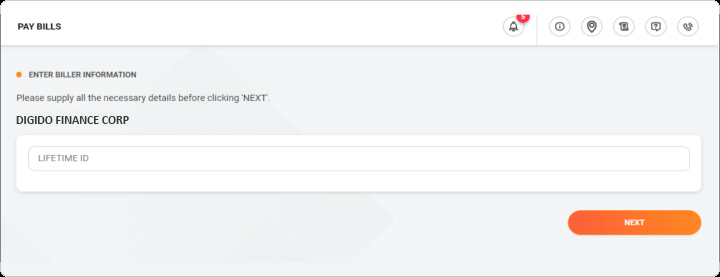

Step 4: Enter your LIFETIME ID and click Next button. Follow this link to Get a Lifetime ID

Step 5: Select the account you want to pay and fill out your amount to be paid and date.

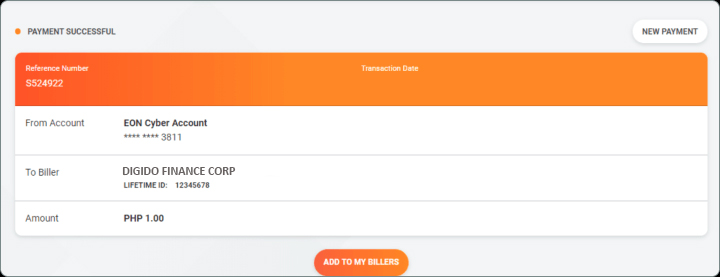

Step 6: Review the payment details and click Pay.

Step 7: You will receive a confirmation that your payment was successful.

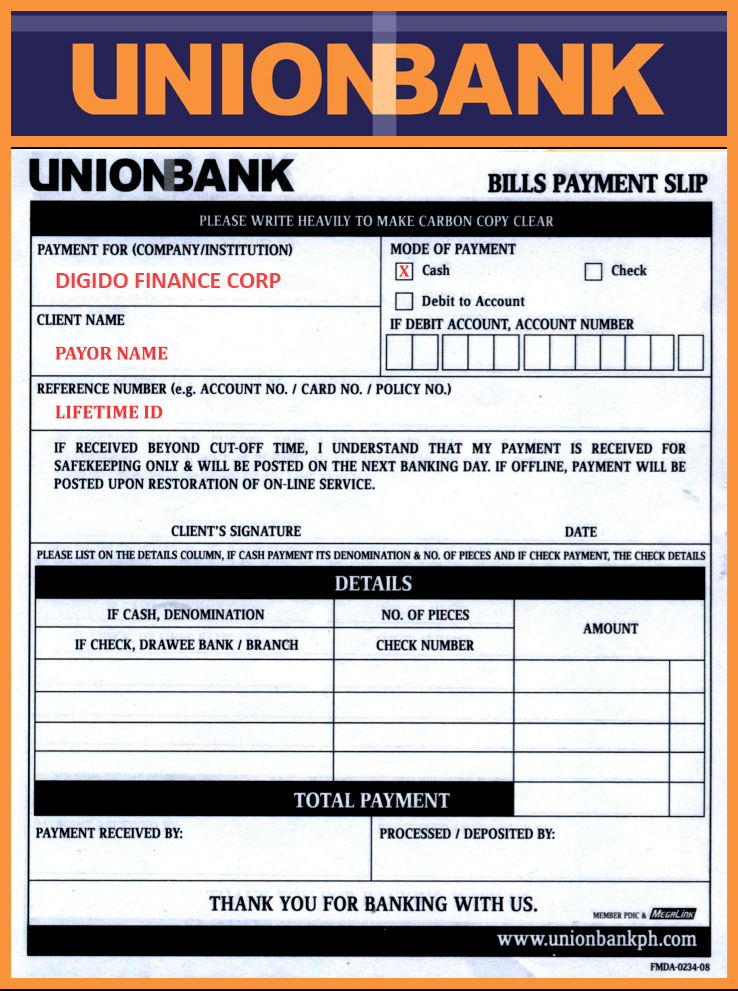

Mode 2: Over-the-counter of Union Bank

This method is suitable even for those who are not customers of UnionBank. To do this you need to visit one of the offices of UnionBank.

Step 1: Proceed to any UnionBank Branch.

Step 2: Fill-out a Bills Payment (as shown in the picture below) in duplicate copies. Once validated by the Teller, you will be given the duplicate copy plus a Transaction Receipt.

Step 3: Segregate CHECK in CASH payments. For check payments, indicate the Drawee Bank/Branch and the check number; For cash payments, indicate denomination and number of bills.

Step 4: If you have an account with Union Bank, and wish to pay via Debit-To-Account, fill-out the Account Number field in the upper right-hand portion of the form.

Learn more:

✦ Loans for bad credit in the Philippines

✦ How to get fast loan in 15 minutes

Who does not fit Union Bank Personal Loan?

Have you requested for a loan at Union Bank the request decline? This leaves one with a lot of questions. This is because quick loans are for pre-qualified Union Bank roll account holders only. The rest can’t get access to this credit. Though that is one reason, here are other reasons why the bank might decline your loan request.

- If you haven’t banked with the institution for the last six months, your loan request will be declined.

- If one lacks a steady income, their loan request shall be declined.

- If the person has a poor credit score or outstanding debt, the bank’s loan request is declined.

- Having submitted incomplete forms renders your loan application null and void.

This is why Digido is a great alternative to a loan at UnionBank.

Learn more useful information about:

✦ Loans when blacklisted in the Philippines

✦ fast and easy cash loan online

✦ Smartphone installment in the Philippines

FAQ

-

Does Unionbank have a salary loan?Yes, UnionBank offers a salary loan through its partnership with Advance Tech Lending. This loan is available as a short-term salary advance, ideal for meeting immediate financial needs. To access this loan, your company needs to be partnered with Advance Tech Lending, which will then verify loan eligibility.

-

What are Unionbank's loan requirements?To apply for a UnionBank loan, you'll need an existing UnionBank account, particularly for Quick Loans. The application process involves completing a form on UnionBank's website, where you'll provide personal and financial details. Required documents include a valid government-issued ID and proof of income, such as payslips or income tax returns.

-

How to qualify for Unionbank quick loan?To qualify for a UnionBank Quick Loan, you must meet certain eligibility criteria that typically involve having an existing relationship with the bank. Applicants are usually required to have an active UnionBank account.

-

Can I reloan with Unionbank if I have unpaid debt?Generally, if you have an unpaid debt with UnionBank, it may affect your ability to reloan. UnionBank typically requires good standing in previous loan agreements to consider a new loan application. If there's an outstanding balance on a quick loan, it would be prudent to clear that debt or discuss restructuring options with the bank to maintain eligibility for future loans.

-

Can I get a quick cash loan from Unionbank?Yes, you can get a quick cash loan from UnionBank. UnionBank offers a fully digital loan program called UnionBank Quick Loans, designed for qualified UnionBank account holders. This program allows for easy and rapid access to cash.

-

How to apply loan in Unionbank mobile app?To apply for a loan through the UnionBank mobile app, you'll need to be an existing UnionBank online banking customer. Once you're logged into the app, you can navigate to the loan section where you can check your eligibility, apply for a quick loan, and manage loan payments.

-

How can I open a Union Bank account in the Philippines?You can open an account through the app without going to the bank. Choose a variety of savings account. Request for a Card and have it delivered. Activate your card instantly through the app.

-

Does Union Bank charge for transfers?There is no fee for transferring funds between your accounts and to other accounts at UnionBank. However, when transferring to an account at another bank, an outgoing transfer fee of Php 10 is charged.

Authors

Digido Reviews

-

HoneylethVery quick and less interest. Keep up the good job. Helps a lot.4

-

SamI loved Digido not just the app but for the whole experienced that I had in applying for a loan. Hassle free and loan disbursement is as quick counting 1-2-3.4

-

NiyellCustomer Service agents are courteous and polite. They extend assistance to resolve issues.4

-

EricaI tried Digido out of curiosity. To cut to the chase, Digido is ideal for "petsa de peligro" days. It's almost payday but also your bills is on due date because they have short payment terms (I was given 7 days term for my first loan). You can get approved as fast as 30mins and the loan will reflect immediately.4