13th Month Pay Computation in the Philippines: How much Should You be Paid?

Key takeaways:

- The 13th month’s salary helps working Filipinos properly celebrate Christmas and New Year

- The 13th month pay rules are governed by Presidential Decree No. 851

- In this article, we will show you an example of how to compute the 13th month salary for different periods of employment

- If you need money fast for an emergency you can always rely on Digido for a quick loan

Table of Contents

The 13th month pay in the Philippines, is one of the most anticipated pays of the year. Contrary to popular belief, it is not a bonus. It is rather the right of an employee.

The 13th month pay is a mandated compensation for private employees in the Philippines. It is a monetary benefit where the employer gives one additional month’s worth of salary to an employee every December of the year.

The thing is that the payment for 13-th month is not always equal to a month of salary. It is calculated according to the number of months you have worked for your current employer.

Take note that the the 13th month’s salary is only based on your basic income. It is not calculated based on your bonuses and employment allowances. The additional compensation is only computed from the time that you were employed, so it can get confusing.

- 0% interest on your first loan

- Only one valid ID needed to apply

- Instant funds transfer to your account

How to Compute 13th Month Pay in the Philippines

The 13th month pay is equivalent to 1/12 of your total basic salary earned during the year. Essentially, it is your basic monthly salary multiplied by the number of months you have worked for the company, all divided by 12. This formula ensures that the 13th month pay reflects the proportion of the year that an employee has worked.

This yearly bonus payment is given no later than December 24th, which means that the employer will assume that you have worked the entire month of December to be able to compute it.

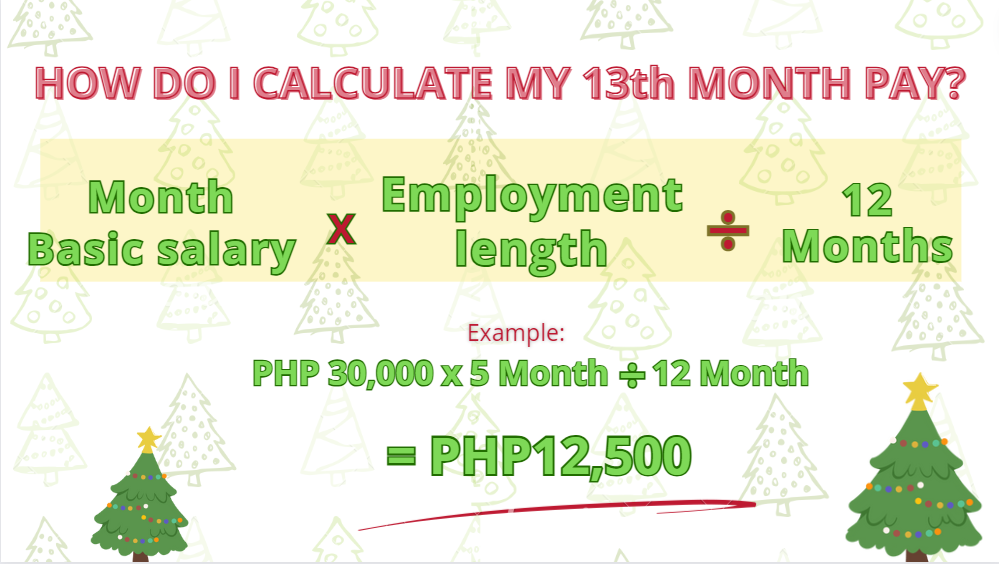

The 13th month formula in the Philippines is the following:

(Basic salary x months worked) ÷ 12 months

Example Calculation:

Suppose an employee has a basic monthly salary of PHP 20,000 and worked for the entire year:

Total basic salary for the year = PHP 20,000 x 12 = PHP 240,000.

13th month pay = PHP 240,000 ÷ 12 = PHP 20,000.

For employees who have not worked the full year, adjust the total basic salary accordingly before dividing by 12. Let us say that your basic salary per month is Php 20,000 and you worked from September to December, then you have worked for 4 months. How to compute 13th month pay for 4 months?

The calculation will be the following:

PHP 20,000 x 4 months = PHP 80,000;

PHP 80,000 ÷ 12 = PHP 6,666.67

Remember that if your salary includes the allowance, bonuses and commissions, they are not part of the calculation. Employees terminated before the payout period are still entitled to a prorated 13th month’s salary.

In the next section, we will be calculating payment for 13th month based on different scenarios. Below we give an example of how to compute 13th month pay for 8 months with 3-days unpaid leave:

| Basic monthly salary | Php 20,000 |

|---|---|

| Daily rate | Php 1,000 |

| Date started | May 2, 2024 |

| Length of employment for the calendar year (by December 31) | 8 months |

| Unpaid leave | 3 days |

| Total annual income (minus unpaid absences) | Php 157,000 |

| 13th-month pay | Php 13,083 |

After adjusting for the unpaid leave (Php 160,000 – 3000), the employee’s total income for the year is Php 157,000. Based on the above figures, the payment for the 13 month is Php 157,000÷ 12 = 13,083.

All about

Motor loan in the Philippines

How to Compute 13th Month pay for 6 Months

You also have to consider your employment length, or the number of months that you have worked in a company for a calendar year. For example, if you were employed or have worked for a company from April to October, then your employment length is six months.

You don’t necessarily need a 13th month pay calculator, as the formula is quite simple: just multiply your monthly salary by the number of months you’ve worked, then divide by 12. Here is the basic 13th month formula for calculating your payment for 6 month:

Your monthly basic salary refers to the amount that your employer pays you for your services. This does not include overtime pay, cost of living allowances, unused leaves, night shift differential, et cetera.

If you’ve been an employee for 6 months, here’s how you would compute your paycheck for month 13. We’re going to use the example above (employee from April to October). If your monthly salary is Php 30,000, your 13th pay is:

(PHP 30,000 x 6 months) ÷ 12 months = PHP 15,000

Because you did not work for the company for the whole calendar year, you will only receive a prorated amount based on the number of months you worked. So based on the sample computation above, your monthly salary of Php 30,000 will be multiplied by 6 since you only worked from April to October. But it will still be divided by 12 months so you get Php 15,000.

How to Compute 13th-Month Pay Prorated

How to compute 13th month pay with absences and late? What we will compute in this section is an example for an employee who has earned different amounts in several months.

To compute the prorated payment for the 13th month, particularly for employees who have not worked the entire calendar year or have varying monthly earnings, you can follow these steps:

- Determine the Basic Monthly Salary. Identify the employee’s basic monthly salary, excluding overtime, bonuses, allowances, and other additional compensations.

- Calculate Total Basic Salary Earned. Add up the total basic salary the employee earned during the months they worked within the calendar year.

- Account for Partial Months. If the employee started or left partway through any month, you need to calculate the salary for the portion of the month they worked. This could involve prorating the monthly salary based on actual days worked if necessary.

- Prorate the payment for 13 month. Divide the total basic salary earned by 12 to get the prorated paycheck for month 13.

Formula:

Prorated 13th-Month Pay = Total Basic Salary Earned During Employment Period ÷ 12

Thus, for an employee who worked only part of the year, their 13th pay is prorated based on the actual months (or days, if applicable) worked, ensuring they receive the equivalent of one twelfth of their annual basic salary earned.

Let us take the scenario below, how to compute prorated 13th month pay when you have time off. The basic pay of this employee is Php 15,000 per month:

| Month | Absence | Salary |

|---|---|---|

| January | No absence | ₱15,000 |

| February | No absence | ₱15,000 |

| March | No absence | ₱15,000 |

| April | No absence | ₱15,000 |

| May | 3 days leave with pay | ₱15,000 |

| June | No absence | ₱15,000 |

| July | 2 days leave without pay | ₱14,500 |

| August | No absence | ₱15,000 |

| September | No absence | ₱15,000 |

| October | 7 days leave without pay | ₱13,500 |

| November | No absence | ₱15,000 |

| December | No absence | ₱15,000 |

On some occasions, the employee did not earn the full amount because he had unpaid absences. In some months, he earned more than Php 15,000 because he rendered overtime (take note that the salary presented is just the basic pay, and does not include other pays like bonuses, sales commissions, and others). Our prorated 13th month pay calculator will show this result:

PHP 178,000 ÷ 12 = PHP 14,833

Learn more:

How to Compute 13th Month pay for Resigned Employees

What if you have resigned from the company? How much would you receive as 13th month’s salary??

Resigned and terminated employees are still entitled to their payment for 13th month, so no need to worry if you decided to leave before the end of the calendar year. This will be given to you as part of your back pay or final pay.

If you have resigned, your 13th month pay formula will be based on your monthly salary multiplied by the number of months you worked, divided by 12 months. For example, your previous salary was Php 40,000/month and you worked for the company for 10 months. The formula will be:

(PHP 40,000 x 10 months) ÷ 12 months

Going by this, your 13th month’s salary will be Php 33,333. If you have resigned, you will receive this as part of your final pay.

Need extra cash before payday? Show 1 valid ID and get an online loan of up to 25,000 pesos! Calculate your pre-approved loan amount:

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

What Is the 13th-Month Pay Law in the Philippines?

By virtue of Presidential Decree No. 851 (1) private employers in the Philippines are required to give out 13-th month pay to all rank and file employees who have worked at least a month in the company. This was introduced in 1975 by President Ferdinand Marcos, who is considered the 13th month pay law author.

The meaning of 13 month pay is additional monetary compensation given to employees at the end of the year. This is given out regardless of their employment status or how they receive their wages, and must be awarded by December 24-th each year.

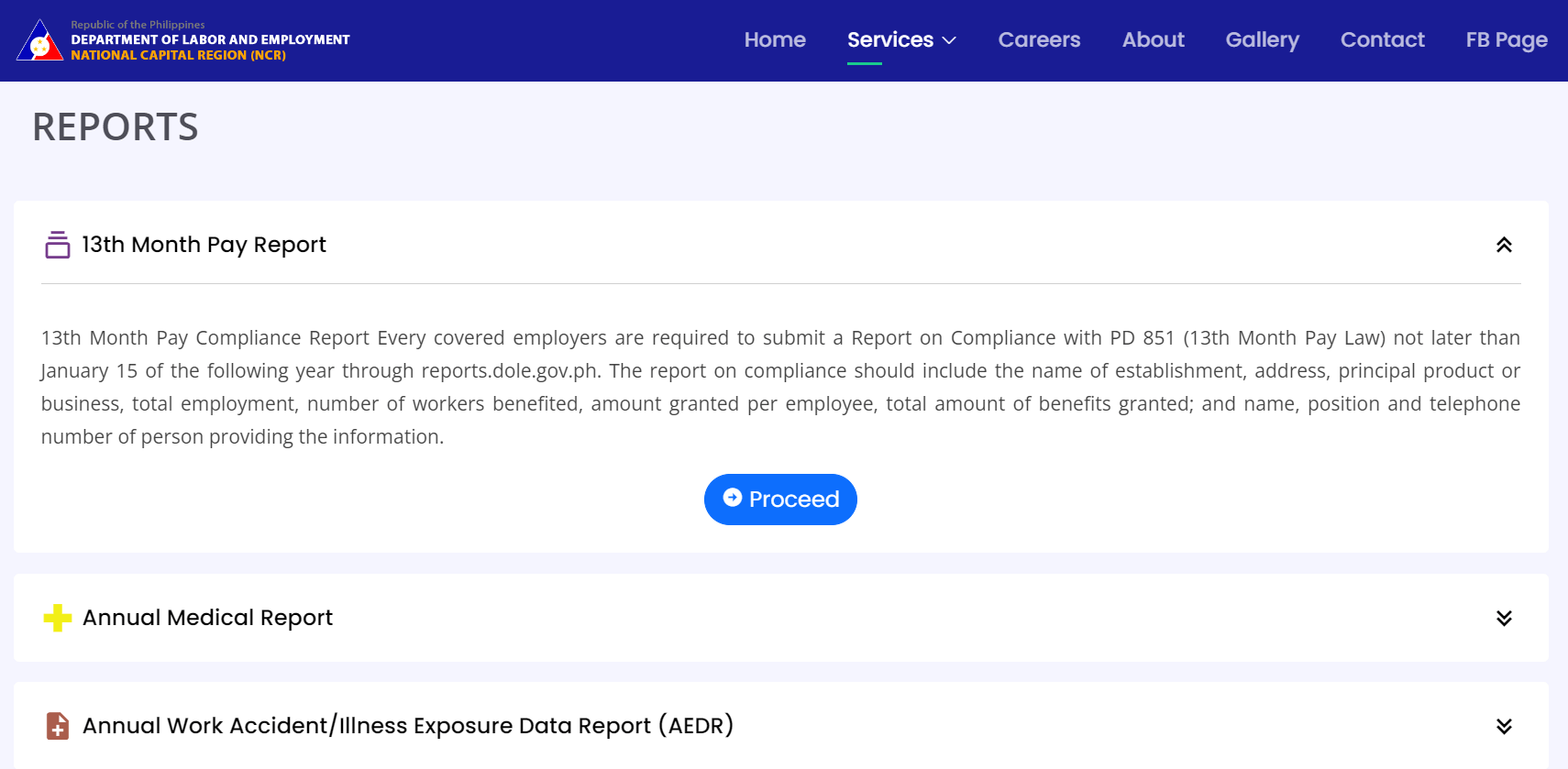

Under PD 851, employers must submit a 13th Month Pay Compliance Report by January 15 each year via reports.dole.gov.ph.

Actually 13-th month pay is not similar to a Christmas bonus: The 13-th month pay is mandated by law, requiring all employers to provide this benefit to their employees, whereas the Christmas bonus is entirely discretionary. It is up to your bosses if they will give out a Christmas bonus in the Philippines for 2024.

What is not Included in the 13th Month pay Computation

Note that only your monthly salary will be considered for the 13th month you are paid. In general, benefits and allowances that are not integrated into your basic monthly salary will not be included in the 13th month pay computation. These include:

- Cost of living allowance (COLA)

- Profit-sharing payments

- Cash equivalent of unused sick and vacation leaves

- Overtime pay

- Premium pay

- Night shift differential

- Holiday pay

- Maternity benefits

The benefits mentioned above will only be included in your 13-th month pay IF they have been integrated into your basic monthly salary in the first place.

The 3th-Month pay Eligibility

Per the guidelines set by the Department of Labor and Employment (DOLE), rank-and-file employees from the private sector are entitled to a 13th month pay provided that they worked for the company for at least a month during the entire year. It is part of employment law that obliges employers to pay either in one lump sum or two installments payable before December 24 of that year.

Those in managerial positions who have the authority to hire, discipline, and discharge rank-and-file employees are unfortunately not eligible for this pay.

The same applies to employees with distressed employers, household workers, and those earning on a commission or task basis. Government employees are also not entitled to receive 13th month’s salary.

Is the 13th-Month pay Taxable?

Under the Train (Tax Reform for Acceleration and Inclusion) Law of 2018 (2), the 13th month is not subject to taxation if the pay is below the threshold. The threshold amount is set at Php 90,000 which means employees receiving salary below that maximum limit will receive their pay in full, tax-free, while those receiving above the threshold will be obliged to pay the corresponding tax.

What to Do if You Don’t Get 13th-Month Pay

If you did not get a 13th month pay, you need to file a report to the Department of Labor and Employment or DOLE (3). You will know how to compute your payment for 13th month with DOLE help and will get all the benefits you are entitled to under the law. The 13th pay is a mandatory benefit. All employees are entitled to get a 13th month pay, provided that they have worked at least one month in the company.

FAQ

-

Is 13th month pay prorated in the Philippines?Even when you leave the company, you are entitled to 13 months of salary. This is also known as 13-month pro rata pay, which is paid to a permanent employee who has worked less than 12 months.

-

Is 13th month pay taxable in the Philippines?The 13th month's salary is exempt from tax, up to a limit of PHP 90,000 and is mandatory.

-

How 13th month pay works?The 13th pay is a mandatory benefit in some countries, given to employees as an extra month's salary at the end of the year. It's calculated based on the basic salary earned over the year, divided by 12, excluding overtime, allowances, and bonuses. It's typically paid by December 24th to help employees with holiday expenses.

-

What is the 13th month pay payslip format?Your 13th month payslip will show the amount of your 13th month plus any deductions.

-

Who has the right to get a 13th month's salary?All employees working in the private sector provided they have worked for at least one month during the calendar year. Rank and file include all workers except those in managerial positions.

-

What is a basic salary?Basic salary is your base rate that is your entitlement. It does not include commissions and bonuses.

-

When exactly is the 13th month's pay date by law?By law, the 13th month's pay must be given to employees no later than December 24th of each year.

-

How to compute 13th month pay with maternity leave?When computing the 13th month pay for an employee who has taken maternity leave, it's important to note that the period of maternity leave is treated as time worked. This means that the employee's entitlement to the 13th month's salary is not diminished because of the maternity leave. Divide the total basic salary earned (including the period of maternity leave) by 12 to determine the 13th payment.

-

Is overtime included in 13th month pay?No, overtime pay is not included in the calculation of the payment for 13th month. The 13th month pay is calculated based on the employee's basic monthly salary only, excluding overtime, holiday pay, allowances, and other benefits or bonuses.

-

How to compute 13th month pay for 7 months?To compute the 13th month's salary for 7 months, multiply the basic monthly salary by 7 (the number of months worked), then divide by 12. This gives the prorated 13-th pay for the period worked.

-

Can I get 13 months' pay if I've only worked for 2 months?Yes, you can. If you're wondering how to compute a 13th month's pay for a 2 month paycheck, here's the formula - multiply your basic monthly salary by 2 (for the two months worked), and then divide by 12. This calculation will give you the prorated 13th month's salary for the period worked

Authors

Digido Reviews

-

MaryNice app. This app truly help someone needed a cash.5

-

ArvinGreat service! Instantly issued a loan for my urgent expenses. Despite the 13th-month pay eligibility for workers, the need for additional funds, especially around the holidays, is common. Thanks for bailing me out quickly!5

-

ChristopherThank you for making me a valued customer. You gave me what I needed in times of desperate need for help. 5 stars for you Digido!5

-

WarrenFast disbursement and reasonable amount of interest. Thank you Digido4

-

MarilenLess than 5 minutes for approval & bank transfer, it is amazingly fast. Interest fees are a bit high, however in times of emergency needs, highly commendable & recommendable. Payment options are wider & flexible up to 30 days. The apps itself is good.4

-

MattI don't regret choosing Digido! I planned my finances around my 13th-month pay day, but I needed to borrow some money. It's a fact that they approve 90% of applications, I received the money loan in exactly 7 minutes. Fast approval and service!4

-

CesI really appreciate this site especially their costumer service. This online response as fast as they can. Anytime anywhere. This is a really big help for me and to my fam. I highly recommended this app.5