AUB Credit Card Online: Easy Application in 5 Steps

Key takeaways:

- AUB Credit Card online banking is one of the popular financial services in the Philippines

- You can use your AUB credit card for shopping, traveling, and paying bills

- There are restrictions on age, income, and other reasons for refusal

- If you are rejected by banks, you can always apply for a 0% interest quick loan from Digido

Table of Contents

In the Philippines, the adoption of credit cards continues to grow, reflecting a broader trend towards cashless transactions.

📌 In 2023, the global credit card payment market size reached USD 644.4 billion. It is expected that the market will reach USD 1,200.6 billion by 2032 (1). According to the Credit Card Association of the Philippines, a total of 11.83 million cards have been issued in the country in the first quarter of 2023 (2).

This growth is further accelerated by the the convenience of digital payments and the expanded online services offered by banks like Asian United Bank (AUB). In this article, you can get acquainted with the AUB credit card review and learn how to obtain this card.

- Get up to PHP 25,000 with 0% interest

- Only 1 Valid ID needed to Apply

- Fast approval in 5 minutes

About Asian United Bank (AUB)

The institution was established on October 3rd, 1997 and it is registered under the Securities and Exchange Commission. It’s one of the banks in the Philippines to have been granted a full-branch license in 1997 (3). This proves the firm is legit and can be trusted to provide high-quality services to their clients.

In 2012, the institution received recognition from the Bangko Sentral ng Philipinas. The permit allowed AUB to expand its commercial bank status. The financial institution continued to make bold moves in the Philippines’ economy. This was seen in 2013 when they lined up the league of Philippines banks which have been publicly listed.

Besides commercial banking, AUB also deals with financial advisory, project-tied lending, direct share investment, capital issues underwriting and trading, loan participation among others. However, one of their best services is the AUB credit card online banking.

Types of AUB Credit Cards

The bank issued its first credit card in 2015. It is known as the AUB Easy MasterCard. It is considered one of the most popular credit cards in the Philippines. What makes the credit card unique is the fact that you can choose exactly how often, when, and how much to pay. Yes, it is that flexible, and there is no annual membership charge for life.

The bank has ensured all its clients are well-taken care of. This is why they are providing you with four MasterCard packages you can choose from. Each of the credit cards comes with its benefits. Let’s break it down to understand more when filing your AUB credit card online application (4).

- AUB Classic MasterCard

Benefits:

✅ For every Php 50.00 you spend, you’ll earn one point of reward

✅ The MasterCard is issued with no annual fee for life and interest on new purchases

✅ The card allows you to make your own choices on how many times to pay per 30 days

✅ The minimum due is as low as Php 250.00 a week, which is affordable

✅ The minimum due can be made once or twice a month or even weekly

- AUB Easy MasterCard

Benefits:

✅ The card has flexible payment terms and the minimum due is Php 1,000.00 weekly

✅ When using the card to pay a bill or even shop, for Php 50.00 spent, you’ll earn one point of reward

✅ To cater to your needs as a consumer, you can make payments once or twice a month or even per week

- AUB Gold MasterCard

Benefits:

✅ There is no annual membership fee required though, the minimum due can only be paid monthly

✅ Plus the card can be used abroad and for every transaction done outside the country, you’ll earn 2x reward points

✅ The amazing thing is that the reward points can be transferred to Mabuhay Miles

- AUB Platinum MasterCard

Benefits:

✅ The platinum card has no annual subscription charge needed. However, when it comes to the minimum credit limit due it can be paid monthly

✅ The card comes with 2x reward points for every transaction done abroad

✅ Plus the reward points can be transferred to Mabuhay Miles with no annual fee

Learn How to Get

Fast Loan in 15 Minutes in the Philippines

AUB Credit Card Requirements

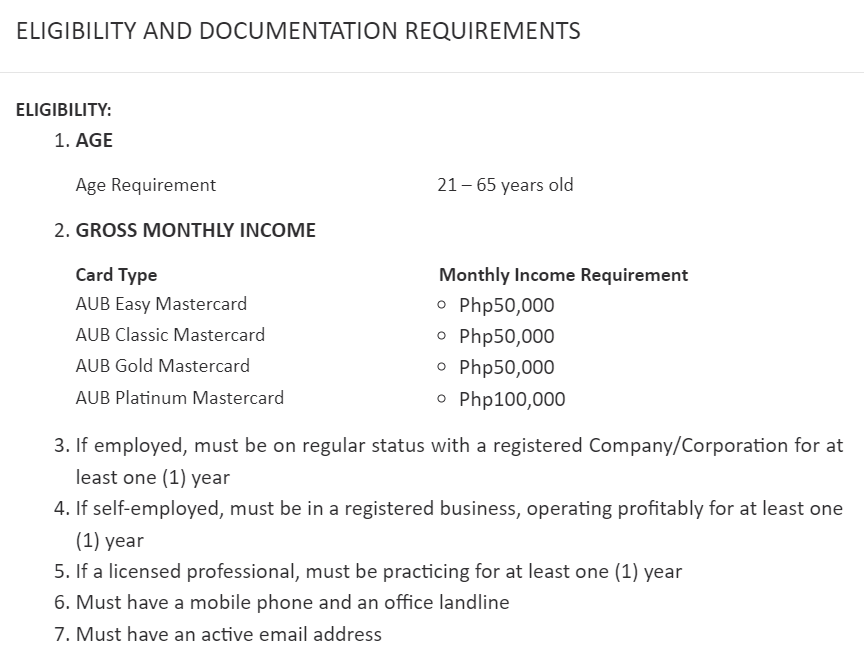

For one to be qualified for a credit card from the bank some things must be met. They include:

- You should be between the ages of 21 and 65 years. However, with an AUB Easy MasterCard the age limit is 55 years old.

- The bank requires you to have a total monthly income of Php 50,000.00 to be considered eligible. For the Platinum Cards it is Php 100,000.00.

- For employed people: you must be in permanent status with a registered company or a corporation not less than one year.

- For self-employed: you should file Income Tax Return (ITR) form (1701,1701Q) and the latest Financial Statements or even DTI registration. Besides, your business has to be registered and cost-effective for at least one year.

- The bank requires an applicant to have at least one landline phone number and an active email address.

Online Loan No Requirements

Get your Loan with Minimum Documents in the Philippines

Financial help for any purpose! Get up to PHP 25,000 in just 5 minutes with Digido! Calculate your pre-approved loan amount:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

5 Steps of Applying for an AUB Credit Card

Here are the steps to follow when making an AUB credit card application. The steps are the following:

1. Selecting the right AUB Credit Card

AUB Bank offers you four types of credit cards that you can choose from: Easy, Classic, Gold, and Platinum. Each of the cards comes with its benefits. In the previous section, we talked about the cards and their benefits. Hence, we recommend going through them and selecting one that fits your needs.

The best way to pick one that fits your needs is by comparing the different cards. Look at the benefits and needs each MasterCard presents and meets:

- Easy MasterCard is fit for people who are low monthly income or semi monthly income earners and lack dependants

- Classic MasterCard is good for breadwinners, married couples or even parents with low-income

- Gold Card is ideal for middle monthly income earners, who travel a lot

- Platinum Card is perfect for upper-income earners, who travel a lot

Once you have evaluated your options and decided which card meets your needs and wants, you move to the next step.

2. Prepare the AUB Credit Card Requirements

There are certain requirements that one should meet to qualify for a credit card. These requirements include age and other legal documents. For the credit card request to be approved, the documentation provided must be legal and correct. For example, there should be no mistakes in your credit report. If the bank notices a red flag in your application you won’t receive the card.

3. Submitting the AUB Credit Card application

When it comes to submitting your application, the AUB Bank offers you three official channels. You could choose to walk into your nearest branch and hand in your application.

The other option would be visiting https://www.aub.com.ph/ and submitting your application with just a click of a button. On the other hand, you can call the AUB customer service hotline (02) 8282-8888 or 1-800-10-282-888 or email to creditcards@aub.com.ph.

However, the most preferred method is through their website which is faster and can be accessed on time. As long as you have a smartphone or a laptop and an Internet connection you are good to go.

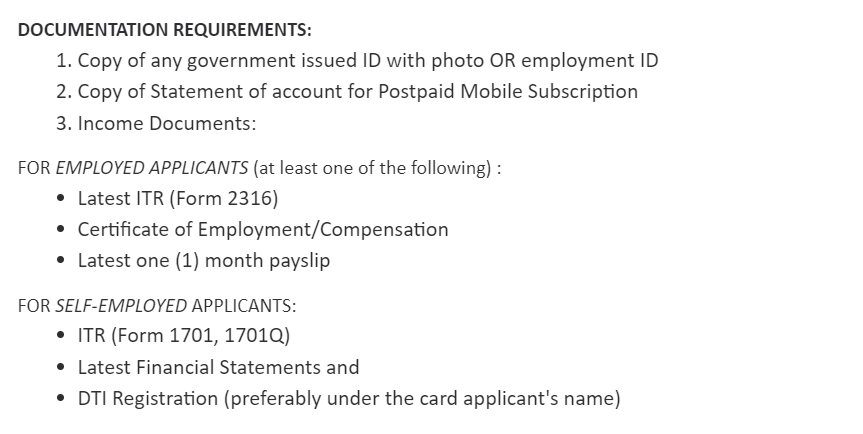

4. Checking Your Credit Card Status

After you have submitted your application successfully, you can begin to check for your credit card status. The Asia United Bank credit card application processing takes from 7 to 14 working days depending on the card type. This starts from the day you have handed in your application. The bank will then go through your application and send a text notification regarding your credit status.

However, one can still keep tabs on their credit status through the AUB card delivery online or even via phone call (02) 8282-8888 hotline number or 1-800-10-282-888 domestic toll-free number.

If you choose to track it online then go to the official AUB website and select “Credit Cards”. Then click the “Track Your Application/Delivery» section down the page and enter the required details. This will give you an instant notification about your credit card application status.

5. Activating the Credit Card

Once your credit card has been delivered, you are required to activate it immediately. The activation you are expected to do confirms to AUB Bank that you have received the card. You can call the bank through AUB service hotline number (02) 8282-8888 within working hours from 6 AM to 11 PM.

The bank will then ask you for certain information to confirm you are the true cardholder before activating it. Apart from the call, one could send an AUB Credit Card Activation via SMS to (0917) 581-0480 and the card will be activated.

Learn How to Get

Easy Сash Loan in just a 5 minutes Online

Advantages of Asia United Bank Credit Cards

- The AUB card does not have an annual fee. It makes it one of the best credit cards in the Philippines and sustainable even for low monthly income earners.

- There are no interest rates and annual fees on purchases.

- The bank offers its clients rewards points for every Php 50.00 spent, which can be converted to GetGo rewards points for every peso, AirAsia Big rewards point, eGift, and Panda Travel vouchers. (16)

- The card can be linked to Alipay or PayPal which makes it convenient for international purchases.

- It has over 5,000 payment channels in the Philippines making AUB a reliable bank for many Filipinos.

Disadvantages of AUB Credit Card

However, not everyone will be qualified for the AUB MasterCard, which is a disadvantage. This is because of the following issues:

- When you have a poor credit score or even errors in your credit report. Once the bank goes through your application and finds these red flags, you won’t be qualified for the card. However, this is a general banking practice, not a special feature of the AUB.

- Another disadvantage is an interest charge on missed payments.

- There is also a foreign currency transaction service fee.

- The overall monthly income of Php 50,000.00 locks out many applicants who are not able to raise such a monthly income, but are in need of a credit card

Learn Where to Get

Fast Loan with Bad credit in the Philippines

Where to get money if you are denied a credit card from a traditional bank??

If you need money, but can’t get an AUB Credit Card, for one reason or another, apply for a fast loan from Digido. It will take you only 15 minutes to fill out the application form and await the loan decision.

Why Digido? There are at least five advantages of applying to this service:

- Fast and understandable process

All the details of the loan are transparent and simple. You see the requirements to the borrower and the credit terms, including all possible fees and charges.

- 24-hour availability

You can borrow money at any time, both in the daytime and at night. There is no need to wait for hours – the loan decision will be ready in less than 5 minutes.

- Simple application

All you need to apply for a fast loan is your smartphone or a laptop with access to the internet. The list of the documents required includes only proof of identity (proof of income will increase the chances of approval)

- A good chance of approval

Our service approves 9 of 10 loans. So, you can rely on Digido in a difficult financial situation, even when you urgently need money.

Take a fast loan of Php 1,000.00 to 10,000.00 for a period of 7 to 15 days. Submit an online application and get an approval in 4 minutes — much faster and easier than traditional banks.

Learn How to Get Loan

for Freelancers and Self-employed in the Philippines in the Philippines

FAQ

-

Can I withdraw cash from an AUB credit card?You can withdraw money from your AUB Credit Card using the “CashOut Installment Program”. You can pay for goods and services at businesses that do not accept credit cards, such as housing contractors, travel agencies, dental clinics, auto parts, and other similar transactions.

-

How to check my AUB credit card application status?Open the “Credit Card” section of the Bank’s official website and click the “Track Your Application/Delivery” button at the bottom of the page. You can also contact the specialists of the support service via (02) 8282-8888 hotline number or 1-800-10-282-888 domestic toll-free number, and ask them about your card’s status.

-

How do I look through my AUB credit card balance?Login to the official AUB website in your personal cabinet, select the “Credit Cards” section and there you will see your balance.

-

How do I activate my AUB credit card?Log in to the “Credit Cards” section of the official AUB website. Click on “AUB credit card online banking” and select “Register”. Then provide all the necessary data and follow the instructions.

Authors

Digido Reviews

-

JaypeeI am so thankful to this lending app. Its so nice to use plus their customer service is good. I always use this but sometimes I use to make a late payment but this app have a choices to extend it. Thank you, Digido.5

-

CherieI gave 5 star because it is very easy application and fastest loan to disburse a money unlike the other loan apps. Received cash on my aub card within half an hour! Thank you Digido.5

-

ChristineEfficient and reliable, a standout service! I needed a quick cash for my unexpected expenses, and they delivered it quickly. The application process was seamless, the funds landed on my aub classic mastercard swiftly. No hassle, no waiting, and the 0% interest for this loan was a real bonus! 👍5

-

AzenVery fast and reliable source of money. Easy payment option also :)4

-

DamienHaving been rejected by traditional banks, i decided to give Digido a try. I was amazed by how quick and non-judgmental the process was. My loan was approved in less than 10 min, and the funds were available on my AUB credit card online app almost instantly!4

-

NormanThe process is very smooth and perfect! And would like to commend also the agent who evaluated me over the phone, she is so polite and very nice. Nice lending app and nice customer service! I would highly suggest this app to all of my friends and colleagues. Thank you!4

-

TheresaThis app is very helpful and easy to apply. Thank you so much! More power to Digido! Highly recommended.4