How To Get Professional Tax Receipt or PTR in the Philippines

Key takeaways:

- The PTR is proof that you paid your tax due to the government

- Only professionals with a valid PRC ID must pay for PTR

- Professionals have to pay the PTC annually

Table of Contents

As a professional in the Philippines, you are required to pay a special kind of tax known as the professional tax receipt (PTR) to ensure compliance with the country’s tax laws. This tax is applicable to various professions, including doctors, lawyers, accountants, engineers, and other professionals who practice their expertise in the Philippines.

- Apply with only 1 Valid ID

- First loan with 0% interest

- Up to PHP 25,000 in only 5 min

Today, we will discuss everything you need to know to get a professional tax receipt, or PTR Philippines. We will show you what PTR is, where to get professional tax receipt, how to get professional tax receipt online, provide a step-by-step guide to obtaining a PTR, as well as information about PTR requirements and exemptions. In the end, we hope we have helped you become a legitimate business or professional in the Philippines.

PTR Meaning: What Is Professional Tax Receipt

A professional tax receipt is proof that you paid your taxes to the government. As a practitioner of a profession, you must pay your taxes. Once you have done so, you can go to your local government and get one.

Without it, you are essentially violating the law. However, do not be confused between PTR and the actual tax. The professional tax receipt differs from the tax you pay quarterly or annually.

To explain further, there is a tax that you must pay if you earn money. This tax is the regular tax that you pay to the Bureau of Internal Revenue(1). All qualified earners must pay taxes—professionals, businesspeople, and employees.

The Professional Tax Receipt is different. It is a special kind of tax levied only on people who have a profession—these are people who have special skills that the government regulates.

Learn about

Income Tax Return: How to Get ITR in the Philippines

Professionals Who Must Have PTR Number

Every professional must pay his PTR, provided that he is registered as a professional. Because of this, many freelancers do not have to get a PTR.

In the Philippines, a technical definition of a professional is one who has a license from the PRC or Professional Regulation Commission(2). Some jobs or professions in the country have strict regulations, and you need to get an ID or pass the test before you can be a legit professional.

Here are some examples of professionals who need a PRC certification:

- Doctors

- Engineers

- Teachers

- Lawyers

- Accountants

There are many other kinds of professionals. It is the government that decides which one requires a PRC ID. Essentially, the PRC ID is proof that you passed the standard of the country to practice your profession.

As a professional, you are bound by laws and oaths about the things that you do. Violation of these can cause harm to people. It is why you need to be regulated.

On the other hand, non-professionals, who still have a profession, are different. Some examples of these are:

- Writers

- Graphic artists

- Animators

- Logo makers

These people will not cause harm if they botch a job. Therefore, there is no need to regulate them. Also, there is no need for them to get a PRC ID.

Everyone with an ID from the PRC has a responsibility to pay professional tax receipt yearly. You pay this not to the Bureau of Internal Revenue but to the province where you belong.

Need Money in Minutes? Get an urgent loan in Digdo ASAP at 0% interest for any purpose! Calculate your pre-approved loan amount right now:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

Learn How to Get

Doctor’s Loan in the Philippines

Who Is Exempted From Paying PTR

Only professionals who work exclusively for the government are exempted from paying the PTR. It means that if a government employee has a side job where he earns from his profession, he must still pay his PTR.

Professional Tax Receipt Requirements

Here are the PTR requirements:

- PRC ID – you will only get this if you are a professional who was issued an ID by the PRC. If you are a graphic artist, there is no need to get one. However, if you are a nurse or electrician, you need a PR ID.

- Accomplished Form – you must get a professional tax receipt form from the tax office. Then, you must sign it. We do not recommend that you download this from a website, as the form changes from time to time. It is better to get this from the government’s physical office.

Before we discuss how to get a PTR number, we must tell you that you also need a copy of your last professional tax receipt that was issued last year. It is fine if you do not have one yet because it is your first time.

Now, if you just graduated and got ID from the Professional Regulation Commission, it is best that you pay your PTR immediately before the deadline. It does not matter if you found a job or not. You must pay the PTR for as long as you get your PRC ID. If you do not pay your PTR, the government may fine you.

Read about

PRC online application in the Philippines

How to Get Professional Tax Receipt

To get a professional tax receipt, you must go to your municipal or city hall. Ask the guard or information clerk where to get one, and they will show you the way. Before you go to the municipal hall, make sure that you bring your PRC ID with you and your ball pen.

How To Get PTR: A Step-by-Step Guide

Now, let us discuss the step-by-step process on how to get ptr number.

Step 1: Talk to the Clerk

Once you get to the window and tell the clerk that you will pay for a PTR, they will look for details about you.

Step 2: Sign the Application Form

The clerk will hand out a paper to you, which the application document. Then, you must find a spot where you can fill it out. You will also receive a number, which indicates it is your turn to be served once called. Make sure you sign form correctly, completely, and that you double-check the entries. Sign the signature area of the application form, too.

Step 3: Sit and Wait

Wait for the clerk to call your name or number. The process actually varies from one city to another. In some offices, you will sit on a chair and move to the next one as the queue moves forward.

If this is the case, it is the guard who will give you the application form once you enter the establishment. Then, you must take your seat and move as the crowd moves.

Once it is your turn, hand over the form and your PRC ID to the clerk. They will record your details and then give you another piece of paper. This paper contains information about how much you will pay.

Step 4: Pay the Tax

The last step is to pay the tax. Go to the cashier and then present that paper you got from the clerk. The payment is no more than ₱300. After the payment, you will now receive your PTR.

What if you do not have the time to pay your PTR? Well, do not worry because you can pay your PTR even if you do not go to your municipal or city hall. What you can do is send someone on your behalf. Just make sure that this person carries authorization from you.

What PTR Number meaning?

The PTR number is a unique identification number assigned to the professional and is used to track their tax payments and other related transactions with the government.

In the Philippines, the PTR number is used by professionals to comply with the legal requirement of paying their professional tax. It is also used as proof of payment of the professional tax, which is required for various transactions such as renewing a professional license, registering a new business, or participating in public bidding processes. The PTR number is also required when filing income tax returns as proof of payment of the professional tax.

Learn How to

Renew Your Business Permits in the Philippines

How Much is the Cost of the PTR?

The cost of PTR in the Philippines varies per profession. However, it must not be more than ₱300 per year.

How Long Is the PTR Valid?

The PTR is only useful or recognized for a calendar year. You must pay it before January 31st of every year. Then, you must pay it again next year.

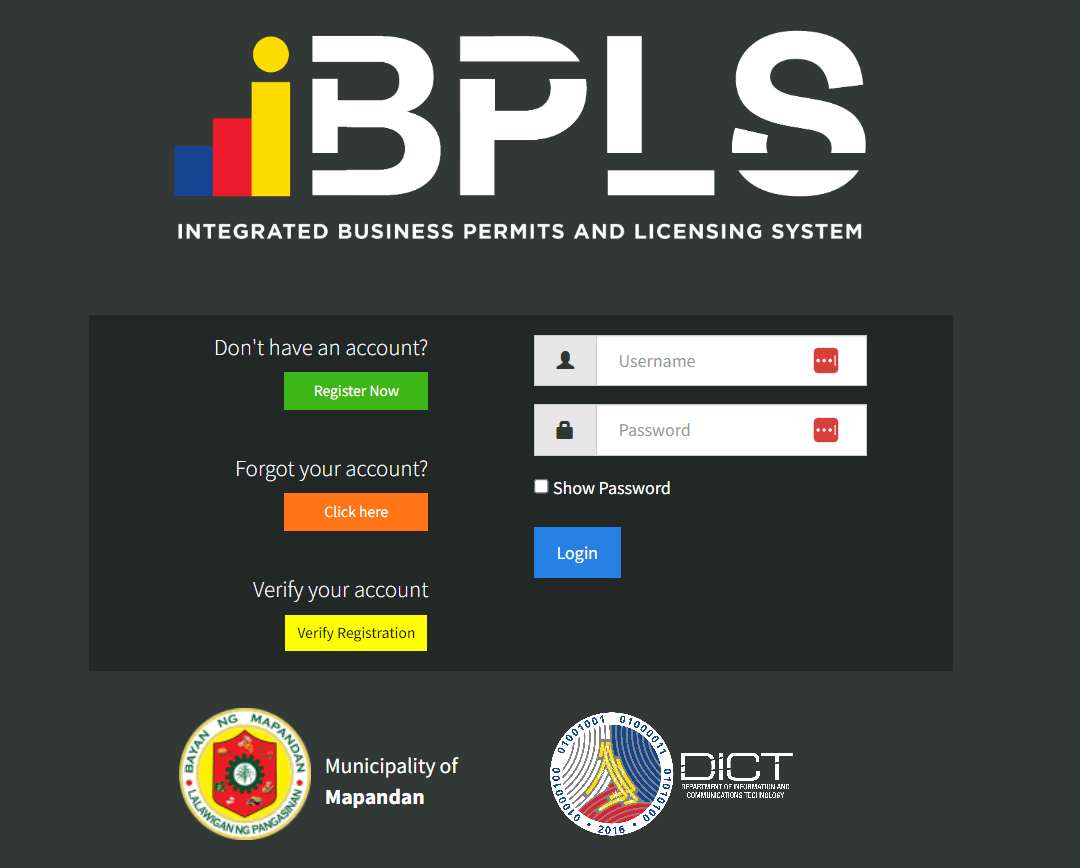

How to Get Professional Tax Receipt Online

If you’re still interested how to get PTR online in the Philippines, you may be able to do so through the Bureau of Internal Revenue (BIR) eServices website(3). The Bureau of Local Government Finance (BLGF) has implemented an online system for the issuance of PTRs through the Electronic Business Permitting and Licensing System (eBPLS) portal.

However, the availability of online PTR applications may vary depending on your location and the specific BIR office that handles your tax registration.

To get your PTR online, you can follow these steps:

- Go to the eBPLS portal website of your respective city/municipality in the Philippines.

- Create an account if you haven’t already done so.

- Fill out the PTR application form and provide all the necessary information.

- Upload the required documents such as your ID, certificate of registration, and proof of payment.

- Submit the application and wait for approval.

- Once approved, you can download and print your PTR.

As of now, some LGUs already have online portals or systems for PTR application and payment, while others may still require applicants to personally visit their offices. It is best to check the website or social media pages of your respective LGU’s treasurer’s office or business permit and licensing office to know if online PTR application is available in your area.

Summary: Where to Get PTR

The Professional Tax Receipt Philippines is a mandatory tax that professionals pay in the Philippines. It is a document proving that you have fulfilled your financial obligations to the government. As a PRC license holder, you must pay it annually, or the PRC can revoke your PRC license or ID.

Whether you are a seasoned professional or just starting your career, understanding the process of obtaining a PTR and staying up-to-date with tax laws can help you avoid penalties and maintain your professional standing.

FAQ

-

PTR VS OTR: What is the difference?OTR is an occupational tax receipt that you pay, similar to the PTR. However, it is for people who do not have a professional ID because they are not required to have it. Examples are writers.

-

If I have several professions, will I pay several PTR?Yes, you will. Your PRC ID for one profession is different from your profession as a lawyer, in case you practice both. However, this is rare.

-

If I moved residence, where would I pay PTR now?You will now pay in the new city or town where you live. In the Philippines, we pay taxes where the business or practitioner operates.

-

How long is PTR valid?PTR is valid for one year. You must pay it before January 31st of every year.

-

How much is the fee for ITR?The fee is no bigger than ₱300.

-

How can I pay for my PTR?You must go to your municipal or city hall and pay from there. You cannot get professional tax receipt online.

-

Do I need to bring documents?Yes, you must present your PRC ID. Bring a ballpen, and last year’s PTR.

-

Who issues the PTR?Your local government issues the PTR.