How to Check Your Credit Score in the Philippines

Key takeaways:

- If you are planning to borrow money for housing loan or a car loan, it is important that you take care of your credit score.

- If you have a bad rating, you will not be able to borrow money, especially from banks.

- For small loans, getting approved is a lot easier than that with large loans from banks, one example is Digido.

- You have a chance for a Digido loan even with a bad credit history, but you have to pay it back on time anyway. It will improve your credit rating.

A credit score is a measurement of your “credibility” as a borrower. The higher your score, the more likely you will get approved for a loan or credit card. You can achieve and maintain your good credit standing by paying bills on time and only applying for loans that you need. In countries like the United States, there are several facilities or organizations that gather and score its citizens as far as credit is concerned.

In the Philippines, only a few people know about their credit information or credit standing. Verification is done through the Philippine credit scoring system. What many Filipinos do not realize is that credit score is something that has existed for a long time. Today, you will learn the basics of credit ratings in the Philippines and why this is important.

- Get your first loan with 0% interest rate

- Up to PHP 25.000 for up to 180 days

Loans with a Bad Credit Score in Digido

Just because you have a bad score does not mean you cannot get money. You can still get approved, especially in facilities like Digido.

The good thing about Digido Financial Corporation (with SEC Registration No.: 202003056) [6] is that it is an honest company. It does not exploit a borrower with a bad credit information by inflating the interest. Everyone is treated fairly here.

Here are the simple requirements to get money through Digido:

- You must be a Filipino citizen;

- 21 – 70 years old;

- 1 issued government ID

- Working mobile phone

As you can see, the requirements are really minimal. The best part is that Digido applications have so many benefits compared to traditional lenders or banks.

Here are the features of Digido:

- 0% interest on loan for up to PHP 10.000

You will not pay a higher interest rate just because your score Philippines is low.

- Easy Online Application (Web, mobile Apps)

You do not have to visit a physical location to apply for a loan. Everything is online. You will fill out the form online and also upload your documents.

- Fast Approval and Receiving Money within 30 minutes

Loans in Digido work in as short as 30 minutes; no need to wait for several days to be approved. The credit limit for the first loan will be 10,000 pesos and 25,000 pesos for future loans.

Apply now

👉 Whether you have a high or low credit score or or you are blacklisted from Philippine banks, you can rely on Digido. All you get here is convenience, and you will not be exploited like you would if you applied for a loan from other conventional financial corporations. However, you still have to pay your bills on time. Otherwise, the facility will also rate you with a low score, and you will not be able to borrow next time.

If you have a Digido unpaid loan, you can extend it or contact the company on (02) 8876-84-84 and they will offer you a solution depending on your situation. Immediately after repayment you can apply for a new credit. Your payment should be made on time, and then the limit will increase. You can also make early repayment of an existing loan.

Credit Score, Credit Report, and Credit History – What’s the Difference?

There are several terms that people may find confusing. In this section, we will define the differences between good credit score, report, and history.

There are several terms that people may find confusing. In this section, we will define the differences between good credit score, report, and history.

1. What is Credit Score Philippines?

A credit score is a three-digit figure which determines your creditworthiness. There is no single global standard as to how the ratings are made. Some institutions use letters, while some use numbers. No matter what they use, your goal is to have a high rating.

A high credit score means that you are trustworthy in the eyes of banks and creditors, and that you are a good borrower who pays your debts.

On the other hand, if your credit standing is low, it means that you have a history of not paying your loans or bills on time. If a lender sees this, he is not going to approve your loan or credit card.

There are many factors that affect your credit information in the Philippines, such as:

- Age

- Annual income

- Existing Debt

- Borrowing history

- Timeliness of payments

- Employment Status and History

- Number of Inquiries on Credit Report

- Type and Number of Credit Accounts

- Relationship with Financial Institutions

Not all financial institutions use the same factors, and not all of them use the same formula. What matters here is that you can get a good credit rating in the Philippines by paying your debt on time.

👉 Also Read How to Get

a Student Gadget Loan in the Philippines

2. What is Credit Report in the Philippines?

A Credit Report in the Philippines [1] is a document which contains your credit score. It also includes details about you, plus your credit history if the financial institution needs it.

Here are some of the details you will find in a credit report:

- Your name, address, gender, age, address;

- Details of your credit line as if you have a credit card

- Details about your public records such as if you filed for a bankruptcy

- List of institutions that have asked for your credit report in the past

Different credit reporting bureaus have different data reporting methods. Not all of them have the same access to your personal and public financial history, so this information is going to vary.

3. What is Credit history?

Your credit history refers to your credit activity, the credit cards and loans that you have and whether you’re paying them on time. As the term implies, it refers to your historical behavior of using credit and paying loans in the past.

Did you pay on time and in full or did you bailout?

The credit history is part of the report. If you borrowed, for example, ₱100,000 five years ago and paid only ₱50,000, this history will be included in your financial credit history. Once a lender sees this, the natural tendency is for the lender to say that you are a high-risk individual.

Some credit history reports also show your bank accounts, average daily balance, spending habits with your credit card, and many more. The credit history is used to determine your final credit score in the Philippines, and it also tells a lender whether you are worthy of another credit or not.

👉 Find out How to Take

a Fast loan Approval in 1 hour in the Philippines

What factors Affect your Credit Score?

These factors affect your credit standing, so you should take note of these:

| Factor | Description |

|---|---|

| Payment history | Banks and private lenders will take a hard look at your credit payment history – how often do you pay, how much you’re paying, and if you’re paying on time. |

| Types of credit use(d) | This pertains to the variety of credit you’ve utilized, such as personal loans, credit cards, housing loans, and car loans, if applicable. |

| Length of credit history | This refers to the duration for which you’ve held your credit cards or loans. A longer credit history generally reflects positively on your creditworthiness. |

| Amount of credit owed | This indicates the total owed amount, encompassing both loan balances and credit card debts. Higher debt levels might hinder approval for new loans or credit. |

| New credit applications | Your credit report will take note if you have pending applications for new credit, and how often you are applying for new loans. Having new credit all at once is not a good look. |

👉 Learn useful information about

Fast Loans in 15 Minutes

Why do I need a Good Credit Rating?

You need to have a good credit rating in order to have a better standing and relationship with banks and financing institutions.

Having a good credit score gives lenders the confidence to lend money to you or give you new credit. It means that you are a good payer who does not miss a payment cycle. Having a positive credit standing allows you to have higher loan amounts at more favorable rates. Your bank may opt to waive your annual fees if you’re paying on time, too.

A good credit score also signifies financial stability. It means that you are responsible enough to have a stable income and not rely on loans for your daily expenses. Applying for new loans or credit cards every now and then is not a great look.

Your credit history will also affect your chances of getting insured. If you have a favorable credit score, insurance companies will offer you better premium rates on your car or life insurance, for example.

Potential employers may also look at your credit history during background checks. A good credit score will increase your chances of getting hired.

👉 Find out more about How to Borrow Easily

a Cash Loans for Blacklisted in the Philippines

How Can I Get My Credit Report in the Philippines?

Now, let us talk about how to get your credit report in the Philippines. In the United States, there are several credit reporting agencies that you can rely on. But how can I check my credit score here in the Philippines?

One agency that you can trust is the Credit Information Corporation (CIC)[2]. To get your CIC credit report, go to the CIC website and register for an account. They will guide you how to check credit history in the Philippines.

You must complete the verification process, also known as Know Your Customer, and then proceed with the online application. The thing is that you have to personally visit the physical office of CIC in Makati City to be able to get your credit data if you do not qualify for the online reporting.

Another company where you can get your credit score is called TransUnion. It is a global entity, and it is also the first credit bureau of the Philippines. If you want to get an idea on your credit behavior, you can go to the TransUnion website and request for a report.

TransUnion gives out two types of credit score reports. The first one is business reporting, which is for insurance companies, banks and lenders. On the other hand, a personal report will show you your personal credit score and history here in the Philippines.

👉 Learn about

Multi-Purpose Loans in the Philippines

How to Check My Credit Score in the Philippines

In the Philippines, individuals can obtain their credit report along with their credit score through the Credit Information Corporation (CIC) and its accredited credit bureaus. Here’s a summary of the process and other relevant details:

How to Request Your Credit Report:

- CIBIApp: One of CIC’s accredited credit bureaus, CIBI Information Inc., has launched the CIBIApp. Through this app, you can obtain a copy of your credit report and credit score online.

Access the app via your web browser at [cibiapp.cibi.com.ph] [3](https://cibiapp.cibi.com.ph/#/login). - Character Verification: This process is done online through MeetMe, a video call feature of the CIBIApp. On the day of your online interview appointment, prepare the IDs you uploaded during registration.

- Receiving the Report: Your CIC Credit Report will be sent to the email you provided during your appointment scheduling.

Cost: Is a free credit report in the Philippines? A CIC Credit Report with a credit score from CIBI costs PHP 235.00 (VAT inclusive).

Disputing Errors:

- If you find any erroneous data on your CIC Credit Report, you can file a dispute online through the

- CIC’s [Online Dispute Resolution Process (ODRP)](https://www.creditinfo.gov.ph/online-dispute-resolution-process-0)[4].

- Filing a dispute is free of charge.

Note: The credit score is a service provided by CIC’s accredited credit bureaus and is derived from CIC’s credit reports. If you haven’t had any loan transactions in your credit report for the last two years, a credit score cannot be generated for you.

Another company where you can get your credit scores is called TransUnion. It is a global entity, and it is also the first credit bureau of the Philippines. Just go to the website and get your report in the Philippines.

There are 2 types of data here. The first one is a business reporting, which is for insurance companies, banks and lenders. If you want to know your credit scores and history in Philippines, you have to select a personal report. Loan companies check borrowers using credit scoring.

👉 Do you know How to Get

a Fast Cash without a Bank Account

Credit Scoring System in the Philippines

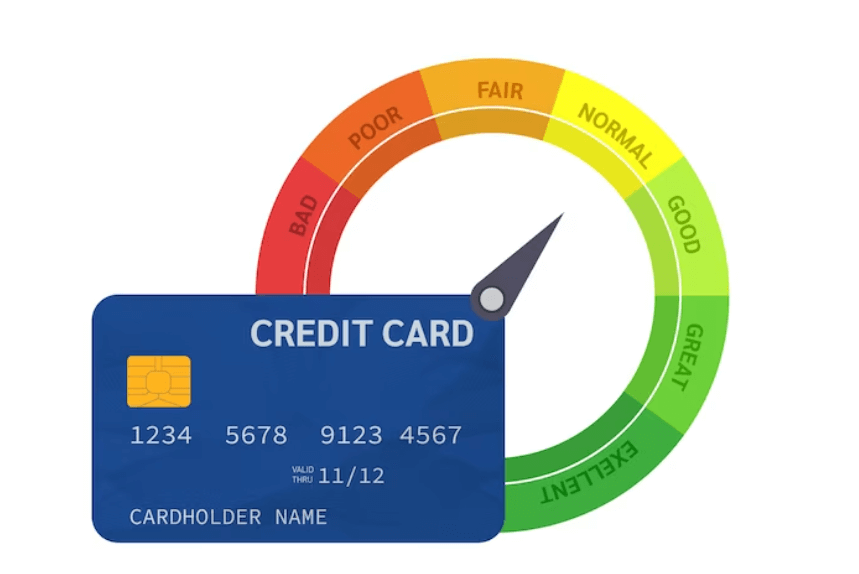

The credit score system in the Philippines ranges from 300 to 850, with 850 being the highest score you can possibly attain. If your score is around 800 to 850, it means that your credit standing is exemplary.

If you have a score ranging from 700 to 799, you have a good credit standing. A number between 650 to 699 is a fair score; a number between 600 to 649 is a poor score.

Anything below 600 means a bad credit score. If your score is 600 and below, you will have a hard time getting approved for loans, applying for credit cards, and even getting insurance policies.

To maintain healthy credit, try to keep your credit score at 650 and above.

What is a Good Credit Score in the Philippines?

There is no single number that can represent a good credit score in Philippines. Some lending services use numbers higher than 3,000, some higher than 600, and some use letters. To know what a good credit history is, you have to contact the reporting bureau of your choice. Generally speaking, an excellent credit score is above 750.

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

10 Tips on How to Clear bad Credit history in the Philippines

Clearing or improving a bad credit history in the Philippines involves a series of steps, similar to those in many other countries. Here are some steps you can take to address a bad credit history:

- Obtain Your Credit Report: Before addressing your credit issues, you first need to know what they are. Obtain a copy of your credit report from the CIC or other credit reporting agencies recognized by it.

- Review for Inaccuracies: Make sure all the information in your credit report is accurate. If there are errors or discrepancies, you can dispute them with the credit bureau.

- Pay Outstanding Debts: Prioritize paying off your outstanding debts. If you can’t pay the entire amount at once, negotiate with your creditors for a payment plan or a reduced settlement amount.

- Negotiate with Creditors: If you have any negative items on your report, try negotiating with the creditor. Some might agree to remove or adjust the negative entry once you settle your debt or meet specific conditions.

- Maintain Good Financial Habits:

– Always Pay On Time: This is the most straightforward way to improve your creditworthiness over time.

– Limit New Credit Applications: Every time you apply for credit, an inquiry is made. Too many inquiries can negatively impact your credit score.

– Reduce Your Debt: Aim to keep your credit utilization low. The ratio of your debt to your available credit can significantly impact your credit score.

– Diversify Your Credit Types: A mix of credit (e.g., credit cards, personal loans, mortgage) can show lenders that you can manage different types of credit.

- Secured Credit Cards: If you’re having trouble obtaining a regular credit card due to your history, consider applying for a secured credit card. This type of card requires a cash collateral deposit that becomes the credit line for that account. By using it responsibly and paying off the balance on time, you can slowly rebuild your credit.

- Avoid New Negative Records: Ensure you don’t incur any new debts, late payments, or any other negative records as you’re trying to clean up your history.

- Regularly Check Your Credit: Keep an eye on your credit reports regularly to ensure that all information is accurate and that you’re making progress in improving your credit.

- Consider Credit Counseling: If you’re overwhelmed with managing your debts, you might want to seek the advice of a credit counselor or a financial adviser who can guide you on managing your debts and improving your credit score.

- Understand the Limitations: Negative information doesn’t stay on your credit report indefinitely. In the Philippines, as per the Credit Information System Act (CISA)[5], negative information will typically remain on your credit report for a maximum of seven years.

How to Improve Your Credit Score in the Philippines

Once you have received your credit information and found out you got a low grade, the next step is to make sure that you make an effort to improve your credit score in the Philippines.

Here are some tips:

- Always pay your bills on time – institutions report to credit bureaus whether you are paying your utilities on time or not. This includes electricity, gas, water, phone bills, internet bills, credit card bills, and more.

- Keep debts low – do not borrow money so often and in large amounts.. But if you do, make sure you pay them on time. If you are not paying the full amount due, make sure that the amount you owe is small.

- Do not borrow money or apply for credit cards very often – Doing so will give the impression that you are heavily reliant on credit. Do not apply for different types of loans or credit at once. Before you apply for a new credit, make sure that you really need it.

- Do not close unused credit cards – if you have credit cards that you are not using, keep them open, but make sure you pay your annual fees and that they do not cost you a lot of money to maintain.

It takes a while to build a good credit score in the Philippines. The trick here is that you maintain a habit of being finance responsible. Do not take money that you cannot pay. If you get a loan or if you get approved for a loan or credit cards make sure you pay what you owe before the due date.

👉 Read about

OFW Loan one Day Process in the Philippines