Understanding Estate Tax Philippines: A Complete Guide for Filipino Inheritors

Key takeaways:

- Estate tax and inheritance tax are one and the same

- The estate tax is a mandatory tax for the properties of someone who died

- You will face penalties if you do not pay taxes

Table of Contents

Are you expecting to receive an inheritance from a family member who just passed away, or are you concerned about taxes by the time you leave this earth? If you are, you have come to the right place. In this article, we will explain all the important things about estate taxes in the Philippines.

What is Estate Tax in Philippines

Estate tax is a kind of tax that where you pay for the opportunity or the process of transferring cash or physical properties. The Bureau of Internal Revenue legally describes it as the tax on the properties of a deceased person. The tax is to be paid by the beneficiaries of the deceased.

Estate tax in the Philippines is a tax on the right of the deceased person to transmit their estate to their lawful heirs and beneficiaries at the time of death. The estate tax is levied on the net estate, which is the gross estate less allowable deductions.

- Only 1 Valid ID needed to Apply

- First loan with 0% interest rate

Estate Tax Law in Philippines

The estate tax in the Philippines is governed by the Republic Act No. 8424 (1), also known as the Tax Reform Act of 1997.

Before the Tax Reform for Acceleration and Inclusion (TRAIN) law in 2018 the estate tax in the Philippines was applied at a rate that varied between 5% and 20% based on the value of the net estate. This meant that higher-value estates were taxed at a higher percentage than lower-value estates.

In 2018, under the TRAIN law [Republic Act (RA) No. 10963] (2), the Philippines adjusted the estate tax rate to a flat rate of 6%. The flat rate applies to a net estate over Php 200,000. If the net value of the estate is less than or equal to 200,000 Philippine Pesos, then no estate tax is imposed. This means the heirs or beneficiaries will receive the entire estate without any amount being deducted for estate tax purposes.

Allowable deductions include ordinary deductions (like funeral expenses, judicial expenses, medical expenses, etc.), special deductions for the family home, standard deduction, and deductions for shares of surviving spouse.

The TRAIN Law implemented in the Philippines on January 1, 2018. If someone received an inheritance before the TRAIN Law was enacted, their estate would be subject to the previous tax laws in effect at the time of their death.

Here is the estate tax table Philippines before and afte TRAIN LAW for your reference:

| BEFORE TRAIN LAW | TRAIN LAW in 2018 | ||||

|---|---|---|---|---|---|

| Over | But not Over | TAX COST | Plus | IF THE EXCESS IS OVER | 6% of the Net Estate (Value of net estate = value of gross estate less allowable deductions) |

| 200,000.00 | 200,000.00 | Exempt | – | 200,000.00 | |

| 500,000.00 | 500,000.00 | 0 | 5% | 500,000.00 | |

| 2,000,000.00 | 2,000,000.00 | 15,000.00 | 8% | 2,000,000.00 | |

| 5,000,000.00 | 5,000,000.00 | 135,000.00 | 11% | 5,000,000.00 | |

| 10,000,000.00 | 10,000,000.00 | 465,000.00 | 15% | 10,000,000.00 | |

| 1,215,000.00 | 20% | ||||

Learn about

Occupational Tax Receipt – OTR Meaning and Requirements

Standard Deduction in Estate Tax

The “standard deduction” is a fixed amount that can be automatically deducted from the gross estate of the deceased person, regardless of actual expenses or losses. In the context of the Philippines’ estate tax, the standard deduction under the TRAIN Law is Php 5 million.

This means that, when calculating the net estate (the value of the estate that will be subject to the estate tax), one can automatically subtract Php 5 million from the gross estate (the total value of the deceased’s assets), without needing to provide any proof of expenses or losses.

For example, if the gross estate was worth Php 10 million, after the standard deduction of Php 5 million, the net estate would be Php 5 million. The estate tax would then be calculated on this net amount.

The standard deduction is part of the government’s effort to simplify the taxation process and lessen the tax burden on heirs.

What is the Difference Between Gross Estate and Net Estate?

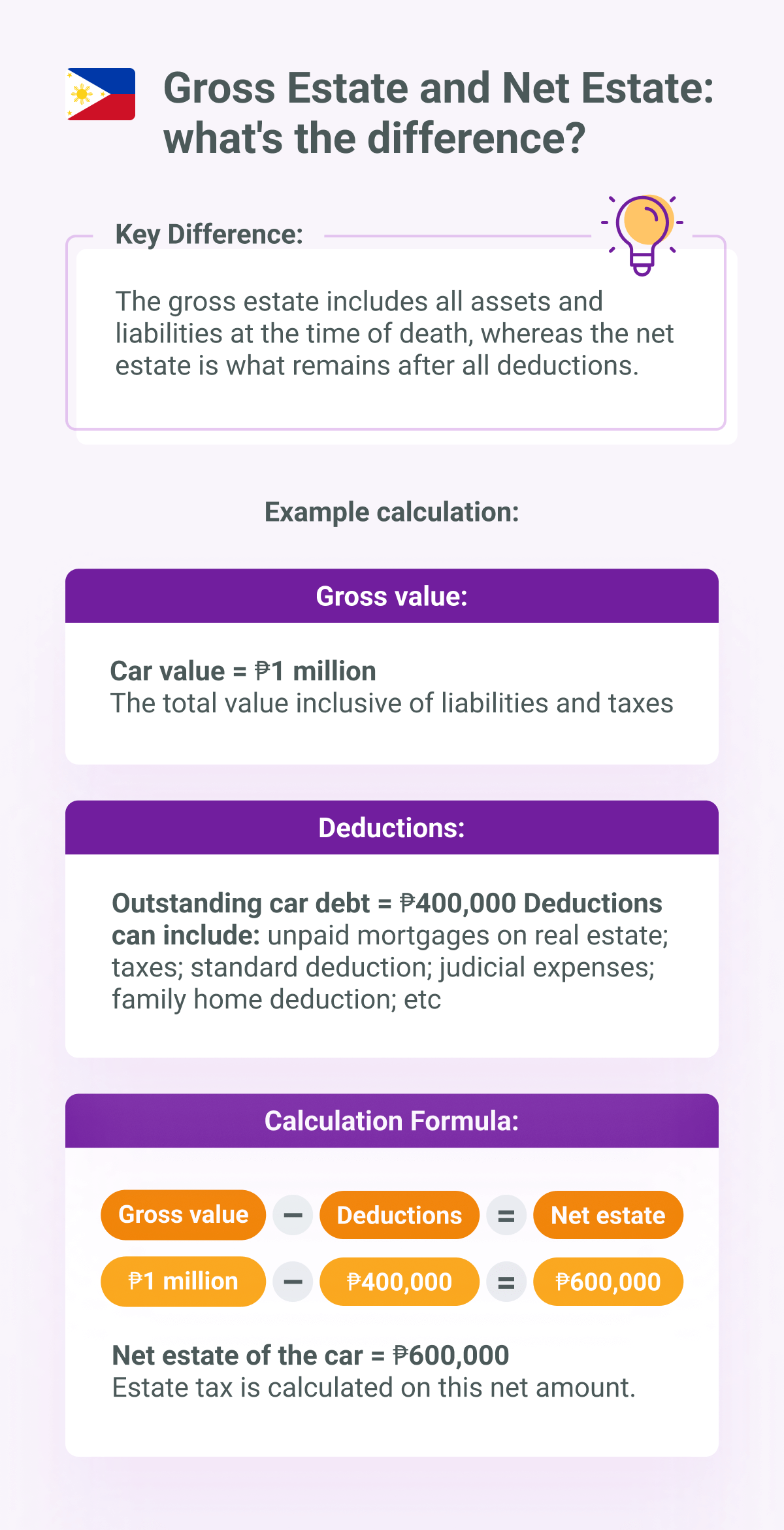

Gross estate means or refers to the total value of the properties of the person who died. This value includes all the liabilities, and also the taxes, the deceased should have paid.

Net estate refers to the value after the liabilities and taxes have been paid. For example, let us say that the value of the car that the deceased left is ₱1 million. However, he owes ₱400,000 to the car dealer because he bought it in installments.

The gross value of the car, as an estate, is ₱1 million. The net estate, however, is ₱600,000. In paying the estate tax, you only take into account the net value.

Need extra money? Show 1 valid ID and get an online loan of up to 25,000 pesos! Calculate your pre-approved loan amount with Digido’s calculator:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

What Objects Fall under the Philippine Estate Tax

In the Philippines, estate tax is levied on the net estate of a deceased person, which can include a variety of assets. Not all properties are taxable. The main classifications of properties that can be considered an estate are:

- Real Estate: This includes land, houses, condominiums, and any other type of real property located in the Philippines.

- Cash and Bank Deposits: All cash, savings, checking accounts, and time deposits in Philippine and foreign currencies are included.

- Stocks: Stocks in any corporation, both Philippine and foreign, are subject to estate tax.

- Personal Property: This can include vehicles, jewelry, furniture, artworks, antiques, and other valuable personal items.

- Retirement Benefits: Retirement benefits received from the government and private institutions are part of the gross estate.

- Life Insurance Policies: The proceeds of life insurance policies are subject to estate tax, depending on who the beneficiaries are and who paid the premiums.

- Business Interests: Ownership stakes in businesses, partnerships, or corporations are included in the estate for tax purposes.

- Other Financial Investments: This could include bonds, mutual funds, foreign investments, etc.

In the Philippines, there are certain assets and properties that are exempt from estate taxes:

- Family Home: If a family home is included in the estate, an amount of up to Php 10 million is exempt from estate tax.

- Medical Expenses: Medical expenses incurred within one year prior to the decedent’s death are deductible from the gross estate, up to Php 500,000.

- Funeral Expenses: These can be deducted from the gross estate up to an amount of Php 200,000.

- Accidental Insurance Benefits: Accidental insurance benefits are not included in the gross estate and are therefore not subject to estate tax.

- Amounts Received by Heirs Under RA No. 4917 (3): Amounts received by the heirs under RA No. 4917 are exempt from estate tax provided the requirements under the law are complied with.

As you can see, the government does not charge estate taxes for personal things like clothing and accessories. However, expensive jewelry is part of an estate. As such, wristwatches and rings that cost a lot of money are also taxed. Most people, however, do not declare these properties anymore.

Learn What is

The Cost of Funerals in the Philippines

Who has the Obligation to pay the Estate Tax?

The children or heirs of the deceased are the ones who must pay the estate tax because the dead cannot do it. These individuals will take on the roles of executor and administrator. Their main duty is to pay for the estate taxes of the deceased property owner.

In the Philippines, the responsibility for paying the estate tax generally falls to the following individuals or entities:

👉 Executor or Administrator: The executor of the will or the administrator of the estate usually has the primary responsibility to pay the estate tax. An executor is someone who has been designated in the will to administer the estate. If there is no will or no executor named in the will, the court may appoint an administrator.

👉 Heirs: If there’s no executor or administrator, or if the executor or administrator is unable or unwilling to pay the tax, then the responsibility can fall on the heirs. They are liable to the extent of the value of their inherited portion of the estate.

👉 Beneficiaries of the Estate: In the absence of an executor or administrator and if the heirs cannot pay, the beneficiaries who received properties, rights, or assets from the deceased are liable to pay the estate tax.

👉 Transferees of Properties: These are individuals who receive properties from the estate by way of contracts or agreements.

👉 Donees: Donees refer to the recipients of a gift. They are liable if the property was transferred to them before the death of the decedent to evade the payment of the estate tax.

Inheritance Tax vs Estate Tax in Philippines

Estate tax is an obligation to the government that you pay for TRANSFERRING assets to a different person or owner after the original owners die. Inheritance Tax and Estate Tax are the same thing. Other countries treat these two separately. In the Philippines, you do not make double tax payments.

Learn What is

a VUL Insurance in the Philippines: Benefits and Risks

Estate Tax Computation in the Philippines

The computation of estate tax in the Philippines involves several steps, as outlined in the National Internal Revenue Code and the provisions of the TRAIN law. Here’s how you can compute the estate tax:

Step 1: Determine the Gross Estate – The gross estate comprises all the property, wherever situated, which the decedent owned or had interest in at the time of their death.

Step 2: Apply Allowable Deductions – Subtract all allowable deductions from the gross estate to calculate the net estate.

Step 3: Calculate the Net Taxable Estate – The net taxable estate is the gross estate minus all allowable deductions.

Step 4: Apply the Tax Rate – A flat tax rate of 6% is applied to a net estate over Php 200,000.

How to Compute Estate Tax in the Philippines

Suppose a decedent leaves a gross estate worth Php 15 million. The allowable deductions total Php 6 million. The estate tax calculation would be as follows:

- Gross Estate: Php 15,000,000

- Allowable Deductions: Php 6,000,000

Net Taxable Estate: Php 15,000,000 – Php 6,000,000 = Php 9,000,000

The Net taxable estate is above Php 200,000, so the flat estate tax rate of 6% applies:

Estate Tax Due = Net Estate * Estate Tax Rate

Estate Tax Due: Php 9,000,000 * 0.06 = Php 540,000. Therefore, the estate tax due would be Php 540,000.

Ноw to File a Return for Estate Tax in Philippines

Filing an estate tax is simple. The first thing you have to do is prepare the affidavit, then the documents. After that, you can visit your BIR RDO office. The BIR person-in-charge will tell you which government department you need to consult with, such as the Engineering office, for property value assessment.

Where to Pay the Estate Tax?

You will pay in the Regional District Office (4) of the respective BIR office where the deceased lived. This BIR office is also called RDO.

You must register and process the estate tax that you must pay within a year, or you will suffer penalties. In addition to this, you must file the tax in Office of the Commissioner at RDO No. 39, South Quezon City if the deceased has no residence in the country.

Read How To Get

a Professional Tax Receipt or PTR in the Philippines

When should you File the Estate Tax?

According to BIR, you must file your document and pay the estate tax within a year after the death of the owner. In special cases, the BIR Commissioner can extend this period. However, this extension cannot exceed 30 days.

Sometimes, people who inherit lands are going through hardships. If the BIR Commissioner finds that this is the case, he may extend the tax period up to five years if settled in court. Outside court settlement, the Commissioner can extend it up to two years.

Some people who really have no financial means to pay the tax can opt to sell the property. However, this will result in another tax. This kind of tax is what we call capital gains tax.

Documents and Requirements for Paying Estate Tax in the Philippines

There are several documents that you need to prepare to pay estate taxes in the Philippines. These documents vary according to your situation.

📝 Here are the basic requirements:

- Estate Tax Return Form (BIR Form 1801) (8)

- Death Certificate – this must be an original copy with a certification

- The tax identification number of the dead person and the heirs

- Any of the these:

– Affidavit of Self Adjudication

– Deed of Extra-Judicial Settlement of the Estate

– Court order if settled judicially

– Sworn Declaration of all properties of the Estate

- Certified copy of the schedule of partition of the land

- Proof of Claimed Tax Credit

- CPA Statement on the itemized assets of the decedent like jewelry

- Certification of the Barangay Captain for the claimed Family Home

- Duly notarized Promissory Note for “Claims Against the Estate” arising from Contract of Loan

- Accounting of the proceeds of loan contracted within three (3) years prior to death of the decedent;

- Proof of the claimed “Property Previously Taxed”

- Proof of the claimed “Transfer for Public Use”

- Copy of Tax Debit Memo used as payment, if applicable

You must prepare the original copy and two photocopies for each document.

🏠 If the property is real estate, you must prepare the following:

- Certified true copy of the Transfer/Original/ Condominium Certificate/s of Title of real property/ies

- Certified true copy of the Tax Declaration of real properties at the time of death, if applicable

- Certificate of No Improvement issued by the Assessor’s Office where declared properties have no improvement.

🔍 For personal properties, you need to prepare:

- Certificate of Deposit/ Investment/ Indebtedness owned by the decedent and the surviving spouse.

- Photocopy of Certificate of Registration of vehicles

- Proof of valuation of shares of stock at the time of death, if applicable

- For shares of stocks not listed/not traded – the Latest Audited Financial Statement of the issuing corporation with computation of the book value per share

- For shares of stocks listed/traded – Price index from the PSE/latest FMV published in the newspaper at the time of transaction.

- For club shares – Price published in newspapers on the transaction date or nearest to the transaction date.

- Photocopy of certificate of stocks, if applicable

- Proof of valuation of other types of personal property, if applicable

Finally, the BIR may ask you for special power of attorney and also some documents like a map of the plot of land.

Learn about

Income Tax Return: How to Get ITR in the Philippines

Estate Tax Amnesty in the Philippines

The Estate Tax Amnesty in the Philippines was initially introduced under Republic Act (RA) 11213 (5), or the Tax Amnesty Act of 2019, signed by President Rodrigo Duterte.

The Estate Tax Amnesty Programm is to ease the financial burden on those with unsettled estate taxes, particularly in the challenging economic environment.

Most recently, the Senate approved another extension of the estate tax amnesty by another two years, pushing the deadline to June 14, 2025 (7). If this extension becomes law, it will provide heirs with the option to pay their unsettled estate taxes in installments within two years without incurring civil penalties and interest. This law will cover the estates of those who passed away on or before May 31, 2022.

Learn How to Apply for

a Credit Card Amnesty Program in the Philippines

Conclusion

What is Estate Tax Law in Philippines? The estate tax is a mandatory tax (6) that you must pay if a person dies. The people who will pay this tax are the people that the deceased left behind. If the tax is unpaid, the property will never be transferred to your name.

FAQ

-

How much is Estate Tax in the Philippines?The rate of estate tax in the Philippines - 6% of the net estate value. The net estate is calculated by subtracting all allowable deductions from the total value of the deceased person's assets. This flat rate applies to a net estate over Php 200,000. If the net value of the estate is Php 200,000 or less, no estate tax is imposed.

-

What is "standard deduction" for gross taxable estate?The "standard deduction" is not something that you pay, but rather, it's an amount that is subtracted from the gross estate when calculating the net taxable estate. The standard deduction is a fixed amount of Php 5 million that can be automatically deducted from the gross estate. This reduces the value of the estate that will be subjected to the 6% estate tax.

-

When does the standard deduction apply?The standard deduction applies to every estate tax computation in the Philippines, regardless of the size of the estate, or whether the decedent was a resident or non-resident of the Philippines. This means that when computing the estate tax, you can automatically deduct Php 5 million from the gross value of the estate. This is done before applying the flat 6% estate tax rate to calculate the tax due.

-

What will happen if you did not pay the estate tax?The cash or the physical properties will never be transferred to your name unless you pay the estate tax.

-

What is the meaning of amnesty?This program provided heirs with unsettled estate tax liabilities a one-time opportunity to settle their obligations without the burden of additional penalties and interests.

-

When is the deadline for amnesty?The date is June 14, 2025.

-

What should I do if Hefty Estate Tax?You can sell the property or borrow money from the bank.

-

What is the purpose of estate tax in the Philippines?The purpose of the estate tax in the Philippines is to generate revenue for the government and to ensure fair and equitable distribution of wealth within society.

-

Who should pay this estate tax?The people who will pay the estate tax percentage in Philippines are the beneficiaries.

-

What is the rule of estate tax in the Philippines?The basic rule is 6% of the net estate amount or value. The estate tax exemption Philippines is the liability so it is already factored in the net value.