Loans to Pensioners in the Philippines: How to Get a Pension Loan

Key takeaways:

- In the Philippines, there are many opportunities to get a pension loan both through the government and through private companies.

- This can be a serious financial support in case of an emergency.

- Retirees can borrow from a bank, a pawn shop, an online company, or through a government program such as the SSS loan.

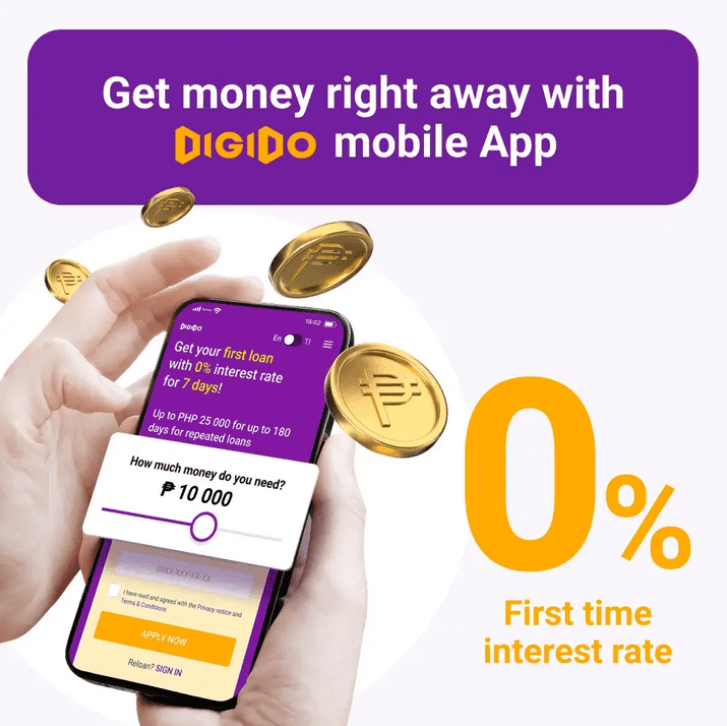

- People who are retired but are still actively working, such as running their own business, and are still under the age of 70 can take advantage of loans at Digido.

As soon as a person retires and becomes a pensioner, his or her income is most often reduced. It becomes more difficult to plan large purchases or expensive treatment. And even more money is needed, because health costs are increasing, and sometimes you need to help your children. To solve this problem, there are loans for pensioners in the Philippines.

- Only 1 Valid ID to Apply

- Approval rate of more than 90%

- For Filipino citizens to 70 years old

What is Pension Loan in Philippines

In the Philippines, a pension loan is a type of loan designed for retired individuals who receive a regular pension. It allows pensioners to borrow money against their pension income, providing them with access to additional funds. Pension loans are typically offered by banks, financial institutions, or government agencies. The loan amount is often determined based on the pension amount received by the borrower, and the loan term may vary depending on the lender and can be from 1 day to 2 years.

Pension loans can be used for various purposes:

- Medical Expenses: Covering medical bills, hospitalization costs, medications, or treatment expenses.

- Home Improvement: Funding repairs, renovations, or upgrades to the pensioner’s residence.

- Debt Consolidation: Consolidating existing debts, such as credit card bills or loans, into a single loan with more favorable terms.

- Education Expenses: Financing educational pursuits for themselves, their children, or grandchildren, such as tuition fees or educational materials.

- Travel and Vacation: Funding travel expenses, including transportation, accommodation, and other related costs.

- Purchase of Appliances or Furniture: Buying essential household appliances or furniture items.

- Emergencies: Dealing with unforeseen financial emergencies or unexpected expenses with quick loans for pensioners.

- Small Business or Entrepreneurial Ventures: Starting or expanding a small business or entrepreneurial endeavors.

- Daily Living Expenses: Meeting regular living expenses, such as utility bills, groceries, or personal needs.

Learn about

Senior Citizen Benefits and Discount in the Philippines

Can I Take a Pension Loan at Digido?

Digido is an online money lending service that provides small instant loans for people who are receiving a pension but still working or running their own business and are still 70 years of age or lower. Unlike traditional bank loans that take 5-7 days, Digido sends the money within minutes, eliminating the need to wait in long lines.

So what is the process of obtaining a online loans for pensioners from Digido?

Before actually getting a loan, you must first know what type of loan and how much you need. First-time borrowers can only borrow PHP 1,000.00 to PHP 10,000.00 and these amounts are payable within 5-15 days. Now there is a special offer of interest-free loan for a first-time borrower. Repeat borrowers can borrow PHP 1,000.00 to PHP 25,000.00, which is payable within 5-35 days. The interest rate for loans under the short term is 1.5% daily. Just 3 simple steps and you will get the money within an hour:

- To visit their website – click “Apply Now” button

- Enter your desired loan amount with slider and provide your phone number for registration.

- Upload your only 1 valid ID and personal information through the online section.

Once approved, receive the money in the most convenient way for you (on yoour bank account or e-wallet), usually within half an hour.

Digido is a popular choice for its quick and hassle-free loan process, making it a go-to option for personal fast loans for pensioners in the Philippines. To get money in just 30 minutes, click “Apply Now” button and follow the 3 quick steps above!

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

Pension Loan Requirements

As already mentioned, in order to get a loan for pensioners in government organizations such as banks or government institutions, you need to meet a list of requirements, the most common of which:

- Age: Generally, you need to be a senior citizen and have reached the retirement age, which is usually 60 years old for government employees and 65 years old for private sector employees. Loans to individuals over 70 years old may be granted on an individual basis.

- Pension: You should be a recipient of a regular pension from a government agency or private company. The pension should be verifiable and have a stable income source. As a standard rule, the minimum pension amount should not be less than PHP 10,000

- Loan Purpose: You may be required to specify the purpose of the loan, such as medical expenses, home improvement, or personal use.

- Loan Amount: The loan amount you are eligible for may depend on factors such as your pension amount and ability to repay.

- Collateral or Co-maker: Depending on the lender, you may be asked to provide collateral (such as property or a vehicle) or a co-maker who will assume responsibility for the loan if you are unable to repay it.

Learn How To Get

Senior Citizen ID in the Philippines: Easy Steps

Loan to Pensioners Available in the Philippines

| Loan Type | Description |

|---|---|

| Government Pension Loans | Many government institutions in the Philippines, such as the Social Security System (SSS) and the Government Service Insurance System (GSIS), offer pension loans |

| Personal Loan for Senior Citizens | Some banks and financial institutions provide personal loans specifically for pensioners, which can be applied for both online and in branches in the Philippines |

| Cash Loan for Pensioners | Cash loans designed for pensioners allow retirees to access funds quickly and easily |

| Instant Loan for Pensioners | Some lenders may offer instant loan options that provide immediate access to short term loans for pensioners |

| Online Loans for Senior Citizens | Certain online lenders offer special loan products tailored to senior citizens, including pensioners |

| Home Equity Loans or Reverse Mortgages | For pensioners who own a property, these loans provide a way to access funds by borrowing against the value of their property |

Where to Get a Pension Loan

Consider a few ways where a pensioner can take a loan

- Government Lending Programs

- Bank Loans

- Pawnshops

- Quick Lending Companies

Learn about

Fast Loan in 15 Minutes

Which Banks Gives Loan for Pensioners

There are several banks in the Philippines that offer loan products specifically designed for pensioners. Some of these banks include:

👉 Philippine National Bank (PNB)

PBN has recently launched a low-interest loan program specifically designed for retirees and pensioners. Key features of this loan program include:

– Low-interest rate: The loan for retirees program offers a competitive interest rate of 1.25%, which can be significantly beneficial for retirees seeking financial assistance

– Eligibility for all PNB customers aged 70 years old: This loan program appears to be open to PNB customers who are 70 years old, regardless of their employment status or pension source.

👉 Penbank (Pensioner’s Bank)

Penbank is an organization that lends to pensioners under the age of 70 years in the Philippines. The maximum loan amount offered is 150 thousand pesos. For pensioners under the age of 65, the maximum loan term is 2 years. It’s important to note that Penbank only issues loans to individuals living within its service area.

👉 Philippine Veterans Bank (PVB)

Philippine Veterans Bank (PVB) is an organization owned by World War II veterans. They offer loans to pensioners in the range of 20 to 50 thousand pesos. One distinguishing feature of PVB is the possibility of extending the loan maturity in case of force majeure circumstances. This indicates that PVB may be more flexible in providing loan term extensions to pensioners facing unforeseen and unavoidable events.

Read about

Getting a loan without a bank account in the Philippines

What is a SSS Pensioner Loan?

SSS Pensioner Loan (1) is a program run by the Social Social Security System that allows retirees to borrow large amounts from SSS. In this case, SSS acts as a lending company for SSS pensioner loan.

What exactly is SSS?

The Social Security System is an agency set up to handle insurance for employees who are not working in government (GSIS handles insurance for government employees) so every employee of all privately owned businesses must adhere to the monthly contributions. The contributions are also sourced from volunteer contributors, i.e., self-employed and private individuals. Overseas Filipino Workers (OFWs) also pay a certain amount.

SSS members who fail to pay their monthly contributions are not required to pay the missed months, however, to be approved for a instant cash loan for pensioners, the borrower must have 36 posted contributions and the last 6 should be within the last 12 months before applying for the loan.

Who Can Become a Member of the SSS Pension Loan Program?

All retirees who are SSS members should be:

- 85 years old by the time the loan term ends;

- Still receiving their monthly SSS pension in full without deduction;

- Receiving pension with an active status and not for less than 1 month;

- SSS pension is not being used to pay off an earlier loan under the SSS calamity package.

How Much Can a Pensioner Borrow from the Social Security System?

It all depends on the Basic Monthly Pension (BMP) plus PHP 1,000.00. Dependent’s Pension is not included. The higher the pensioner’s Basic Monthly Pension, the higher the amount that can be borrowed but there is a maximum cap of PHP 200,000.00 at the highest end.

Learn All about

SSS Pension Computation in the Philippines

Benefits of SSS Pension Loan Program

Sure, here’s a table that represents the benefits offered by the Pension Loan Program (PLP) of the Social Security System (SSS):

| Benefit | Description |

|---|---|

| Financial Assistance | Provides significant financial assistance to eligible retirement pensioners for daily expenses, medical costs, etc. |

| Protective Measures | Protects pensioners from predatory loan sharks that charge high interest rates and take ATM cards as collateral. |

| Competitive Interest Rates | Offers a lower interest rate of 10% per year (on a diminishing principal balance), compared to rates as high as 20% from private institutions. |

| Online Application | Allows eligible pensioners (2) to apply for loans online via the My.SSS Member Portal (3). |

| Flexible Loan Amounts | Offers loans equivalent to three, six, nine, or 12 times the basic monthly pension plus a P1,000 additional benefit. |

| Reasonable Loan Terms | Sets the payment term according to the size of the loan, with specific terms for loans equivalent to three, six, nine, or 12 times the basic monthly pension. |

| Loan Limit | Ensures pensioners do not over-borrow by setting a maximum loan limit of P200,000. |

| Ensured Minimum Pension | Requires that the net take-home pension should at least be 47.25% after loan repayment. |

GSIS Pension Loan

Now we’ll tell you about the GSIS loan. The GSIS pension loan (4) is similar to the SSS, but it’s only for government employees. To use the GSIS pension loan, you need to fill out an application. Then you must send it to the officer in charge at the GSIS office where you are duly registered. Provide your ID card and other documents proving that you are a senior citizen.

The maximum loan you can get is 500,000 pesos, and the interest rate on the GSIS senior citizen loan is 10% per year. You can repay the loan in 24 equal monthly payments. This amount will be deducted from your pension each month.

Next, let’s talk about the GSIS survivorship pension loan. The Board of Trustees has decided to pay back the survivorship loan. This means that spouses and children can receive the GSIS pension of a deceased member, even if they are working themselves. The survivor loan is called a BSP or basic survivor pension. The government, through GSIS, will pay the surviving spouse of the member. The total amount is 50% of the member’s minimum basic pension. If there is no spouse, the children will be the beneficiaries.

FAQ

-

Can a pensioner apply for a loan?Yes, some companies give loans to pensioners. For example, Digido gives loans to Filipinos up to age 70, as long as they have extra income.

-

Can a pensioner get a loan from SSS?Yes, a pensioner can do it online if he/she meets all the requirements.

-

How can a retired borrower get approval for a loan?To obtain approval for a loan, a retired borrower needs to submit a comprehensive set of documents and demonstrate good health. Additionally, they must provide information about a co-borrower who is willing to assume loan payments in case of unexpected situations.

-

Are Online Pension Loans Legit?Yes, many companies in the Philippines issue loans legally and have a registration number in the government registry.

-

Why is the Digido app well-suited for seeking Loans for Pensioners from Direct Lenders?Digido can be a convenient loan app for pensioners in the Philippines because:

- Digido is a certified and legitimate financial services provider in the Philippines

- Pensioners who use Digido can benefit from the convenience of obtaining loans without leaving home

- Digido an excellent option for those who have been rejected by traditional banks

- For first-time borrowers, Digido provides loans with 0% interest, requiring only one ID

- Digido stands out for its user-friendly and straightforward interface, making the loan application process convenient and accessible for pensioners

- With Digido's swift approval process, pensioners can receive funds in as little as 30 minutes, making it an ideal solution for urgent financial needs

Digido Reviews

-

ChristianAmazing Digido instant Loans for senior citizen Philippines. Quick process and easy, and the interest rates were very reasonable. I recommend this service, I tested it.5

-

AnthonDigido was a lifesaver for me when I needed a loan to cover some unexpected expenses. As a senior citizen, I was worried about being rejected by loan providers due to my age. However, Digido made the process so easy and convenient for me. I recommend Digido to any senior citizen in need of a loan.4

-

CarloI wanted to find a lending institution that serves seniors and I came across Digido. I was pleasantly surprised to find out that they offer loans to seniors like me. Their customer service was excellent and they were able to walk me through the entire process. I am very grateful to Digido for their great service5

-

MalayaWhen it comes to quick loans for pensioners, Digido stands out. The application was straightforward and took just a few minutes, and they needed only one ID from me. Truly a convenient and fast service.5

-

AndreIf you need an instant loan for pensioners, Digido is the way to go! As a pensioner, I was able to get a loan quickly, with minimal documentation! I was amazed at the speed and efficiency.5

-

SinagCan pensioners apply for a loan? Absolutely, with Digido. It was simple and quick! I would recommend them to any pensioner in need of financial assistance5