How to create a PayPal account in the Philippines

Key takeaways:

- PayPal is the most popular online payment system in the Philippines.

- PayPal is an excellent option for immediate fund transfer and online purchases.

- But there should be money in your PayPal account first.

- You can use the funds for your PayPal transaction.

Table of Contents

With 372 Million active users spread across 200+ countries and support for 100+ currencies, PayPal is the central cogwheel of the digital payment revolution worldwide.

PayPal enjoys strong market dominance in digital transactions in developed countries like the US or UK. But the widespread mistrust in online transactions and worries like:

“Will I get the exact product I ordered?”

“Is the platform safe to share my financial data?”

“Will someone hack my account and withdraw money?”

“If anything goes wrong, where should I contact?”

Stopped PayPal from replicating the success in developing economies such as the Philippines.

But the pandemic-induced lockdowns and the insistence on Covid Appropriate Behaviours brought a tectonic change in our lives. For employment, Work From Home (WFH) is the new normal; for purchasing its “Online Purchase.” Knowingly or unknowingly, we are now part of the digital economy.

A Filipino has many options such as digital wallets, credit cards, debit cards, or online banking for his online transactions.

But what makes PayPal the most popular online payment system in the Philippines, with a whopping share of 77% for cross-border transactions?

- 0% Interest on your First Loan

- Only 1 Valid ID needed to Apply

- Fast online Application Process

How to Make PayPal Account in the Philippines

The overwhelming popularity of PayPal across the world is due to its attributes of reliability, ease of use, features, customer support, and affordability.

The overwhelming popularity of PayPal across the world is due to its attributes of reliability, ease of use, features, customer support, and affordability.

A valid email address is the only requirement to open a PayPal account. There are no monthly fees or maintenance charges either.

It uses end-to-end encryption and follows the most advanced security measures to ensure an impenetrable, secure environment for your sensitive financial information. Now a significant number of Filipinos are working as freelancers or doing online jobs. They need an online payment system to receive international payments.

Lockdowns and travel restrictions have changed the shopping habits of people. An online shop needs to offer a reliable and easy-to-use digital payment system for its customers.

PayPal is the ideal choice for such situations. It has a global presence, supports multiple currencies, and posses an easy-to-use interface. So, both your international and local clients won’t have any issues in using them.

If you are traveling or working abroad, using the bank account or credit card issued from your home country for local purchases is a hectic and costly affair. But PayPal overcomes this situation by converting your wallet money to local currency and then use it for purchase.

This feature is a tremendous advantage for OFWs to meet the frequent demand for mobile data recharge for their kid’s online classes.

Also learn more about

Dragonpay reference number

Requirements For Creating a PayPal Account

Part of what makes PayPal the ideal online payment system is that it doesn’t require certain documents to open an account. However, you will need the following requirements to secure your account and use it to receive and send funds:

- Active and valid email address

- Active and correct mobile number

- Valid ID for verification, such as your Passport, Driver’s License, National ID, or TIN

- Active and valid bank account in the Philippines

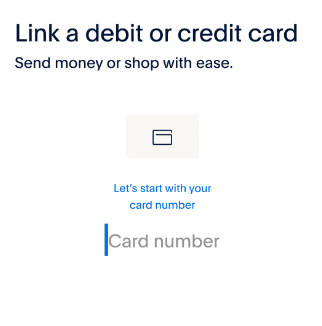

PayPal also allows users to add a credit or debit card to their account. Adding this makes it easy to make purchases online or pay for services using the platform without transferring money from your bank account before making a payment.

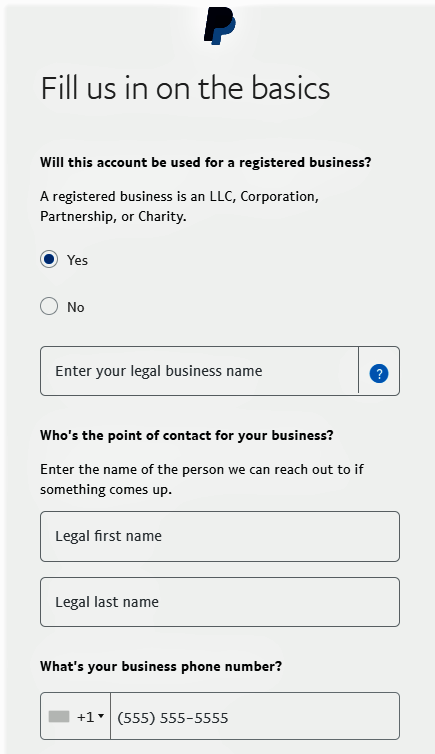

Should you need a PayPal Bussiness Account, you’ll also need to provide business documents on the platform, such as:

- Business name

- Business address

- Business contact number

- Business email (if different from personal email)

The requirements for a PayPal account listed above are necessary for security purposes. The information allows them to verify your identity and protect against fraud and abuse. These are especially important for a PayPal Business account wherein you receive income from your offerings and pay suppliers and partners.

The platform ensures security in money transfers, so you don’t have to worry about your funds being misused or handled, even if there are large amounts in your account.

Learn about

How to Renew Business Permit

How To Create a Personal PayPal Account?

A personal Paypal account is used for individuals who plan on using their funds primarily for online shopping and purchases. With a personal account, users can also easily send funds to family and friends locally or internationally without the hassle of manual conversions or long waiting periods that often come with bank or remittance transfers.

To create a personal PayPal account, follow these seven steps:

Step 1: Download the PayPal app from the Google Play Store (Android) or Apple App Store (iPhone) or scan this code

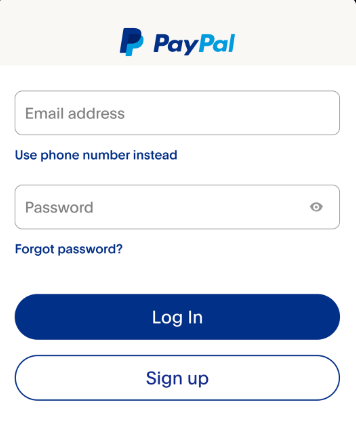

Step 2: Open the PayPal app and choose the “Sign Up” option.

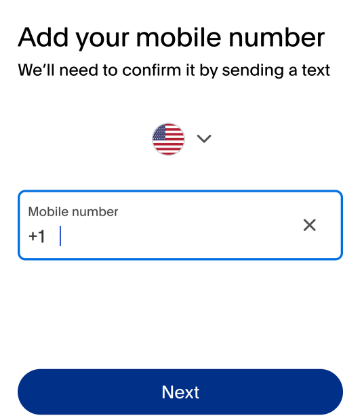

Step 3: Add a valid mobile number that will be used to verify your account, and choose next.

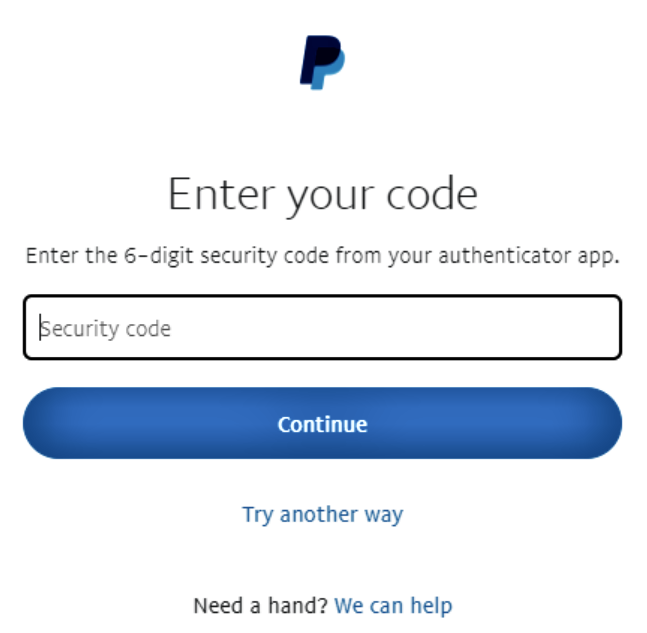

Step 4: You will receive a confirmation code via text message. Input the code.

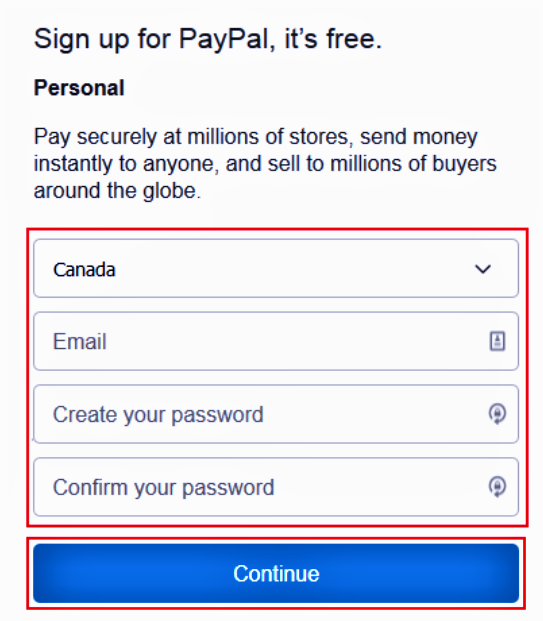

Step 5: On the next screen, fill in your email address and desired password.

Step 6: Set up your profile with the requested information.

Step 7: Link your credit card, debit card, or bank account.

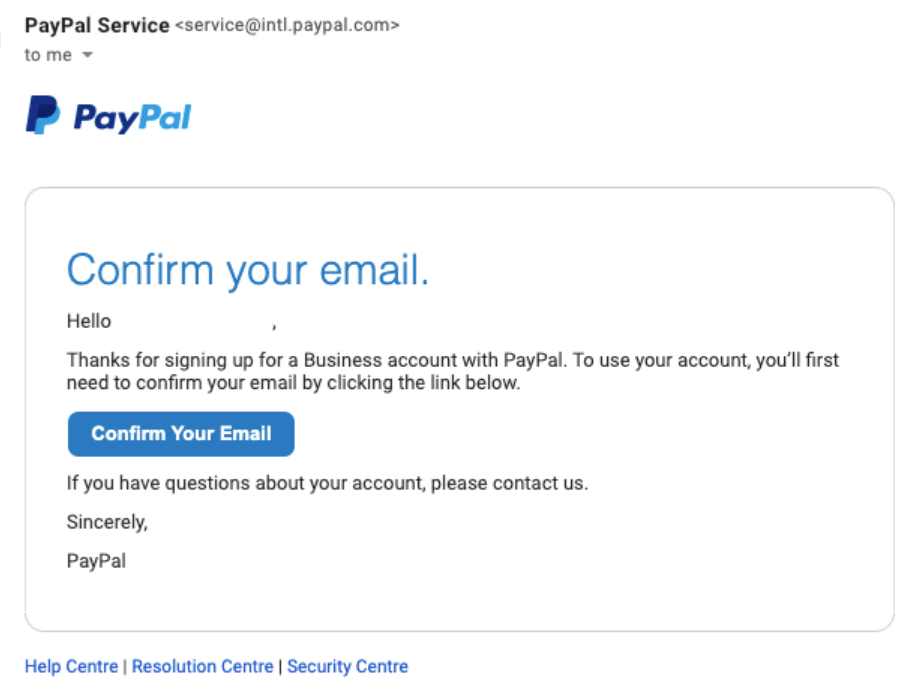

Step 8: Verify your email address.

Following these simple steps makes it easy to open an oline account with PayPal and streamline the process of online transaction with a high level of security and minimal issues or errors. This way you can rest assured your funds are safe!

How To Create a Business PayPal Account

A PayPal Business account is for those who run a business or shop and need to accept customer payments. Business accounts offer more features and access to different tools that can help you reach out to customers and expand your operations.

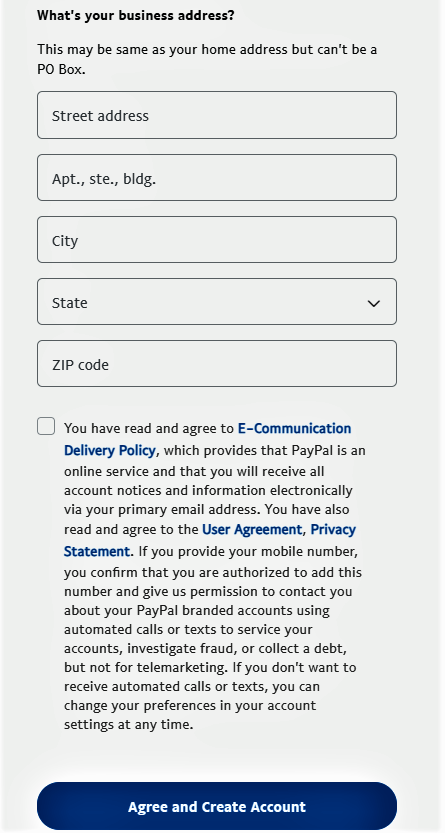

To create a business PayPal account, here are the steps you should follow:

Step 1: Download the PayPal app from the Google Play Store (Android) or Apple App Store (iPhone), and click the “Sign Up” option.

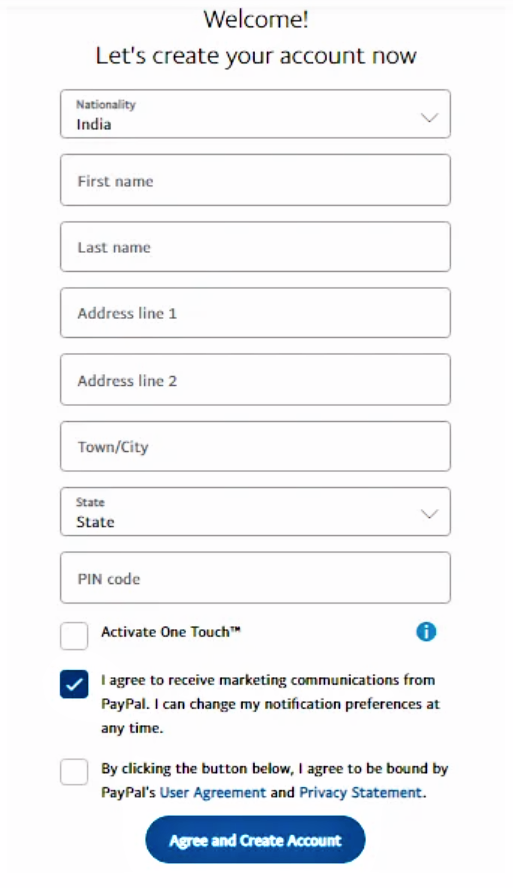

Step 2: Fill in your personal details and contact information. Make sure that all information is valid and accurate, as this will be used for identity verification.

Step 3: Choose a strong password and provide a valid email address.

Step 4: Select your preferred payment method and add the required details.

Step 5: Agree to terms, conditions and privacy policy.

Step 6: Click on “Agree & Create Account” and wait for PayPal to send you a confirmation message that your account has been created.

Below are the filed in which you will have to fill in to ensure your business account with PayPal is verified so that payments made to the account do not go through a 39 day holding period.

Once your PayPal account is created, you can receive and send payments from customers or clients. Ensure all the information you provide is valid and accurate for security purposes. You may also be asked to verify your identity.

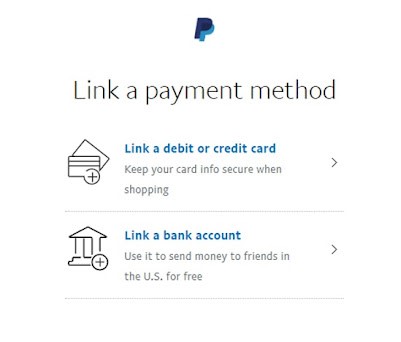

How to link a Bank Account / Credit or Debit Card in PayPal

PayPal is just a payment platform. To make transactions, you need to add money to the wallet. We achieve this by linking your bank account, credit card, or debit card to the PayPal account and transfer money from it to the PayPal account.

Similarly, you can withdraw money from a PayPal account only by transferring it to the linked bank accounts or cards. Once the amount is available in your account, you can collect it by visiting the ATM or through the bank.

Do you know how to

get loan no bank account needed in the Philippines

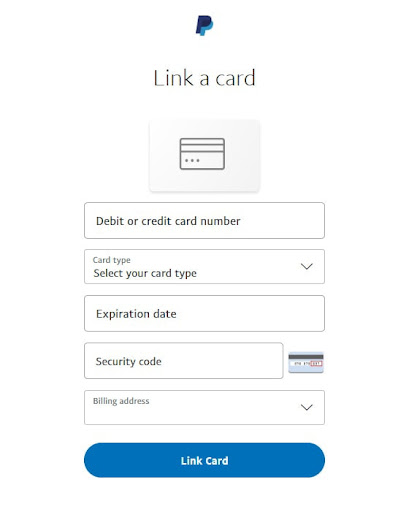

The linking process is as follows:

Step 1: Login to your account

Step 2: Click on the option “Link A Card” available on the account summary page.

Step 3: If any other card/account is already linked, this option may not be available. In such cases, click on the “Wallet” on the top menu bar.

Step 4: Enter your credit/debit card or bank account details.

Step 5: Review the details and click “Link Card” or “Link Your Bank”

That’s it.

Useful information about

24 hour payday loans fast and easy

How To Verify Your Paypal Account In The Philippines

PayPal allows withdrawal of money to verified accounts or debit or credit cards only.

To confirm your card and verify your PayPal account, click on the “Confirm your Card” option available on the wallet page and follow the on-screen instructions.

Those without a bank account or credit card can link their fully verified digital wallets such as Gcash, PayMaya, or Payoneer and can use PayPal without any limitations.

PayPal does not charge for transferring money between PayPal accounts. Still, there is a withdrawal fee when you move your money from PayPal to a bank account or credit/debit card.

How To Verify PayPal Account Using PayMaya?

The Philippines has a number of local online payment platforms that allow linking and verification with your PayPal account. Knowing how to verify PayPal account Philippines with PayMaya is a straightforward process that can be accomplished in 10 to 15 minutes:

Here are the steps to verifying your PayPal account using PayMaya:

Step 1: Download the PayMaya app on your iOS or Android mobile device.

Step 2: Open the PayMaya App and get your Visa virtual card number.

Step 3: Open your PayPal account (app or web) and choose “Link Your Bank”

Step 4: Enter your PayMaya Virtual Visa Card number and choose “Link Card”

Step 5: Wait for the 4-digit verification code via SMS and input the code in the “Enter PayPal Code” box to complete verification.

Verifying your PayMaya account on PayPal is as good as a credit or debit card, meaning you can transfer funds from PayMaya to PayPal and vice versa.

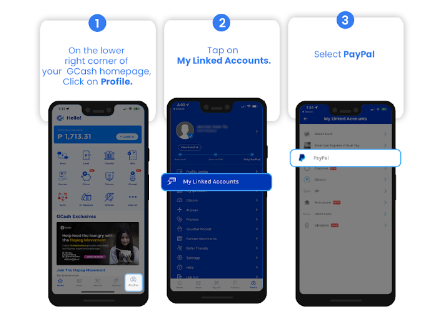

How to Verify a PayPal Account Using GCash?

GCash is another popular online payment platform that receives and transfers funds locally. The verification process with GCash is also straightforward and does not take more than 19 minutes to accomplish.

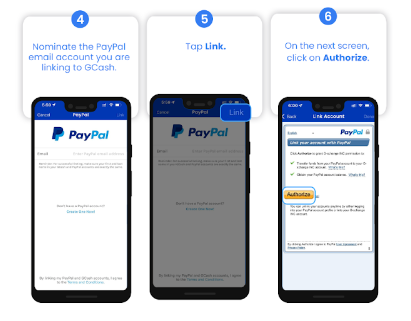

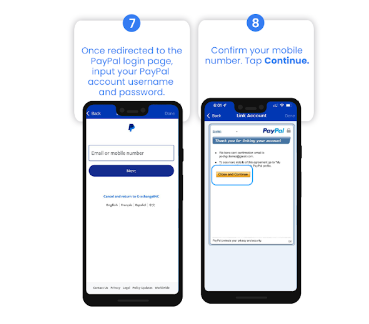

Here are the steps to verifying your PayPal account using GCash:

Step 1: On the GCash app, click on the “Profile” icon in the lower right-hand corner.

Step 2: Choose “My Linked Accounts” on your profile page and select PayPal.

Step 3: Enter the PayPal details of the account you want to verify/link to GCash

Step 4: Select “Link” in the upper right-hand corner

Step 5: Choose “Authorize” on the next screen

Step 6: You’ll be redirected to the PayPal login page to enter your username and password.

Step 7: After logging in, you’ll be redirected back to GCash to confirm your mobile number.

Step 8: Complete your verification by choosing “Continue”

Learn more about

24/7 loans for unemployed

Need extra money? Show 1 valid ID and get an online loan of up to 25,000 pesos! Calculate your pre-approved loan amount with Digido calculator:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

What Are The PayPal ID Requirements?

PayPal will require you to provide a verified and valid identification card before completing your first transaction, whether business or personal. The Paypal ID requirements in the Philippines are there to protect all platform users and ensure seamless transactions among users, with minimal to no issues.

Here are the accepted IDs you can use for your Paypal account:

- Passport

- National ID

- Driver’s License

Upon choosing your ID preference, PayPal will also request for you to input the valid ID number or code associated with that ID. When inputting your information, make sure that the ID number is correct to avoid account blocking in using your funds. More often than not, the process only takes 5 minutes and does not result in any issues or errors.

PayPal Requirements for Transfer Money

There is no sending limit for a PayPal account holder as long as the money is available. If your PayPal account doesn’t have the balance, you can use the linked account/card balance for the transfer.

There is no sending limit for a PayPal account holder as long as the money is available. If your PayPal account doesn’t have the balance, you can use the linked account/card balance for the transfer.

The charges, like conversion charges, apply only to the recipient. The sender doesn’t need to worry about finding additional money as a transfer fee.

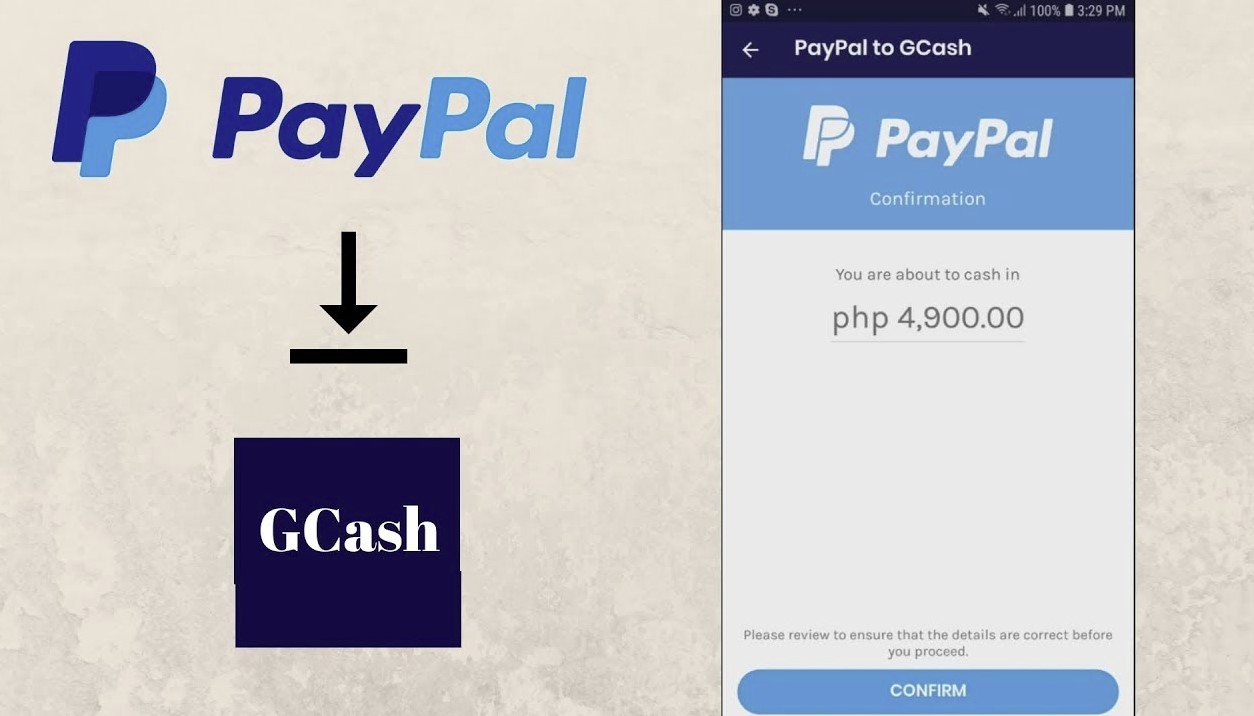

Withdrawal from PayPal account to your linked cards or account incurs a withdrawal charge that varies with the amount, banks, and country. However, if you transfer your money to your digital wallet accounts such as GCash or coins, ph, there are no withdrawal charges. You can withdraw money from PayPal to Gcash wallet by linking the PayPal account to GCash using the option “Link PayPal account” in the Gcash interface. After authorization in the PayPal interface, log in to your GCash account and select “PayPal to Gcash” as the “cash In” option.

Enter the withdrawal amount and currency. Then wait for the notification message from Gcash. PayPal to coins.ph transfer is a bit different from the PayPal to Gcash transfer.

PayPal doesn’t allow direct transfer to coins.ph wallet. So you have to transfer first to GCash wallet and then configure GCash as the cash-in option for your coins.ph account.

How To Send Money Through PayPal

Whether it is the app or website, simplicity is the core of PayPal. Sending money through PayPal is the embodiment of their focus on user experience.

The steps to send money to another PayPal user is as below:

- Login to your account

- Click “Send & Request

- Enter recipient’s email address, amount, and currency

- Select “sending To a friend.

- Choose the funding source – PayPal Balance or any of your linked credit or debit card.

- Review and click the “Send Payments” button

Your recipient will get a notification about the transfer.

How to put money to PayPal

One can add money to his PayPal wallet by transferring funds from linked bank accounts, credit/debit cards, or digital wallets. You can also increase your PayPal balance by requesting/ accepting remittance to your PayPal account.

How to Withdraw Money from PayPal to BPI or a Philippine Bank Account

Transferring your funds from Paypal to a Philippine bank account requires you first to link your bank account to your PayPal profile. Once you have linked your respective bank account, you can transfer funds to and from PayPal using the “Transfer Money” button on your dashboard.

From there, simply complete your PayPal bank transfer following on-screen directions. For those transferring funds from PayPal to BPI, how many days it takes depends on when you transfer the funds. Transfers take 2 to 4 business days to complete, so transferring on the weekends or holidays may take more time than transferring early in the week.

How To Transfer Money From PayPal To GCash And Back

You need to link your PayPal account to your GCash account. You can then easily transfer money from your PayPal account to your GCash wallet within 24 hours.

You can link your GCash account to your PayPal account via the GCash app. However, this is only convenient for funding your GCash from your PayPal account. To transfer money from GCash to PayPal you will have to use your GCash MasterCard debit card.

How To Transfer Money From PayPal To PayMaya And Back

To transfer money from your PayPal account to PayMaya, open your PayPal account and click on “Transfer Funds” and then on “Transfer Money”. The minimum allowable transfer is PHP 100 for transfers, but there is no maxim amount so long as you have the available funds in your account.

PayPal remittance in the Philippines via PayPal to PayMaya uses the PayMaya card number, which is as good as a credit/debit card number and accepted by PayPal as a type of account to transfer funds to. Keep in mind that PayMaya recently rebranded to Maya, so there might also be changes to their policy regarding fund transfers from PayPal.

How To Transfer Money From PayPal To Payoneer And Back

Just like GCash and PayMaya, you’ll need to link your PayPal account to your Payoneer account before you can transfer funds. Once you’ve linked your accounts, go to your PayPal account and click on “Transfer Money”. Your connected Payoneer account should be part of the link accounts options.

From there, choose your Payoneer account and input the desired amount of funds to transfer. Your funds should transfer to your Payoneer account, similar to a transfer to a bank account. Using Payoneer for a PayPal cash out in the Philippines is another effective way to transfer funds from one platform to the other with minimal issues or errors.

How To Transfer Money From PayPal To Coins.ph And Back

There is no direct way to transfer funds from PayPal to Coins.ph, you can still transfer using GCash as the intermediary for how to transfer PayPal to Coins.ph. Follow the usual steps of transferring from PayPal to GCash, then log into your GCash account, link your Coins.ph account to GCash and make the transfer to coins.ph.

While you will need GCash to transfer money to coins.ph, it is possible to make the transfer seamlessly, albeit an extra step in the process.

What Are The PayPal Fees?

As an online financial platform, PayPal has its own set of fees when transferring funds from one place to another. These fees are not as hefty as other platforms but can accumulate as you continually use the platform to cash in and out with your funds. The fees are also based on the country you created the account and the current exchange rates of currency.

For a quick insight into the PayPal transfer fees here’s a list:

- PayPal To PayPal Transfer Fees in the Philippines: Paypal does not charge a fee to send payments. However, the recipient will shoulder the cost, which is 15 PHP. Note that funds sent under the “Friend and Family” category do not incur fees on the sender’s and receiver’s sides.

- PayPal Transfer Fees To Bank Accounts in the Philippines: There is no transfer fee for bank transfers of PHP 7,000 and above. Below this minimum amount, you see a PHP 50 deduction to the final transfer amount.

- PayPal Transfer Fees To GCash: Transfering funds to GCash has no withdrawal fees.

- Paypal Transfer Fees To PayMaya (Maya): The fee is PHP 50, regardless of the amount.

Other considerations:

- Transfer fees may vary depending on currency conversions and whether or not it is a personal transaction to Friends and Family or a business transaction.

- Take note that PayPal has its own conversion rate, different from international standards that may cause your counverted funds to be lower than expected based on the current exchange rate.

How To Close Your PayPal Account

When closing your PayPal account, be sure to withdraw all your funds, as you won’t have the chance to regain the remaining balance after the account has been closed. Here is the step-by-step process for closing your PayPal account:

Step 1: Navigate to your profile setting.

Step 2: Locate the “Account Options” tab and choose “Close Account”.

Once your PayPal account has been closed, you can no longer re-open it. Should you need a PayPal account in the future, you can still use the same email as the closed account, but it will not store or have any information from the previously closed account.

How to Buy load using PayPal

Several websites and Mobile Apps are available for purchasing load online. Specify the mobile number you wish to load and the denomination in the corresponding interface. During check out, choose the option “PayPal” and then make the payment.

PayPal Buyer Protection policy offers complete reimbursement of your purchase cost, including shipping costs, in the event of non-delivery or product mismatch from seller description. Similarly, it protects you from the financial implications of unauthorized purchases from your account if you report it within 60 days.

Similarly, the seller protection feature safeguards the seller from the fraudulent claims of unauthorized payments or non-receipt of the purchased item.

These protection policies alleviate the fears of online purchases. The smooth interface of the mobile app makes the entire process a cake-walk experience for the user.

The Philippines has all the ingredients to create a perfect ecosystem for the growth of the digital economy and PayPal. The Filipinos are known for their internet literacy levels and technical adaptability. Hence such a massive growth of PayPal in the Philippines is not surprising. But it is inspiring.

How to use PayPal in the Philippines

The overwhelming popularity of PayPal across the world is due to its attributes of reliability, ease of use, features, customer support, and affordability.

A valid email address is the only requirement to open a PayPal account. There are no monthly fees or maintenance charges either.

It uses end-to-end encryption and follows the most advanced security measures to ensure an impenetrable, secure environment for your sensitive financial information.

Now a significant number of Filipinos are working as freelancers or doing online jobs. They need an online payment system to receive international payments.

Lockdowns and travel restrictions have changed the shopping habits of people. An online shop needs to offer a reliable and easy-to-use digital payment system for its customers.

PayPal is the ideal choice for such situations. It has a global presence, supports multiple currencies, and posses an easy-to-use interface. So, both your international and local clients won’t have any issues in using them.

If you are traveling or working abroad, using the bank account or credit card issued from your home country for local purchases is a hectic and costly affair. But PayPal overcomes this situation by converting your wallet money to local currency and then use it for purchase.

This feature is a tremendous advantage for OFWs to meet the frequent demand for mobile data recharge for their kid’s online classes.

FAQ

-

How to load PayPal in the Philippines without a bank account?Unfortunately, there is no such option at the moment. You can only deposit money into PayPal via a bank account.

-

Can I Send Money to Philippines using PayPal?You can transfer funds between more than 200 different countries. However, PayPal's international transfers aren't free, so you'll have to check what the fee is for each transfer within your country of choice.

-

Is PayPal Safe to Link Bank Account 2020?PayPal uses extensive security measures to safeguard your bank account or credit card numbers. PayPal provides 100% protection against unauthorized payments sent from your account.

-

Where Can I Cash out my PayPal in Philippines?You can cash out at over 20,000 BancNet ATMs in the Philippines or shop anywhere with the GCash MasterCard.

-

What is a Paypal Document Number?A PayPal document number, or the Merchant ID, is only required for PayPal Business accounts. The Merchant ID is a 13-character string of numbers and letters that is automatically assigned upon creating a PayPal Business account. The Document number cannot be edited or changed.

-

How to get a PayPal card in the Philippines?A PayPal Card is Not Available in the Philippines at this Time.

-

How to Encash PayPal in the Philippines?There is no direct way to encash your funds from PayPal. However, you can use linked platforms like GCash, PayMaya, or your bank account to transfer your funds and cash them out.

Authors

Digido Reviews

-

IanThank you Digido. This app is very helpful in times of emergency needs. Easy to apply and disbursed in my account. God bless you.5

-

MarkA very reliable loan app. You can have the approved amount transferred to your account in less than 3 minutes. Highly recommended to those who need immediate cash☺4

-

CharieAmazing! So easy to loan and approval is very fast only a minute. That's why I rate this with 5 stars.5

-

AllanVery nice loan app. I've using this for several times and I have no problem at all. I got loan amount increase as I pay on time and also up to 30 days payment terms. Fast cash transfer in seconds. Just pay on time guys and everything's ok🙂👍5

-

JerickThanks for fast approval of my 1st loan... I will definitely recommend this to my friends and workmates4