SSS Salary Loan Online Application 2024

Key takeaways:

- The money you contribute to SSS makes you eligible for a loan.

- If you already have SSS credit, but you still need extra money, you will have to take credit elsewhere.

- The best alternative you should try is Digido.

- It is a lending institution that has a loan available to you online up to 25,000 pesos.

Table of Contents

Any employee who needs cash must take advantage of the SSS salary loan. The thing is that it is rarely discussed in company welcome meetings. Today, you will learn everything you need to know about the SSS salary loan.

- Interest-free first loan

- No proof of income is require

- Only 1 valid ID needed to apply

What is an SSS Salary Loan?

The SSS salary loan is granted to Filipino citizens who are paying members of the SSS. There is no specific amount that you can borrow, but the organization uses a certain formula.

Essentially, a paying member could borrow. When we say “a paying member”, we are referring to both those that are employed, self-employed, and voluntary.

This loan should not be mistaken as a home loan. The loan amount is small, and it will not be enough for you to build a house.

The SSS salary loan interest rate is 10% per annum depending on the diminishing principal balance. It shall be amortized over 24 months or two years. The 10% interest rate will be charged on the outstanding principal balance until the loan is fully paid.

Moreover, a 1% service fee will be deducted and charged from the proceeds of the loan.

If you’re looking to renew your SSS salary loan, you will only be allowed to do so after paying at least 50% of the original principal amount.

→ Useful information about 24 hour payday loan

Who Can Apply for SSS Salary Loan?

If you want to know how to apply for a salary loan in an SSS online appointment, you need to know the eligibility requirements and whether or not you meet the criteria.

- First, you must be an SSS member. Second, you should have at least 36 months of contributions in total, with six months of these contributions made in the last 12 months.

- Alternatively, you can apply for a two-month salary loan if you don’t meet this criteria. To be approved of this, you must have 72 total contributions with six of them made in the last 12 months.

- The SSS salary loan amount is typically equivalent to one month of your current salary.

- This amount, of course, will be prorated. People get promoted and earn more money. But this does not mean you can always loan the equivalent of your current salary.

- In addition, SSS members who are employed must make sure that their employer has made updated monthly contributions and loan remittances.

- Moreover, you should not have availed other SSS benefits like total permanent disability, retirement, and death.

You can get an application form for an SSS salary loan on the SSS website.

If you already have an SSS account and are wondering how you can activate your SSS online registration, the agency will email you a link where you can activate your account on the SSS member website.

→ Also learn more about Lending app for students in the Philippines

SSS Salary Loan Requirements 2024

To know how to apply for an SSS loan online, you also need to prepare your requirements. If you are employed, here are the things you need to prepare:

– SSS digitized ID;

– 2 valid photo IDs (preferably from the government);

– SSS online membership.

If you are an OFW, there are some additional requirements for you on how to apply for an SSS salary loan online 2024. See them below:

– SSS ID of your authorized representative in the Philippines;

– 2 valid IDs of the authorized representative with signatures;

– Letter of authority given to the authorized party; the OFW must also sign it;

– SSS ID of the OFW filing the loan.

Take note that you have to prepare the originals and some copies of these documents. If you are filing in person, they will look at the original ones. You can visit the official website and know how many days to get SSS ID.

Need Money in Minutes? Apply for a loan from 1K up to 25K using 1 valid ID only. Calculate the cost of your pre-approved loan and click ‘Apply Now’:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

How to Apply for a SSS Salary Loan Online 2024?

So, how to apply for an SSS salary loan online? Read below for the steps.

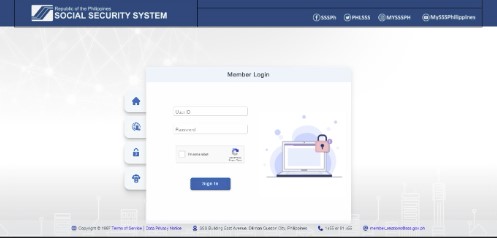

1. First, you must register for an online my.sss account and then log in.

If you already have an SSS online account, go to the SSS member website and log in there.

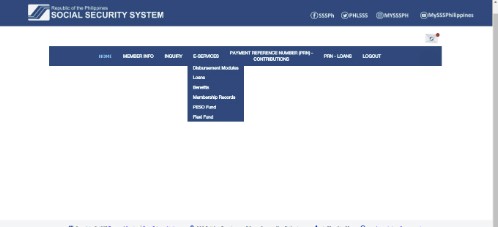

2. Click on the Electronic Services or E-SERVICES tab.

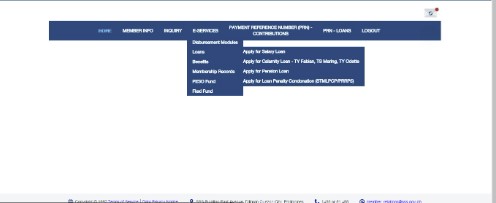

3. Under the E-Services tab, choose loans, then choose Apply for Salary Loan.

4. Pick your preferred loan disbursement channel.

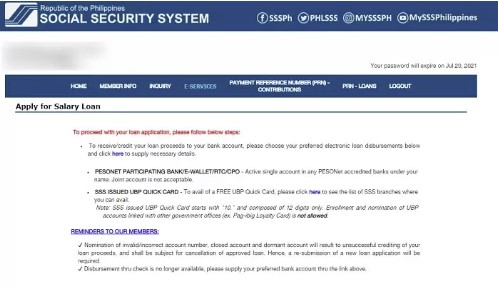

Make sure that you follow the steps to acquiring a SSS Salary Loan as indicated below.

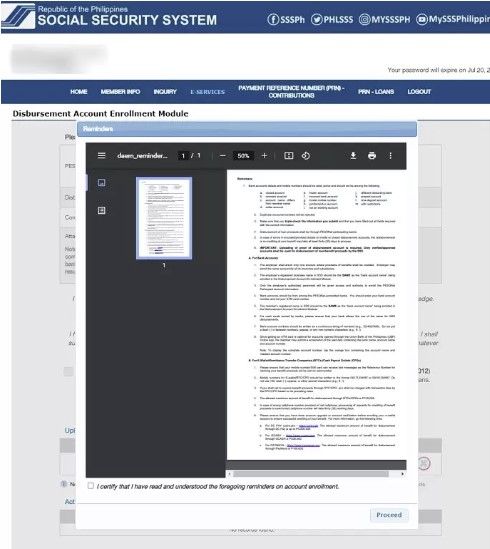

5. Read the SSS Disbursement Account Enrollment Module (DAEM) document, then agree and certify once you’re done.

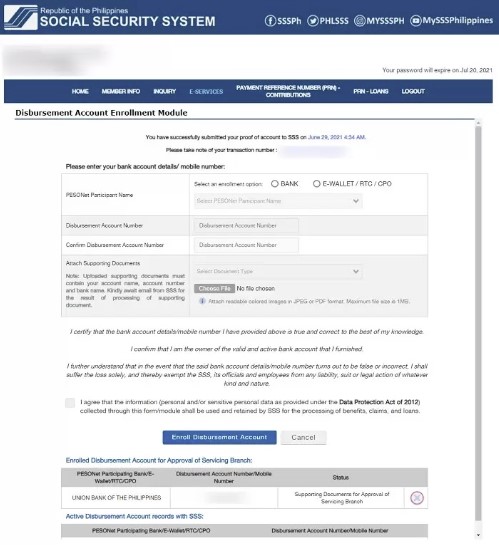

6. Enroll your bank account or mobile number using the DAEM.

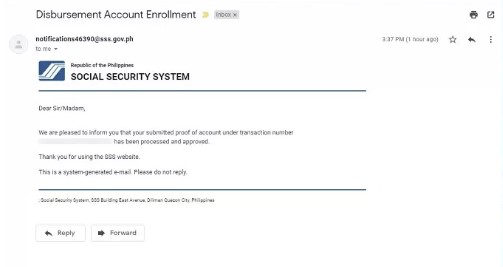

7. Wait for your SSS disbursement account enrollment to be approved.

8. You can now apply for an SSS Salary Loan!

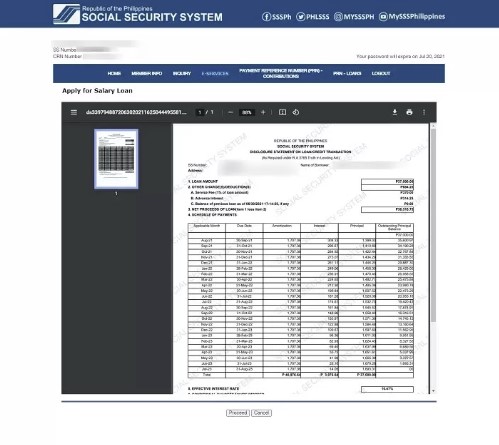

9. Read and agree to the terms of loan disclosure.

10. Wait for the status of your SSS online salary loan application.

11. Claim your salary loan!

Follow the prompts and wait for approval. Once approved, your money will be deposited in a bank. As such, you also need to enrol a bank account to SSS. These banks must be participating in the SSS salary loan Disbursement Program. The last step on how to apply for a salary loan in SSS online is to tick the box that says you are agreeing to the terms and conditions. Click on PROCEED, then SUBMIT. Get the transaction number and keep it. You may need it in the future.

Whether you applied for a loan in person or online, the SSS salary loan check release online or physical one will be released 3 to 5 days after the loan was approved.

→ See also a list of motorcycle financing companies in the Philippines

SSS Salary Loan Computation

Here is a sample computation of how much you can apply for a SSS salary loan, based on your monthly salary and your monthly SSS contributions. Your eligible salary loan amount will depend on the average of your 12 latest monthly salary credits.

As an example, we will show you how much your SSS salary loan amount will be on a monthly salary of Php 20,000.

SSS Loan Calculator

| Monthly salary | SSS contributions (employee & employer share) | Salary loan amount (1 month) |

| Php 20,000 | Php 2,430 | Php 2,430 x 12 months =

Php 29, 160 |

SSS Salary Loan table

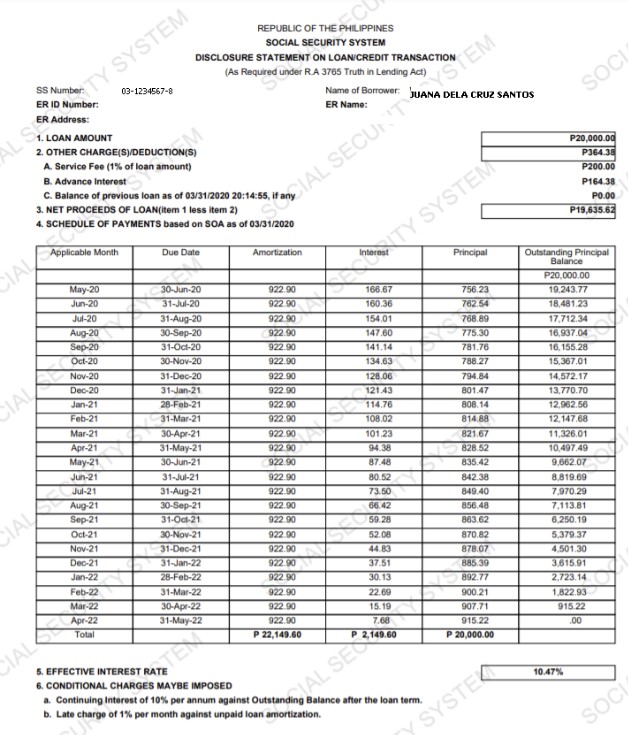

If you want to know more about SSS salary loan, the monthly amortization and interest rate in relation to your loan amount, you can look at this table below. This is a sample disclosure statement on a loan transaction.

Example of a repayment schedule for a SSS loan

| Applicable Month | Due Date | Amortization | Interest | Principal | Outstanding Principal Balance (PHP20,000,000) |

| May-20 | 30-Jun-20 | PHP922,90 | 166.67 | 756.23 | 19.243.77 |

| Jun-20 | 31-Jul-20 | PHP922,90 | 160.36 | 762.54 | 18.481.23 |

| Jul-20 | 31-Aug-20 | PHP922,90 | 154.01 | 768.89 | 17.712.34 |

| Aug-20 | 30-Sep-20 | PHP922,90 | 147.60 | 775.30 | 16.937.04 |

| Sep-20 | 31-Oct-20 | PHP922,90 | 141.14 | 781.76 | 16.155.28 |

| Oct-20 | 30-Nov-20 | PHP922,90 | 134.63 | 788.27 | 15.376.01 |

| Nov-20 | 31-Dec-20 | PHP922,90 | 128.06 | 794.84 | 14.572.17 |

| Des-20 | 31-Jan-21 | PHP922,90 | 121.43 | 801.47 | 13.770.70 |

| Jan-21 | 28-Feb-21 | PHP922,90 | 114.76 | 808.14 | 12.962.56 |

| Feb-21 | 31-Mar-21 | PHP922,90 | 108.02 | 814.88 | 12.147.68 |

| Mar-21 | 30-Apr-21 | PHP922,90 | 101.23 | 821.67 | 11.326.01 |

| Apr-21 | 31-May-21 | PHP922,90 | 94.38 | 828.52 | 10.497.49 |

| May-21 | 30-Jun-21 | PHP922,90 | 87.48 | 835.42 | 9.662.01 |

| Jun-21 | 31-Jul-21 | PHP922,90 | 80.52 | 842.38 | 8.819.69 |

| Jul-21 | 31-Aug-21 | PHP922,90 | 73.50 | 849.40 | 7.970.29 |

| Aug-21 | 30-Sep-21 | PHP922,90 | 66.42 | 856.48 | 7.113.81 |

| Sep-21 | 31-Oct-21 | PHP922,90 | 59.28 | 863.62 | 6.250.19 |

| Oct-21 | 30-Nov-21 | PHP922,90 | 52.08 | 870.82 | 5.379.37 |

| Nov-21 | 31-Dec-21 | PHP922,90 | 44.83 | 878.07 | 4.501.30 |

| Dec-21 | 31-Jan-22 | PHP922,90 | 37.51 | 875.39 | 3.615.91 |

| Jan-22 | 28-Feb-22 | PHP922,90 | 30.13 | 892.77 | 2.723.14 |

| Feb-22 | 31-Mar-22 | PHP922,90 | 22.69 | 900.21 | 1.822.93 |

| Mar-22 | 30-Ap-22 | PHP922,90 | 15.19 | 907.71 | 915.22 |

| Apr-22 | 31-May-22 | PHP922,90 | 7..68 | 915.22 | .00 |

| Total | PHP 22,149,60 | PHP2,149,60 | PHP20,000 | – |

→ Read about OFW Loan in OWWA

How to Pay a Loan in SSS?

If you want to be in good standing with SSS you need to pay your loan. If you do not pay on time, your loan will incur interest. See below on how to pay a loan in SSS:

If you want to be in good standing with SSS you need to pay your loan. If you do not pay on time, your loan will incur interest. See below on how to pay a loan in SSS:

✓You can pay by going to SSS offices;

✓You can pay using Bayad Center establishments;

✓You can pay via banks that offer this service.

To get the information on how to pay an SSS loan in Bayad Center, just go to any establishment in the Philippines that has the Bayad Center logo. These organizations are in partnership with SSS.

→ Useful information on how to check if you are blacklisted

How many months are there to loan in SSS?

Some people ask how many months or years there are to loan in SSS. The answer is the following: 24 months. You must be able to pay your loan in 24 months. You have to start paying in the second month after the loan was released to you.

What happens to unpaid SSS salary loans?

If you do not pay your SSS loan, the organization will deduct what you owe if you ever need money again. You also cannot apply for another salary loan, calamity loan, or any other kind of loan.

If you ever get disabled or if you die, the money you owe will also be deducted from your or your beneficiaries’ benefits.

The catch is that the deduction will be huge, especially if you stopped paying your loan for many years. The interest you pay is not the only interest you incur. SSS will also charge other interests in case you stop paying.

The best thing to do is to pay your loan on time and pay it in full. If you are short on money, pay your loan as soon as you have money available. The worst thing that can happen is to have loan arrears bigger than your benefits.

→ Learn about How to Renew Business Permit

Alternative for SSS Salary Loan

If you already have an SSS loan and you still need more money, you have to borrow somewhere else. The problem is that if you borrow from banks, you will pay a lot of interest.

The best alternative that you should try is Digido. It is a loan institution where you do not have to apply in person.

Here are the basic eligibility requirements:

- You must be a Filipino citizen;

- You must be between 21 and 70 years old;

- You must have a valid government-issued ID;

- You must have an active phone number.

To apply, all you have to do is to create an account, and then scan the documents and attach them. On top of the requirements, you also have to present a certificate of employment or proof of income. After filing a loan, you could get approved within a few minutes.

Apply nowConclusion

The money you contribute to SSS gives you the privilege to apply for a loan. Use this opportunity to get some cash if you are short. If you lack the requirements, or if there are complications with how to loan in SSS online, then you could always rely on loaning from other companies.

This is where Digido comes in. It is a private loan institution that aims to reach the underbanked. There is no fuss when you are applying for a loan here – simply sign up online and provide the documentary requirement, and you may get approved within 5 minutes.

Apply now

FAQ

-

How long will it take to get an SSS salary loan?There is no definite number of days. After submitting your loan, your employer has only 3 days to approve your SSS salary loan application status. If you want to know how to check loan status in SSS, you will get these instructions on the SSS website. From here, SSS will approve your loan. To be honest with you, it can take a week or even months. But once the SSS salary loan application has been approved, you will have 3 to 5 days to wait for the check to be ready or for the money to be deposited into your account.

-

How to check loan status in SSS?Just log in to your SSS account, and then click on INQUIRY. Next, click on LOAN INFO and then you will see the status. This is the only method on how to check SSS loan status online. For offline, you will receive a text message. You will also receive an email from SSS once your loan has been approved. The method on how to check SSS loan status via text is to simply wait. Make sure that your active phone number is the one listed in SSS. If the phone number you have on the SSS records is not correct, you will not receive this message. Your loan balance may not be updated. Do not panic. SSS has its interval when they update their records. At best, make sure you have a copy of your payment receipts. Make your payment logs in a notebook to avoid overpaying.

-

How to check loan balance in SSS?Here is the method on how to check loan balance in SSS: ✓Log in to SSS; ✓Select MY LOANS; ✓Click on SALARY LOAN BALANCE. From here, you will see how much money you still owe. Do not be surprised if it is bigger than what you originally owed. SSS charges interest, but this interest amount is small. The interest rate is only 10% per year, but this can also increase over time.

-

How many days does SSS salary loan Release 2024?The loan proceeds shall be available to member-borrower's account within three to five working days from approval date of the loan.

-

How can I check my SSS loan status?Go to www.sss.gov.ph , then member login to view check your loans info.

-

How can I check my SSS loan status through SMS?To inquire about the status of your loan, text SSS LOANSTAT to 2600. For example: SSS LOANSTAT 0529310429 1234.

Authors

Digido Reviews

-

EricaI tried Digido out of curiosity. To cut to the chase, Digido is ideal for "petsa de peligro" days where it's almost payday but also your bills is on due date because they have short payment terms (I was given 7 days term for my first loan). You can get approved as fast as 30mins and the loan will reflect immediately.5

-

MelissaI highly recommend this App. Convinient and user-friendly. This App is amazing! So easy to loan and approval is very fast just a few minutes. Disbursement is super fast. The Staff are very accomodating, polite, respectful, courteous and friendly. Digido is is very reliable, costumer service is awesome. I love the flexibility it gives to their clients and I can definitly reccomend it to anyone who needs finacial assistance. To the management and staff, thank you very much for the helping hands!5

-

MarcA very reliable loan app. You can have the approved amount transferred to your account in less than 3 minutes. Highly recommended to those who need immediate cash☺5

-

JoelDigido is the very best loan app I had ever applied with. Reliable loan Co. especially in this difficult times. Kudos to the mgt. Keep up the good work and the great service to your clients. Highly recommended. God bless and more power🙏4

-

DanicaSuperb App. It is very easy and fast approval. it's my second loan since the last time. Very happy to apply for this app. Highly recommended.5