Secure Loans: List of Legit Online Lending Apps Philippines

Key takeaways:

- Loan Apps are becoming increasingly popular in the Philippines

- Safety and trustworthiness are important factors to consider when choosing a loan App

- Legality and registration of the loan app must be checked

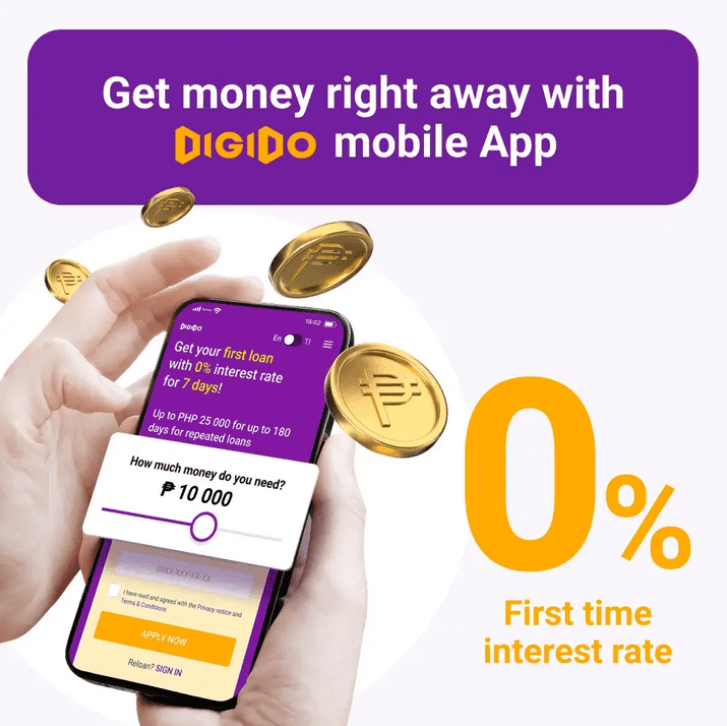

- Get approved in no time and enjoy a zero-interest your first loan with Digido

- With Digido, you can get fast, secure and easy access to the funds you need, all from the comfort of your own home.

Loan Apps is giving customers unprecedented access to borrowing money in the Philippines. Its increasing popularity has proven that more Filipinos are preferring to avail of a loan just by using a smartphone and opening an App. The Philippines is currently witnessing fast-paced growth in the financial technology industry which includes online lending companies.

When you are in dire need of money and have run out of people to ask for help and loan Apps are there within your reach, who wouldn’t? It is important to know some of the best online loan App in the Philippines this 2024.

- Up to PHP 25,000 In only 4 minutes

- Get your first loan with 0% interest rate

Important Elements to Consider When Choosing an Online Loan App

You must make sure that the loan apps you are availing are 100% safe and trustworthy. There should be no risk of losing your money, getting scammed, or falling into debt traps.

It is crucial to consider factors that ensure the safety and security of your personal and financial information. Although most online lenders are reputable, it is essential to check their registration and licensing status to avoid falling prey to fraudulent activities.

By carefully reviewing the eligibility requirements, repayment terms, as well as the level of customer support and usability of the application, you can make an informed decision and choose the Best Online Loan App Philippines for your needs.

Factors to consider when choosing the Best online loan App Philippines 2024:

1. Legality and Registration

Online lending companies in the Philippines such as Digido are registered with and licensed by the Securities and Exchange Commission (SEC). They also have a Certificate of Authority (CoA) before they can offer loans. You may visit the SEC website (1) to check if the online lending company you are dealing with has the corresponding license and registration.

2. Eligibility Requirements and Application Process

Applying for a loan will require you to provide minimum personal information, such as your name, address, phone number, date of birth, and proof of income to verify and check your credit eligibility. However, you are bound to check the legality and registration of the mobile app to avoid phishing or incidents of fraud.

3. The Loan Amount and Repayment Terms

Lending companies give specific amounts you can avail of including the length of time it takes for a loan to be paid off completely when making regularly scheduled payments. These terms should also be found in the Disclosure Statement.

4. Interest Rates, Fees, and other Charges

The interest rates, penalty, and other fees and charges associated with the loan must be clearly specified in the Disclosure Statement prior to the completion of a loan transaction. There should be no hidden fees or charges.

5. Security and Privacy measures

Security is the customer’s right to be protected against threats and danger which generally refers to unauthorized access to data while privacy is the right to control how data and personal information is used, and the protection provided to prevent data breach.

6. Customer Support and user Reviews

Customer service and support mean meeting customer expectations, this includes listening to customers’ needs, actively engaging with customers, and showing customers your appreciation. User reviews are important to consider as these are comments written or spoken by people who have interacted with the company and had experiences worth sharing.

7. Usability of the Application

Usability describes the level of ease with which a system allows a user to get to that goal. Usability is also about effectiveness, efficiency, and the overall satisfaction of the user.

List of Legit Online Lending Apps With Low Interest in the Philippines

If you’re looking for top loan apps Philippines, it’s important to make sure you’re dealing with lending apps legit. With so many options available, it can be difficult to determine which apps are trustworthy and offer the best terms. However, by doing your research and reading reviews from other users, you can find lending apps that have a good reputation and are known for their reliability.

Here are some of the best loan providers in the Philippines that are not only legit, but also offer competitive rates and flexible repayment options.

✅ Digido Philippines online Loan App

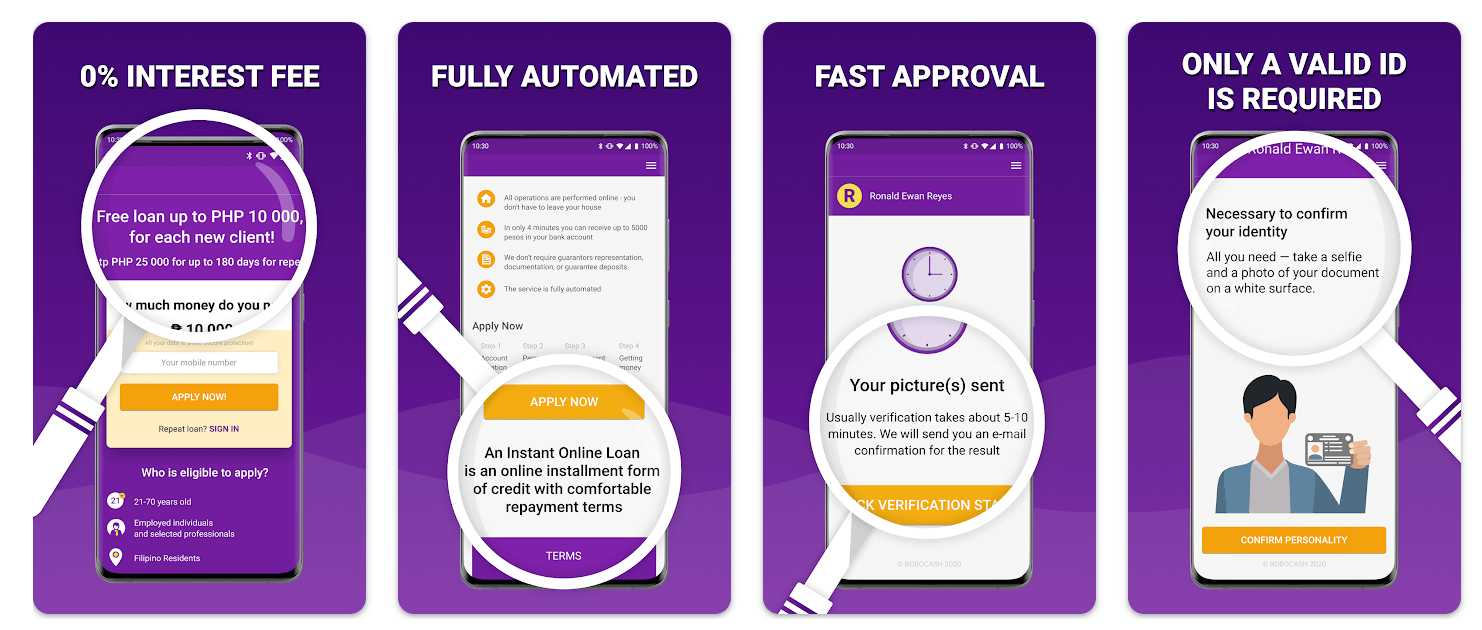

Digido proved repeatedly to be one of the most preferred and best cash loan app Philippines. Filipinos and residents can have access to Digido 24/7. They can obtain a rapid loan just by using only their cell phone and the Internet by downloading Digido Philippines for free.

With a high user rating and fast availability for iOS and Android, Digido provides loans with almost 90% acceptance rate that is coupled with a straightforward application process, thus making it one of the best cash loan apps in the Philippines. Regular customers are given a credit limit of Php 25,000*, while new users can apply for a max loan amount of Php4,000 with a 0% interest rate for first borrowers.

🎁 There are also Promotions and Raffles! You can get valuable prizes such as the iPhone 14 and others on your first and second loan

The loan approval rate is as high as 90-95% depending on the credit standing of the borrower.

Just Download the Digido App on your smartphone, complete the registration process in just 5 minutes and upload 1 valid ID. Wait for application updates that will be sent to your email.

Calculate the cost of your pre-approved loan and click ‘Apply Now’:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

✅ Tala App Philippines

One of the legit apps that provides loans in the Philippines is Tala. A forefront provider of mobile technology that focuses to transform financial services and credit scoring in the country. Among the principal benefits you can derive from engaging with Tala include the easy-to-use user interface and active social networks that regularly update their product offers and debt repayment options.

✅ MoneyCat App

Moneycat Financing Inc., popularly known as MoneyСat, is a business operator officially recognized with an excellent app. in the Philippines. It is a legitimate company that is registered with the Securities and Exchange Commission. The MoneyСat app is available for free download and usage on Android devices through Google Play. Users have rated the MoneyСat app 4.5 stars overall. Interest rates are at 0.54%% per day.

✅ BillEase Loan App

BillEase is an online shopping partner that allows you to shop and pay at a later time even without a credit card. All you have to do is to submit an application form and wait for their approval. An initial credit limit will be established which can be used to purchase from its 2,000+ merchant partners. BillEase has 250 employees working locally for Filipinos to have better access to cheaper and fairer financial services. They charge the lowest interest rate at only 3.49% monthly. BillEase is the flagship product of FDFC, a financial technology company in retail credit for Southeast Asia.

✅ Cashalo App

Cashalo is a fintech platform in the Philippines that offers digital credit to cash-strapped individuals.

Borrowers can access Cashalo’s financing products via a mobile app and that loan proceeds can be credited to the borrower’s choice of bank or mobile wallet.

They offer financing products such as Cash Loan, Lazada Loan, and Buy Now, Pay Later. Cashalo is legit and has SEC Registration No. CSC201800209 and Certificate of Authority No. 1162. They have over four million users, and no collateral is required to qualify for a loan.

Loan payment terms depend on the type of loan and borrowers must be 21 years old and above, employed, or have a steady income, and must have a valid government ID.

The payment terms also will depend on the type of Cashalo loan you apply for, but generally, borrowers can choose from terms of up to 90 days.

Note: The information about loan providers presented in the text is subject to change and borrowers are advised to contact their chosen financial or lending company directly for the most updated information.

Learn How to Get

Quick Loan For Unemployed

Digido Loans App: A Legitimate App Offering Low Rates to Filipinos

Digido is one of the best loan Apps in the Philippines. Borrowers are given immediate solutions in times of financial emergencies. With minimal eligibility requirements and customer-centered approaches, Digido has become a top loan app in the Philippines.

For new customers who have not previously taken a loan from Digido, the interest rate is 0%. A first-time borrower can borrow up to Php 10,000. Repeat borrowers can borrow up to Php 25,000 for up to 180 days*. You can get a loan with Digido in less than 15 minutes!

The lending company has launched an Android app and plans to release versions for HUAWEI soon, catering to Filipino users. With apps, accessing credit information and repayment schedules becomes easy and convenient. Applying for online credit takes only five minutes, and funds can be used for urgent needs. Using the lender’s app on weekends and holidays is hassle-free, and funds are available immediately when required.

Digido provides fast online payday instant loans with 0% interest for the first clients. All you need to provide is Only 1 Major ID ( proof of income can increase your chances of fast approval)

Digido’s quick loans with no interest are a great help for Filipinos who are new in building a credit history. It also helps borrowers cope with their first financial commitments and motivates them to improve their chances to avail of a better loan in the future.

If you are a repeat borrower with satisfactory payment history of in your previous loans, can avail our Installment loan. At Digido, short-term loans for pensioners are also available. The loan approval rate is as high as 90-95% (based on the borrower’s evaluation)

Advantages of Borrowing Money with Digido online App 🔥

- Easy and convenient application process

- Rapid decision-making

- An adaptable lending process

- Reduced transaction costs

- Saved time and resources

- Secure ePayment transactions

- Complete transparency in the payment process

- 24/7 facilities

- Improved rates

- Increased comfort to customers

- Tailored promo/discount offers

- Excellent after-sales support

Learn How to Apply

Online Loan No Requirements Philippines with Minimum Documents

General Requirements For Obtaining a Loan with a Mobile App

A stable and reliable internet connection is vital when applying for a loan online. You must also have an active mobile phone and a bank account (If you don’t have a bank account, some lenders, such as Digido, offer other ways to disburse loans) to get the money.

Here are the simple but important requirements needed for obtaining a loan with a mobile App in the Philippines:

| Requirement | Description |

|---|---|

| Citizenship | Must be a Filipino citizen |

| Residency | Must be a resident of the Philippines |

| Age | Must be between 21-70 years old |

| Valid Government ID | Must possess a valid government ID such as a driver’s license, passport, PRC ID, SSS ID, UMID, postal ID, and COMELEC voter’s ID |

| Active and Registered Mobile Phone Number | Must have an active and registered mobile phone number in compliance with Republic Act 11934, otherwise known as the SIM Registration Act of the Philippines |

| Registration on the Lending Website | Must be registered on the lending website |

| Steady Income | Must have a steady income |

| Employment | Must be officially employed for more than 3 months |

The requirements for borrowers vary depending on the lender. Each lender has its own criteria for approving loans, which may include factors such as credit score, income, employment status, and age.