What is WISP SSS in the Philippines and What are the SSS WISP Benefits

Key takeaways:

- SSS WISP is a savings initiative obligatory for employees with an MSC of over PHP 20,000

- The WISP SSS contribution is 14%

- WISP Plus is a voluntary savings program for SSS members with withdrawal options available

- The WISP Plus entry contribution is PHP 500

- The WISP program doesn’t allow withdrawals. If you are in need of money, request an online loan from Digido, a state-licensed lender with a 90% approval rate

Table of Contents

More and more people start planning for their happy and thriving retirement in advance. However, it is a serious challenge to find a trustworthy financial institution to allocate your life-saving to. To assist the Filipino residents on the matter, the Social Security System (SSS) founded the Worker Investment and Savings Program (WISP) for its members. In this article we will explore how SSS WISP works, who can sign up for it, and what bonuses it offers.

What is WISP in SSS?

The Social Security System (SSS) is a government agency in the Philippines that provides social protection programs. One of them was launched in 2021 and is called the Workers’ Investment and Savings Program (WISP). The benefits that the initiative offers are exempt from taxes and based on the market performance.

The program was designed for SSS members with a monthly salary credit (MSC) of over PHP 20,000. The MSC is announced to rise to PHP 30,000 in 2024 and PHP 35,000 in 2025 (1).

Learn all about

SSS Pension Computation in the Philippines

- Up to PHP 25,000 In only 4 minutes Online

- Only 1 Valid ID needed to Apply

- 0% Interest for First loan

Is SSS WISP mandatory?

There are two types of WISP memberships: voluntary and mandatory, depending on the individual’s income and their employment mode.

- All Filipino employees working in private companies, regardless of their employment status (regular, contractual, or casual), must be registered in SSS. If their MSC exceeds PHP 20,000, they are automatically admitted into the program.

- Self-employed individuals (SE), voluntary members (VM), and overseas Filipino workers (OFM) under the age of 60 are the categories of contributors who reserve the right to participate in WISP by choice. There are two conditions though: they should be active SSS members and make their SSS contributors in a timely manner.

Your membership type defines how much you will have to contribute to WISP SSS. You can check the calculations in the SSS WISP computation tables below.

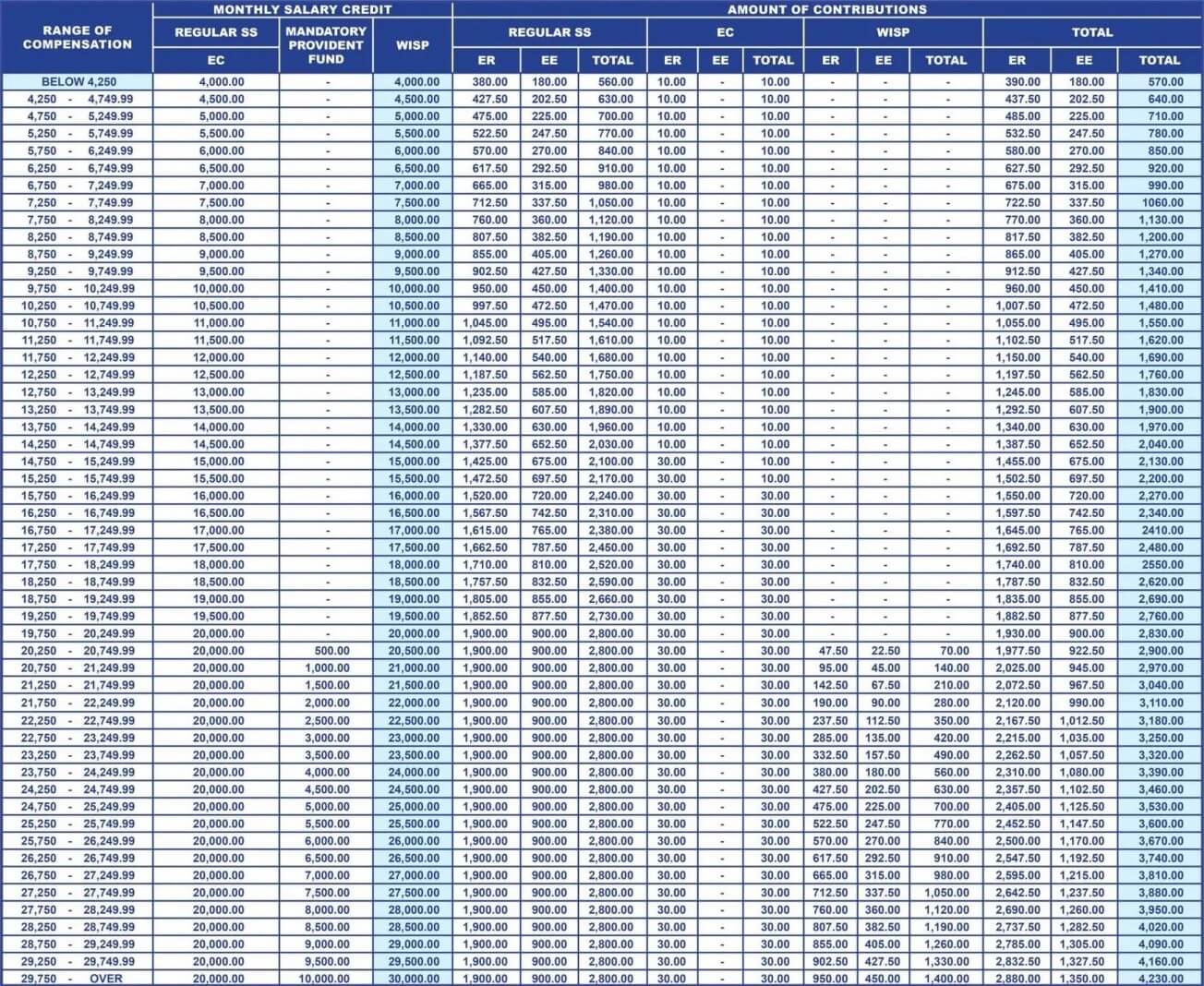

SSS WISP table for automatic enrollees (2):

Since the beginning of this year, the overall monthly contribution rate of an employed SSS member has risen from 13% to 14%. However, the employee (EE) pays only 4.5% ― the major portion, 9.5%, is covered by the employer (ER).

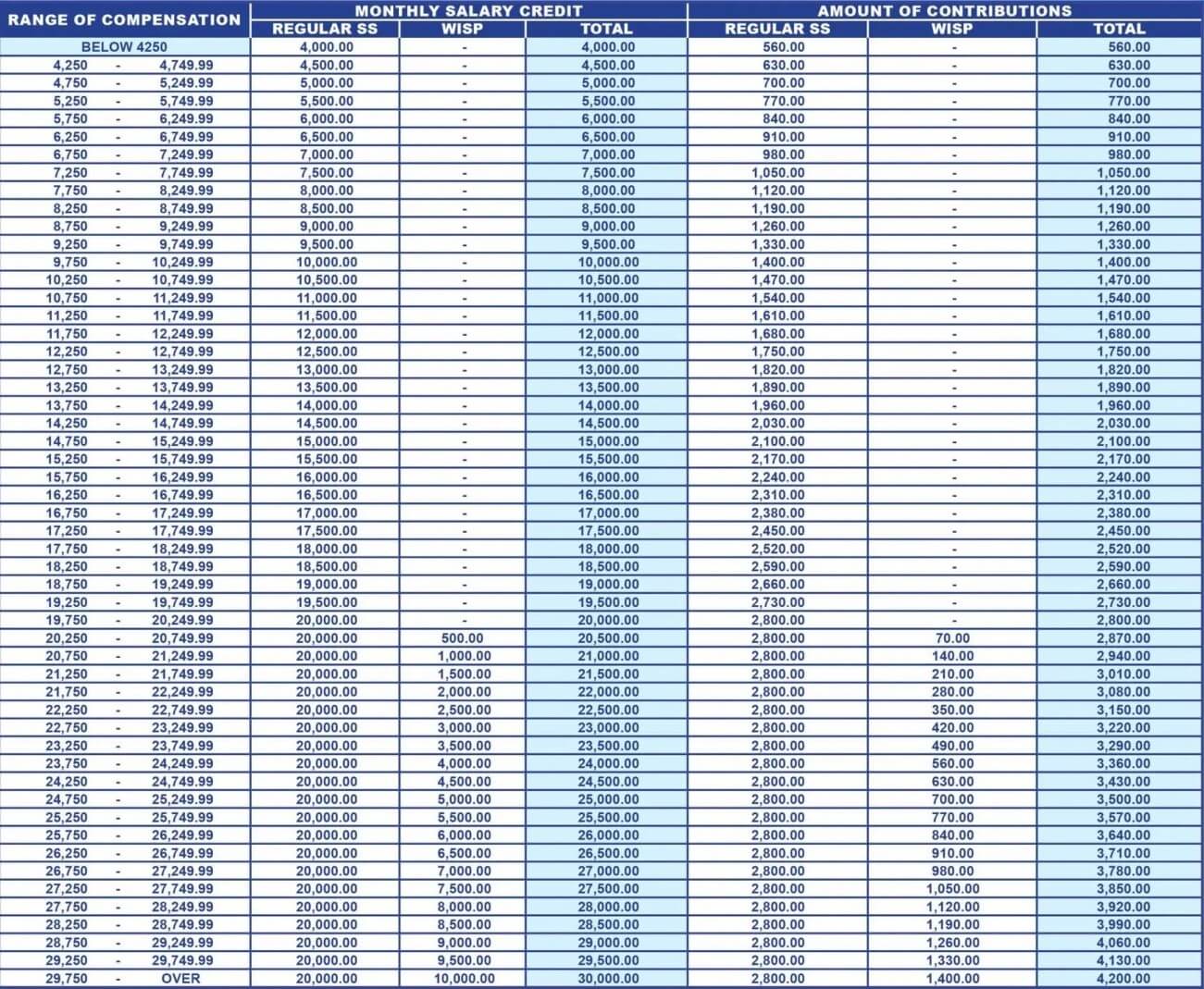

SE/VM/OFW WISP SSS contribution table (3):

In the case of the voluntary membership categories, the rate is the same, 14%. SEs, VMs, and OFWs transfer this portion of their SSS reported monthly salary to the fund by themselvcheck tes.

If you want to figure out the exact WISP rate, he status of your total contributions and earnings, go to your personal profile on the SSS portal.

Want to know more? Learn

All About SSS Monthly Contribution Table

What are the SSS WISP Benefits?

WISP offers additional benefits apart from those provided under the standard SSS program. These include retirement pensions, total disability and death survivorship benefits.

Being a member of WISP has its pros:

- By making contributions above the regular ones, you’ll save for your retirement quicker.

- WISP is a safe initiative regulated by the government, so you will secure your funds and accumulate competitive tax-free interest while you work.

- WISP allows you to get what you’ve saved in a lump sum or monthly payments, or so-called annuity. If you choose the annuity option, the fund will transfer regular top-up payments to your account until the total amount of your savings is fully repaid. Be wary that the minimum reimbursement period is 15 years.

Disadvantages of Using WISP

The program also has its cons such as:

- Your total accumulated account value (TAV) will be the basis for calculating the additional payments that will be released alongside pension, total disability or death benefits. Therefore, your WISP compensation will depend on how much you have contributed. The less you’ve paid, the less you’ll get.

- WISP doesn’t have an early withdrawal option, and the benefits are only payable after you fill in the final application for benefits.

Learn How to

Apply for a Subsidized SSS Educational Loan in the Philippines

Need Quick Cash? Apply now with just 1 government valid ID! Calculate your Pre-approved Loan Amount with Digido Calculator:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

How to Apply for WISP in SSS

If you want to participate in the SSS WISP program, you’ll need to create a personal account on the SSS portal first. Here’s what you need to do:

- Go to the SSS website and select Not yet registered with My.SSS.

- Fill in the required data: your name, date of birth, and email.

- The system will generate a confirmation link, a user ID, and send them to your inbox. Click the link provided in the email to activate your SSS account.

- You will then be redirected to another page where you will need to set a password.

- Once it is completed, you will automatically log in to your account.

- To see your WISP payments, select Contributions under the Inquiry tab.

Learn more

How to Get SSS ID in the Philippines

What is WISP Plus in SSS?

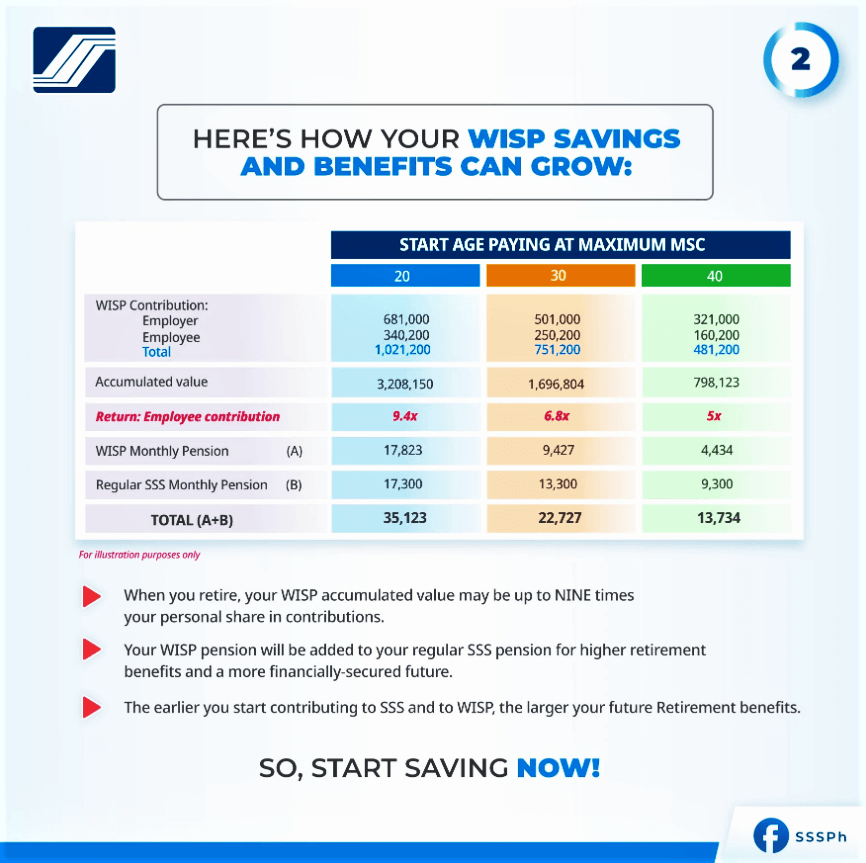

WISP Plus is a purely optional savings and investment program available to the SSS members in addition to the regular SSS WISP scheme. It also operates on a tax-free basis, has higher returns than standard savings deposits in the bank, and provides additional retirement benefits.

The minimum required contribution is PHP 500 (1), however, there is no upper limit. Thus, the more you invest, the more you’ll earn in the long-term perspective.

SSS WISP Plus Benefits

Let’s take a look at how you can benefit from SSS WISP Plus investiments:

- Enhanced returns.The expected annual return on investment (ROI) for WISP Plus is 6%.

- Investment distribution. By adding SSS WISP Plus to your personal financial plan, you will cleverly diversify your savings and divide investment risks between various assets.

- Expert management. Your investments will be strategically handled by a professional operational team with years of financial expertise and exceptional decision-making abilities.

- Convenient payment format. You can make a contribution either on the website or in any SSS office at any convenient time ― there is no strict schedule you’ll need to adhere to.

- Lucrative tax-free plan. You can earn more in the long run, especially if you claim the money after a few years of being a member or when you stop working altogether.

Who Can Join the WISP Plus Program?

The WISP Plus program is available to every SSS member, regardless of their membership type, monthly income report, or most recent salary.

According to the program’s terms and conditions, employed SSS members who wish to join must have at least one contribution made to SSS within the past three months. Self-employed, OFW and voluntary members are required to make a regular SSS contribution in the ongoing payment month.

SSS members who have already received final benefits like those for full incapacity or retirement are unable to participate in the program (4).

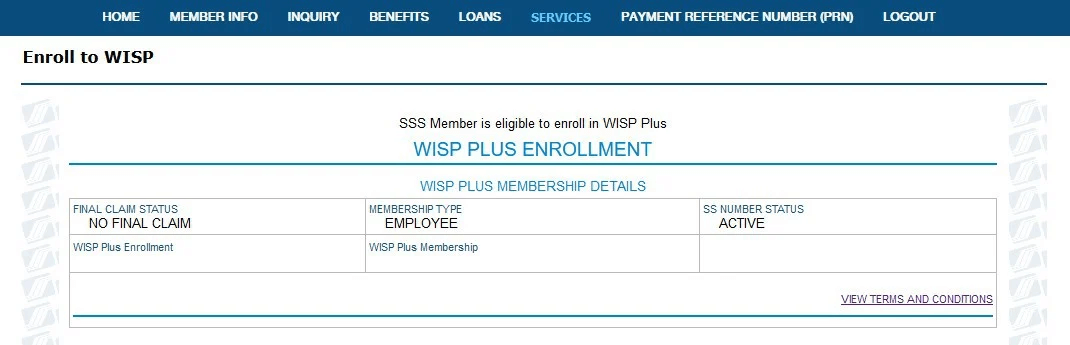

How to Register for WISP Plus Program Online

All you have to do to sign up is complete the application procedure once, and your membership will never expire. Here’s what you do to get started:

- Access your SSS account.

- Find the Services section and click Enroll to WISP Plus.

- Read and accept Terms and Conditions.

- The system will notify you on your successful registration in the WISP Plus program and will send you reminders on upcoming payments.

Withdrawals Under the SSS WISP Plus Program

SSS allows partial and complete withdrawals within WISP Plus once you meet specific terms:

✅ You should have been a WISP Plus member for a minimum of one year.

✅ You can make partial withdrawals, but be way of the following terms:

- The withdrawal amount will be based on your TAV in the previous month.

- You will be authorized only one partial withdrawal a month.

- The remaining balance on your account must be over PHP 500.

✅ In the first year of your WISP Plus membership, you will be permitted to withdraw any sum only in extreme circumstances, including the following:

- Critical illnesses such as cancer, organ failure, heart-related or neuromuscular-related illnesses

- Involuntary termination of employment

- Relocation from the host country if you’re an OFW

- Other terms stipulated by SSS.

- Once you have fully withdrawn your TAV, you must re-register to become a WISP Plus member.

WISP Plus SSS Interest Rate

The rate at which you will receive your earnings will depend on how long you have been a member; the longer you stay in the program, the higher your interest becomes:

| Membership in WISP Plus, years | % earnings |

|---|---|

| 1 to 2 | 60% |

| 2 to 3 | 70% |

| 3 to 4 | 80% |

| 4 to 5 | 90% |

| 5 and more | 100% |

The amount you’ve earned from your investments will be calculated at the end of the year and accredited to your account.

WISP Vs WISP Plus

Despite the fact that WISP and WISP Plus are both SSS regulated initiatives, the terms of the two programs are different. We have compiled the key points in the table below:

| WISP | WISP Plus | |

|---|---|---|

| ✅ Who is eligible |

Note: A member must have an MSC exceeding PHP20,000 and should not have made any prior claims in the regular SSS program. |

All SSS members |

| ✅ How to register | If you are a SSS member and have an MSC over PHP 20,000, you will be signed up automatically.

|

Via My.SSS |

| ✅ Contribution |

|

From PHP 500 and more |

| ✅ Payment period | Monthly with regular SSS contributions | Anytime |

| ✅ Withdrawal | No | Yes |

| ✅ Reimbursement method | Lump sum or annuity | Lump sum |

Conclusion

Considering today’s exaggerated cost of living and inflation rate, a SSS pension alone may not be sufficient enough to provide for your prosperous life once you retire. The WISP and WISP Plus might be great options to consider if you want to save for your retirement and get extra benefits. They are tax-free, runned by the state, and offer higher returns than normal SSS contributions.

- Only 1 Valid ID needed to Apply

- Up to PHP 25,000 in just 4 minutes!

Learn How to

Claim SSS Unemployment Benefits

FAQ

-

Can someone in my family contribute to WISP SSS on my behalf if I am an OFW?An OFW can authorize a representative in the Philippines to make a payment on their behalf, or they can pay their contributions through an SSS-accredited collecting partner in their host country.

-

I haven't received a notification of my latest payment being processed. What steps should I take?If your payment hasn’t been confirmed, reach out to your employer or contact the Helpdesk at PRNHelpLine@sss.gov.ph for further assistance.

-

I've noticed an incorrect amount accredited on my WISP SSS account. What is the process for solving this issue?To revise an amount displayed on your account, kindly visit the nearest SSS office. Please carry your identification document and a validated evaluation receipt with you for proper verification.

-

Who qualifies as the primary beneficiaries of an SSS member?The primary beneficiaries of an SSS member typically include their spouse and children under 21 years old. However, if the member is single and childless, their parents become the secondary beneficiaries. Alternatively, the member can indicate their preferred beneficiaries if they do not fall under the primary or secondary categories.

-

Are WISP and WISP Plus different programs?WISP is a mandatory program for SSS members with a monthly salary credit of more than PHP 20,000. WISP Plus is an optional investment initiative without the MSC requirement. WISP account value is not withdrawable, and WISP Plus value can be taken out after 1-year membership.

-

Is WISP Plus a safe investment?WISP Plus is aimed at preserving and increasing capital by investing in less risky funds available in the market. The program complies with the laws of Sec. 26 of Republic Act 11199 and adheres to the principles of safety, high yield and liquidity.

-

Can I modify the current sum of the SSS WISP Plus contribution I am paying?You can easily adjust your SSS WISP Plus contribution via My.SSS account.

-

Do expats have to contribute to WISP SSS?Expatriates in the Philippines have the option to pay WISP SSS contributions by obtaining an SSS number and following the same algorithm as Filipino members.