All About SSS Contribution Table 2024 (Updated)

Key takeaways:

- Here you will find the Lastest SSS Contribution Table 2024

- The money you contribute to SSS makes you eligible for a loan.

- Need money but you are not entitled to get a SSS loan? Get a quick loan from Digido

- Enjoy 0% interest on your first loan, get up to 25,000 pesos in just a few minutes

Table of Contents

The Social Security System, or widely known as SSS (1), updates the monthly contribution table every year. Many Filipinos are against the SSS new contribution rate. However, it is the Republic Act 11199 that made the increase into reality.

The Social Security System (SSS) of the Philippines has undergone notable changes in its contribution rates from 2023 to 2024. Here’s a summary of the key statistics and changes:

- Contribution Rate Increase: In 2023, the SSS implemented a contribution rate of 14%, which was a rise from the previous rate of 13% in 2021. This increase is part of a scheduled series of rate hikes as mandated by the Social Security Act of 2018 (Republic Act No. 11199).

- Monthly Salary Credit Adjustment: Alongside the rate increase, there was an adjustment in the Monthly Salary Credit (MSC). The minimum MSC was set at PHP 4,000, and the maximum MSC increased to PHP 30,000.

- Fund Life Extension: These adjustments have contributed to extending the projected fund life of the SSS. As of the latest reports, the SSS fund life is now expected to last until 2054, providing a more extended period of benefits for members and pensioners (2).

- Future Plans: The SSS is aiming to gradually increase the contribution rate to 15% by 2025, ensuring the long-term viability and financial health of the fund.

We’re hoping that this article will answer all of your SSS contribution inquiries!

- Only 1 Valid ID needed to Apply

- Up to PHP 25,000 in just 5 minutes Online

- Receive the Money via Bank account or E-wallet

President Rodrigo Duterte signed R.A. 11199 (3), or the Social Security Act of 2018, on February 18, 2019. With this law, the SSS contribution rate should increase every other year until it reaches 15% in the year 2025. The reason behind the increase is to provide retirement security for all the members. And this is not only for the existing pensioners but also for the future retirement of the other members.

Who can Pay the SSS Contribution

If you are employed, your employer is responsible for remitting your SSS contribution. Your employer will deduct the amount of your share directly to your pay. Additionally, your employer will pay his share for your SSS contribution.

But if you are a self-employed individual, you can pay your SSS contributions online. You can remit your share using the SSS mobile app, Gcash, Paymaya, Unionbank online, or BPI online. Note that you first need to sign in to the SSS website and create an account.

How much is the SSS Contribution Rate in 2024

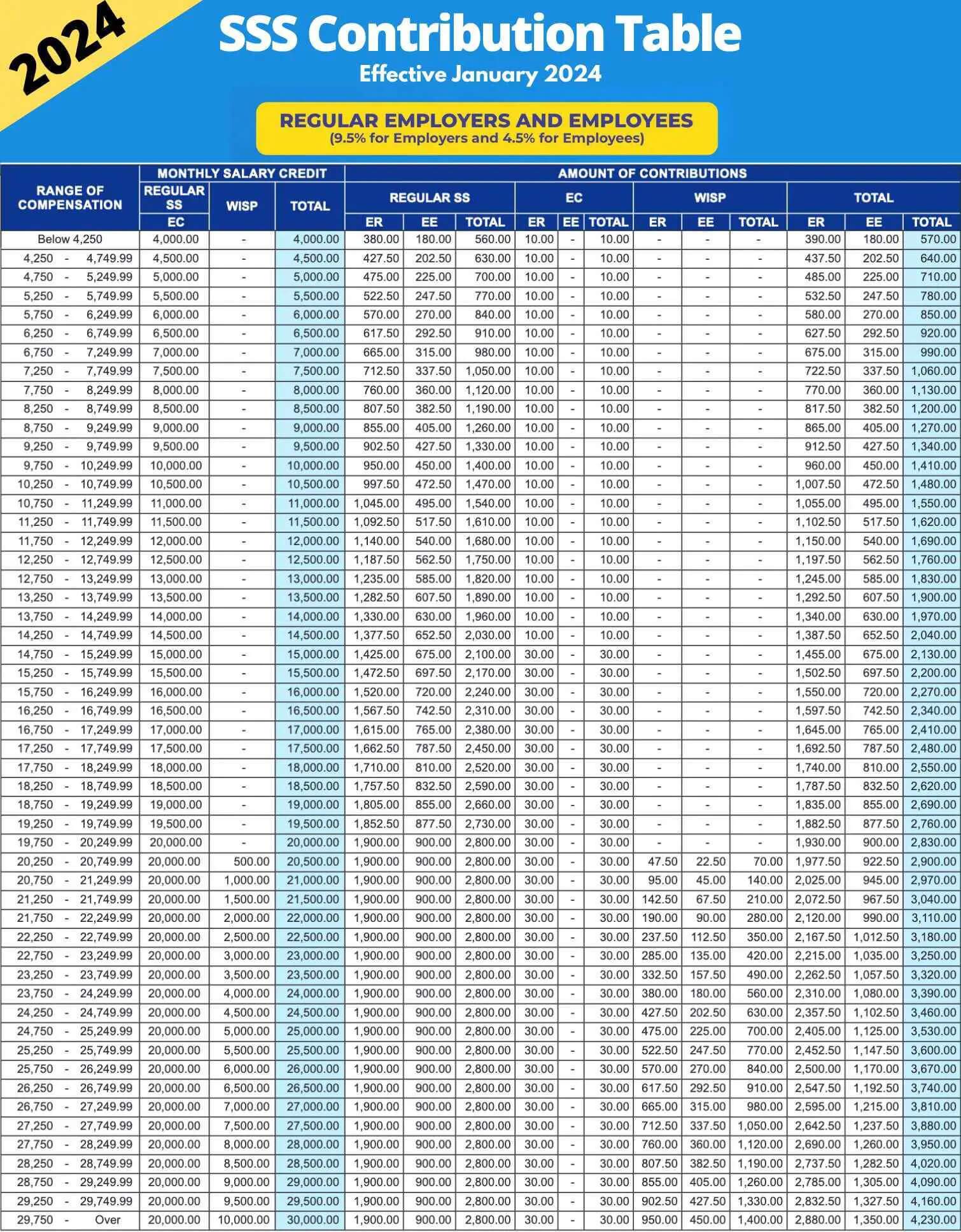

For employed members, the contribution split between the employer and the employee has been adjusted. The employer’s share of the contribution has increased to 9.5%, while the employee’s share remains at 4.5%. This allocation is part of the commitment to strengthen the fund and enhance the benefits provided to members.

Self-employed members, as well as voluntary, non-working spouse, and OFW (Overseas Filipino Worker) members, are responsible for the entire 14% contribution rate based on their declared earnings under the SSS salary bracket. The contribution rate for these members is based on their Monthly Salary Credit (MSC), with the minimum MSC set at PHP 4,000 and the maximum MSC at PHP 30,000.

Need cash for an emergency? Calculate your pre-approved loan amount with Digido calculator:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

Learn all about

7-Eleven Payment Services Guide

SSS Contribution Table 2024 with Monthly Salary Credit

Mentioned above are the computation of each type of SSS members’ contribution. To help you have a further understanding of the contribution tables below, we will identify the categories indicated in the tables.

- Monthly salary credit – according to the Social Security Law, the monthly salary credit is used as the compensation base for contributions and benefits. Using the MSC, the SSS will compute your monthly contribution based on your monthly salary.

- Range of compensation – your compensation will be based on this, depending on your monthly salary.

- Social security (EE)– this reflects the amount of your contribution as an employee.

- Social security (ER) – this reflects your employer’s monthly contribution.

- EC contribution – contributions for the Employee’s Compensation program.

- WISP – The Workers’ Investment and Savings Program (WISP) is indeed a mandatory provident fund scheme managed by the Social Security System (SSS) in the Philippines. It was implemented as part of the Social Security Act of 2018 (Republic Act No. 11199) and began in January 2021. WISP is designed to provide additional savings for members, particularly aimed at enhancing their retirement benefits. All SSS members with a monthly salary of at least Php 20,000 are required to contribute.

- Total contribution – the full amount of your SSS contributions.

Here are the 5 lastest SSS Contribution Tables for 2024 that you can use to calculate your contribution:

1. SSS Contribution Tables For Employers and Employees 2024

For SSS members who are employed, the minimum monthly salary credit is Php 4,000 while the maximum monthly salary credit is Php 30,000. Total contribution will range from Php 570 to Php 4,230.

Lastest SSS Contribution Table 2024 for Employers and Employees

For your convenience, the same table is presented below in a simple table format

| RANGE OF COMPENSATION

|

MONTHLY SALARY CREDIT | AMOUNT OF CONTRIBUTIONS | |||||||||||||||

| REGULAR

SS |

WISP | TOTAL | REGULAR SS | EC | WISP | TOTAL | |||||||||||

| EC | ER | EE | TOTAL | ER | EE | TOTAL | ER | EE | TOTAL | ER | EE | TOTAL | |||||

| Below 4,250 | 4,000.00 | – | 4,000.00 | 380.00 | 180.00 | 560.00 | 10.00 | – | 10.00 | – | – | – | 390.00 | 180.00 | 570.00 | ||

| 4,250 | – | 4,749.99 | 4,500.00 | – | 4,500.00 | 427.50 | 202.50 | 630.00 | 10.00 | – | 10.00 | – | – | 437.50 | 202.50 | 640.00 | |

| 4,750 | – | 5,249.99 | 5,000.00 | – | 5,000.00 | 475.00 | 225.00 | 700.00 | 10.00 | – | 10.00 | – | – | – | 485.00 | 225.00 | 710.00 |

| 5,250 | – | 5,749.99 | 5,500.00 | – | 5,500.00 | 522.50 | 247.50 | 770.00 | 10.00 | – | 10.00 | – | – | 532.50 | 247.50 | 780.00 | |

| 5,750 | – | 6,249.99 | 6,000.00 | – | 6,000.00 | 570.00 | 270.00 | 840.00 | 10.00 | – | 10.00 | – | – | – | 580.00 | 270.00 | 850.00 |

| 6,250 | – | 6,749.99 | 6,500.00 | – | 6,500.00 | 617.50 | 292.50 | 910.00 | 10.00 | – | 10.00 | – | – | – | 627.50 | 292.50 | 920.00 |

| 6,750 | – | 7,249.99 | 7.000.00 | – | 7,000.00 | 665.00 | 315.00 | 980.00 | 10.00 | – | 10.00 | – | – | – | 675.00 | 315.00 | 990.00 |

| 7,250 | – | 7,749.99 | 7,500.00 | – | 7,500.00 | 712.50 | 337.50 | 1,050.00 | 10.00 | – | 10.00 | – | – | 722.50 | 337.50 | 1,060.00 | |

| 7,750 | – | 8,249.99 | 8,000.00 | – | 8,000.00 | 760.00 | 360.00 | 1,120.00 | 10.00 | – | 10.00 | – | – | 770.00 | 360.00 | 1,130.00 | |

| 8,250 | – | 8,749.99 | 8,500.00 | – | 8,500.00 | 807.50 | 382.50 | 1,190.00 | 10.00 | – | 10.00 | – | – | – | 817.50 | 382.50 | 1,200.00 |

| 8,750 | – | 9,249.99 | 9,000.00 | – | 9,000.00 | 855.00 | 405.00 | 1,260.00 | 10.00 | – | 10.00 | – | – | 865.00 | 405.00 | 1,270.00 | |

| 9,250 | – | 9.749.99 | 9,500.00 | – | 9,500.00 | 902.50 | 427.50 | 1,330.00 | 10.00 | • | 10.00 | – | – | – | 912.50 | 427.50 | 1,340.00 |

| 9,750 | – | 10,249.99 | 10,000.00 | – | 10,000.00 | 950.00 | 450.00 | 1,400.00 | 10.00 | – | 10.00 | – | – | – | 960.00 | 450.00 | 1,410.00 |

| 10,250 | – | 10,749.99 | 10,500.00 | – | 10,500.00 | 997.50 | 472.50 | 1,470.00 | 10.00 | – | 10.00 | – | – | – | 1,007.50 | 472.50 | 1,480.00 |

| 10,750 | – | 11,249.99 | 11,000.00 | – | 11,000.00 | 1,045.00 | 495.00 | 1,540.00 | 10.00 | – | 10.00 | – | – | – | 1,055.00 | 495.00 | 1,550.00 |

| 11,250 | – | 11,749.99 | 11,500.00 | – | 11,500.00 | 1,092.50 | 517.50 | 1,610.00 | 10.00 | – | 10.00 | – | – | – | 1,102.50 | 517.50 | 1,620.00 |

| 11,750 | – | 12,249.99 | 12,000.00 | – | 12,000.00 | 1,140.00 | 540.00 | 1,680.00 | 10.00 | – | 10.00 | – | – | – | 1,150.00 | 540.00 | 1,690.00 |

| 12,250 | – | 12,749.99 | 12,500.00 | – | 12,500.00 | 1,187.50 | 562.50 | 1,750.00 | 10.00 | – | 10.00 | – | – | – | 1,197.50 | 562.50 | 1,760.00 |

| 12,750 | – | 13,249.99 | 13,000.00 | – | 13,000.00 | 1,235.00 | 585.00 | 1,820.00 | 10.00 | – | 10.00 | – | – | – | 1,245.00 | 585.00 | 1,830.00 |

| 13,250 | – | 13,749.99 | 13,500.00 | – | 13,500.00 | 1,282.50 | 607.50 | 1,890.00 | 10.00 | – | 10.00 | – | – | – | 1,292.50 | 607.50 | 1,900.00 |

| 13,750 | – | 14,249.99 | 14,000.00 | – | 14,000.00 | 1,330.00 | 630.00 | 1,960.00 | 10.00 | – | 10.00 | – | – | – | 1,340.00 | 630.00 | 1,970.00 |

| 14,250 | – | 14,749.99 | 14,500.00 | – | 14,500.00 | 1,377.50 | 652.50 | 2,030.00 | 10.00 | – | 10.00 | – | – | 1,387.50 | 652.50 | 2,040.00 | |

| 14,750 | – | 15,249.99 | 15,000.00 | – | 15,000.00 | 1,425.00 | 675.00 | 2,100.00 | 30.00 | – | 30.00 | – | – | – | 1,455.00 | 675.00 | 2,130.00 |

| 15,250 | – | 15,749.99 | 15,500.00 | – | 15,500.00 | 1,472.50 | 697.50 | 2,170.00 | 30.00 | – | 30.00 | – | – | – | 1,502.50 | 697.50 | 2,200.00 |

| 15,750 | – | 16,249.99 | 16,000.00 | 16,000.00 | 1,520.00 | 720.00 | 2,240.00 | 30.00 | – | 30.00 | – | – | – | 1,550.00 | 720.00 | 2,270.00 | |

| 16,250 | – | 16,749.99 | 16,500.00 | – | 16,500.00 | 1,567.50 | 742.50 | 2,310.00 | 30.00 | • | 30.00 | – | – | – | 1,597.50 | 742.50 | 2,340.00 |

| 16,750 | – | 17,249.99 | 17,000.00 | – | 17,000.00 | 1,615.00 | 765.00 | 2,380.00 | 30.00 | – | 30.00 | – | – | – | 1,645.00 | 765.00 | 2,410.00 |

| 17,250 | – | 17,749.99 | 17,500.00 | – | 17,500.00 | 1,662.50 | 787.50 | 2,450.00 | 30.00 | – | 30.00 | – | – | – | 1,692.50 | 787.50 | 2,480.00 |

| 17,750 | – | 18,249.99 | 18,000.00 | – | 18,000.00 | 1,710.00 | 810.00 | 2,520.00 | 30.00 | – | 30.00 | – | – | 1,740.00 | 810.00 | 2,550.00 | |

| 18,250 | – | 18,749.99 | 18,500.00 | – | 18,500.00 | 1,757.50 | 832.50 | 2,590.00 | 30.00 | – | 30.00 | – | – | – | 1,787.50 | 832.50 | 2,620.00 |

| 18,750 | – | 19,249.99 | 19,000.00 | – | 19,000.00 | 1,805.00 | 855.00 | 2,660.00 | 30.00 | – | 30.00 | – | – | 1,835.00 | 855.00 | 2,690.00 | |

| 19,250 | – | 19,749.99 | 19,500.00 | – | 19,500.00 | 1,852.50 | 877.50 | 2,730.00 | 30.00 | – | 30.00 | – | – | – | 1,882.50 | 877.50 | 2,760.00 |

| 19,750 | – | 20,249.99 | 20,000.00 | – | 20,000.00 | 1,900.00 | 900.00 | 2,800.00 | 30.00 | – | 30.00 | – | – | – | 1,930.00 | 900.00 | 2,830.00 |

| 20,250 | – | 20,749.99 | 20,000.00 | 500.00 | 20,500.00 | 1,900.00 | 900.00 | 2,800.00 | 30.00 | – | 30.00 | 47.50 | 22.50 | 70.00 | 1,977.50 | 922.50 | 2,900.00 |

| 20,750 | – | 21,249.99 | 20,000.00 | 1,000.00 | 21,000.00 | 1,900.00 | 900.00 | 2,800.00 | 30.00 | – | 30.00 | 95.00 | 45.00 | 140.00 | 2,025.00 | 945.00 | 2,970.00 |

| 21,250 | – | 21,749.99 | 20,000.00 | 1,500.00 | 21,500.00 | 1,900.00 | 900.00 | 2,800.00 | 30.00 | – | 30.00 | 142.50 | 67.50 | 210.00 | 2,072.50 | 967.50 | 3,040.00 |

| 21,750 | – | 22,249.99 | 20,000.00 | 2,000.00 | 22,000.00 | 1,900.00 | 900.00 | 2,800.00 | 30.00 | – | 30.00 | 190.00 | 90.00 | 280.00 | 2,120.00 | 990.00 | 3,110.00 |

| 22,250 | – | 22,749.99 | 20,000.00 | 2,500.00 | 22,500.00 | 1,900.00 | 900.00 | 2,800.00 | 30.00 | – | 30.00 | 237.50 | 112.50 | 350.00 | 2,167.50 | 1,012.50 | 3,180.00 |

| 22,750 | – | 23,249.99 | 20,000.00 | 3,000.00 | 23,000.00 | 1,900.00 | 900.00 | 2,800.00 | 30.00 | – | 30.00 | 285.00 | 135.00 | 420.00 | 2,215.00 | 1,035.00 | 3,250.00 |

| 23,250 | – | 23,749.99 | 20,000.00 | 3,500.00 | 23,500.00 | 1,900.00 | 900.00 | 2,800.00 | 30.00 | – | 30.00 | 332.50 | 157.50 | 490.00 | 2,262.50 | 1,057.50 | 3,320.00 |

| 23,750 | 24,249.99 | 20,000.00 | 4,000.00 | 24,000.00 | 1,900.00 | 900.00 | 2,800.00 | 30.00 | – | 30.00 | 380.00 | 180.00 | 560.00 | 2,310.00 | 1,080.00 | 3,390.00 | |

| 24,250 | – | 24,749.99 | 20,000.00 | 4,500.00 | 24,500.00 | 1,900.00 | 900.00 | 2,800.00 | 30.00 | – | 30.00 | 427.50 | 202.50 | 630.00 | 2,357.50 | 1,102.50 | 3,460.00 |

| 24,750 | – | 25,249.99 | 20,000.00 | 5,000.00 | 25,000.00 | 1,900.00 | 900.00 | 2,800.00 | 30.00 | – | 30.00 | 475.00 | 225.00 | 700.00 | 2,405.00 | 1,125.00 | 3,530.00 |

| 25,250 | – | 25,749.99 | 20,000.00 | 5,500.00 | 25,500.00 | 1,900.00 | 900.00 | 2,800.00 | 30.00 | – | 30.00 | 522.50 | 247.50 | 770.00 | 2,452.50 | 1,147.50 | 3,600.00 |

| 25,750 | – | 26,249.99 | 20,000.00 | 6,000.00 | 26,000.00 | 1,900.00 | 900.00 | 2,800.00 | 30.00 | – | 30.00 | 570.00 | 270.00 | 840.00 | 2,500.00 | 1,170.00 | 3,670.00 |

| 26,250 | – | 26,749.99 | 20,000.00 | 6,500.00 | 26,500.00 | 1,900.00 | 900.00 | 2,800.00 | 30.00 | – | 30.00 | 617.50 | 292.50 | 910.00 | 2,547.50 | 1,192.50 | 3,740.00 |

| 26.750 | – | 27,249.99 | 20,000.00 | 7,000.00 | 27,000.00 | 1,900.00 | 900.00 | 2,800.00 | 30.00 | – | 30.00 | 665.00 | 315.00 | 980.00 | 2,595.00 | 1,215.00 | 3,810.00 |

| 27,250 | – | 27,749.99 | 20,000.00 | 7,500.00 | 27,500.00 | 1,900.00 | 900.00 | 2,800.00 | 30.00 | – | 30.00 | 712.50 | 337.50 | 1,050.00 | 2,642.50 | 1,237.50 | 3,880.00 |

| 27,750 | – | 28,249.99 | 20,000.00 | 8,000.00 | 28,000.00 | 1,900.00 | 900.00 | 2,800.00 | 30.00 | – | 30.00 | 760.00 | 360.00 | 1,120.00 | 2,690.00 | 1,260.00 | 3,950.00 |

| 28,250 | – | 28,749.99 | 20,000.00 | 8,500.00 | 28,500.00 | 1,900.00 | 900.00 | 2,800.00 | 30.00 | – | 30.00 | 807.50 | 382.50 | 1,190.00 | 2,737.50 | 1,282.50 | 4,020.00 |

| 28,750 | – | 29,249.99 | 20,000.00 | 9,000.00 | 29,000.00 | 1,900.00 | 900.00 | 2,800.00 | 30.00 | – | 30.00 | 855.00 | 405.00 | 1,260.00 | 2,785.00 | 1,305.00 | 4,090.00 |

| 29,250 | – | 29,749.99 | 20,000.00 | 9,500.00 | 29,500.00 | 1,900.00 | 900.00 | 2,800.00 | 30.00 | – | 30.00 | 902.50 | 427.50 | 1,330.00 | 2,832.50 | 1,327.50 | 4,160.00 |

| 29,750 | – | Over | 20,000.00 | 10,000.00 | 30,000.00 | 1,900.00 | 900.00 | 2,800.00 | 30.00 | – | 30.00 | 950.00 | 450.00 | 1,400.00 | 2,880.00 | 1,350.00 | 4,230.00 |

Learn here how to

use Dragonpay App

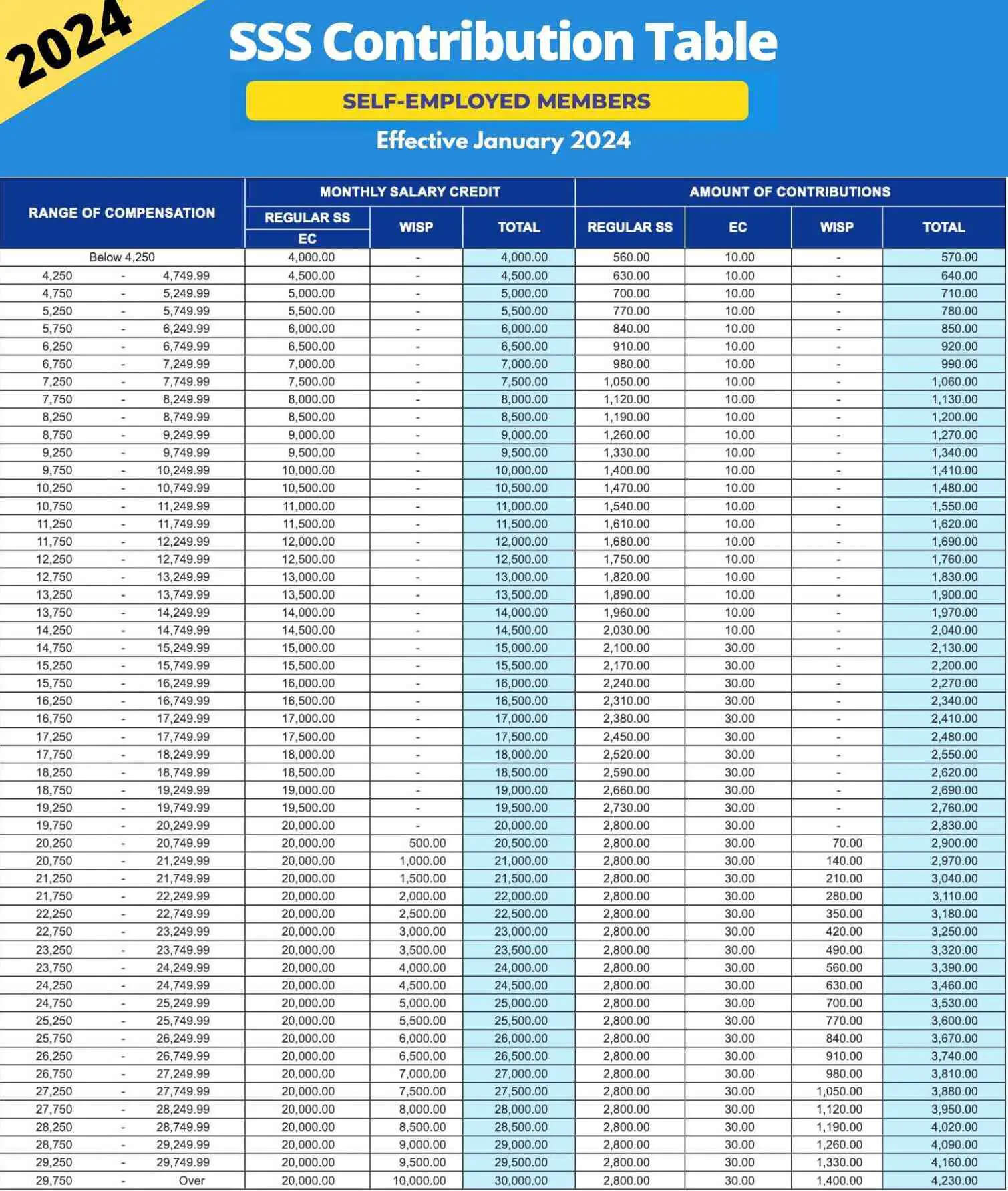

2. SSS Self-employed Contribution Table 2024

The minimum total monthly contributions for self-employed SSS members is Php 570 while the maximum total monthly contributions is Php 4,320.

SSS Contribution Table 2024 for Self-employed Members

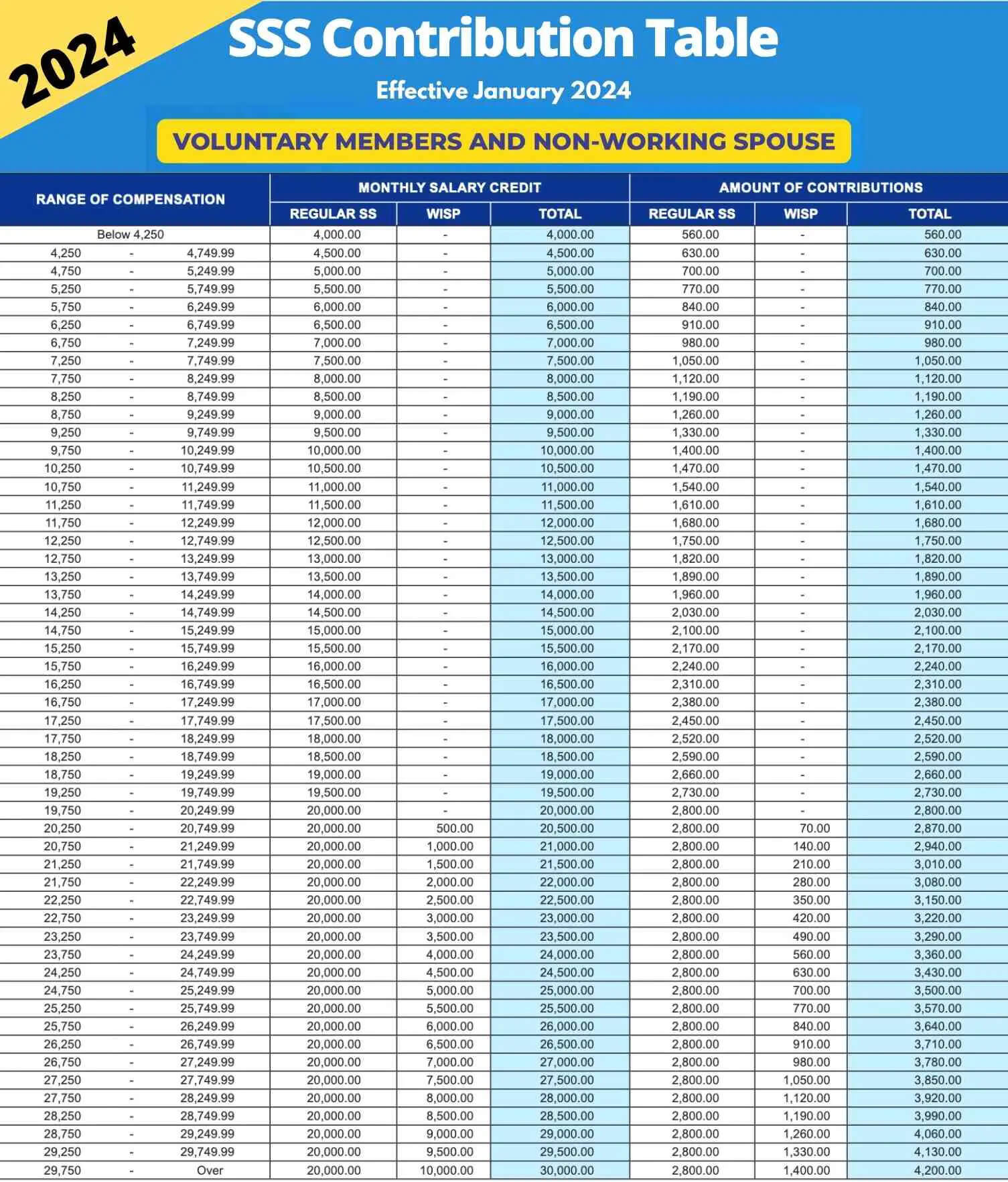

3. SSS Contribution Table for Voluntary and Non-Working Spouse Members

The same goes for voluntary and non-working spouse members: SSS minimum contribution per month is Php 560 and the maximum is Php 4,200.

SSS Contribution Table 2024 for Voluntary and Non-Working Spouse Members 2024

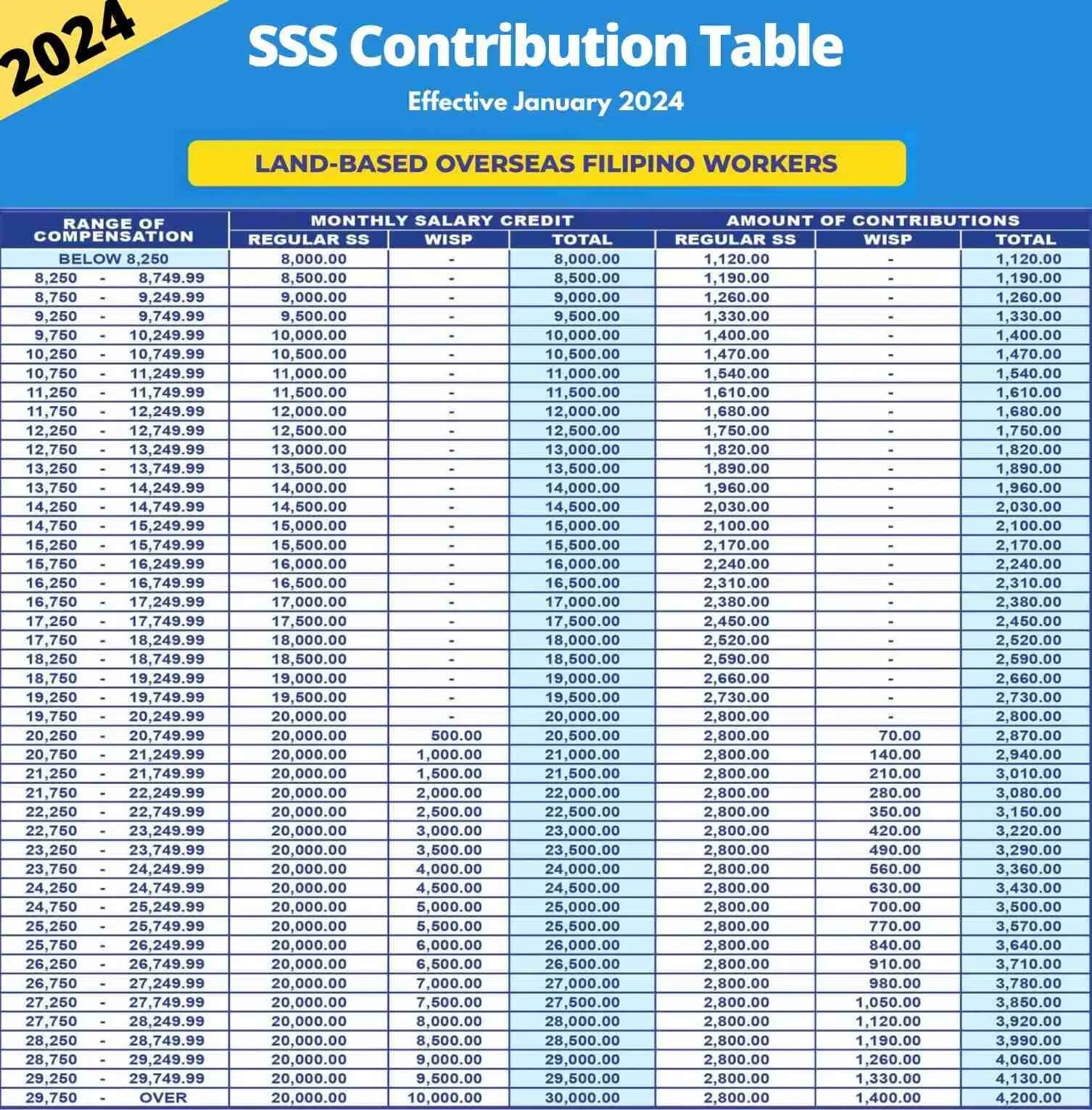

4. SSS Contribution Table for OFW Members for 2024

For SSS OFW contributions, members who are working overseas have a minimum monthly salary credit is Php 8,000.

SSS Contribution Table 2024 for OFW Members

5. SSS Contribution Table for Household Employers and Kasambahay Members 2024

Household employers and local domestic workers will have a minimum sss contribution and maximum sss contribution mounthly – of Php 150 and Php 4,230, respectively.

SSS Contribution Table 2024 For Household Employers and Kasambahay

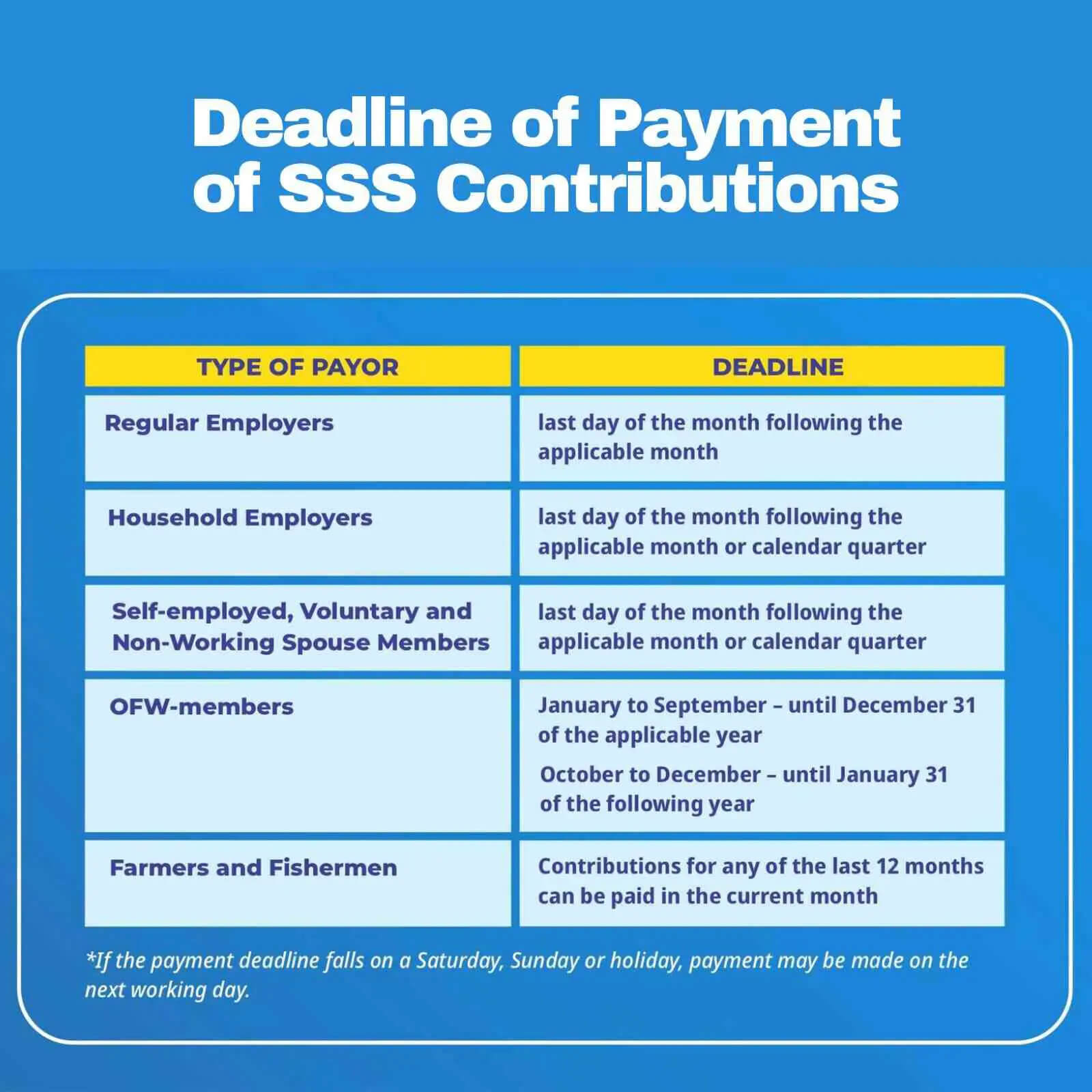

Deadline for SSS Contribution Payment 2024

The due date for remitting SSS contributions by regular employers falls on the final day of the month following the relevant month or reporting period. This same timeframe applies to household employers for their respective month or quarter, as applicable. The subsequent tables outline the payment deadlines for voluntary members, self-employed individuals, Overseas Filipino Workers (OFW), non-working spouses, farmers, and fishermen.

| TYPE OF PAYOR | DEADLINE |

|---|---|

| Regular Employers | last day of the month following the applicable month |

| Household Employers | last day of the month following the applicable month or calendar quarter |

| Self-employed, Voluntary and Non-Working Spouse Members | last day of the month following the applicable month or calendar quarter |

| OFW-members | January to September – until December 31 of the applicable year |

| October to December – until January 31 of the following year | |

| Farmers and Fishermen | Contributions for any of the last 12 months can be paid in the current month |

Note: If the payment deadline falls on a Saturday, Sunday or holiday, payment may be made on the next working day.

Learn all about

In-Demand Jobs in the Philippines

How to Compute Monthly SSS Contribution

As of 2024, the SSS contribution rate has been increased to 14%, up from the previous rate of 13%. This increase is in line with the provisions of Republic Act No. 11199, also known as the Social Security Act of 2018. The aim of this increase is to ensure the financial viability of the SSS fund, support higher benefit disbursements to members, and extend the fund’s life until 2054.

How to Compute SSS Contribution for Employed Members

- Step 1. Identify your basic monthly rate or your gross income. Gross income includes the overtime pay and holiday pay less the absences for the period.

- Step 2. Refer to the SSS contribution chart or the monthly SSS voluntary contribution table 2024. Under the Range of Compensation column, navigate the salary SSS bracket where your gross income falls. Find its corresponding MSC (Monthly Salary Credit) under the Total column.

Note that the Mandatory Provident Fund only applies to members having a gross income that exceeds PHP 30,000. - Step 3. Under the EE column, find your monthly deduction that corresponds to your MSC. For example, if your MSC is PHP 20,000, then your employer will deduct your pay of PHP 900.

- Step 4. To get your total contribution (including the employer share), you can refer to the Total column at the rightmost part of the table. Thus, if your MSC is PHP 20,000 your TOTAL monthly contribution is PHP 2,830. This consists of your share of PHP 900 and your employer’s share of PHP 1,930.

For better understanding, you can compute your total contribution this way:

(MSC x Contribution Rate) + EC Contribution

PHP 20,000 x 14% = PHP 2,800 + PHP 30 = PHP 2,830

Note that the contribution rate is 4.5% for the employee and 9.5% for the employer. Hence, PHP 900 is for the employee and PHP 1,930 is for the employer.

But what if you exceed the PHP 20,000 threshold?

For salaries above PHP 20,000, the additional WISP contribution will also be included in the total contribution. The WISP is calculated separately and added to the regular SSS contribution. Just add the amount from the ‘WISP’ column to calculate the cost of contributions.

How to Compute SSS Self Employed Contributions

- Step 1. Refer to the monthly income you declared on your Form E-1. Under the Range of Compensation column, navigate the salary bracket where your gross income falls. Then, find its corresponding MSC (Minimum Monthly Salary Credit) under the Total column.

- Step 2. Calculate your total monthly contribution this way:

(MSC x Contribution Rate) + EC Contribution

Note that with the SSS new contribution table, self-employed members can now pay for EC contribution themselves as well. Therefore, if your MSC is PHP 20,000, you need to remit the total contribution of PHP 2,830:

(PHP 20,000 x 14%) + PHP 30 = PHP 2,830

If you have noticed, the computations for both employed and self-employed are the same. They only differ in the amount to remit, as with employed individuals, the employer has a share with their contributions.

The maximum monthly SSS contribution for self employed and employed members is PHP 4,230.

Learn all about

Multi-Purpose Loans in the Philippines

How to Compute SSS Contributions For OFW members

- Step 1. Under the Range of Compensation column, navigate the salary bracket where your gross income falls. Then, find its corresponding MSC or Monthly Salary Credit under the Total column. For OFWs, the range of MSC used to compute the contribution is between PHP 8,250 and PHP 29,750 and over

- Step 2. Calculate your total monthly contribution this way (if your MSC is PHP 20,000):

MSC x Contribution rate = Monthly Contribution

The contribution rate for OFWs is 14% of the MSC. For instance, if your MSC is PHP 20,000, the contribution would be PHP 2,800.

Consider the WISP: OFWs with an MSC exceeding PHP 20,000 are also covered by the MPF under the Workers’ Investment and Savings Program (WISP), which requires an additional contribution. The amount varies based on your MSC you can find in the latest SSS contribution table for OFW members below.

The maximum monthly SSS contribution for OFWs is set at PHP 4,200, applicable if your MSC reaches the maximum of PHP 30,000.

Read here How to Get

OFW Loan in the Philippines

SSS Contribution for Household Employers and Kasambahay

As of 2024, the Social Security System (SSS) in the Philippines has specific contribution rates for household employers and their kasambahays (household employees).

The total monthly SSS contributions for kasambahays range from PHP 150 to PHP 4,230, depending on the kasambahay’s monthly salary. The contribution is divided between the employer and the kasambahay, with the employer shouldering a larger portion to ease the burden on the kasambahay.

Household employers are responsible for registering their kasambahays with the SSS and ensuring the timely payment of contributions. Employers must deduct the kasambahay’s share of the contribution from their salary and add the employer’s share before remitting the total amount to the SSS. Employers are also responsible for filing the remittance detail with the SSS.

If the monthly wage of the house helper is below PHP 5,000, the household employer should pay the full monthly contribution. But if it is above PHP 15,000, the SSS computation and procedure for the monthly contribution are the same with the employed members.

- Step 1. Under the Range of Compensation column, find your salary bracket and its corresponding MSC under the Total column.

- Step 2. Under the EE column, find your monthly deduction that corresponds to your MSC. If your MSC is PHP 5,000 your total monthly contribution is PHP 225 which is 4.5% of the contribution rate.

Meanwhile, your employer will share the 9.5% or PHP 475 to complete the 14% rate, plus PHP 10 EC contribution.

(MSC x Contribution Rate) + EC Contribution

PHP 5,000 x 14% = PHP 700 + PHP 10 = PHP 710

Learn all about

Instant Loan For Unemployed

SSS Contribution for Voluntary and Non-working spouse members

To compute the SSS contribution for voluntary and non-working spouse members in 2024, you should follow these steps:

- Step 1. Identify the Monthly Salary Credit (MSC). The MSC is based on your average monthly income. For voluntary members, this ranges from PHP 1,000 to PHP 30,000. For non-working spouses, the contribution amount is fixed and not based on income.

- Step 2. Calculate the Contribution Amount: The contribution rate for both voluntary and non-working spouse members is 14% of the MSC. For example, if a voluntary member’s MSC is PHP 15,000, the monthly contribution would be PHP 2,100 (PHP 15,000 x 14%).

The maximum contribution for voluntary and non-working spouse members is capped at PHP 4,200, which corresponds to the maximum MSC of PHP 30,000.

Non-working spouses have a fixed monthly contribution amount. As of 2024, this amount is PHP 240 per month, which is equally shared between the non-working spouse and their employed spouse (PHP 120 each).

Non-working spouses can contribute for up to 60 months or 5 years. After this period, they should shift to voluntary contributions based on their own income or MSC.

What is the SSS Workers’ Investment and Savings Program

If you are an employee, you have probably noticed a significant increase in your SSS deduction. You may be confused because you know that the contribution rate has increased only by 1%. To make it clear, the additional charge is not a contribution to the usual SSS program. It is the Workers’ Investment and Savings Program (WISP).

The SSS Mandatory Provident Fund, as of 2024, is known as the Workers’ Investment and Savings Program (WISP). WISP was implemented in January 2021 as a compulsory provident fund program under Republic Act No. 11199 (the Social Security Act of 2018). It is designed to provide additional retirement benefits to SSS members.

WISP automatically applies to all SSS members who are contributing to the regular program and have a monthly salary credit (MSC) that exceeds PHP 20,000. The SSS has also introduced WISP Plus, a voluntary retirement savings scheme for SSS members, which is different from the mandatory WISP

The contributions in WISP are placed in guaranteed investments and are tax-free. The returns on these investments are intended to enhance the retirement benefits of the members. In its first year of implementation, WISP generated significant income and offered returns higher than key market indicators.

The advantages include:

✅ Tax-free, guaranteed earnings;

✅ Contributions placed in guaranteed investments.

SSS will divide your provident fund into 3 account types that will surely benefit you:

✅ Additional retirement / disability benefit

✅ Medical benefit

✅ General-purpose (education, housing, livelihood, unemployment).

→ For detailed information, you can refer to the article – What is WISP SSS in the Philippines

Tips and Information on SSS Contributions and Payments

- If possible, always keep a copy of your SSS contribution table based on your category (employed, self-employed, voluntary, etc.) That way, you’re keeping track of how much you are paying contributions for SSS and how often. It can also help you if you’re planning to apply for a SSS loan or avail of its benefits.

- There are lots of ways to get an SSS payment reference number! You can get your PRN through the SSS member website, through the SSS mobile app, through text, through email, through the SSS hotline, or by going to an SSS branch near you.

- You cannot make a retroactive SSS payment for the months that you have missed. However, you can still pay your SSS contributions for the succeeding months.

- If you are an OFW, you can assign a loved one here in the Philippines to pay for your SSS contributions. Just make sure that your representative has your PRN and other payment details.

- You can view or check your SSS contributions online through the SSS website! Just go to the SSS members’ portal and log in with your username and password.

Learn all about

Loans For Students in the Philippines

Why did SSS Contributions Increase?

As it was mentioned at the beginning of this article, the hike of SSS contribution is due to R.A. 11199. The purpose of this increase is to provide additional benefits for the future retirement of members.

The financial assistance of SSS should cope with its members’ growing demands. Since the value of money decreases over time, the old contribution rate is not sufficient to provide significant help. Thus, with the increase of the SSS contribution plus the provident fund, members can assure better benefits. Check out the new sss payment schedule for your job.

Who is Eligible for an SSS Loan

Members can apply for a salary loan to SSS given that they:

One-Month Salary Loan

For members applying for a one-month salary loan, they must have at least thirty-six (36) posted monthly contributions, six (6) of which should be within the last twelve (12) months prior to the month of filing the application.

✅ Have at least 36 months total SSS contributions

✅ Have 6 months of SSS contributions in the last 12 months.

Two-Month Salary Loan

For a two-month salary loan, members must have seventy-two (72) posted monthly contributions, with six (6) of these contributions within the last twelve (12) months before the application month.

✅ Have at least 72 months of posted SSS contributions

✅ Have 6 months of contributions in the last 12 months.

If you are not sure how many months you have contributed, you can check your member account on My.SSS portal.

Вesides the contributions, members must also ensure that their employer is up-to-date in SSS contributions payments, have not been granted a final benefit (like total permanent disability, retirement, or death), be under sixty-five (65) years of age at the time of application, and not have been disqualified due to fraud committed against the SSS.

Where to Get Money if I am Not Entitled to a SSS Loan?

Need money but you are not entitled to get a SSS loan?

If yes, then you came to the right place. Digido offers you instant cash loans for Filipinos in need of funds. Whether it’s for an emergency, house repairs, or any financial contingencies, Digido can provide the money you need.

Here are some of the advantages of receiving loans at Digido:

👉 You can borrow up to PHP 25,000 online with 0% interest for first loan

👉 It’s easier and convenient to apply. Digido only requires 1 government valid ID, and you just need to enter the necessary data into the online application

👉 You will receive your money immediately after signing the contract. You have the option to receive the money via bank transfers, Cebuana Cash Pick-up, or Gcash

👉 Repeat borrowers can avail of installment loans – 95% of applications get approved

Apply now

Conclusion

Note that when computing for your monthly contribution, always check the updates of SSS and updated SSS contribution table 2024. Moreover, make sure that you have updated contributions posted in their system to avoid any problems with your benefits. As a member of SSS, you should also know all new guidelines released by the agency. In summary, with the implemented law, SSS can provide you and the next generation with better retirement assistance in the future.

Articles Sources

- Republic of the Philippines Social Security System https://www.sss.gov.ph/

- Contribution rate increase boosts SSS fund life by 22 years https://www.sss.gov.ph/sss/

- Republic Act No. 11199 https://www.officialgazette.gov.ph/…

Digido Reviews

-

AzenVery fast and reliable source of money. Easy payment option also 🙂5

AzenVery fast and reliable source of money. Easy payment option also 🙂5 -

Miguel S.I was looking for the latest sss contribution table and remembered an old friend of mine! I have borrowed here several times before and have always been very satisfied. It's fast and easy to use. Great platform, I'm glad they are evolving!5

Miguel S.I was looking for the latest sss contribution table and remembered an old friend of mine! I have borrowed here several times before and have always been very satisfied. It's fast and easy to use. Great platform, I'm glad they are evolving!5 -

JoelDigido is the very best loan app I had ever applied with. Reliable loan Co. especially in this difficult times. Kudos to the mgt. Keep up the good work and the great service to your clients. Highly recommended. God bless and more power🙏4

JoelDigido is the very best loan app I had ever applied with. Reliable loan Co. especially in this difficult times. Kudos to the mgt. Keep up the good work and the great service to your clients. Highly recommended. God bless and more power🙏4 -

NonaOne of the Best Loan App. Reliable. Affordable Fees. Thanks, Digido.4

NonaOne of the Best Loan App. Reliable. Affordable Fees. Thanks, Digido.4 -

AndresEven if you regularly pay to sss self employed contribution obtaining a small loan for urgent needs can be time-consuming. That's why I turn to online lenders. I installed this application and gave it a try, and they approved my application. Overall, no complaints so far, everything is good here!4

AndresEven if you regularly pay to sss self employed contribution obtaining a small loan for urgent needs can be time-consuming. That's why I turn to online lenders. I installed this application and gave it a try, and they approved my application. Overall, no complaints so far, everything is good here!4 -

JosephVery convenient when in need. Fast approval and long term payment you can extend the payment with reasonable cost. Thanks and more power!5

JosephVery convenient when in need. Fast approval and long term payment you can extend the payment with reasonable cost. Thanks and more power!5 -

EricaI tried Digido out of curiosity. To cut to the chase, Digido is ideal for "petsa de peligro" days where it's almost payday but also your bills is on due date because they have short payment terms (I was given 7 days term for my first loan). You can get approved as fast as 30mins and the loan will reflect immediately.4

EricaI tried Digido out of curiosity. To cut to the chase, Digido is ideal for "petsa de peligro" days where it's almost payday but also your bills is on due date because they have short payment terms (I was given 7 days term for my first loan). You can get approved as fast as 30mins and the loan will reflect immediately.4

FAQ

-

How much is the contribution for SSS for kasambahay in 2024The total monthly SSS contributions for kasambahays range from PHP 150 to PHP 4,230 - maximum SSS contribution, depending on the kasambahay's monthly salary

-

Where can I pay my SSS contribution?If you are an employee member, your employer will file your SSS contributions on your behalf. However, if you are a voluntary or self-employed member, you will need to pay for your own contributions. You can do so through SSS tellering branches, SSS partner banks, non-bank collecting partners (Bayad Center, SM, GCash, etc.) or abroad over-the-counter for OFW members.

-

How can I update my SSS contributions online?You can update your SSS contributions by logging into the SSS member website. On the main page, select “Payment Reference Number (PRN) - Contributions” then “Generate PRN”. Select your membership type, applicable period of your payment, and your new SSS contribution amount. Copy the payment reference number, make your payment, and you’re all done! You can also update your SSS contributions through the SSS mobile app. You can do your My SSS contribution verification through the SSS member portal.

-

Is paying for SSS contributions really mandatory?Yes, paying for your SSS contributions is mandatory if you are a private employee, an employer, self-employed, or an OFW. However, you are not mandated to pay for SSS contributions if you are a voluntary or non-working spouse, but it could help if you want to claim for SSS benefits or apply for an SSS loan in the future.

-

Can I change the amount of my SSS contribution?Yes, you can change the amount of your SSS contribution or monthly salary credit if you are a voluntary, self-employed, or OFW member. This will happen if your monthly salary has changed. However, SSS employee members cannot change the amount of their contributions on their own, but their employers can change the amount of contributions through the SSS member page.

-

I am a voluntary member but I’ve stopped my SSS payments. Can I still continue?Yes! You can still continue your SSS contributions as a voluntary member even if you’ve stopped. You can resume paying contributions through SSS tellering facilities, partner banks, partner online payment channels, or over-the-counter.

-

How much is SSS contribution for unemployed?the Social Security System (SSS) in the Philippines requires contributions from various types of members, including self-employed, voluntary members, non-working spouses, household employers, and kasambahays. The specific contribution amount depends on the member's income bracket and category. For example, self-employed members, voluntary members, and non-working spouses make contributions based on their declared monthly earnings. The contribution rate for these categories is structured to align with their income levels, providing a range of contribution amounts tailored to different income brackets. Similarly, household employers are responsible for the SSS contributions of their kasambahays. This ensures that household employees receive the benefits of social security coverage.

-

How many years can I pay my SSS contributions?You only need to have at least 120 monthly SSS contributions in order to qualify for retirement pension, but its is better if you continue with your contributions if you want to obtain a highe monthly pension.

-

How much is SSS contribution per month in 2024?If you are employed, the current SSS contribution rate is 14% of your monthly salary credit not lower than P4,000 and not exceeding P30,000, and this is being shared by you and your employer at 4,5 % and 9,5 %, respectively.

-

What is the new SSS contribution effective 2024 year?Based on the circular, the SSS enacted Republic Act No. 11199, otherwise known as the Social Security Act of 2018, which includes a provision that states there will be changes to the contribution effective year 2021, as follows: Social Security (SS) contribution rate increases to 14%

-

How many years should I pay SSS contribution?If with less than 120 monthly contributions, the member shall be entitled to a lump sum amount equivalent to the contributions paid by him/her and on his/her behalf. However, member has the option to continue paying contributions to complete the 120 months to become eligible for monthly pension.

Authors

Digido Reviews

-

AzenVery fast and reliable source of money. Easy payment option also :)5

-

Miguel S.I was looking for the latest sss contribution table and remembered an old friend of mine! I have borrowed here several times before and have always been very satisfied. It's fast and easy to use. Great platform, I'm glad they are evolving!5

-

JoelDigido is the very best loan app I had ever applied with. Reliable loan Co. especially in this difficult times. Kudos to the mgt. Keep up the good work and the great service to your clients. Highly recommended. God bless and more power🙏4

-

NonaOne of the Best Loan App. Reliable. Affordable Fees. Thanks, Digido.4

-

AndresEven if you regularly pay to sss self employed contribution obtaining a small loan for urgent needs can be time-consuming. That's why I turn to online lenders. I installed this application and gave it a try, and they approved my application. Overall, no complaints so far, everything is good here!4

-

JosephVery convenient when in need. Fast approval and long term payment you can extend the payment with reasonable cost. Thanks and more power!5

-

EricaI tried Digido out of curiosity. To cut to the chase, Digido is ideal for "petsa de peligro" days where it's almost payday but also your bills is on due date because they have short payment terms (I was given 7 days term for my first loan). You can get approved as fast as 30mins and the loan will reflect immediately.4