SSS Pension Computation in the Philippines: All about Retirement Benefits

Key takeaways:

- Begin contributing to the SSS as early as possible to maximize your pension benefits

- At least 120 monthly contributions are necessary to qualify for a monthly pension

- You can claim your pension at 60 (optional) or 65 (mandatory)

- You will learn the SSS pension calculation methods in this article

- If your pension is not enough, you can get an easy fast loan from Digido

Table of Contents

Whether you dream of traveling the world or spending quality time with family, early financial planning ensures you can enjoy your retirement years without financial worries.

While the SSS pension offers a safety net for retirees, the benefits alone might not suffice and Investing in additional retirement savings plans is a smart move to ensure a comfortable life post-retirement.

With a contribution rate of 14% of monthly salary credit, set to rise by 1% every other year until 15% in 2025 (1) , it’s vital to understand how these contributions impact future benefits. Simply put, the more you contribute, the better you’ll be set for retirement.

Here’s a brief overview of the SSS retirement benefits and why they’re a key part of your retirement plan.

- Apply with only 1 Valid ID

- Available to age 70

- 0% First Loan

What is an SSS Pension in the Philippines

The pension is a monthly monetary benefit that the Social Security System (SSS) of the Philippines assigns to its members when they reach retirement age and after they apply for retirement benefits. This can be a monthly pension or a lump sum benefit. The lump sum is an option for those who have not completed the required 120 monthly contributions to qualify for the monthly pension.

The pension amount is primarily based on the member’s number of credited years of service and average monthly salary credit, and their age at retirement. While age determines eligibility, the calculation for the pension amount involves more factors.

There are two SSS retirement ages:

- 60 years old (optional) – with at least 120 monthly contributions.

- 65 years old (mandatory)

The optional retirement age of 60 is given that the member has completed at least 120 monthly contributions.

On the other hand, mining workers are exempted as they can retire at 55 (optimal age) or 60 and above (mandatory retirement age).

How to Compute SSS Pension in the Philippines

Members of the SSS can figure out their monthly pension in two ways: by hand or through the online sss pension calculator based on contribution. A common concern among SSS members is determining the amount they will receive as their SSS pension. This amount is primarily influenced by the contributions paid, the duration of membership in SSS, and the presence of dependent minor children.

To compute the SSS pension, three different formulas are applied. The one that results in the greatest amount will be used to finalize the pension value:

| SSS Monthly Pension Formulas for Computation | |

|---|---|

| First formula | Php 300 + 20% of average monthly salary credit (AMSC) + 2% of the AMSC for each Credited years of service (CYS) in excess of 10 years + Php 1,000 |

| Second formula | 40% of your average AMSC + Php 1,000 |

| Third formula | Php 1,200 if you have CYS from 10 to 20 years

Php 2,400 if you have CYS 20 years or more + ₱1,000 |

Sample Computation of the SSS Pension

Let’s apply the same SSS pension formula to a different scenario, making it easier to understand through a practical example.

Imagine a person, who has a monthly salary of ₱40,000 and has been contributing to the SSS for 35 years. Based on the latest SSS contribution table, their Average Monthly Salary Credit (AMSC) is ₱40,000.

Here’s how SSS pension would be computed:

Monthly Pension (MP) = ₱300 + (20% of AMSC) + [2% of AMSC x 25 years (35 years – 10)] + ₱1,000

MP = ₱300 + (0.20 x 40,000) + (0.02 x 40,000 x 25) + ₱1,000

MP = ₱300 + ₱8,000 + ₱20,000 + ₱1,000

Monthly SSS Pension = ₱29,300*

*This example is simplified and does not take into account any potential changes in contribution rates or other factors that may affect the final pension amount.

Online SSS Pension Calculator

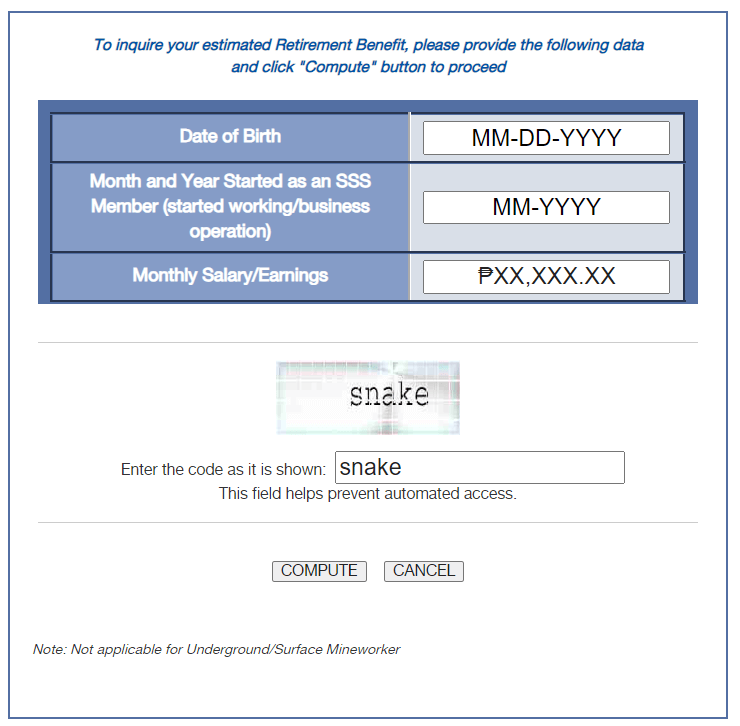

Alternatively, if you don’t have the time to compute your SSS pension, you can consult the SSS Retirement Calculator (Benefit Estimator) (2) at sss.gov.ph website.

To compute your estimated SSS pension, just input your date of birth, the month and year that you started as an SSS member (started working or started your business), and your monthly salary or earnings. You will receive an approximate pension figure based on these criteria.

Here’s what the SSS pension calculator for voluntary members, employed and self-employed looks like on the website:

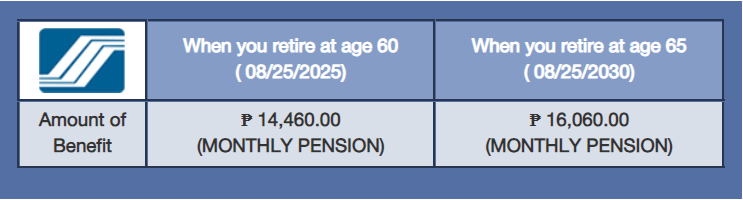

The calculator will also show two pension figures: your monthly pension when you retire at 60, and your monthly pension when you retire at 65. The latter amount is higher.

Take note that the computed amount of retirement benefits is just an estimate and may differ from the actual amount.

How can i check my sss pension online?

- Register for a My.SSS Account: First, sign up for a My.SSS account at the official SSS website. Complete the registration process if you haven’t done so.

- Log In: Use your user ID and password to log in. If you’ve forgotten these, the login page provides a way to reset them.

- Navigate to Contributions: Hover over “Inquiry” on the main menu, then select “Contributions” to see your contribution history.

- View Your Contributions: Examine the table of contributions for accuracy. Contact SSS or your employer for any discrepancies.

- Use the SSS Mobile App: For convenience, the SSS mobile app offers quick access to your contributions after logging in.

What deductions might reduce my SSS retirement benefit?

Your SSS retirement benefit might not be paid out in full due to certain deductions applied by the SSS, if applicable. These can include any unpaid loans from SSS, any overlaps in sickness and partial disability benefits you’ve received, and adjustments for overpaid pension amounts that could occur with changes in your family status, such as the death of a dependent, getting employed after retirement, or getting married.

Learn How to Get

Bad credit Personal loans with Guaranteed approval in the Philippines

SSS Pension Requirements

There are two ways to qualify for SSS retirement benefits. First, you must be an SSS member that is aged 60 and have been separated from employment or self-employment. You must have made at least 120 monthly contributions before the semester of your retirement. However, they can receive a lump sum payment that is equal to the total amount contributed plus interest.

Another way you can qualify is if you are an SSS member who is 65 years old and employed or not. You must have at least 120 monthly contributions before your semester of retirement.

Who Qualifies for the SSS Pension

Requirements for retirement benefits for employed, self-employed and requirements for SSS pension for voluntary members are the following:

- At least 55 years old and separated from employment or self-employment, if you’re an underground mineworker

- At least 60 years old, whether you’re still employed/self-employed or not, if an “underground mineworker” (technical retirement)

- You’re a total disability pensioner who has recovered from disability and is at least 60 years old (or at least 55 if an underground mineworker)

- A former retiree-pensioner whose monthly pension was suspended due to reemployment/self-employment and is now separated from employment or has ceased to be an SE

- A member who is 60 years old and above, but not yet 65, with 120 contributions or more may continue paying as VM up to 65 years old to avail of the higher amount of benefit

The SSS also has pension requirements for beneficiaries. To be considered a dependent, you must be:

A legitimate, legitimated, legally adopted, and illegitimate child who is:

- Unmarried

- Not gainfully employed

- Has not yet reached 21 years old; if already over 21 years old, you must be congenitally incapacitated or while still a minor when incapacitated

- A child who is in a common-law relationship and has not yet reached 18 years old

This table encapsulates both the retirement eligibility criteria for SSS members and the requirements for beneficiaries in a structured and easy-to-understand manner

| Eligibility Criteria | Requirement |

|---|---|

| Standard Retirement Age: | 60 years old, separated from work, with ≥120 contributions |

| 65 years old, employed or not, with ≥120 contributions | |

| Special Conditions: | |

| Underground Mineworkers | SSS early retirement age at 55 if separated from work |

| Technical retirement at 60, regardless of employment status | |

| Recovered from Total Disability | Eligible at 60, or 55 for mineworkers, after recovery from a total disability |

| Return from Suspension | Reapply if pension was suspended due to reemployment/self-employment and now separated or ceased self-employment |

| Continuing Contributions (60-65 years old) | Continue contributing as a voluntary member for a higher benefit if having ≥120 contributions |

| Beneficiary Requirements: | |

| Children (Legitimate, Legitimated, Adopted, or Illegitimate) | Unmarried, not gainfully employed, under 21 years old, or incapacitated since childhood |

| Common-Law Relationship Children | Eligibility extends until 18 years old |

Also read all about

Legit Unemployment loans with No job Verification

Required Documents for SSS Pension Application

To apply for retirement benefits, ensure you have these necessary documents ready:

- Fill out the Retirement Claim Application (RCA) Form (3) or the Application for Disability Retirement Benefit Form (applicable under the Portability Law) (4).

- Present an SSS ID, UMID card, or the receipt stub from SS Form E-6 (5) along with two other valid forms of identification (at least one should include a photograph and signature).

- Provide the original and a photocopy of your bank passbook, ATM card displaying your name, a bank-confirmed deposit slip, or a Cash Card Enrollment document.

- Submit a 1 x 1-inch photograph.

For those appointing a representative to submit a retirement claim:

- The appointed person must show a primary ID (SSS ID, UMID, PRC card, Seaman’s Book, or Alien Certificate of Registration) or two alternative forms of identification.

- A Letter of Authority (LOA) signed by the SSS member or a Special Power of Attorney (SPA) detailing the representative’s filing and signing privileges is required.

- Specific additional documents may be requested for unique circumstances (e.g., for individuals aged between 60 to 64, SSS employees, or underground mine workers).

Retirement benefits claims can be processed at any SSS office, through a designated representative or online application using the My.SSS portal.

Learn all about

Loyalty Cards in the Philippines

Need money that you can get quickly? Get a Low-Interest Personal Loan at Digido, it’s quick, legit and sulit credit for everyone! Calculate your pre-approved loan amount and apply with 1 valid ID only:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

How to Apply for an SSS Pension

Applying for an SSS pension is a lot easier now thanks to the Internet. If you’re looking for a copy of the SSS retirement form, you can go to the SSS website. To be eligible for online application, members must have a registered disbursement account through the My.SSS Bank Enrollment Module, which includes options like UMID-ATM, UBP Quick Card, or any bank accredited by PESONet.

Here’s how you can apply for an SSS retirement benefit or claim online:

- Go to the My.SSS member portal (6) then log in to your account. If you don’t have a My.SSS account yet, you can register using your email address.

- Go to the E-Services menu. Enroll your disbursement account/s in the Disbursement Account Enrollment Module (DAEM).

- Once you have approved DAEM account/s, you can file your retirement claim form under the SSS E-Services menu.

- Once approved, you will receive your retirement benefit on your chosen disbursement account. The benefit will be remitted to your designated bank.

Receiving Your SSS Pension

Applicants are advised to set up a dedicated savings account for their pension, providing a copy of their passbook, ATM card, the first deposit slip, bank statement, or enrollment form for a Visa Cash Card as part of the process.

Pensions from SSS are deposited through a chosen bank, preferably one close to the beneficiary’s residence. In addition, you can receive your SSS retirement benefit in two ways.

- If you opt for the lifetime monthly pension, you will receive your benefit right after filing for a retirement claim.

- If you choose the lump sum payment option, you can receive the first 18 months of your pension at a discounted rate. It will resume on the 19th month.

Take note that the benefits of SSS monthly pensioners will be suspended if they reach the age of 60 and choose to work again.

Find out How to take

Fast student loans with No job

Types of SSS Retirement Benefits

The SSS offers two types of retirement benefits for its members.

- The first is a SSS monthly pension, which is a lifetime cash benefit for a retired member with at least 120 monthly SSS contributions before the semester of retirement

- On the other hand, a lump sum amount will be given to a member-retiree who has not paid the required 120 contributions. The amount is equal to the member and his employer’s paid total contributions plus interest

- Member-retirees are entitled to receive a 13th month pension payable every December, similar to a Christmas bonus

Additional Retirement Benefits:

👉 PhilHealth Membership: Other retirement benefits available to SSS members include automatic National health insurance membership for those who are not yet members after 65 years.

👉 Hospitalization Coverage: While SSS doesn’t offer direct hospitalization benefits, PhilHealth covers these for retirees and their dependents. Hospitalization benefits for a retiree and their dependents only available to those with 120 contributions.

👉 Dependent’s Allowance: SSS provides a dependent’s allowance for up to five minor children of the pensioner, offering either 10% of the pension or Php 250 per child, until they turn 21 or for incapacitated children who cannot support themselves.

If an SSS member dies, the people they have named as their main beneficiaries at the time they retired will receive the full amount of the pension. However, if the member dies within 60 days after their monthly pension payments begin and didn’t name any main beneficiaries, then the backup beneficiaries will get a one-time SSS payment. This payment covers what would have been five years of pension payments, but it doesn’t include any extra money for dependents

Also read all about

Easy cash loans in the Philippines

How to increase your SSS pension

But what if you’re worried about your pension not being able to sustain your retirement? Here are some tips on how to increase your SSS pension:

- Ensure Eligibility for Monthly Pension: Confirm that you’ve made at least 120 SSS contributions before applying. This threshold guarantees eligibility for continuous monthly pensions, a more beneficial arrangement than the lump-sum payment available to those with fewer contributions. Use the online SSS potal to check your contribution count.

- Continue Contributions After 120 Payments: Even after reaching the 120-contribution mark, keep contributing as a voluntary member until you’re 65 to augment your retirement benefit.

- Catch-Up Contributions for Late Starters: If you’re 65 or older and haven’t yet met the 120 monthly contribution requirement, you’re allowed to make voluntary contributions for up to 120 months. This enables you to qualify for monthly pension benefits.

- Wait Until 65 to Claim Pension If Working: If you intend to work beyond retirement age, it’s advisable to delay your pension claim until you’re 65. The SSS pauses monthly pensions for members under 65 who re-enter the workforce.

- Maximize Your Contributions: Aim to contribute at the highest possible rate relative to your salary. This increases your pension amount.

- Avoid Loan Penalties: Stay on top of your SSS loan repayments. Late payments can incur penalties and reduce your eventual pension amount.

- Maintain Continuous Contributions: Make sure that you’re paying your SSS contributions continuously to get a higher average monthly salary credit.

The SSS also offers pension loans for senior citizens online. Under the enhanced Pension Loan Program (PLP), qualified retirement pensioners can avail of loans equal to 3, 6, 9 or 12 times their basic monthly pension (BMP) plus a Php 1,000 benefit. The loanable amount must not exceed the maximum limit of Php 200,000.

Learn also How to Get

Legit and Fast Loan in 15 Minutes in the Philippines

To qualify for PLP, a retirement pensioner:

- Must be 85 years old at the end of the last month of the loan term

- Must not have any outstanding SSS loan balance and benefit overpayment payable

- Must not have any existing advance pension under the SSS Calamity Assistance Package

- Must be receiving their regular monthly pension for at least 1 month with an active status

But if you’re already close to your retirement years and yet you don’t think that your pension will be enough to cover your day-to-day living expenses after retirement, then you can take out quick cash loans from Digido!

With Digido, you can get easy credit of Php 1,000 minimum and a maximum of Php 25,000 for repeat borrowers – in just five minutes wherever you are! No need to waste your time lining up in a bank!

Simply download the Digido App on your smartphone, sign up for an account, fill out the application form, attach 1 personal valid ID, and wait for your loan to be approved!

Digido will disburse your loan to your chosen bank account or e-wallet and Gcash. Repeat borrowers can receive cash at remittance centers!

Apply now

Learn Useful information about

24 hour payday loan in the Philippines

FAQ

-

How to check sss pension online?To check your SSS pension contributions online, register and log into your My.SSS account. After logging in, hover your cursor over the "Inquiry" tab on the main menu, then select "Contributions" from the dropdown options. This action will direct you to a table showing all your contributions from the beginning of your SSS membership to the current period.

-

How much is my SSS pension?The amount of your SSS pension will largely depend on your contributions, the number of years that you have been an SSS member, and the number of your dependents.

-

How can I apply for an SSS pension online?To apply for SSS pension online, you can go to the SSS member portal to file your retirement benefit claim.

-

How many years can I pay my SSS contributions?If you’re 65 years old or older and still working (or not), you already qualify for SSS technical retirement and won’t need to pay SSS contributions. However, voluntary members can still pay their contributions in their retirement years.

-

How much is the maximum SSS pension?The amount of your SSS pension will depend on which formula will yield the highest amount. The SSS retirement computation will be based on your monthly salary credit and number of years of contributions.

-

How can I compute my SSS AMSC?According to the SSS, you can compute your AMSC by dividing the sum of your last 60 monthly salary credits (MSC) before the semester of contingency by 60. Alternatively, you can also compute your AMSC by dividing the sum of all the MSC paid before the semester of contingency by the number of monthly contributions in the same period.

-

How can I compute my SSS pension?We have listed three formulae above which you can use to compute your SSS pension. You can also use the SSS retirement benefit estimator at https://www.sss.gov.ph/sss/portlets/retirementestimator/retirementEstimator1.jsp.

-

How much is the SSS pension per month?The minimum monthly Retirement Pension is P1,200 if the member has 120 months contribution or at least 10 CYS.

-

How many years should I pay SSS contribution to get pension?You need to have at least 120 paid monthly contributions before retirement.

-

Can I stop paying SSS after 10 years?You can stop paying contributions after you make a final SSS benefit claim for total disability or retirement.

-

What is SSS retirement calculator?The SSS Monthly Pension Calculator is an online tool provided by the Philippines' Social Security System to help members estimate their future pension based on their actual contributions. This calculator takes into account the member's credited years of service (CYS), average monthly salary credit (AMSC), and applicable pension formulas to provide an estimated pension amount.

-

When should you file for SSS retirement benefits?You should file for SSS retirement benefits at least 60 days before the date you wish to start receiving your pension, but not more than one year prior to your actual retirement date.

-

How many months of contributions are needed to avail the SSS pension?To be eligible for the SSS pension, a member needs to have made at least 120 monthly contributions to the Social Security System. However, they can receive a lump sum payment, which is equal to the total amount of contributions made plus interest.

Authors

Digido Reviews

-

MaryVery efficient, fast reliable company. Reasonable rates with very friendly and accommodating customer service! I highly recommend it! 👍👍👍5

-

FrinaI like Digido loan site the most because they low interest rate within and had a prolongation service incase you can't meet your due, it really helps alot in time of need. In addition their loan process speed and disbursement is by far the fastest.5

-

AbigailOne of the Best Loan App. Reliable. Affordable Fees. Thanks, Digido.5

-

NonaIt's very easy to file a loan on this app and it's very convenient, you just need to wait a minute and there you go, loaned amount was already in your account. Thanks Digido, we can rely on this loan platform in times of needs. And it would be better if loan interest will be lessen a little bit.4

-

RollyHi everyone I could recommend this excellent apps coz the agents are approachable and answers the needs in times of emergency. They us give lower interest and loan prolongation in case you could not pay on time. Thanks to them and keep it up. Mabuhay!!!4