Where to Get a TIN ID in the Philippines and How to Meet All the Requirements

Key takeaways:

- A TIN ID is a prerequisite of BIR before you can settle taxes

- You cannot print official receipts without a TIN ID

- If you possess a TIN ID, you can apply for a digital TIN card

- Next goal is to fund your business. Apply for a Digido Fast Loan and get the money with 1 valid ID only

Table of Contents

The BIR Tax Identification Number of TIN is a system-generated reference index number issued by the BIR to every citizen registered in its database. You can apply for it even if you are a student or an applicant.

All you must do is go to the BIR office and submit the documents. Today, we will show you how to apply for a TIN ID brick by brick, regardless of your status.

- Only 1 Valid ID needed to Apply

- Enjoy 0% interest on your first loan

What is the TIN ID

A tax identification card or TIN ID confirms that you are a taxfiler.

As an employee, you are supposed to pay taxes, provided that you earn enough money to get taxed. The revenue of the government comes from taxes.

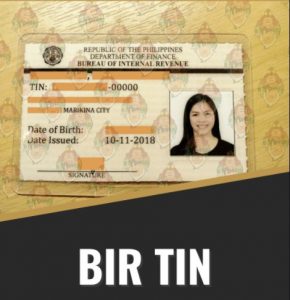

Every TIN card comprises an unmatched identification number — the number of the taxpayer who owns the card. Besides, it contains the cardholder’s personal data: his or her full name, birth day, card issue date, address, photo, and signature. It looks like a thin and small cardboard; many people have their cards laminated to protect them from scratches and water.

The cards are produced only by the BIR office. Every card bears the BIR logo. A TIN ID confirms the taxpayer’s identity and the fact that he or she is a registered taxpayer.

It’s worth noting that a TIN ID card has no expiration date.

Businesses must pay taxes, except those that applied for MSME status (1). MSME means micro, small, and medium enterprises. These are companies that have a small asset size. Those who get approved for this status will pay only a minimal amount of tax. However, they must still have a BIR ID or taxpayer ID.

How to Get

Quick Payday loan in the Philippines

Why Do I Need a TIN ID?

You can use your TIN ID to transact with other institutions, as it is a valid identification card. For example, some financial institutions ask for a TIN as part of their accepted requirement before issuing a loan to you.

For many government agencies, a TIN card is acknowledged as a valid primary personality identification document, like the National Bureau of Investigation Clearance for the clearance application. Some institutions, however, such as the Philippine Postal Corporation, accept it only as a secondary ID. The same position is shared by the Department of Foreign Affairs.

Being just a printed piece of paper, a TIN ID card can’t completely replace a primary personality identification document on many occasions. Some institutions do not want to accept a TIN ID card as the main identity document, because it can be easily faked. There are websites that offer a TIN ID online registration service, but these websites are fake. The only legitimate way you can get an ID from the BIR is by going there in person.

- Is a TIN Card a Valid ID?

Note that some companies may accept it, while others may not. It is their prerogative to decide if they want to accept it or not. Thus, whenever you visit a governmental institution, a business establishment, or a bank, make sure you possess a government-issued valid ID at hand, such as your passport, vehicle license, or postal ID. In this case, you will be able to use your TIN card as a secondary ID.

Where to Get the TIN ID in the Philippines

Every taxpayer in the Philippines is tied to a certain Revenue District Office (RDO). It depends on the citizen’s place of residence and employment or business. People visit RDO to pay due taxes and update their personal data. There, they can also get or replace their TIN IDs.

Therefore, if you need a tax identification number, you should go to your RDO. How to find it if you have never been to this office yet? Call the BIR Customer Assistance Division hotline at 8538-3200 or email to contact_us@bir.gov.ph and ask the specialists about your RDO. Specify your place of residence and occupation details.

What Are the TIN ID Requirements in 2024

To save time upon application of your TIN card, you must prepare the documents you need. Below are the things you need to present (2):

BIR form or Tax Form if you are employed or self-employed — this is the BIR Form 1901 (3) and BIR TIN ID form 1902. (4)

- One valid ID — the ID that came from the government, such as your birth license, passport, vehicle license, etc.

- Payment of Php 30.00 as the Annual Registration Fee.

- BIR Printed Receipts or Invoices.

- Marriage agreement, if applicable.

- Passport — for alien employees.

- Working permit (for citizens earning only compensation income), and others depending on the taxpayer’s status.

The list of additional documents that may be required includes:

- Special Power of Attorney and ID of the authorized representative, if you want him or her to transact with the BIR instead of you.

- DTI Certificate if you want your business name to be printed on the card.

- Different documents depending on your employment and the type of business:

- Franchise Documents for common carriers

- Copy of the Trust Agreement for trusts

- Certificate of Authority for Barangay Micro Business Enterprises, and so on.

Take note that you only have ten days to submit the form and get an ID the day you start employment. If you are late, you can also apply before your tax due date.

Can you hire fixers to get a TIN card? No, you should never hire fixers. These people are corrupt. You should also avoid working with people on the internet saying that they will get you the card for a certain TIN ID price.

In addition, do not be scammed by people who sell TIN Cards. How much is a TIN ID? The card itself is free, you’ll only have to pay Php 30.00 as the Annual Registration Fee.

Learn How to Get

Online loan with No Requirements

How to Get a TIN ID Card

If you already have a TIN, the only thing you have to do to get a TIN ID card is to go to the BIR office where you were issued your TIN, and then make an application for a card.

If you do not have a TIN yet, then the first step is to apply for one. To do this, you should go to the Regional District Office where you live or where your employer is registered.

Here is how to get a TIN ID if you possess (5) a TIN number already:

- Step 1: Print and fill out the necessary BIR Form. The list of BIR Forms for different types of taxpayers is given below.

- Step 2: Submit the BIR Form and the documentary requirements with the New Business Registrant Counter of the RDO. Make sure you’ve prepared all the documents required. Once you have submitted the requirements, you will be told when to come back for the ID.

- Step 3: Pay Php 30.00 at the New Business Registrant Counter of the RDO. You may be also asked to make a payment for the BIR Printed Receipt or Invoice.

- Step 4: Wait for the RDO to issue your Certificate of Registration and the “Notice to Issue Receipt/Invoice”, along with the TIN ID.

- Step 5: Attach your latest 1×1 photo to the card, and then sign the card.

How to get a TIN ID online? It’s impossible to get the physical card online. The only card you can process via the internet is a digital one. Below, we’ll tell you how to get it. There are many scammers out there who will sell you fake physical TIN IDs. Do not fall for these traps. If you ever see an offer for a TIN ID card application online, you have to validate it from the website of BIR itself.

Need Cash Fast? Get up to PHP 25,000 in just 4 minutes with our first loan at 0% interest!

Calculate your pre-approved loan amount with Digido calculator:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

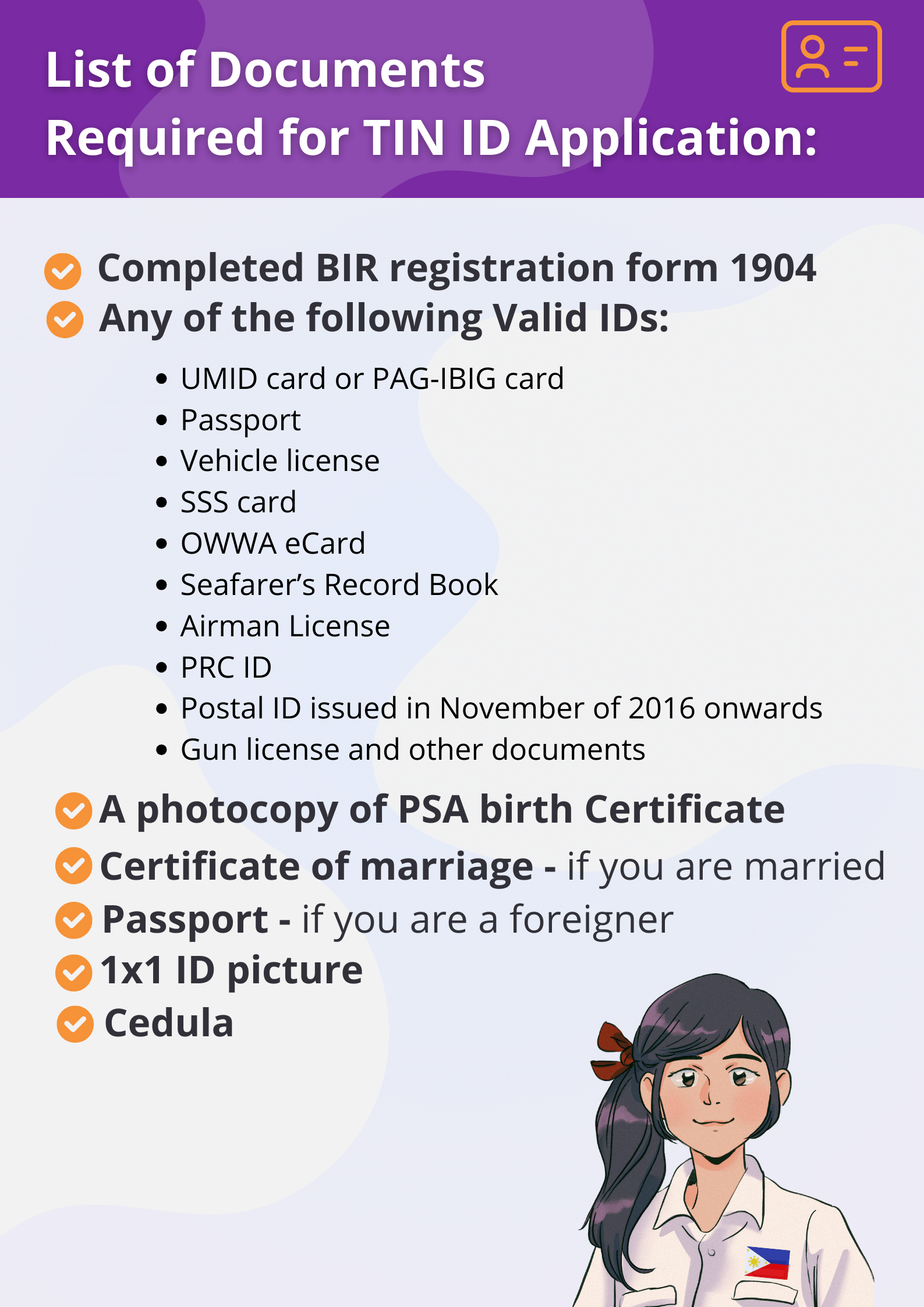

📌 How to Get a TIN ID for the Unemployed

You do not have to be employed to get a TIN. It is provided under Executive Order No. 38. (6)

Here are the TIN ID requirements for unemployed citizens:

- BIR form 1904 (7)

- Valid IDs, including the original and a photocopy of your birth notification

- Certificate of marriage if you are married

- Passport if you are a foreigner

- 1х1 ID picture

- Cedula

You can use many IDs that came from the government. Some IDs that were not issued by the government are also valid. Below is a list:

- UMID card or PAG-IBIG card

- Passport

- Vehicle license

- SSS card

- OWWA eCard

- Seafarer’s Record Book

- Airman License

- PRC ID

- Postal identity card that was issued in November of 2016 onwards

- Gun license and other documents

The process of receiving a TIN for the unemployed is simple. Just follow these steps:

- Print the BIR form 1904 and complete it

- Make a copy of your ID and birth certificate

- Visit the regional BIR office or the RDO

- File the form and the requirements

You must submit the form to your BIR regional office. It is the BIR office where you live, not just any BIR office.

The BIR does not have a centralized system. People working in one RDO do not have access to your documents if you processed them in another RDO.

Once you have done this, the BIR officer will tell you the next step. If they have the bandwidth, you can get your ID on the same day. If not, the officer will tell you what date and time to come back to claim your ID.

How to get a TIN ID online for unemployed citizens? No, BIR has no online method to apply for TIN. As such, you really have to go to the BIR office. The BIR opened an online registration, but it was put on hold.

Also learn more about

How to pay using Dregonpay

📌 TIN ID Application and Requirements for Students

Filipinos older than 18 can receive a TIN ID under Executive Order No. 98. (8) For that, they need to secure the following requirements:

- Birth license, driver’s license, or any other identity document issued by the government

- Passport (for foreign nationals)

- 1×1 ID photo

- Treaty of marriage (for married women)

In fact, the list of TIN ID requirements for students is the same as for unemployed citizens. The steps on how to get the document are also the same:

- Fill out BIR Form 1904 and file your requirements to the BIR office, where you’re registered

- Wait for your application to be processed

- Get the card and then attach your 1×1 ID picture to it

📌 Applying for TIN ID for New Employees

If you are a new employee, your employer will process your TIN card application instead of you. The things you need are the same as applying for TIN if you are a student or unemployed.

If you’re a newbie taxpayer, follow the given plan to receive your TIN ID:

- Fill out BIR Form 1902 and submit all the necessary TIN ID requirements to your HR

- The specialist will process your application for you. Wait until your card is issued and get it on the appointed day

- If your employer asks you to file your TIN application yourself, visit the RDO where your company was registered and submit all your BIR ID requirements Your documents will be processed within the day or longer depending on the office’s opportunities

The difference is that you will not have to queue up anymore in the BIR office. It is likely that the employer has an officer who does this.

📌 How to Get a TIN ID for Employees and Individuals with Existing TIN

If you already have a TIN ID, you can obtain the corresponding card in your RDO. Make sure it is the same office where you were previously registered.

Here, the procedure for obtaining the card is quite simple:

- Submit the requirements in your RDO. Have the valid ID at hand to confirm your identity in the office.

- Wait for the TIN card to be issued. If the RDO is not busy, your card may be ready in several minutes or an hour. If the office is not ready to issue the card the same day, you will be asked to come back again in one to three working days.

- Receive your card. Attach your photo to it and sign the card.

Learn about

Fast Loan in 15 Minutes

📌 Procedure for Obtaining a TIN Card with an Authorized Representative

According to the law, you must process the application in person. But if you can’t do it yourself, you may apply for a special power of attorney and ask a designated official to secure a TIN card on your behalf and then give it to you.

To do that, you should prepare all the necessary BIR TIN ID requirements with regard to your employment and conclude a special power of attorney authorizing an agent to help you. The document can be signed at the notary office. The authorized representative will file your documents to the BIR office and get assured your card is being issued.

Note that in this case, the set of your documents must include the Board Resolution (Resolution for Appointment of Authorized Person) (9) detailing the name of the authorized representative who will confer with the Bureau.

If you fail to prepare this document, the BIR personnel will refuse your authorized representative to secure the card on your behalf. Besides, your authorized representative must have any government-issued ID at hand, so that he or she can confirm their identity.

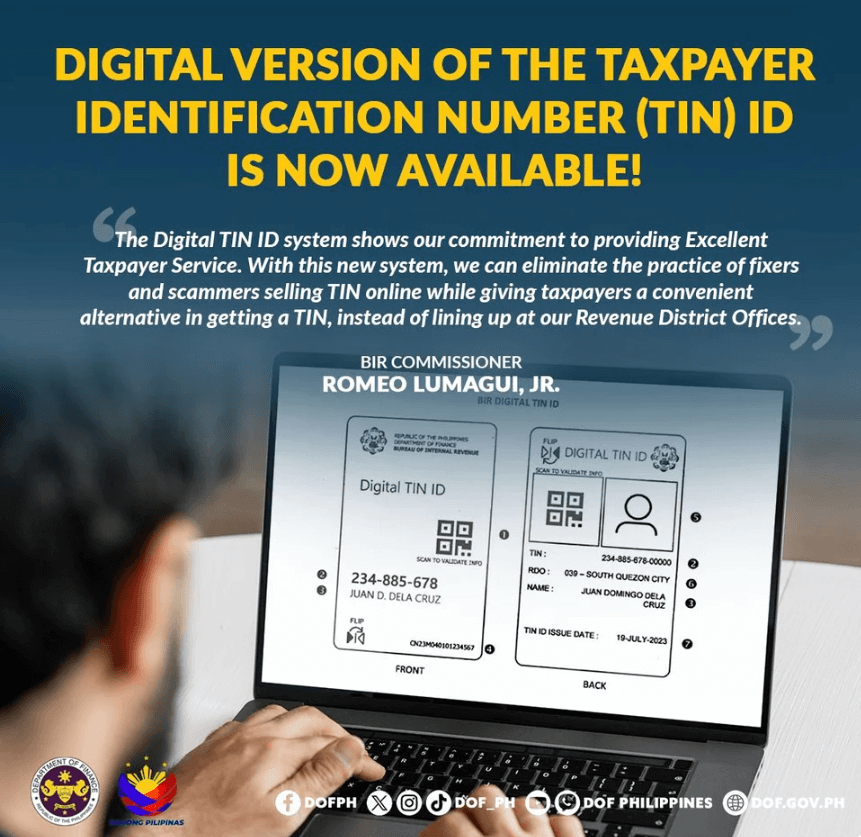

TIN ID Online Registration: How to Get a Digital TIN ID

For those who don’t want to lose time visiting an RDO and queueing, there is a good alternative – getting a digital TIN ID. It is available to citizens with an existing TIN. If you don’t have any TIN ID yet, you can’t get its digital version.

A digital TIN ID can be received via the Online Registration and Update System (ORUS) (10). Here, you can also update your personal information, if something changes.

To secure a digital TIN ID, adhere to this step-by-step guide:

- Update your email address specified in the RDO. Make sure the address is valid and you really use it. To do this, fill out Form S1905 (Registration Update Sheet) (11) and send it to your RDO.

- Visit orus.bir.gov.ph, select ‘New Registration’, and sign up for an ORUS account (12).

- Read the terms of service, check the box, and press ‘Agree’.

- Fill out the form providing all the necessary information. You will have to submit the data on your existing TIN — make sure you have it at hand.

- Assign and confirm your password.

- Tick the captcha box and press ‘Register’.

- Fill out the TIN ID online application form.

- Upload your 1×1 photo. It should be recent and have a white background with no borders. Make surу your face is entirely visible in the photo (no sunglasses, hats, etc.).

- Wait for your digital TIN ID to be issued. You will receive it via email.

When you have a digital TIN ID, you don’t need to obtain a physical TIN ID card. Your digital document will be honored as a valid ID (13).

Pay special attention to the fact that a digital TIN ID can be only received via the ORUS. If someone offers you to get this document via a different website or sells intermediary services to help you process a TIN ID, he or she is surely a swindler, who is trying to pull money from you. Don’t trust such people.

Image: Department of Finance (Facebook)

What Is a Green TIN ID

In fact, the color of a TIN ID card is of no relevance. No matter whether your card is yellow or green — it is valid anyways.

The difference in colors is actually connected with the date of the card’s issuance. Before July 26, 2021, the BIR issued yellow TIN cards. Then the country’s government made a statement, according to which yellow cards were replaced by green ones (14).

However, the Bureau of Internal Revenue noted that despite the implementation of the new TIN ID cards, previously-issued old cards were still valid. Therefore, yellow and green TIN ID cards are the same, there is no actual difference between them.

Who can receive a new green card? It is available to the following citizens (15):

- taxpayers who obtain their TIN for the first time

- married females updating their names

- citizens who change in the registered address

- taxpayers who have lost or damaged their TIN cards

Learn all about

What bills you can pay at 7-Eleven

How to get TIN ID if Lost or Damaged

If you lost your TIN ID or it got damaged, you can get a replacement ID. The process is similar to getting a new TIN ID card, but you may need some other documentation.

Here are the requirements to change a missed or damaged TIN ID:

- BIR form 1905

- Payment for the new ID

- An affidavit of loss signed by a notary public

- ID picture

There is a document you need to sign if you need a new ID, which is the BIR Form 0605. The cost is Php 100.00. To pay for it, you must go to the bank partner of BIR. Once you get the payment slip, you must go back to the BIR office and present it.

Take note that you must indicate your BIR TIN number in your affidavit. If you do not know how to sign an affidavit, you must consult a lawyer or notary public.

The BIR officer may ask you for extra identification. If you are married, part of the requirement is to submit your marriage certificate.

From here, you must wait for further instructions from the BIR personnel. They will tell you when you need to come back for your new TIN ID.

To give you more details, see below:

- Go to your regional BIR office, or RDO, which means Regional District office.

- It must be the same office where you took your original TIN card.

- Tell the guard about your issue.

- You will be directed to a window.

- Go to that window and tell the BIR personnel what you need.

- He will give you a form to fill out.

- The BIR personnel will tell you what documents to provide.

- Fill out the form; make sure you do not miss a line.

- Make sure you choose “Lost/Damaged card” in the checkbox provided.

- Give the form back to the officer.

- Pay for the form; you may pay it in the BIR office itself or at an accredited bank.

- Once you have the payment receipt, go back to the BIR personnel you spoke to.

- The officer will process it.

Now, wait for further instructions on when to get in person, someone can do it for you. After the application, you can send someone to pick up your card. However, you must write an authorization letter. This letter must say that you are authorizing a particular person to transact with BIR on your behalf.

This person must have an ID, and that ID must match what is on the letter. This letter of authorization is also called a special power of attorney, which you should notarize ahead of time.

Where to Get money to Start a Business?

Now when you have a TIN ID, your next goal is to fund your business. You can borrow from a bank, use your savings, or partner with friends and families.

It can be difficult to borrow money from a bank because of the large number of checks and documents that need to be collected. For example, proof of income. A better choice that you can look into is to get money from Digido. Digido is an online loan facility where you can Get Up to PHP 25,000 In only 4 minutes.

Here are the requirements for getting money:

- You must be a Filipino citizen

- You must be between 21 and 70 years old

- You must have working mobile number

- You have 1 valid government ID

Summary

A BIR ID is important because it is one of the proofs that you are a registered tax-paying member of society. All employees who have a taxable income must pay their taxes. If you are employed, you are lucky because it is your employer who will deduct the taxes and process your TIN ID application.

If you are self-employed, you must process it on your own. You can also ask for the help of an accountant if you want, and then pay for the accountant’s services. If you already have a TIN ID, you can obtain a digital TIN. It is free of charge and is honored as a physical ID.

Disclaimer: This article was written based on information available to the writer at the time of publication and the article was published for promotional, reference, and educational purposes only. Nothing in the articles published in the website is intended to constitute legal or financial advice and users are advised to seek counsel from legal and financial professionals.

Likewise, rates or offers published in the websites are promotional marketing offers only and do not constitute any binding contract between the Corporation and the website users.While the writers and publishers of the articles in the website wrote the articles using credible information available to them at the time of publication, any changes or updates to the information presented in this article may not be reflected here.

Hence, users are enjoined to exercise appropriate diligence in using the data and information published in the website, and they are urged to study and compare it with other credible sources. Users understand that the writers, publisher, website owner and the Corporation are not liable for any damage or injury they sustained for their wrongful or erroneous use of the data or information written in the article and published in the website.

Note: The information presented in the tables is subject to change and borrowers are advised to contact their chosen bank/financial entity directly for the updated information

Learn about

Buy Now Pay Later in the Philippines

FAQ

-

What happens if you forget your TIN number?You should call the BIR on (02) 981-8888. You will need to give the BIR staff some personal information before they will give you your lost TIN.

-

Is it free to get a tax identification card?Yes, it is free to get a TIN. It is also free to get a TIN ID card. If people are selling this to you, do not buy it. You should also not purchase offers of TIN ID card samples, as there is no such thing. However, when you apply for a business TIN, you will have to pay a TIN ID fee of 30.00 the Annual Registration Fee Proof of Payment.

-

How to obtain this card with a present TIN?If you already have the TIN, you should go to the BIR office to get a card. It is important to note here that you must go to the office where you got your TIN number. To get the card, you must be able to present the requirements for a TIN ID card: bring a valid ID plus the documents of your TIN application that were stamped by the BIR.

-

How many days does it take to get a TIN ID?The answer to this varies. There are weeks or months as it depends on the workload of the RDO in your area.

-

When is a TIN ID expiration date?It has no expiration date. The card will always stay valid.

-

Can I have two tax identification numbers?No, you cannot have two TIN numbers. Each individual can only have one.

-

How to get a TIN ID online?There is no way to get a physical TIN ID card online. What you can do is to download the BIR forms via the internet, and then fill them out. The only way to get a TIN ID card in the Philippines is to visit the BIR office and submit your documents there. But you can get a digital TIN and it is really processed online.

-

Can I change my personal data on the TIN ID?Yes, you can change your name on your TIN ID if you’re self-employed or a professional. You’ll need BIR Form 1905 if you want to do that.

-

Do I have to pay any charge for my digital TIN?No, a digital TIN ID is always free of charge.

-

Can I obtain a digital TIN ID if I don’t have any TIN at all?No, you can’t. A digital TIN ID is affordable only to those taxpayers who already have an existing TIN.

-

Do I need to receive a new digital TIN ID if I update my personal information?Yes, you do. You must update your digital TIN ID, if your name or address has been changed. The same refers to the situations when a taxpayer switches to a different RDO.

-

What is the difference between yellow and green TIN ID?These cards have no difference, except the date of their issuance. They are both valid.

Articles sources

- 1. MSME Status Registration System

- 2. Application for Taxpayer Identification Number (TIN)

- 3. BIR Form No. 1901

- 4. BIR Form No. 1902

- 5. Processing of Application for Taxpayer Identification Number Card

- 6. Executive Order No. 38, s. 2023

- 7. BIR Form No. 1904

- 8. Executive Order No. 98, November 29, 2019

- 9. Resolution for Appointment of Authorized Person

- 10. BIR - eServices

- 11. BIR Form No. S1905 - Registration Update Sheet

- 12. BIR Online Registration and Update System (ORUS)

- 13. How to get your digital TIN ID

- 14. BIR Revenue Memorandum Circular 58-2023

- 15. BIR clarifies policies, guidelines on TIN card

Authors

Digido Reviews

-

John MarkI found here all requirements for tin id for unemployed is very important and also can be used as an additional document for a quick loan, I got a loan very fast with tin5

-

JaypeeI am so thankful to this lending app. Its so nice to use plus their customer service is good. I always use this but sometimes I use to make a late payment but this app have a choices to extend it. Thank you, Digido.5

-

JohnDigido is the best! I just claimed 4000k on my first loan with zero interest, 7 days term! Claimed through Cebuana, Wow! I am now officially Recommending Digido App.4

-

CharieAmazing! So easy to loan and approval is very fast only a minute. That's why I rate this with 5 stars.5

-

TheresaThis app is very helpful and easy to apply. Thank you so much! More power to Digido! Highly recommended.4

-

DanicaSuperb App. It is very easy and fast approval. it's my second loan since the last time. Very happy to apply for this app. Highly recommended.5