How to Get Loans for Self-Employed in the Philippines

Key takeaways:

- Loans for freelancers in the Philippines can provide quick access to funds

- There are various credit options available for freelancers, including personal loans, business loans, and credit cards

- You can use helpful companies like Digido to get a freelancer loan online with no fuss

- Register your business and pay your taxes; this will prove to the lender that you are able to pay the loan

The average salary of a freelancer in the Philippines (1) is ₱24,000. It is too small, and freelancing has hidden costs, such as taxes, computer maintenance, internet, etc.

Freelancer’s income is not stable. Because of this, it is not unusual for a freelancer to be in a tight financial situation. It is why loans for the self employed are a necessary thing in Phillipines.

For what purposes a freelancer loan may be required:

- Freelancers in the Philippines may need money to upgrade their equipment and software to meet the demands of their clients.

- They may also require funds for marketing expenses to promote their services and attract new clients.

- They may encounter unexpected expenses such as medical emergencies, car repairs, or other personal emergencies that require immediate funding.

- Also they may need a loan to cover cash flow gaps during periods of low client demand or delayed payment from clients.

- Finally, they may need a loan to invest in their professional development and acquire new skills to stay competitive in their industry.

If you are a freelancer, you have come to the right place. In this article, we will show you how to get loan for freelancers Philippines, where, and which companies are the best

- In only 4 minutes you can Receive Up to PHP 25 000

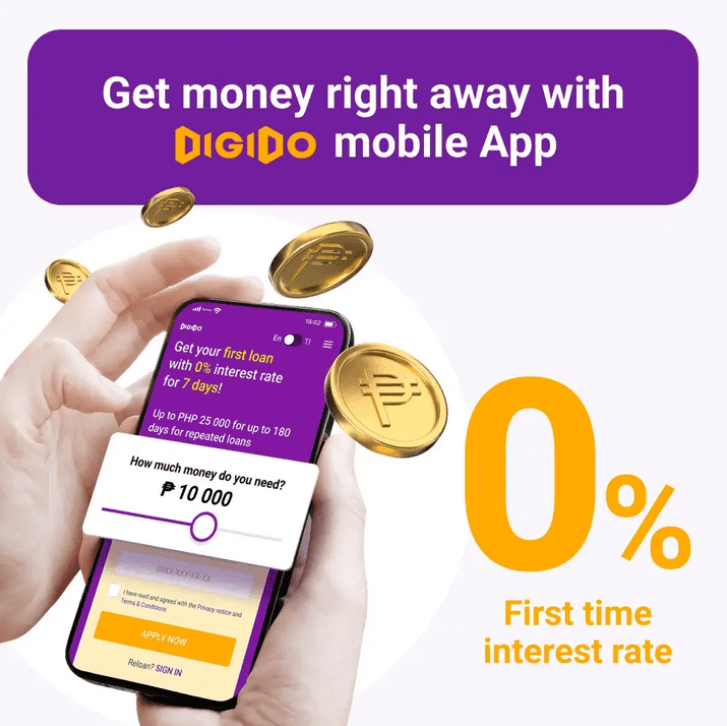

- Get your first loan with 0% interest Rate

- Minimum documents required

Where to Get a Loan for the Self-Employed in the Philippines

In the Philippines, freelancers have access to various credit options, including personal loans and bank cards. While these options are not exclusively tailored for freelancers, they can still be utilized by them to meet their financial needs. Here are some examples of loans freelancers can take advantage of:

- Personal Loans: Some financial institutions offer personal loans specifically for freelancers that do not require collateral and have flexible repayment options.

- Business Loans: Freelancers who have a registered business can apply for business loans to finance their operations or expansion plans.

- Salary Loans: Freelancers who have a regular source of income from their clients can apply for salary loans that offer higher loan amounts and longer repayment terms.

- Credit Cards: Freelancers can also apply for credit cards that offer rewards programs and other benefits that can be used to offset business expenses.

To get a loan as a freelancer in the Philippines, all you need to do is apply. You can do this in banks or loan apps. It is important to note that the availability and terms of these special credit options may vary depending on the lender and the freelancer’s financial situation.

How to Improve Your Chances of Getting a Loan as a Freelancer?

One of the ways to improve your chances of getting approved for a loan is to legitimize your freelance status. What does that mean?

It means that you must register your business as a freelancer. As such, you have to apply for the following:

- DTI Registration

- Business Permit / Mayor’s Permit

- BIR

If you have these documents, loan companies, and banks will recognize you as an earner. They will see you as a legitimate business.

Learn all about –

Freelancer Tax in the Philippines: How to File and Pay Taxes?

👉 Register as a Taxpayer and File Your ITR

Why is it necessary to register as a taxpayer? As a taxpayer, you can get a document from the government to prove you are earning money. Employees are lucky because they can easily present their payslips from their employer.

But what if you are self-employed, like a freelancer? You cannot have a payslip. The only way you can prove your income is through your ITR(2) .

ITR means income tax return. It is a tax that you pay annually to the Bureau of Internal Revenue. You can do this yourself or hire an accountant to do it for you. Before you can pay taxes, you must register your business with the BIR.

👉 Get Recognized by Getting A Business Permit

Since we talked about the BIR, we should also add that you need a business permit. This permit is not a simple barangay permit.

A business permit is also called a Mayor’s Permit. It is a document from the government proving that your town or city officially recognizes you as a legitimate business. You must renew your business permit every year.

👉 Prepare Your Supporting Financial Documents

To be able to apply for a loan, you must prepare certain documents, which we will discuss in this section.

- Bank statements for the past six months – this is a printed document from your bank to prove that you have a bank account

- Certificate of employment from clients – a certificate from your employer showing that you have a job and are earning money.

- Certificate of Earnings – if you are a freelancer, you cannot get a certificate of earnings. Rather, you must present your BIR ITR document.

👉 Show proof of capacity to pay

To get approved for a loan, you must show your capacity to pay. You must present documents proving that your monthly loan should not be more than what you earn. In addition, you must also pay consistently and on time. It is the only way you can build a high degree of credibility.

👉 Maintain a Good Credit Score

A good credit score means you are trustworthy. Banks and financial institutions calculate a score for a person whose record is on their file. The score determines whether you are a good borrower or high-risk.

👉 Look for the right banks

It is a good idea to borrow money or apply for a freelancer loan from a bank where you have already had an account for a long time. They know you, and they have a record of your transaction.

We are not saying that you must only borrow from a bank. What if you do not have a bank? What you can do is look for loan apps. For example, you can apply for a loan even if you do not have a bank account.

Companies offering Personal loans for Freelancers

Some of the top banks in the Philippines that offer personal loans include BDO, BPI, Metrobank, Security Bank, and Citibank. The terms and conditions of these loans may vary depending on the bank and the borrower’s financial situation. To help you fast-track your loan, we have prepared a list of the best loan providers for Filipinos.

- BPI – with BPI, all you need to do is go to their website and apply. You do not need to upload documents if you meet their salary conditions. You can get the loan approved in as short as five days,

- Citibank – this bank is generous when it comes to personal loans. They offer up to 2 million PHP loans. The main documents you need are the loan form, identification cards, and BIR docs.

- Security Bank – like Citibank, you can loan up to 2 million PHP, with a rate of 30% per year. The requirements are the same, but they will need the DTI certificate of your business.

Opt for Unsecured Loans From a reputable Financial Institution

We recommend applying for a loan from a trustworthy financial institution or reputable online lending platforms. Private loan apps, on the other hand, differ from traditional banks as they have more lenient documentation requirements, faster approval times, and no collateral requirements. This makes it easier for freelancers to get approved for a loan. Fast loans are often available, with a simplified application process, and funds can be deposited into your account quickly. Here are examples of such lenders:

Comparison of Lenders Providing Quick Loans for Freelancers

| Personal Loan Provider | Features and Requirements |

|---|---|

| Digido | Highly secure, fast approval, max loan of ₱10,000 for first time borrowers and ₱25,000 for second time. There is 0% interest rate, plus you will enjoy the convenience of applying online. |

| Tala | App loan available, fast loan up to ₱25,000, low-interest rates |

| Juan Hand | Pay loans up to 3 months, loans up to ₱15,000, payout available in 7-11, PayMaya, and other apps. |

You can improve your credit history: By taking and repaying loans from private lenders on time, freelancers can improve their credit history and increase their chances of getting loans from other financial institutions in the future.

Calculate your loan cost and click ‘Apply Now’, join the 95% we Approve!

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

Benefits of Digido Personal Loans

Digido is one of the best loan companies in the Philippines. They offer loans for freelancers, and you can expect to get approved even if it is your first time.

The good news we can share is that in our loan program for freelancers, we do not ask for any of these things from our clients.

Learn More About

HMO for Freelancers

Here are the best benefits of using our platform for freelancer loans in the Philippines:

- High approval rate and fast processing

- In only 4 minutes you can receive up to ₱ 10 000.00

- Up to PHP 25 000 for up to 180 days for repeated loans

- The interest rate is zero for first loan

- The application is online

- The process is fully automated

As such, Digido provides one of the best financial support for freelancers when needed. Although banks offer loans, they need a lot of documents from you. It is also such a hassle to apply because they ask for so many other supporting documents. With Digido platform, all it takes is an online application, and you should get a decision quickly

Conclusion

Loans are an integral part of life. As freelancers, you may be dealing with a “dry season” when you do not have a lot of orders from clients. Therefore, Loans for Freelancers can provide freelancers with the financial stability they need to invest in their business, upgrade equipment, and cover unexpected expenses, which can ultimately lead to increased income and growth opportunities.