How to Get a Cedula - Community tax certificate in the Philippines

Key takeaways:

- The cedula is proof of identification and certification that we are paying our taxes appropriately.

- Community taxes are usually low, but tough financial times are coming.

- If you’re having a hard time paying for a cedula, you can always turn to Digido for loan.

Table of Contents

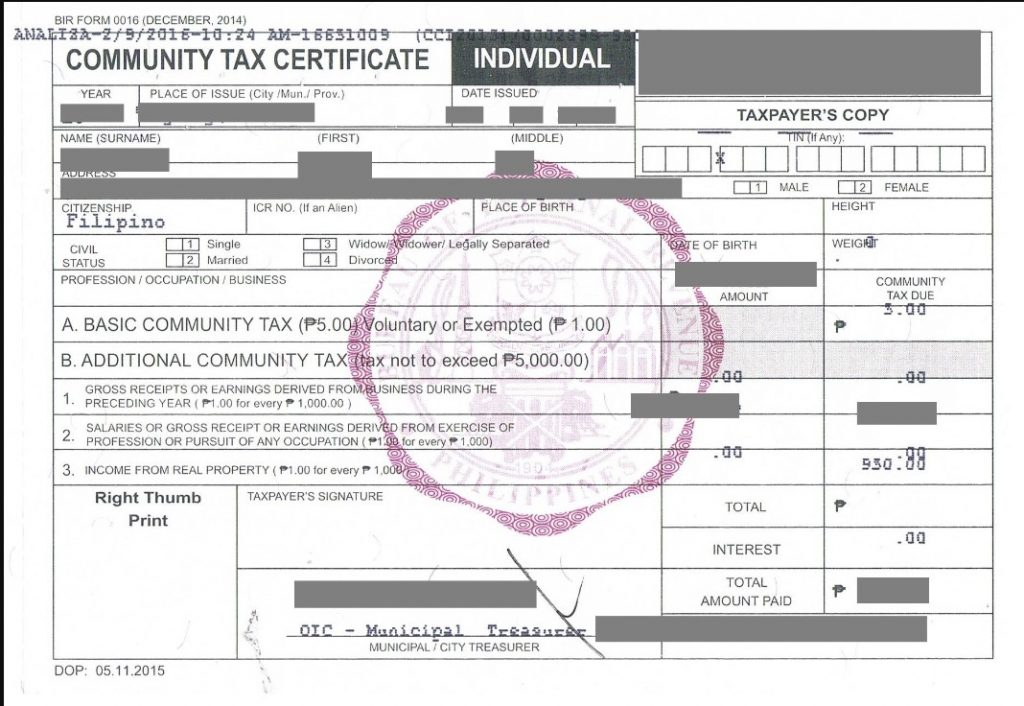

A cedula or community tax certificate (CTC) is perhaps one of the most important documents that you can get in this country. You can use it as proof of identification, to pay your taxes, and as certification that you have indeed paid your taxes.

It’s easy to get a cedula or community tax certificate (CTC) here in the Philippines. Just go to your city or municipality and tell them that you’d like to pay your community tax. In this blog, we will give you a brief introduction on the cedula and how and where to get one.

- Get up to PHP 25,000 in only 4 minutes

- Only 1 valid ID needed to apply

- Fast approval in 5 minutes

What is cedula in the Philippines?

A cedula or community tax certificate (CTC) in the Philippines is a document that is issued to an individual or business entity upon payment of community tax. A cedula can be used as proof of identification when applying for a job, registering a business or filing your income tax returns.

The cedula contains a CTC number which is required in many government transactions. The paper itself is usually not required.

The cedula validity is one year from the date of issue. For example, if you were issued a cedula on June 1, 2023, it will be valid until June 1, 2024.

→ Useful information about fast payday loans in the Philippines

Who is eligible for community tax certificate?

Take note that qualifications for a cedula may vary depending on the municipality. If you meet any of the general following qualifications, you are eligible for a cedula:

Take note that qualifications for a cedula may vary depending on the municipality. If you meet any of the general following qualifications, you are eligible for a cedula:

- Resident of the Philippines and is 18 years old and above

- Individuals who have been employed on a salary for at least 30 consecutive working days during the calendar year

- An individual who is engaged in a business or corporation

- An individual who owns a real estate property or a collective asset value with a value of Php 1,000 and above

- An individual who is required to file income tax returns

Where can I get a cedula?

If you’re planning to get a cedula, you should go to your barangay, municipal or city hall. Make sure that you’re getting a cedula in the municipal or city jurisdiction of your residence or business.

→ Learn Can I Get a Loan with a Bad Credit Score at Digido?

Cedula requirements

The basic requirements for a cedula may vary depending on the municipality or city. However, there are some basic cedula requirements which you can easily acquire. Note that there are different requirements for individuals, businesses and representatives.

Requirements for individuals

- Valid government-issued ID

- Community tax declaration form

- Copy of payslips

- Proof of income

Requirements for businesses

- Valid ID

- Community tax declaration form

- Approved business tax declaration evaluated by the city treasurer office

Requirements for representatives

- Valid ID

- Authorization letter

- Photocopy of valid ID of individual or business being represented

→ Also read all about quick personal loan in the Philippines

What is the purpose of a community tax certificate

Since it can be used as proof of identification, some government agencies and private transactions will require you to present a cedula or CTC. These transactions include:

- Applying for a job

- Getting government licenses and certificates

- Income tax returns

- Proof of payment of dues

- Proof of residency

- Proof of property ownership

- Registering a new business

Need Quick Cash? Apply for a quick cash loan with just 1 government valid ID and enjoy a 90% approval rate on your loan! Calculate your pre-approved loan amount:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

How to get a cedula: step by step instructions

Is this your first time getting a cedula? Or has it been a long time since you applied for one and you’ve now forgotten the steps?

Whatever your reason for getting a cedula is, here’s how you can get a cedula! Take note that these steps may vary depending on the city or municipality you’re in.

1. Visit the city hall, municipal hall or barangay hall within your area of residence or business.

2. Present your valid ID and fill out the community tax declaration form with the following information:

- Full name

- Address

- Citizenship

- Civil status

- Profession/occupation

- Date of birth

- Place of birth

- Height & weight

- Tax identification number (TIN)

- Gross annual income, if employed

- Signature

3. Present the accomplished declaration form along with your ID and other requirements.

4. Pay the cedula fees and sign the required copies

5. Wait for your cedula to be issued.

How to get a cedula online

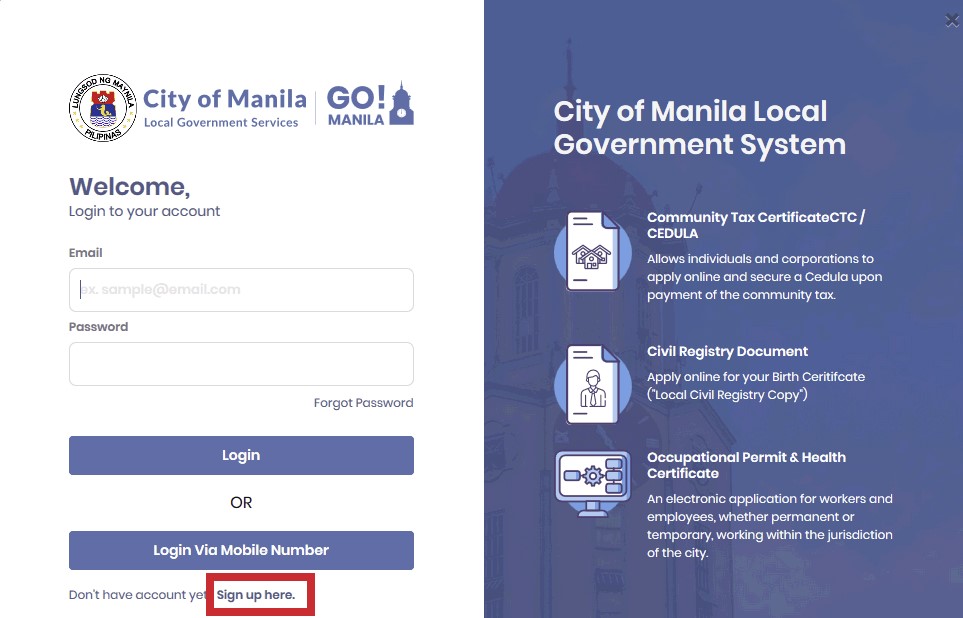

If you don’t want to go out of your house and line up in your city or barangay hall, some jurisdictions allow you to get a cedula online.

If you are a resident of the City of Manila, San Fernando, La Union or Cebu, you can fill out a community tax declaration form online, have it printed, then present it to the city hall and pay the applicable fees.

In addition, the city government of Manila allows its residents to get a cedula application without going to the city hall through the Go! Manila app.

→ Also learn more about fast student loan

Cedula computation for 2024

Are you wondering how the government computes your cedula? We’re going to give you a table community tax rates so you have an idea on how to compute the cedula.

| TAX | INDIVIDUALS | CORPORATIONS |

| Basic community tax | Php 5 | Php 500 |

| Additional community tax | Php 1 for every Php 1,000 of income from business, profession or real estate property; shall not exceed Php 5,000 | Additional Php 2 in tax for every PHP 5,000 of gross earnings for the previous year

The maximum additional community tax for a corporation shall not exceed Php 10,000 |

| Maximum community tax | Php 5,000 | Php 10,500 |

How much does a cedula cost?

The cost of a cedula may vary depending on your city or municipality. However, we can give you approximate figures to help you prepare.

The cost of a cedula may vary depending on your city or municipality. However, we can give you approximate figures to help you prepare.

CTC for individuals

– Basic community tax (at least Php 5)

– Additional Php 1 in tax for every Php 1,000 of gross earnings in the previous year

– Php 1 tax for every Php 1,000 of a real estate property’s total assessed value

CTC for businesses

– Basic community tax (at least Php 5)

– Additional Php 2 in tax for every PHP 5,000 of gross earnings for the previous year

– Php 2 tax for every PHP 5,000 of a property’s total assessed value

While community taxes can appear low, we understand that sometimes it can be too much for some Filipinos. They may not have enough money to pay their community taxes, or they have already exhausted their income on daily expenses.

If you’re having a hard time paying your community tax, you can always turn to Digido for a quick cash loan. With Digido, you can get at least Php 1,000 in five minutes! You can even get up to Php 25,000 if you’re a repeat borrower!

Download the Digido app on your smartphone, sign up for an account, fill out the application form with your personal information, upload supporting documents, indicate your loan amount and presto! You can get quick credit in five minutes!

Conclusion

The cedula holds an important role in our history and society. Aside from reminding us of Bonifacio’s heroism and sacrifice, a cedula can be used as proof of identification and certification that we are paying our taxes appropriately.

Community taxes are usually low, but if you’re having a hard time paying for a cedula, you can always turn to Digido for quick cash loan.

Digido Reviews

-

RollyHi everyone I could recommend this excellent apps coz the agents are approachable and answers the needs in times of emergency. They us give lower interest and loan prolongation in case you could not pay on time. Thanks to them and keep it up. Mabuhay!!!5

RollyHi everyone I could recommend this excellent apps coz the agents are approachable and answers the needs in times of emergency. They us give lower interest and loan prolongation in case you could not pay on time. Thanks to them and keep it up. Mabuhay!!!5 -

NonaIt's very easy to file a loan on this app and it's very convenient, you just need to wait a minute and there you go, loaned amount was already in your account. Thanks Digido, we can rely on this loan platform in times of needs. And it would be better if loan interest will be lessen a little bit.5

NonaIt's very easy to file a loan on this app and it's very convenient, you just need to wait a minute and there you go, loaned amount was already in your account. Thanks Digido, we can rely on this loan platform in times of needs. And it would be better if loan interest will be lessen a little bit.5 -

AbigailOne of the Best Loan App. Reliable. Affordable Fees. Thanks, Digido.5

AbigailOne of the Best Loan App. Reliable. Affordable Fees. Thanks, Digido.5 -

MaryVery efficient, fast reliable company. Reasonable rates with very friendly and accommodating customer service! I highly recommend it! 👍👍👍4

MaryVery efficient, fast reliable company. Reasonable rates with very friendly and accommodating customer service! I highly recommend it! 👍👍👍4 -

FrinaI like Digido loan site the most because they low interest rate within and had a prolongation service incase you can't meet your due, it really helps alot in time of need. In addition their loan process speed and disbursement is by far the fastest.4

FrinaI like Digido loan site the most because they low interest rate within and had a prolongation service incase you can't meet your due, it really helps alot in time of need. In addition their loan process speed and disbursement is by far the fastest.4

FAQ

-

What is the meaning of a cedula?A cedula is the personal registration tax certificate issued in the Philippines upon payment of the community tax certificate.

-

How long is the validity period of a cedula?The cedula is valid for one year.

-

How and where to get cedula?You can get a cedula from your barangay, city or municipality of residence and/or business.

-

What is the community tax certificate (CTC) number?The CTC number can be found on the cedula. This is a requirement for some government transactions.

-

How is the cedula computed?The cedula is computed based on the basic community tax, additional community tax, your salary, and the value of your property.

-

Can I get cedula online?If you're a resident of Manila, San Fernando in La Union, or Cebu, you can get cedula online.

-

Can I get barangay without cedula?This is most often a requirement, but there are some barangays that may not require a cedula.

-

Does cedula expire Philippines?Cedula validity Cedula expiration is usually after one year from the date of issue.

Authors

Digido Reviews

-

RollyHi everyone I could recommend this excellent apps coz the agents are approachable and answers the needs in times of emergency. They us give lower interest and loan prolongation in case you could not pay on time. Thanks to them and keep it up. Mabuhay!!!5

-

NonaIt's very easy to file a loan on this app and it's very convenient, you just need to wait a minute and there you go, loaned amount was already in your account. Thanks Digido, we can rely on this loan platform in times of needs. And it would be better if loan interest will be lessen a little bit.5

-

AbigailOne of the Best Loan App. Reliable. Affordable Fees. Thanks, Digido.5

-

MaryVery efficient, fast reliable company. Reasonable rates with very friendly and accommodating customer service! I highly recommend it! 👍👍👍4

-

FrinaI like Digido loan site the most because they low interest rate within and had a prolongation service incase you can't meet your due, it really helps alot in time of need. In addition their loan process speed and disbursement is by far the fastest.4