A Complete Guide to Obtaining an SSS ID Number in the Philippines

Key takeaways:

- SSS offers various types of benefits and loans

- You have to be an SSS member and meet many other conditions in order to qualify

- Digido is a great alternative if you wanted to get a loan from SSS but your loan was not approved

- With Digido, it is easy to apply for a loan online and it is fast to get an approval

Table of Contents

In the Philippines, unemployed and self-employed citizens can register and pay monthly contributions to prepare for retirement under the social security system. Those who are employed are required to pay.

Paying contributions to the Social Security System (SSS) in the Philippines is crucial for several reasons. It ensures eligibility for various benefits such as healthcare, maternity leave, disability, retirement, and unemployment. Being a member also offers financial protection against the unforeseen events and provides a safety net for you and your family during times of need.

Getting a SSS ID is quite easy! Today, we will talk about SSS ID number and how you can get one.

What is an SSS ID?

An SSS ID, or Social Security System ID, is a personal identification issued by the Social Security System to its members in certain countries. This ID serves as official proof of membership in the nation’s social security program, which is designed to provide financial support and benefits to its members during times of need, such as retirement, disability, maternity, and unemployment. The SSS ID card contains the member’s SSS number, name, date of birth, and photo, ensuring secure and convenient access to social security services and transactions.

- Only 1 Valid ID needed to Apply

- Fast approval in 5 minutes

- 0% interest for first loan

Benefits of the SSS ID in the Philippines

The SSS is not just a retirement or pension plan that the government provides for its members. It also offers different kinds of loans and benefits. Here are the benefits you can get if you are a paying member:

- Sickness and disability benefit – you can get paid a sum of money if you are debilitated to work. This can be due to sickness or in accidents that have rendered you disabled.

- Maternity benefit – pregnant women have 60 days of maternity benefit. A pregnant woman can get a salary worth 2 months by the end of the pregnancy.

- Retirement – those who retire at the age of 60 or 65 can get a lifetime pension. The amount of the monthly SSS pension depends on the contributions of the retired member.

- Death and funeral – SSS members who passed away can get death and funeral benefits. The SSS will provide funds for the funeral, which are separate from the pension that the underage and spouse beneficiaries of the deceased.

You can also apply for a housing loan. As mentioned earlier, you can also apply for a salary loan. As always, the values you can loan depend on your total contribution, and how much you have contributed.

Is SSS ID a Valid ID? Yes, the SSS ID acts as a government-issued ID, which can be used for various official transactions requiring identity verification. Its digital features, such as a magnetic stripe or chip, enable secure and efficient processing of transactions and claims, ensuring members can easily access their entitlements. Almost all credit companies accept a SSS ID as a valid ID. Of course, Digido also accepts a SSS ID as an ID.

Learn How to Get

Government Loans For Unemployed in the Philippines

How to Apply for SSS ID number?

Keep in mind that you cannot apply for SSS valid ID unless you have the SSS ID number. To get an ID number, you must register as a member first. Once you become a SSS member, you will be issued your ID number.

To apply for this, you just have to go to the nearest SSS office and tell them that you want to be a member. If you are employed in a big company, you do not have to worry about this. The company will take care of processing your membership.

Below we will tell you step by step how to apply for a SSS ID number yourself on the SSS website:

Here’s what you’ll need to get an SSS ID number:

- A laptop or smartphone with stable internet access.

- A working printer

- A working email address and cell phone number

- Your PSA certificates such as PSA birth certificate and PSA marriage certificate if the applicant is married

Learn How to Get easy

Fast Loan in 15 Minutes

Steps for SSS ID Online Application

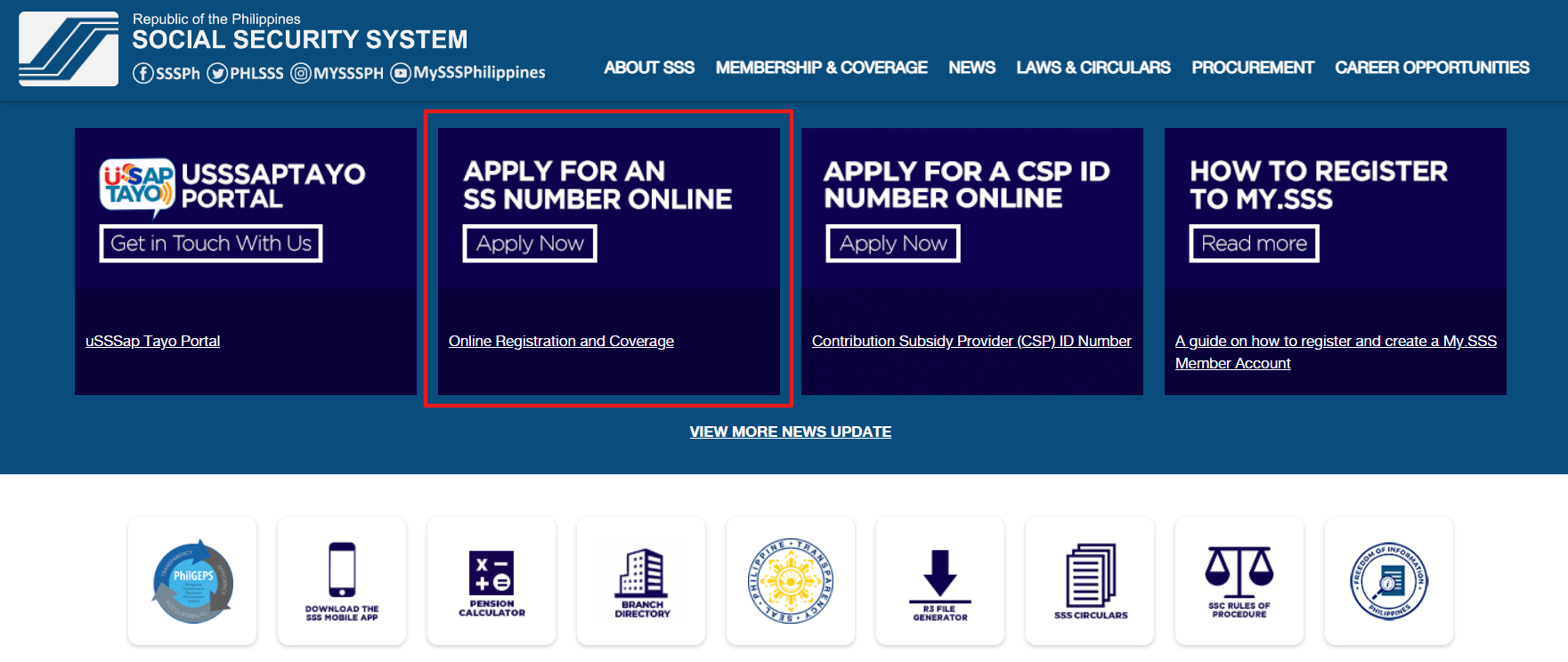

- Visit the SSS website (1) and click on the “Apply for SS Number Online” option on the homepage.

- Find the Registration Link: Look for the link or button that says “No SS Number Yet? Apply Online!” or a similar prompt for new users.

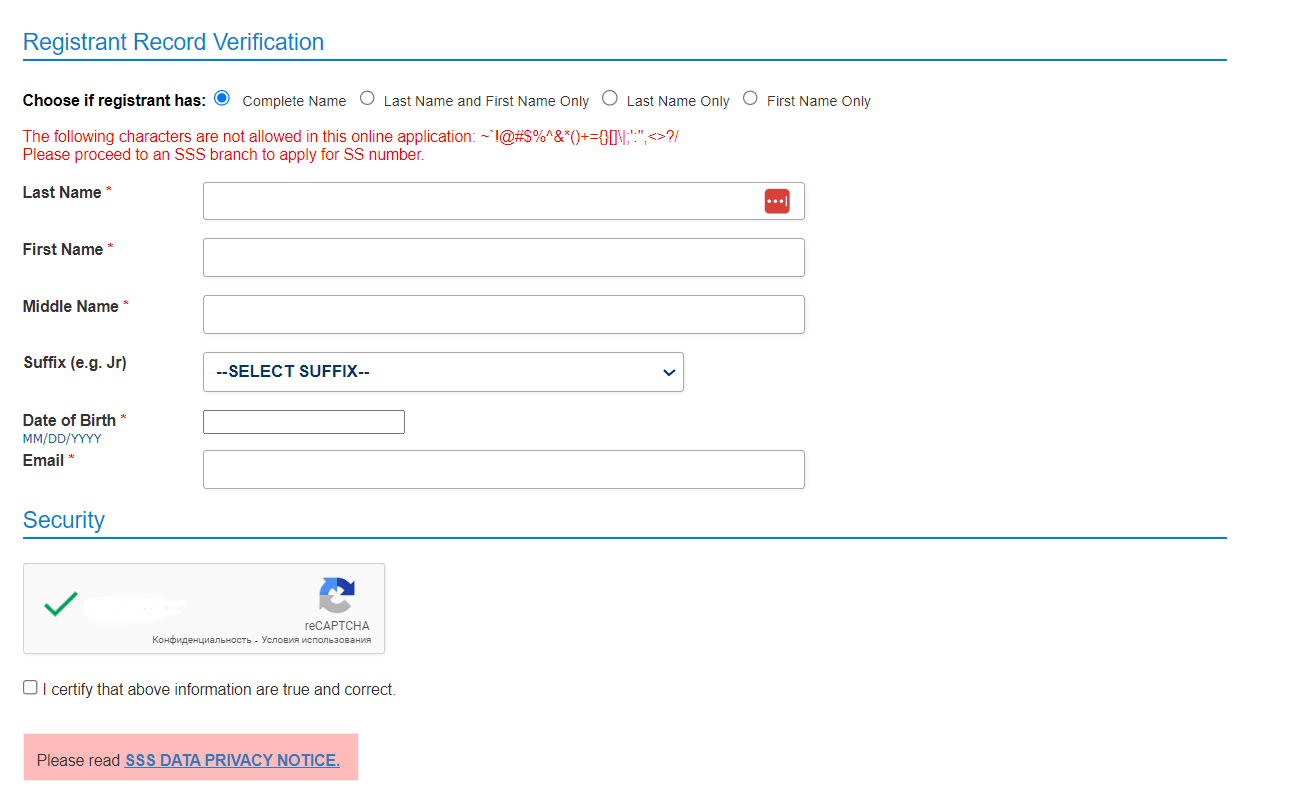

- Complete the online form with accurate personal details and submit it.

- A link will be sent to the email you provided. Click this link within five working days to proceed. If it expires, you’ll need to restart the registration process.

- After clicking the email link, enter the required information, including beneficiary details. Double-check all entries for accuracy before generating your SS number.

- Then click the “Generate SS Number” button to find out your SS number and print the form, SS Number Slip and Transaction Number Slip. You will also receive PDF copies of these documents by email.

- Check your email for a link to activate your My.SSS account and a list of required supporting documents to obtain an SS number.

Upon receiving your SS number, your membership status is marked as “Temporary.” To fully benefit from SSS membership, visit an SSS branch with the necessary documents to complete your registration.

- Print your personal record form, SS number receipt, and the email confirmation of your SS number application.

- Prepare PSA-certified birth certificates for yourself and, if applicable, your children and marriage certificate.

- Non-working spouses need their working spouse’s signature on the printed form, indicating awareness of the SSS membership.

- Bring the above documents to an SSS office. Not all branches offer all services, so you may need to schedule an appointment. For assurance, contact the SSS hotline.

After submitting the required documents, your temporary membership status will be upgraded to permanent. Additionally, creating a MySSS account is recommended for easier online access to your records, benefits, and privileges.

Now that you’ve obtained your SSS number, you might consider getting an SSS ID card.

Once you have your ID number that is printed in the official SSS document, go to the SSS office. Tell the guard that you are applying for an ID. The guard will give you the SSS UMID ID form and a list for the SSS UMID ID requirements. Fill out the form in the office, and then queue up.

This time, wait for your turn for your picture, signature and thumb print to be taken. Once you are done with this process, you will be told to come back and get your ID in person.

How long to get SSS ID?

After submitting the online application, receiving your SSS number is almost immediate once you complete the required steps and validate your email. However, turning this number into a permanent status involves visiting an SSS branch with the necessary documents, which can vary in time based on appointment availability and specific branch processing times.

Learn How to Get

Loan without a Bank Account in the Philippines

SSS ID Requirements

Before you go to any SSS office, you have to prepare your documents required for an SSS ID. Here are the things that you need to get an SSS ID card:

- ePersonal record form – this is a form you can get from the SSS office.

- Printed SS Number slip – you can only get this once you have applied for SSS membership. As a member, you will receive a slip that has your SS number. You need to keep this and present it once you apply for an identification card.

- Birth certificate – you have to present an original copy that is verified by the National Statistics Office; you also need to provide its photocopy.

- Valid ID – you can present other existing IDs like driving license, passport, and others: DFA Passport, a Professional Regulation Commission (PRC) card or a Seaman’s book

In case you do not have other IDs, you can present a baptismal certificate, your ID from the Professional Regulation Board. If these are still not available, you can choose from the following:

- School ID;

- Company ID;

- Voter’s ID;

- NBI Clearance that is not expired;

- Postal ID.

If you have a tax ID, you can use that too.

Now, you must also provide original and photocopies of your marriage certificate if you are married, and also the birth certificate of your children. Make sure you have photocopied everything. For some documents, they only need the photocopy. For some others, they need the original copy.

Need Quick Cash? Apply now with just 1 government valid ID and enjoy a 90% approval rate on your loan. Calculate your pre-approved loan amount with Digido calculator:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

Where to get SSS ID card

If you’re looking for where to get an SSS ID, here are your options:

- Online Application: Initiate your application by visiting the official SSS website. Log in to your My.SSS account to fill out the preliminary application form.

it’s important to note that the initial application process cannot be fully completed online due to the need for capturing biometric information. - SSS Branches: Apply in person at any SSS branch (2). Be sure to bring the required documents.

- GSIS Offices: For government employees, applications can also be processed at GSIS offices.

- POEA Offices: Overseas Filipino Workers can apply at designated POEA offices to facilitate their SSS card applications.

Remember to schedule an appointment if required and check the specific documentation needed for the SSS ID card application.

Learn full information here 👉

Obtaining a UMID ID CARD in 2024: Steps in the UMID Application Process

Here are the SSS ID card Requirements (3):

To apply for an SSS ID card (now UMID) in the Philippines, you generally need the following:

- Completed SSS Form E-6.

- One primary ID (e.g., DFA Passport, Driver’s License, PRC Card) or two secondary IDs (e.g., NBI Clearance, Voter’s ID, School ID).

- Proof of SSS membership (SS Number slip).

- Additional documents may be required such as birth certificate, marriage certificate (if applicable), and others depending on individual circumstances.

Is UMID ID and SSS ID the same?

Yes, the UMID (Unified Multi-Purpose ID) and the SSS ID are essentially the same in their function within the Social Security System (SSS). The UMID card was introduced in 2011 to replace the old SSS ID, which was first issued in 1998. Therefore, the UMID is often considered the de facto SSS ID today. Members are required to present their UMID cards for personal transactions with the SSS.

Learn useful information about

Fast payday loan in the Philippines

Digido Loan Requirements

Whether you need money to pay for your SSS ID or if your loan from SSS was denied, you can get a loan from Digido.

Here are the requirements for applying for a loan from Digido:

- One government ID;

- You must be a Filipino citizen;

- You must be between 21 and 70 years of age

- you have a working smartphone

If you are operating a business, you can present your DTI registration and other business documents it’s optional, it will increase your chance of approval.

We only require 1 government valid ID 🔥

Apply nowHere are the benefits of getting a loan from Digido:

- Easy application – you can apply for a loan online; you do not have to go to a physical location

- No interest on your first approved loan

- No proof of income or guarantor needed

- Fast approval – you can get approved in as short as 5 minutes

- Only one government-issued ID is required

- Easy to get money via the Digido mobile app

- Online transaction – your funds will be deposited to your bank account or e-wallet; you will also pay your debt online (7-Eleven Payment Services, Cebuana Lhuillier, GCash, M.Lhuillier and others) or pickup points!

Digido is 100% online. It aims to provide loans to the underserved market. Need money that you can get quickly, apply for a loan now in 5 minutes:

Apply now

In conclusion, obtaining an SSS ID, now known as the UMID card, is important step for every Filipino worker, ensuring access to a wide array of social security benefits. By carefully following the outlined steps—gathering the necessary documents, completing the application, and attending the biometric capturing session—applicants can navigate the process smoothly. And don’t forget, in any emergency situation when you urgently need financial help – Digido is always available for a quick interest-free loan.

FAQ

-

How to know my SSS ID number?To find your forgotten SSS number, you can check through your My.SSS account online, examine your old SSS ID, look for your SSS number on your E-1 or E-4 form, consult your SSS contributions payment form (RS-5), reach out to your HR department or employer, search through your email, inquire via email or phone to SSS, or visit any SSS branch directly.

-

How many days does it take to get an SSS ID card?Once you've successfully applied and your data has been captured, SSS now aims to deliver the UMID cards within 30 working days. For those in the National Capital Region (NCR), the delivery via PhilPost should take about two weeks, while for those outside NCR, it could take up to four weeks.

-

How much is SSS ID?Applying for an SSS ID, now known as the Unified Multi-Purpose ID (UMID) in the Philippines, is free of charge. There are no fees associated with the application for this ID card. This makes it accessible for all eligible SSS members to obtain their UMID without worrying about additional costs. The replacement fee for the Unified Multi-purpose Identification (UMID) card is 200 pesos.

-

Is SSS ID same as UMID?The SSS ID is no longer produced, instead UMID has been used since 2011, which combined SSS, GSIS, Pag-IBIG and National health insurance program.

-

Is SSS ID available now?Yes, the SSS ID, also known as the Unified Multi-Purpose Identification (UMID) card, is available. Members of the Social Security System can apply for the UMID card by following the application process outlined on official websites and utilizing the appointment system for their application .

Articles sources

Authors

Digido Reviews

-

RollyHi everyone I could recommend this excellent apps coz the agents are approachable and answers the needs in times of emergency. They us give lower interest and loan prolongation in case you could not pay on time. Thanks to them and keep it up. Mabuhay!!!5

-

Deborah P.Borrowing from Digido is easy and safe. I have borrowed here for the second time and I am very satisfied. All you need its onу valid id. For example with just sss id my online application loan was approved in a few minutes, and I had the money in my bank account instantly 🔥5

-

RitzThe approval was so fast, i wasnt ready to apply as I was just testing how the app worked. The next thing I know the money was on its way.4

-

KayceeI couldn't believe that applying for a loan could be so hassle-free. With only SSS ID, the online application loan approved so fast, making Digido a go-to for me when I needed emergency funds!4

-

MerlynDigido is the best online lending company. Faster loan to get no more long processing and fill up everything. Thanks5

-

AnnalynIf you are interesting where to get loan using sss id without additional documents, the Digi do app is the way to go! I got my quick loan within minutes because the approval came almost instantly. I just pay back the same amount I borrowed - it's easy with 0% interest on the loan here!5

-

AbigailIt's very easy to file a loan on this app and it's very convenient, you just need to wait a minute and there you go, loaned amount was already in your account. Thanks Digido, we can rely on this loan platform in times of needs. And it would be better if loan interest will be lessen a little bit.4

-

JosephVery convenient when in need. Fast approval and long term payment you can extend the payment with reasonable cost. Thanks and more power!4