Metrobank Credit Card Overview: Choosing the Right Credit Card for your Needs

Table of Contents

About Metrobank Philippines

Metrobank, officially known as Metropolitan Bank & Trust Company, is one of the premier banking institutions in the Philippines. It was founded in 1962 and has grown to become a major provider of financial services, not only within the Philippines but also on an international scale.. It offers savings accounts, loans, credit cards, remittance services, investments, bancassurance, business banking and private wealth management.

The bank is known for its extensive branch network across the Philippines, making it accessible to a wide customer base.

- Apply with only one Valid ID

- Fast approval in 5 minutes

- Easy online application

Metrobank Credit Card Types

Wondering which Metrobank credit card to get? Metrobank offers a diverse range of credit cards tailored to different lifestyles and needs, each with unique benefits and features. Here is a list to help you choose!

Metrobank World Mastercard

This card is designed for those who frequently travel and enjoy a luxury lifestyle, offering significant rewards and benefits that enhance travel experiences and everyday spending.

With the Metrobank World Mastercard, you get 50% off when you dine, exclusive access to 1,000 airports and 500 lounges worldwide, traveler rewards, discounts at partner merchants, 0% installments, e-commerce protection, value-added services and much more!

Enjoy your travel privileges: You earn 1 air mile for every ₱17 spent on foreign currency transactions. Cardholders receive two complimentary global lounge passes per year through Dragon Pass, providing a comfortable travel experience. A promotional low foreign exchange service fee of 1.85% is applied to transactions, which is beneficial for those who travel or make purchases in foreign currencies

- Interest rate: 3%

- Annual fee: ₱6,000

- Minimum annual income: ₱1,500,000

- Cash advance fee: ₱200 (1)

Metrobank World Mastercard does offer 0% installment plans. This feature is available for various purchases, allowing cardholders to manage large expenses more conveniently by spreading the cost over time without interest. The 0% installment option can be applied to different purchase categories such as appliances, gadgets, furniture, and more, across various durations depending on the merchant’s terms.

Metrobank Platinum Mastercard

The Metrobank Platinum Mastercard offers a variety of premium perks tailored for those who enjoy shopping and dining, as well as for frequent travelers looking for convenience and rewards.

Get 50% off when you dine, plus rewards points, 3x points at Rustan’s Department Stores, 0% installment, 24/7 VIP customer service 24-hour concierge service and more with the Metrobank Peso Platinum Mastercard!

Every purchase earns reward points, which can be redeemed for a wide range of items such as gift certificates, miles, or even applied towards the card’s annual fee. The first supplementary card is offered free of charge, which can be beneficial for managing family finances more effectively

- Interest rate: 3%

- Annual fee: ₱2,500

- Minimum annual income: ₱700,000

- Must be a primary cardholder of another bank for at least 9 months with a credit limit of at least PHP 75,000

- Cash advance fee: ₱200

Metrobank M Free Mastercard

Enjoy the benefits of a credit card without the hassle of annual fees! The Metrobank M Free Mastercard does not charge an annual fee for life, making it a cost-effective option for those who prefer to avoid extra charges.

You also get 0% installment, rewards and perks courtesy of M Here, and value-added services like Bills2Go, Cash2Go, M Connect and more! Perfect for first-time cardholders!

Cash2Go: This feature allows cardholders to convert a portion of their credit limit into cash, which can be paid back in installments, providing flexibility in managing cash flows.

- Interest rate: 3%

- Annual fee: FREE!

- Minimum annual income: ₱867,000

- Must be a primary cardholder in another bank for at least 9 months with a credit limit of at least ₱25,000

- Cash advance fee: ₱200

Metrobank Titanium Mastercard

Enjoy 2x rewards points every time you shop and dine using your Metrobank Titanium Mastercard! You can avail of the 0% installment program, deals from M Here partner merchants and value-added services like Bills2Pay, Cash2Go, M Connect and more!

- Interest rate: 3%

- Annual fee: ₱2,500 (For new cardholders who apply within specific promotional periods, there are no annual fees, which can significantly reduce the cost of having a credit card)

- Minimum annual income: ₱180,000

- At least 6 months of employment as a full-time employee or primary cardholder with another bank

- Cash advance fee: ₱200

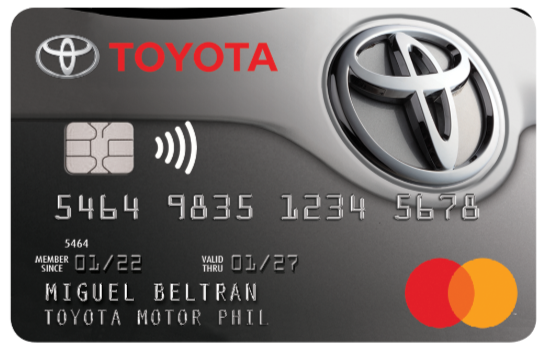

Metrobank Toyota Mastercard

The Metrobank Toyota Mastercard offers specific benefits for Toyota enthusiasts. Cardholders can earn rewards points on everyday spending and Toyota dealership expenses, which can be redeemed at Toyota dealerships across the Philippines. Additionally, it provides special discounts on Toyota services, parts, and accessories. The card also features a flexible installment plan (2) for new vehicle purchases, parts, services, and accessories at participating Toyota dealers. For travel convenience, it includes travel insurance and motorist roadside assistance.

- Interest rate: 3%

- Annual fee: ₱2500 and ₱1,250 for each supplementary cardholder

- Minimum annual income: ₱180,000

- Must be a primary cardholder in another bank for at least 9 months with a credit limit of at least ₱25,000

Learn more about

Can I Get a Bad Credit Loan at Digido?

Metrobank Visa Credit Cards

Metrobank offers a diverse range of Visa credit cards that come with numerous advantages tailored to meet different lifestyle needs. Each card is designed to enhance convenience, provide valuable rewards, and offer security features that make transactions safer and more efficient.

Here’s a brief overview of the types of benefits you can expect with Metrobank Visa Credit Cards:

- Rewards and Points: Earn rewards points for every purchase that can be redeemed for a variety of rewards, including travel, merchandise, or even fee waivers.

- Travel Benefits: Certain Metrobank Visa cards offer travel perks such as complimentary airport lounge access, travel insurance, and competitive rates on foreign currency transactions.

- Shopping and Dining Offers: Enjoy exclusive discounts and promotions at various dining, shopping, and entertainment venues.

- Security Features: Metrobank Visa cards come equipped with advanced security technologies such as EMV chips and SMS notifications for transactions, ensuring your card use is protected against fraud.

- Convenience: The cards are accepted worldwide, and many offer contactless payment options for quick and easy purchases.

- Flexibility: Some Metrobank Visa cards offer features like balance transfer, flexible payment. Let’s take a look at each one of them!

Metrobank Visa Travel Platinum

This card lets you earn 3x rewards points on airlines, accommodation and shopping overseas! You also get airport lounge access at over 950 lounges worldwide, rewards points for purchases as low as ₱17, 0% installment, and deals from M Here partner establishments! You earn 1 mile for every ₱17 spent on airline tickets, hotel bookings, and foreign currency transactions. For other categories, you earn 1 mile per PHP 50 spent, making it a fast way to accumulate miles.

The first supplementary card is offered free of charge, which can be a significant saving and convenience for families or partners sharing the same account.

- Interest rate: 3%

- Annual fee: ₱5,000

- Minimum annual income: ₱700,000

- Cash advance fee: ₱200

Metrobank Cashback Visa Platinum

Shop with your Metrobank Cashback Visa on groceries, telecom, bookstores and school fees and get 5% rebate (3) on retail purchases.

- Interest rate: 3% or 36% Annually

- Annual fee: ₱3,500

- Minimum annual income: ₱180,000

- Must be a primary cardholder in another bank for at least 9 months with a credit limit of at least ₱25,000

- Cash advance fee: ₱200

Metrobank Rewards Plus Visa

Be pampered with 2x rewards on online gadgets, telecom and transportation purchases! Earn 1 reward point for every ₱20 spent and enjoy 0% installment for up to 24 months.

Double Rewards Points: You earn double rewards points on all online purchases, which includes spending on gadgets, internet services, and mobile services. This makes it particularly appealing for tech-savvy consumers.

No Annual Fee: If you spend a minimum of ₱180,000 annually with your card, the annual fee is waived. This feature also applies to new cardholders who apply within a specified promotional period.

Flexible Rewards Redemption: The points you earn are never-expiring and can be redeemed for a variety of rewards, including electronic gift certificates (eGCs), miles, or donations, providing flexibility in how you choose to use your rewards.

- Interest rate: 3%

- Annual fee: ₱2,500

- Minimum annual income: ₱180,000

- At least 6 months of employment as a full-time employee

- Cash advance fee: ₱200

On Metrobank’s website, you can compare various credit cards, which is highly beneficial for prospective cardholders. This Metrobank credit card comparison tool allows users to evaluate different cards side-by-side, focusing on features such as interest rates, rewards, annual fees, and special offers.

Need Quick Cash? Apply for a fast money loan in Digido with just 1 valid ID. Calculate your pre-approved loan amount:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

Learn more about

Urgent Cash Loans For Unemployed

Metrobank Credit Card Requirements

Once you have decided on your target Metrobank CC, now is the time to prepare the required documents!

You can apply for a Metrobank credit card if:

- You are at least 18 to 70 years old

- You are a regular employee for at least 6 months or a principal cardholder with another bank

- You have a minimum annual gross income of at least ₱180,000

Submit any government ID with your photo such as:

- Passport

- Driver’s license

- TIN ID

- UMID

- PRC ID

- PWD ID

- All other valid IDs issued by the Philippine government

For the proof of income, you need to submit the photocopy of the following.

For regular employees:

- Copy of the latest ITR duly stamped as received by the BIR or authorized agent bank, or employee copy of BIR 2316 duly signed by the employer

- Copy of last 3 months payslip from the date of application

- Original copy of certificate of employment, only for top 1,000 corporations (must include name, position, date of employment and gross annual income)

For self-employed, any of the following:

- Copy of latest audited financial statement with BIR or bank stamp

- Copy of latest ITR duly stamped as received by the BIR or authorized agent

For cardholders of other banks:

- Latest credit card/s billing statement with at least 9 months as principal cardholder

For foreigners:

- Proof of income or employment

- Copy of alien certificate of registration/immigrant’s certificate of residence (ACR/ICR) or visa

Learn more about

Fast student loan online

How to apply for a Credit Card in Metrobank

Applying for a credit card at Metrobank involves a straightforward process that you can initiate online. Here’s how to do it:

- Choose the Right Card: First, visit the Metrobank credit card section on their website to review different credit cards and choose one that best suits your needs.

- Eligibility Check: Ensure you meet the eligibility criteria for the chosen card. Typically, you need to be between 18 and 70 years old, have a certain minimum income, and possess valid identification.

- Document Preparation: Gather necessary documents which include a valid government-issued photo ID, proof of income (like recent pay slips or income tax return), and other specific documents depending on whether you’re employed, self-employed, or a foreign national.

- Application Submission: You can apply online by visiting the Metrobank application page, filling out the application form, and uploading the required documents. Alternatively, you can visit a Metrobank branch to apply in person.

- Wait for Approval: After submitting your application, there will be a processing period during which the bank reviews your documents and credit history. They will notify you of the approval or rejection of your application.

Steps for Metrobank Credit Card application

Once you’ve acquired the Metrobank requirements for a credit card, you can apply for a Metrobank CC by going to the bank branch nearest you or online at https://www.metrobankcard.com/apply.

If you choose to apply online, here are the steps for Metrobank credit card online application:

- Check your eligibility through the drop-down menu. Check all that applies to you.

- Indicate if you have an existing Metrobank credit card. If yes, you need to provide the first 6 digits and the last 4 digits. If you have an existing card with another bank, provide your credit limit. If not, indicate if you have a Metrobank deposit or investment.

- Give your personal details, then agree to the terms and conditions. Click Next.

- Take note of your Online Reference Number (ORN). You will need your ORN if you want to check on your credit card application status.

- Provide your present address, permanent address, home phone number, home ownership, birthplace, mother’s maiden name, gender, marital status, education, other government ID and number. Click Next.

- Provide your income and employment information. Click Next.

- Indicate if you are a Metrobank depositor and/or if you have CCs from other banks. Click Next.

- Enter the name that you want to appear on the card and where you want your statements to be delivered. Click Next.

- Upload your documents.

Can i get a Metrobank credit card online without visiting the office?

Once your Metrobank credit card application is approved, the card is typically mailed to your registered address. The delivery time can vary but generally, it takes about 7 to 10 business days for the card to arrive. There’s no need to visit a Metrobank office to pick up your credit card unless specifically requested or if there are issues with delivery.

If you need the card urgently or if there’s a delay beyond the usual delivery time, you can contact Metrobank’s customer service for assistance.

How do I know my Metrobank Credit Card Limit?

You can find out your Metrobank credit card limit by checking your monthly statement, where it’s typically listed. Alternatively, you can log into your Metrobank online banking account or mobile app to view your credit limit directly. If you prefer, you can also contact Metrobank’s customer service for assistance. This way, you can ensure you are informed about your credit limit and manage your finances accordingly.

What’s the best Metrobank Credit Card for Beginners?

For beginners looking for a Metrobank credit card, two great options are the Metrobank Titanium Card and the Metrobank Rewards Plus Card. Both are particularly suitable due to their friendly features and lower income requirements compared to other premium cards.

The Metrobank Titanium Card is beneficial as it offers double rewards points on essential retail categories like online shopping, dining, and department store purchases. There’s no annual fee for new cardholders if applied for during specific promotional periods, making it economically feasible for those new to credit cards.

The Metrobank Rewards Plus Card, on the other hand, offers double rewards points on all online spends, gadgets, internet, and mobile services, which can be attractive for tech-savvy beginners. Similar to the Titanium Card, it also features a no annual fee option under certain annual spend conditions, which can help manage costs while building credit.

Both cards require the applicant to have a minimum annual income of PHP 180,000, which is relatively accessible for many working individuals.

Useful information about

24 hour online loans

Metrobank Credit card Promos and Rewards

There are lots of Metrobank credit card promos for every cardholder, from rewards points to lounge access to free travel insurance! It also offers a Metrobank cash to go service (Cash2Go), M Connect, M Here, MSOA and more.

Metrobank offers several attractive credit card promotions and rewards for 2024:

- Spends to Surprises Promo: Cardholders can earn PHP 1,000 worth of eGCs for every PHP 20,000 spent in a single receipt. The promo requires registration and runs from February 15 to April 15, 2024.

- Big Travel Bonus: If you use your Metrobank credit card for travel-related expenses, you can earn up to PHP 10,000 in eGCs based on the total amount spent during the promo period. This promotion is specifically geared towards substantial travel expenditures.

- Up to PHP 9,000 eGCs or GCash credits: Available for high-value purchases, where you can earn significant eGCs or GCash credits depending on the amount spent. This promo also utilizes a registration and tracking system via a dedicated portal..

- Hotel Discounts: Significant discounts on hotel stays, such as up to 50% off at selected resorts and hotels like Badian Island Wellness Resort and Boracay Tropics. These offers are tailored for vacationers looking to use their Metrobank cards to secure better rates on accommodations.

These promotions not only offer cashback and discounts but also enhance the overall utility of using Metrobank credit cards for various purchases, both online and offline.

Also read all about

Digido loan app for easy cash

Bank Credit Card Alternatives

Bank credit cards are great, but no one can guarantee that you will be approved for one. Thankfully, there are great alternatives to credit cards with much higher approval rates. Digido is one of them!

With Digido, you can apply for a minimum loan amount of ₱1,000 to a maximum of ₱25,000 for repeat borrowers. You can even get your quick credit within five minutes! Perfect for emergencies and personal loans!

Here are the main advantages of borrowing from Digido:

- First loan with 0% interest rate

- Only 1 Valid ID needed to Apply

- No proof of income is required

- Fast approval in 5 minutes

- Simple online application via mobile App

Aside from a higher approval rate, Digido also does not require too many documents. All you need to submit is your valid government ID. You can simply apply for a loan and get your loan all within the Digido app! Just click on “Apply Now” and get your money in as little as 10 minutes!

Apply nowFAQ

-

Help, I lost my Metrobank credit card! How do I report this?You must report your lost credit card immediately through the bank’s customer service hotline.

-

Is there a Metrobank maintaining balance?If you have a Metrobank savings account or Metrobank debit card, your maintaining balance can range from 0 to ₱2,000.

-

Is there an age limit for a Metrobank credit card?You have to be at least 18 to 70 years old to apply.

-

What is the Metrobank card hotline?You can call the customer service hotline at (02) 8870-0700 for Metro Manila and 1-800-1888-5775 for domestic toll-free.

-

How can I check my Metrobank credit card application status?Your CC application will be evaluated and processed within 2-3 weeks. To check the status of your application, you can call (02) 8870-0700 or 1-800-1888-5775. You can also send an email at customerservice@metrobankcard.com.

-

Are there other Metrobank credit card promos available?Yes! You can check other promos here https://www.metrobankcard.com/promotions.

-

Is there a Metrobank balance conversion calculator?Yes! Just go here https://www.metrobankcard.com/cardsservices/balance-conversion-calculator.

-

What is the minimum annual gross income requirement for a Metrobank credit card?The minimum annual gross income requirement is ₱180,000.

-

Can I get a Metorbank gold credit card?Yes, Metrobank does issue a gold credit card. Specifically, they offer the Metrobank Platinum Mastercard, which provides a range of high-end benefits including dining deals, rewards points, and e-commerce protection for online purchases. This card caters to those who seek premium services and privileges from their credit card.

-

Can i get Metrobank credit card online?Yes, you can apply for a Metrobank credit card online. Metrobank offers an online application process that is straightforward and convenient. Your card will be delivered to your home.

Authors

Digido Reviews

-

IanThank you Digido. This app is very helpful in times of emergency needs. Easy to apply and disbursed in my account. God bless you.5

-

EllaVery fast! Its really for emergency purposes!5

-

FrancisI can't thank Digido enough for their quick service. I got approved for a loan within minutes, and the money was in my metrobank visa account shortly after. Their online application is straightforward, and their customer service is top-notch. Highly recommended5

-

DanicaSuperb App. It is very easy and fast approval. it's my second loan since the last time. Very happy to apply for this app. Highly recommended.4

-

MelissaI highly recommend this App. Convinient and user-friendly. This App is amazing! So easy to loan and approval is very fast just a few minutes. Disbursement is super fast. The Staff are very accomodating, polite, respectful, courteous and friendly. Digido is is very reliable, costumer service is awesome. I love the flexibility it gives to their clients and I can definitly reccomend it to anyone who needs finacial assistance. To the management and staff, thank you very much for the helping hands!4

-

CharieAmazing! So easy to loan and approval is very fast only a minute. That's why I rate this with 5 stars.5

-

SamhI've used Digido a few times when my Metrobank credit card limit was exhausted, and I have always been impressed by how easy and fast it is to get a loan. The approval process is really quick, and the money is in my account within minutes. Repaying the loan from my own account takes just a couple of seconds 👍5

-

AnnaThe application process is simple, and the funds are disbursed quickly. Their customer service is also very accommodating. I've had to extend my payment a couple of times, and they made it easy for me!4