How to Calculate Overtime Pay in the Philippines

Key takeaways:

- Overtime pay is between 25% and 35%

- The basis of OT calculation is your basic pay

- Overtime only gets paid if the work is rendered after the first eight hours

Table of Contents

The Philippines is a country that protects its employees. As such, those who work in legit companies can expect to get paid properly. Today, we will show you how to calculate overtime pay in the Philippines, so you know if you are earning right!

Definition of Overtime Pay Computation Philippines

Overtime pay is payment for work rendered above of the minimum eight hours (1). If the employee worked for more than eight hours a day, he is entitled to overtime pay. Overtime pay must be higher than the usual rate of the employee.

The purpose of overtime pay is to ensure that the employee gets properly compensated. It also ensures that the employee will not be abused. The common rate of overtime pay in the Philippines is 25% above the eight-hour period (2).

- 0% interest for first loan

- Only 1 Valid ID to Apply

- Fast Approval in 5 minutes

Learn about

Backpay Computation In The Philippines

Different Types of Overtime Pay Philippines

There are many types of overtime pay in the Philippines, which we shall describe below

- Ordinary Day Overtime – this is overtime on days that are not rest days and are not holidays.

- On Rest Day Overtime – this is the overtime pay for the employee who works during his rest days.

- On Special Holiday Overtime – this overtime only applies if the employee worked during a day that the government declared as a special holiday.

- On Regular Holiday Overtime – this is the overtime rate for the employee if he worked on a regular holiday, such as Christmas or New Year’s Day.

The computations vary per overtime, so the employee can earn more depending on the type of day he worked. For example, holiday work is double pay, so it is higher than the usual overtime rate of 25%.

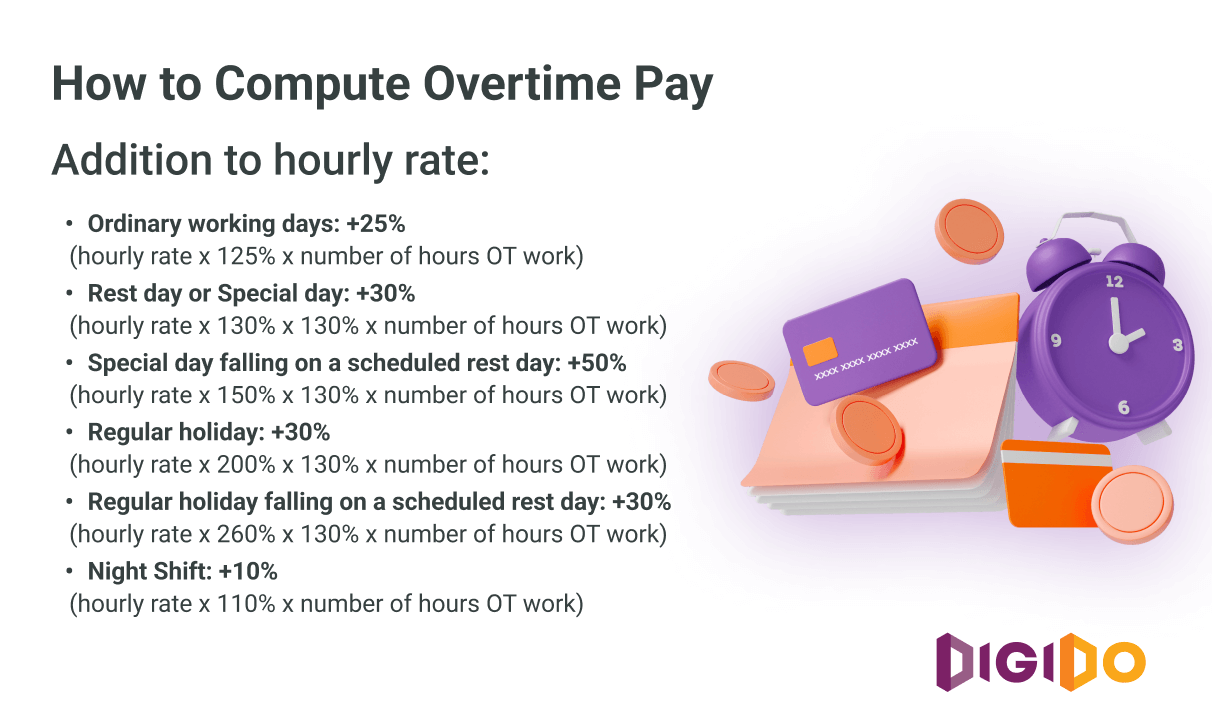

What is the Сomputation of Overtime Pay

According to Article 87 of the Conditions of Employment(2) from the Department of Labor and Employment(3), the overtime rate is 25% of his regular hourly wage. If the work performed beyond eight hours is on a holiday or rest day, the employee must be paid 30% more.

Here are the formulas:

- Overtime during a regular day: 25% x regular hourly rate

- Overtime during a holiday day: 30% x holiday hourly rate

As you can see, there are different rates that affect the computation of overtime. These factors are regular days, rest days, holidays, and special holidays.

How to Compute Overtime Pay Philippines for Daily Paid Filipino Employees

To calculate the overtime if you are paid daily, the company has to divide your daily wage by eight hours. For example, if your daily age is ₱800, the calculation for your hourly rate is:

- ₱800 / 8 = ₱100

Your hourly wage is ₱100. Your overtime pay is 25% higher, so the calculation is ₱100 x 25% = ₱25. It means that your overtime pay for an hour is ₱125.

How to Compute Overtime Pay Philippines for Monthly Paid Filipino Employees

If you are paid monthly, the company will divide your monthly salary by the number of working days for that month. The result will then be divided to calculate your hourly rate. Let us say that your monthly salary is ₱50,000.

Let us say you have 22 working days for that particular month: Here is the formula to get your daily wage:

- ₱50,000 / 22 = ₱2272.727

Now, we should get your hourly rate, which is ₱2,272.727 / 8 = ₱284. If the overtime rate is 25%, your overtime pay for an hour is ₱284 x 25% = ₱71 + ₱284 = ₱355. For each hour of overtime, you get paid ₱355.

Learn How to

Compute 13th Month Pay

Overtime Computation Philippines for Ordinary Work-Day

The first thing to do for overtime computation Philippines for an ordinary workday is to multiply your hourly by 25%. Once you have this number, just add that to your hourly rate.

Let us say that your hourly rate is ₱200. Multiply that by 25%, and you get ₱50. Add the ₱50 to your hourly rate, and you get an hourly overtime rate of ₱250.

Computation Overtime Pay for Night Shift

In the Philippines, the computation of overtime pay for night shift employees is based on the Night Shift Differential (NSD) rate, which is an additional compensation for work rendered between 10:00 pm to 6:00 am. The NSD rate is 10% of the employee’s regular hourly rate for each hour of work performed during the night shift.

To compute the overtime pay for night shift employees, you need to:

- Determine the employee’s regular hourly rate.

- Compute the NSD rate by adding 10% of the regular hourly rate to the regular hourly rate.

- Multiply the NSD rate by 1.25 to get the overtime rate for work performed in excess of 8 hours.

- Multiply the overtime rate by the number of overtime hours worked.

Here’s an example:

If an employee’s regular hourly rate is PHP 100 and he/she worked 3 hours of overtime during the night shift, the computation would be:

- NSD rate = ₱100 x 10% = ₱10 + ₱100 = ₱110

- Overtime rate = ₱110 x 1.25 = ₱137.50

- Overtime pay = ₱137.50 x 3 = ₱412.50

Therefore, the overtime pay for the employee who worked 3 hours of overtime during the night shift would be ₱412.50.

Under Philippine labor laws, the NSD rate is set at 10% of the employee’s regular hourly rate for each hour of work performed during the night shift. In addition to the NSD rate, employees who work overtime during the night shift are entitled to overtime pay computed based on the NSD rate.

Overtime Rate Philippines 2024

Here is a table that will show you the different overtime pay computation Philippines:

| DAY | Overtime Rate Phlippines |

|---|---|

| Regular Day | 25% |

| Sundays and Holidays | 35% |

| Special Holiday | 30% |

| Holiday Restday | 50% |

Learn All about

SSS Pension Computation in the Philippines

Requirements for Overtime Pay Computation

What are the requirements to be eligible for overtime pay? The first requirement is that you should have worked for at least eight hours.

In addition, only rank-and-file employees have a right to overtime pay. Those who have been promoted to supervisory positions and up will no longer receive OT pay.

There are also other factors that you must consider when it comes to being paid overtime. The overtime pay only applies to your regular wage or basic salary. It means that it cannot be applied to allowances, night differential pay, or bonus pays like incentives.

Here is an example:

Let us say that your basic pay is ₱100 pesos per hour. On top of that, you are getting an allowance of ₱50. So, your total salary per hour is ₱150. Now, if you work overtime, the calculation will only be based on your basic pay, which is ₱100, not ₱150.

Need Quick Cash? Apply now with just 1 government valid ID. Calculate your pre-approved loan cost and click ‘Apply Now’:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

Common Issues with Overtime Pay

There are common issues about being paid with overtime. The most common is a miscalculation. It is not the fault of the employee but the payroll department.

If the payroll miscalculates the overtime pay, the employee can file a complaint. The other issue is the lack of education. There are some employees who misunderstand overtime calculations.

Read about

Separation Pay Computation

Tips on how to address these issues and protect employees’ rights

Overtime pay is the right of an employee. If you are an employer, there are some things you can do to ensure that you do not violate the law.

Here are some tips:

- Hire a legal counsel

- Hire an accountant

- Make your payroll automated

You can also work with a third-party payroll company. They charge a fee for calculating the salaries of your employees. However, you must give them the proper input or data so they can also calculate the right salary.

Learn

Is Overtime Pay Taxable in the Philippines? 2024 Tax Guide

Summary: How to Compute Overtime Pay in Philippines

As a Philippine employee, the government has provisions to protect you. You are entitled to overtime pay, and the rate is between 25% and 35% of your salary. You can complain to the Department of Labor and Employment if your overtime pay is not being paid.

However, it is important to note that the employer has the responsibility to comply with the labor laws and regulations set by DOLE (Department of Labor and Employment) regarding overtime work. Employers cannot force their employees to work overtime, and employees are entitled to refuse to work overtime if they have already rendered the maximum allowable hours of work or if their health and safety are at risk.

FAQ

-

Who Isn’t Eligible for OT Pay?Employees who are in a supervisory position and up are not qualified for OT pay.

-

When Can Employers Require OT Work?Employers are allowed to require their employees to work overtime only if the reason for doing so is acceptable and compliant with the regulations and expectations set by DOLE If the reason for requiring overtime work is outside of the DOLE's boundaries and expectations, then the employer cannot require their employees to work overtime.

-

Can an Employee ask their Employer to Let them Work Overtime?Yes, an employee in the Philippines can ask their employer to let them work overtime, but it is ultimately up to the employer's discretion whether to allow the employee to work overtime or no

-

How many Hours can Employees Render for OT work?Employees in the Philippines can Render up to 8 hours of Overtime Work per week.

-

What is a Night Shift Differential (NSD) rate?Philippines, there is a Night Shift Differential (NSD) rate, which is an additional compensation for work rendered between 10:00 pm to 6:00 am. The NSD rate is a percentage of the employee's regular hourly rate, and it is computed based on the number of hours worked during the night shift.

Authors

Digido Reviews

-

JoseI couldn't wait for my overtime pay computation, but I needed some extra money urgently. Digido came to the rescue with their quick loan disbursal process. I was amazed that I could get a loan within one day, and all I needed was a single document. The convenience and efficiency of Digido's services exceeded my expectations.5

-

EmmanuelConsidering that the overtime rate in the Philippines is not particularly high, I was hesitant about taking on extra work. However, when an unexpected expense arose, I had no choice but to seek financial assistance. This company came through with their quick loan application process and i recieve monye in a few minutes. Great! Digido good choice!4