Cebuana Lhuillier in the Philippines

Last updated: March 28, 2024

Written by: Digido Financial Writers Team | Reviewed by: Anna Kireeva

Key takeaways:

- Cebuana Lhuillier PawnShop is one of the largest pawn shops in the Philippines.

- It accepts gold items as collateral and also offers domestic and international money transfer and insurance services.

- You can easily pay your Digido loan with Cebuana Lhuillier.

The Cebuana Lhuillier Pawnshop is a popular pawnshop and money-transfer service in the Philippines with at least 1,500 branches nationwide. But the service had its humble beginning back in 1935 when it was still known as Agencia Cebuana. Many branches in all cities of the Philippines serve as Сebuana bills payment.

How to pay Digido loan at Cebuana Lhuillier

Cebuana Lhuillier has a large network of branches throughout the country.This makes loan repayment via Cebuana convenient for Digido borrowers.

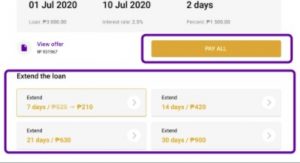

1. Go to your Cabinet by logging in at https://digido.ph/, select “Pay All” or “Extend”.

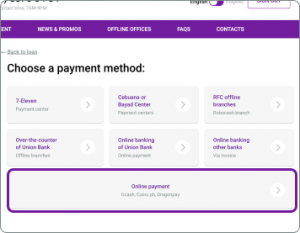

2. Click “Online payment”.

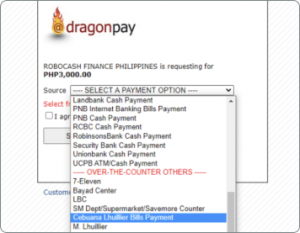

3. Select “Cebuana Lhuiller” and tick the box to agree on the terms and conditions.

→ Also learn more about Loans For Filipino Students

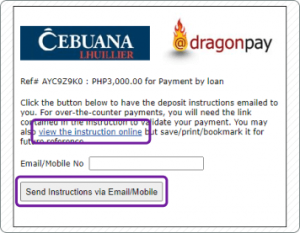

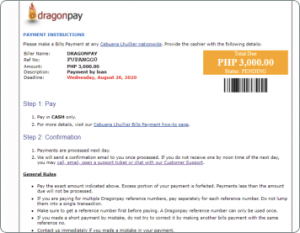

4. You will receive an email with the Reference number to pay at any Cebuana Lhuillier branches. Payment will be made using the Dragonpay.

5. You also can view the instructions by clicking “view the instructions online”.

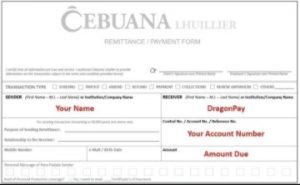

6. Go to your nearest Cebuana Lhuillier Branches, ask for a payment form and write DragonPay as Receiver, Full name, Reference Number, and Amount to pay. Click here to view all Cebuana Lhuillier branches near you.

7. Go to the Payment counter, give your payment form and your payment. Once done, payment will be processed within 24hrs. You will receive an sms notification from us once your payment is posted on your account.

Congratulations! Now you know how to pay Digido thru Cebuana. It turned out to be very easy.

Digido has been working with Cebuana Lhuillier for years and recommends them as a reliable partner. You can pay with Cebuana Lhuillier for our loans and use their other services as well.

You can also repay the Digido loan via Bayad Center→

Cebuana Lhuillier History

Cebuana Lhuillier was established by a French consul Henry Lhuillier in the province of Cebu. Based on historical accounts, it appears that Agencia Cebuana has merely stayed local at least until the 70’s and 80’s when it really began to start extending its branches into Metro Manila. It was only in 1987 when Agencia Cebuana was renamed Cebuana Lhuillier. At this point, Philippe Jones Lhuillier got into politics in 1998 and was appointed Philippine Ambassador to Italy while his son Jean Henri Lhuillier headed the company.

Cebuana Lhuillier was established by a French consul Henry Lhuillier in the province of Cebu. Based on historical accounts, it appears that Agencia Cebuana has merely stayed local at least until the 70’s and 80’s when it really began to start extending its branches into Metro Manila. It was only in 1987 when Agencia Cebuana was renamed Cebuana Lhuillier. At this point, Philippe Jones Lhuillier got into politics in 1998 and was appointed Philippine Ambassador to Italy while his son Jean Henri Lhuillier headed the company.

As technology is advancing and more types of transactions are becoming available, Jean Henri Lhuillier added other services like money-transfer, remittance, insurance, money changer, account remittance, and other collection services. To maintain customer loyalty, it is also the first among its peers to offer a 24k loyalty card program. So far this program has 5 million members as of 2014. Right now Cebuana Lhuillier can be found almost everywhere: in wet markets, malls, and even near university belts. Branches are found around different provinces and cities. They can be searched by simply typing the right keyword in Google like “Cebuana Lhuillier Antipolo”. Google Maps are one of the places to get a list of branches. Cebuana Lhuillier branches serve as convenient payment points for all Filipinos. All transactions take place online. Cebuana bills payment fees are low and available to everyone.

But money exchange and pawnshops aren’t the only businesses they are involved in. In order to promote their brand, they are also active in sports. They have teams in basketball, softball, and tennis. Its president Jean Henri Lhuillier is currently the manager of the Philippine Davis Cup Team. He is also the chairman of PhiTA or the Philippine Tennis Association. And if that’s not enough yet of a position to hold, he is also the president of the Amateur Softball Association of the Philippines. But of course, they are not the only one with sports teams; other companies from a wide variety of industries also have their own sports teams. So not only are they competing with their peers in business but also in sports.

Cebuana Lhuillier also has its foundation aimed at helping those who are in need like those affected by calamities. It carries out disaster relief operations and medical missions. It also has a scholarship program for an alternative learning system.

→ Read all about Pros and cons of 7 Eleven bills payment

FAQ

→ Learn about In-Demand Jobs in the Philippines

Cebuana Loan Requirements

In order to obtain loans, it has to be done via traditional pawning. For this, the applicant must have a valuable item to be pawned.

What items are accepted?

1. Gold;

2. Jewelry;

3. Watches;

4. Electronic gadgets.

Aside from the items to be pawned, the applicant must also present a valid ID:

1. Passport;

2. Voter’s ID;

3. Postal ID;

4. OFW ID;

5. Driver’s license;

6. OWWA ID;

7. Integrated Bar of the Philippines (IBP);

8. Government Service Insurance System GSIS e-card;

9. Social Security System (SSS) ID;

10. Senior Citizen Card;

11. Home Development Mutual Fund (HDMF ID);

12. GOCC;

13. Company ID;

14. Professional Regulation Commission (PRC) ID.

Other documents include:

1. Police clearance;

2. National Bureau of Investigation (NBI) clearance;

3. Barangay certification;

4. Seaman’s book;

5. Department of Social Welfare and Development (DSWD) Certification;

6. Alien Certification of Registration/Immigrant Certificate of Registration;

7. Certification from the National Council for the Welfare of Disabled Persons (NCWDP).

You can find out the amount of Cebuana Lhuillier payment charges on the official Cebuana website. There you can also download the Cebuana bills payment form. You can pay any bills and services, including utility bills. For example, many people in the Philippines prefer the convenience of Cebuana Lhuillier Meralco bills payment. It’s as useful as paying your bills via 7-Eleven or GCash.

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

→ Also learn What is Dragonpay

Cebuana Lhuillier branches that are open 24/7

Here is a list of some Cebuana Lhuillier 24 hours branches.

- Cebuana Lhuillier Makati branches

Pitogo – Makati Branch

Address: 15 Kalayaan Ave. Bo. Pitogo, Makati City

P. Burgos – Makati

Address: 5058 P. Burgos St., Makati city

Oplan Suyod Branch A, B, and C

Address: 1782 Candelaria St. corner N. Garcia St., Brgy. Valenzuela, Makati City, Metro Manila

- Cebuana Lhuillier Baguio 24 hours branches

Baguio 1

Address: 25 Abanao St., Brgy. Asco, Baguio City, Benguet

- Cebuana Lhuillier Davao branches

CLH Matin

Address: Egger Building, Matina Crossing, Davao City

Cebuana Lhuillier operating hours vary depending on the location like those located inside malls or commercial buildings. Of course, if the commercial is only open for a certain number of hours then so are all the businesses inside. So make sure to check a Cebuana Lhuillier working days online.

→ Read How to get OFW Loan

What is Cebuana Lhuillier Insurance?

What is Microinsurance?

This is an insurance program meant for minimum wage earners. In the event of an accident or death, medical or funeral expenses for the insured person can be covered. There are a variety of these programs under this category that applicants can choose from. For a single application, the insured can be covered for a certain length of time. An example is their ProtectMax Insurance for a low starting fee of PHP 50.00 or roughly $1.00, the applicant can be covered for up to 4 months. Depending on the type of emergency, the lowest amount that can be covered is PHP 1,000.00, and the highest being around PHP 25,000.

What is Cebuana Lhuillier Micro Savings?

This is a regular savings account that can hold any amount of money. Account holders can deposit and withdraw money anywhere at any time through Cebuana Lhuillier’s network of over 2,500 branches in all cities of the Philippines. This makes financial services even more accessible. Only 1 valid ID is needed to open such an account. The minimum initial deposit is Php 50 and the maximum possible balance in the account is Php 50,000. The minimum balance to receive interest is 500 pesos and the annual interest rate is 0.30%.

Apply now→ Learn about Buy Now Pay Later in the Philippines

Features of Pawnshop Loan

A pawn shop loan is a special type of loan that will require you to submit an item of significant value such as a gadget or jewelry. The amount of money you will get will also depend on the evaluated monetary value of the object you wish to pawn. The more cash you need the more valuable item you need to pawn. In some cases, you might have to pawn multiple items. They will evaluate the item and the estimated value will typically be lower than the item’s original price. It’s like selling them a second hand item. Once they determine the value and you agree to it, you can get the cash you need.

Now, to get it back, you will have to pay for the item, essentially buying it back, but at a higher price because they added interest. Depending on the loan terms, you may pay a high amount that’s why it’s always a good idea to pay back as soon as possible. You may also lose the item if you don’t pay after a given amount of time or depending on the agreement. Cebuana Lhuillier offers this service, you can read more about Cebuana Lhuillier rates on their website.

The advantages of a pawnshop loan:

– You will definitely get a loan if you have valuable collateral

– You may not work officially or have a steady income

– You get money very quickly

– You can buy back your collateral if you follow the terms of the agreement

The disadvantages of a pawnshop loan:

– If you don’t have something of value, you can’t get a loan

– You have to go in person to have your mortgage appraised and to take it to the pawn shop

– If you don’t pay your debt, you may lose your collateral.

In general, it is a very convenient form of borrowing. Millions of Filipinos use the services of pawnshops.

→ Learn more about Easy Loan For Unemployed

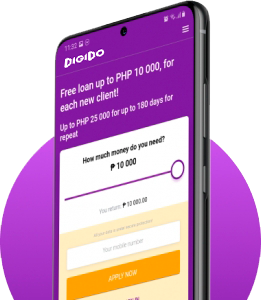

Online Loan in Digido

Digido is a money lending service that provides borrowers a small loans. For those who are borrowing for the first time, they can loan as high as PHP 10,000.00 with a daily interest of 0%. Loan term is possible from 7 to 15 days. This amount is just perfect for paying bills or for starting a very small business, especially in today’s economic and health climate which is rather uncertain.

Repeat borrowers can borrow up to 🟣 PHP 25,000.00 for a period of up to 🟣 30 days, with a daily interest of 🟣 1.5%. Digido does not require a deposit of valuables, guarantors and references from the workplace. Even if you are a freelancer you can get a loan. It is advisable that any amount borrowed must be repaid as soon as possible to avoid incurring penalties.

Who is qualified to borrow from Digido?

Borrowers must be Filipino citizens, within 21 to 70 years of age, and must possess the proper documents such as government-issued IDs. For retired applicants, they must have another source of income aside from a monthly pension. It is also necessary to have citizenship of the Philippines and a permanent address in the Philippines. In addition, you need an ID and a working cell phone.

Digido Reviews

-

RitzThe approval was so fast, i wasnt ready to apply as I was just testing how the app worked. The next thing I know the money was on its way.5

RitzThe approval was so fast, i wasnt ready to apply as I was just testing how the app worked. The next thing I know the money was on its way.5 -

RonSo far my transaction with Digido has no problem. This is my 3rd loan with this online loan. My wife and my friend also using Digido. And i will say that it is recommended for those who need paper money.5

RonSo far my transaction with Digido has no problem. This is my 3rd loan with this online loan. My wife and my friend also using Digido. And i will say that it is recommended for those who need paper money.5 -

NonaOne of the Best Loan App. Reliable. Affordable Fees. Thanks, Digido.4

NonaOne of the Best Loan App. Reliable. Affordable Fees. Thanks, Digido.4 -

ChecheI really trust this app. I think this is my 4th loan and my credit is getting higher. I recommending this to people like me when you need cash. Thanks, Digido!4

ChecheI really trust this app. I think this is my 4th loan and my credit is getting higher. I recommending this to people like me when you need cash. Thanks, Digido!4 -

LeomaDigido is very reliable and flexible. It is very easy to reloan. They are very helpful. Recommended to those who are planning to take a loan. Interest is very low. 👍5

LeomaDigido is very reliable and flexible. It is very easy to reloan. They are very helpful. Recommended to those who are planning to take a loan. Interest is very low. 👍5