All About PayMaya

Last updated: January 12, 2024

Written by: Digido Financial Writers Team | Reviewed by: Anna Kireeva

Key takeaways:

- One of the most popular e-wallets in the Philippines is PayMaya.

- PayMaya offers bill payments, money transfers and various purchases.

- Another good thing about PayMaya is that you can also use their physical card.

- Unfortunately, Digido doesn’t have a payment option through PayMaya. But you can choose another convenient method.

Mobile wallets have seen an uptick in users and transactions especially over the past two years. The increased need for connectivity especially during a pandemic has led to more people embracing digital solutions, particularly those that help them deal with their money. It does help that a lot more people are glued to their smartphones nowadays.

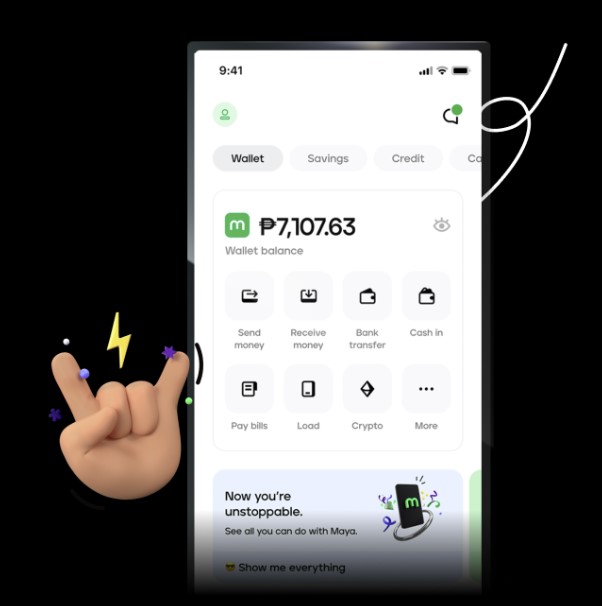

Mobile wallets like Maya (formerly known as PayMaya (1) do a great job at helping people manage their money using their phones. With Maya, you can send money, pay your bills, and shop online without having to leave your home!

What is Maya?

Maya (2) is one of the well-known e-wallets in the Philippines. Just like any other e-wallet in the country, you can send money, pay your bills, top up your mobile load, and shop for goods and services from your smartphone. It has a very user-friendly interface which you can easily get used to. It is also a more secure way of transferring money and paying for goods and services, especially nowadays when the pandemic is still a threat.

Through Maya, you can comfortably pay for your electric, water, internet, phone or whatever bill that comes your way! Just download the app from Google Play or App Store and sign up for an account using your mobile number.

PayMaya is now Maya

In late April 2022, Paymaya announced that it has rebranded to Maya (3) in a bid to become an “all-in-one money app” that customers can trust. It has received a digital banking license from the Bangko Sentral ng Pilipinas (BSP) that will allow Maya to act as a digital bank, offering savings accounts and even cryptocurrency services.

To reflect the rebrand, Maya has changed its logo and interface into a sharp and sleek black and dark green color palette.

And now that PayMaya has recently rebranded into Maya, its services have now been expanded to include digital banking and crypto investing!

With the help of the digital banking license, Maya has launched Maya Bank, a digital bank where you can open a savings account at 6% introductory interest rate (much higher than traditional banks!). Maya also has a new crypto feature that lets users buy, sell and hold cryptocurrency.

The new Maya brand will be visible across all of PayMaya’s platforms, including its payments solution Maya Business and Maya Center.

→ Learn more about quick loan with no job verification

Is PayMaya legit?

Yes, Maya (formerly known as PayMaya) is a legitimate app. It has received a digital banking license from the Bangko Sentral ng Pilipinas (BSP) to establish digital banking services in the country. PayMaya Lending Corporation is also registered with the Securities and Exchange Commission (SEC).

Rest assured that your money is in good hands, and in the event that something unfortunate happens, Maya will do its best to help you get your money back.

How to Use PayMaya App?

How do you use the Maya app and how can you sign up for a Maya account?

- Download the Maya app from Google Play or App Store.

- Launch the Maya app, then fill out the form for the registration process. Tap “Continue”.

- Check and read the Data Privacy Policy page. Tap “Agree”.

- You will receive a verification number via text. Enter this number in the Maya app. Tap “Verify”.

- Go to “View Card”, then enter your birthday and address.

- Go to the “Online Payment Card Number” page, then enter the necessary details. After this, Maya will send you a confirmation on your account activation. And you will create a Maya account.

- After the activation of your Maya account, you can add money to Maya using a credit card or add money in Maya using Globe load.

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

→ Useful information about 24 hour payday advance

Ways to use PayMaya account

PayMaya provides various services. You can also use a PayMaya in different ways. Here are some of them:

How to use a PayMaya for Steam

- In the Steam Wallet Xquareshop, select the Steam Wallet voucher you prefer.

- Select on the E-wallet, then choose PayMaya.

- When you get into the payment page, you have the option to pay through your PayMaya wallet or via QR code. If you choose your PayMaya account, you need to login to your account first.

- Check your order details, then complete the payment process.

- After you successfully paid the voucher, Steam will redirect you to the order page. Your Steam Wallet code will reflect, and you will receive it at your email address too.

How to use PayMaya card for pay bills

What is a Paymaya card? The card will help you with online payments:

- First, make sure that your PayMaya account has available cash in Paymaya. Go to the store’s page and select the item(s) you want to purchase.

- Proceed to the payment process, then select Debit/Credit Card or the VISA/PayPal payment method.

- Enter your PayMaya card details:

- card number;

- expiration date;

- CVV2 or the security code.

- Open your PayMaya app, then confirm your payment. You will receive an SMS as confirmation that your payment is successful.

How to withdraw money from Paymaya without a card

You may withdraw your cash through ATMs here in the Philippines and abroad. PayMaya cards are available for all upgraded users.

→ Do you know how do I get a loan without a bank account?

How to withdraw money from PayPal to Paymaya

1. Link your PayPal and PayMaya account

2. Now you can start transferring money from PayPal to PayMaya.

3. Login to your PayPal account and click “Transfer Funds” or go to the “Wallet” tab and click “Transfer Money”.

4 .Enter the amount you want and choose your PayMaya account.

5 .As soon as you confirm the withdrawal amount, your transfer will be processed.

Can I use Paymaya for Paypal? The answer is yes!

Where to buy PayMaya physical card

You can purchase a PayMaya card at the:

– PayMaya website;

– SM Store Business Services;

– Robinsons Department Store Business Centers.

How to use PayMaya in Lazada

1. Open your Lazada mobile app, then select the item(s) you want.

1. Open your Lazada mobile app, then select the item(s) you want.

2. Tap “Add to Cart”. Open your cart and proceed to payment by tapping “Check Out”.

3. Enter your shipping details, as well as your billing information. Tap “Place Order”.

4. Choose “Credit/Debit Card” as your payment method.

5. Enter your PayMaya details, then tap “Pay Now”.

→ Also read all about Easy Loan online with fast approval

How to use PayMaya in PayPal

1. Log in to your PayPal account on your computer. On the Summary page, click the “Withdraw Funds”.

2. Enter the amount you want to withdraw.

3. Choose PayMaya. Make sure that you linked your PayMaya account to your PayPal account.

4. Confirm your withdrawal amount, then wait for 4 business days for the amount to be reflected on your PayMaya account.

How to use PayMaya in Shopee

1. Open your Shopee mobile app, then select the item(s) you want for use Paymaya in Shopee.

2. Tap “Add to Cart”. Open your cart and proceed to payment by tapping “Check Out”.

3. Enter your shipping details, as well as your billing information. Tap “Place Order”.

4. Choose “Credit/Debit Card” as your payment method.

5. Enter your PayMaya details, then tap “Place Order”.

How to use PayMaya in Spotify

So, how to pay Spotify using PayMaya?

1. Make sure you have loaded up your PayMaya account.

2. At Spotify, sign up for an account. Enter the necessary information.

3. Enter your PayMaya details. After this, you will get your Spotify Premium.

How to use PayMaya in Google Play

1. You can also use your PayMaya in any in-app purchases at Google Play. To use it, the app should accept payments via Mastercard or VISA.

2. Go to Google Play and install the app of your choice.

3. Enter your PayMaya details to complete your in-app purchase.

→ Learn about Loyalty Cards in the Philippines

How to use Paymaya in Netflix

So, how to pay Netflix using PayMaya?

1. Tap the “My Cards” tab at the bottom of the screen

2. Select “Online Payment Card Number.”

3. Use the card details in your PayMaya virtual credit card to purchase a Netflix subscription.

How to use Paymaya in Playstation store

1. Log in to your PayMaya app

2. Tap “Gaming”.

3. Choose your desired product.

4. Confirm and pay. You will then receive a unique voucher code that you can use to add funds to your PSN Wallet.

How to use PayMaya in PSN

1. Go to the PayMaya mobile app and log in to your account. Tap “Gaming”.

2. Select the product you prefer.

3. Confirm your choice, then pay. You will receive a voucher code after your successful payment.

4. Use this unique code to fund your PSN Wallet.

→ Learn about In-Demand Jobs in the Philippines

FAQ

How to Load Up PayMaya and Send Money

Here are some of the ways on how to load PayMaya card/app:

How to load PayMaya using BDO

Top up your account at any BDO branch:

1. Go to any BDO branch that you prefer. Get a BDO Cash Transaction Slip.

2. Fill out the important details. For the company name, write PayMaya Philippines, Inc. Then fill in your PayMaya account information:

3. Subscriber’s Name;

4. Subscriber’s PayMaya Account Number;

5. Transaction Amount.

6. Tick/Check the box for the Bills Payment.

7. Present the slip to the teller and provide the cash payment.

8. You will receive an SMS confirmation to notify you about the transaction.

Top up your account via BDO mobile app/online:

Top up your account via BDO mobile app/online:

1. Open your BDO mobile app, then log in to your account.

2. Tap “Send Money”. Select “To Another Local Bank”.

3. From the drop-down menu, navigate and choose “PayMaya Philippines, Inc.”

4. Enter the required information. Wait for your One-Time Pin sent to you.

5. Check the details, then confirm your transactions. When done, you will receive an SMS notifying you of the successful transaction. So you added money from BDO to Paymaya.

How to load PayMaya using BPI online

1. Open your BPI Online Banking or your BPI mobile app, then log in to your account.

2. Go to Menu, tap “Payments/Load”. Select “Load E-Wallet”.

3. Enter the required details.

4. Choose your source BPI account under the “Load From” section.

5. Find PayMaya through the “Load To” and select it. Under the “Reference Number”, enter your Paymaya mobile number.

6. Enter the amount, then tap “Next”. Make sure that the details you input are correct.

7. Input your One-Time Pin sent to you.

8. You will receive an SMS notifying you of the successful transaction.

How to cash in PayMaya in 7-Eleven

Top up using PayMaya barcode:

1. Go to the PayMaya app, then log in to your account.

2. Tap “Add Money”, then choose the 7-Eleven.

3. Input the amount, then continue. Wait for the barcode to be generated.

4. Go to any 7 Eleven kiosk, then show the barcode to the cashier for scanning. Pay the amount plus a fee.

5. You will receive an SMS notifying you of the successful transaction.

Top up using SMS:

1. Create a new message, then text:

2. ADDMONEY 711 [amount]

3. Send to 292907969.

4. Wait for the code. Once received, go to any 7-Eleven branch with a CLiQQ kiosk. Enter the required information.

5. Give to the cashier the CLiQQ kiosk receipt. Pay the amount plus a fee.

6. You will receive an SMS notifying you of the successful transaction.

How to Cash Out in PayMaya

To withdraw your cash from PayMaya, you need to use your PayMaya physical card. You can go to any BancNet ATM and use your card to cash out. If you are outside the Philippines, you can use it as well at any VISA Plus ATM. But make sure that you have linked your PayMaya account to your card.

How to cash out PayMaya without a card?

Unfortunately, you cannot withdraw your funds in your PayMaya account without a card. If you have an upgraded account, you can purchase one at PayMaya official website.

How to cash out PayMaya in Palawan Express?

You cannot cash out Paymaya to Palawan, but you can send your money to a recipient through Palawan Express.

1. In your PayMaya dashboard, tap “Send Money”.

2. Enter the 16-digit number of the Palawan Express branch where your recipient will get the money.

3. Input the amount.

Pros and Cons of PayMaya

Here we have compiled the most popular advantages and disadvantages that customers of the service are talking about online.

Pros of PayMaya:

- Easy, convenient, and free to use;

- Has a lot of affiliate partners when loading up such as 7-Eleven;

- Can withdraw the cash in the Philippines and abroad.

Cons of PayMaya:

- Some shop online do not accept PayMaya;

- Cash in may take a while;

- PayMaya app is accessible only via smartphones;

- Logins do not have two-factor authentication.

Can I Repay a Digido Loan with PayMaya?

How to pay Digido in PayMaya? Unfortunately, Digido does not have a payment option via PayMaya. But you can choose another method by paying your loan to these affiliated payment centers of Digido:

- 7-Eleven;

- Cebuana or Bayad Center;

- RFC offline branches;

- Union Bank (over the counter and mobile banking);

- Other banks (online banking via invoice);

- Gcash, Coins.ph, Dragonpay.

Remember that you can apply for a quick loan in Digido for up to 25,000 pesos at any time. To do so, you need to be a Filipino citizen and between 21 and 70 years old, as well as provide a valid ID and mobile phone number.

→ Also learn more about How to pay through Dragonpay

How to Borrow Money from PayMaya

How to Borrow Money from PayMaya

Many people think that PayMaya is only a payment processing tool. They do not realize that you can apply for a loan. When people ask, “Can I borrow money from Рaymaya?” The answer is yes, you can.

Today, we will show you how to get a loan in PayMaya in simple and easy steps. This loan is what many people call PayMaya Cash ni Juan.

What is the Cash ni Juan PayMaya loan?

The PayMaya loan Cash ni Juan is a lending product of PayMaya in partnership with SnapCash Lending Inc. To use it, you must first be a PayMaya user. Users can borrow between ₱2,000 and ₱5,000. The borrowers are expected to pay the loan in 14 days.

How to Apply PayMaya Loan

The company has several conditions before one gets approved for a loan. First off, you must be between 18 and 65 years of age. Also, the interest is 0.08%.

Here are some more things you need to know:

• Use PayMaya often; you will not get approved for a loan if you do not use the app

• Upgrade your account; upgrading is free, and you will go through a video call with PayMaya

After upgrading your account, you can now apply for a loan. With an upgraded account, you can also request a PayMaya VISA Debit Card.

After the upgrade, you need to activate your Credit Scoring Options. There are many boxes that you have to check, such as Profiling, Profile Sharing, and Credit Scoring.

With Credit Scoring, the company will calculate your credit score based on data that comes from the PLDT Group. They are like the equivalent of Equifax in the US. They share your credit data with third-party entities.

Once you have built an acceptable PayMaya credit score, the PayMaya lending app will show you a banner that says PayMaya credit loan or PayMaya loan application.

PayMaya loan requirements

Want to get a loan from Maya (formerly known as PayMaya) but don’t know where to start? We have prepared a guide for you?

Maya offers loans through the Cash ni Juan service. In order to avail for a loan from Maya, you need to download the app and sign up for an account. In addition, you must be a regular Maya user and your Maya account must be upgraded, along with the Credit Score option on your account.

You will be notified once you have been qualified for a Maya loan.

How to be qualified for a PayMaya loan in 2024

It’s easy to be qualified for a Maya loan! The PayMaya loan requirements are as follows:

- You must be a Filipino citizen.

- You must be a regular Maya customer with an upgraded account.

- You have to undergo an e-KYC process by speaking to a Maya representative.

- You will then be offered amounts to borrow. Your loanable amount will increase as you apply for more loans.

How Much Can I loan in PayMaya

The maximum amount of money you can loan is ₱5,000. The minimum and the maximum term is 14 days. What means that essentially, your loan term is fixed at 14 days. It does not matter if you paid the loan three days earlier. You will still pay the interest for 14 days.

With the PayMaya loan application, the interest is 0.08% per day. Below is an example of the maximum loan.

• Loan amount: ₱5,000

• Interest: 0.08% x ₱5,000 = ₱4

• Total interest to pay = ₱4 x 14 days = ₱56

Once you pass the PayMaya loan requirements and you got a loan of ₱5,000, you must pay a total of ₱5,056 within 14 days.

There is no mention whether or not PayMaya charges late fees or penalties, but it is safer not to test it. Keep in mind that you have a credit score. If you do not pay your bills on time, your credit score gets negatively affected. The lower your credit score, the less likely you will get approved for a loan.

How to Loan in PayMaya App

Does PayMaya offer a loan? Not really. PayMaya, as the company, is not the lender. Instead, it is their business partner that offers the loan.

To start, you have to check your PayMaya app. From there, you will see a box that looks like an advertisement. It says Congratulations! You are qualified for a loan of ₱2,000. It will say ₱5,000 if you qualify for that amount.

1. To start, tap on the Loan Now button. Once there, you have to tap the box that says Available for You. The loan amount varies. Some can loan ₱2,000, and some can loan ₱5,000.

2. Now, this is where it gets interesting. The interest you pay depends on your credit score. While the typical interest rate is 0.08%, some people pay an interest of 0.30%.

3. The number of loans you had before and whether you paid them on time have an impact on the money you can loan. On some occasions, you may have already loaned three times, and yet your limit is still ₱2,000.

4. Now, once you tap the Loan Now button, you will find the details of the loan. For a loan of ₱2,000, there is a processing fee of ₱120. As such, you will only receive ₱1,880. Remember, you owe ₱2,000, not ₱1,880.

5. Then, your term begins. You have to pay that ₱2,000 within 14 days, plus interest of 0.30%. As mentioned earlier, the interest varies. Some may pay only 0.08%.

6. In total, you have to pay ₱2,084 in 14 days. You will also see this detail before you tap on a button that says 2Get Money”.

You need to scroll down to the bottom to agree with the terms and conditions. Once you tap that blue “Get Money” button, you will receive a one-time password. Enter that, and the system will deposit ₱1,880 into your PayMaya account.

Maya Loan Advantages

Once you use the PayMaya loan, you get an affiliate link. You can send this link to friends. If they use PayMaya, you get ₱50 in your account. Although this is an affiliate process, PayMaya calls it a referral program.

They also offer cash back. This cashback comes in the form of a discount. For example, if you buy phone air credit for ₱700, you only pay ₱650.

Lastly, you can apply for a PayMaya debit card once you upgrade your account. They will send you a VISA card, and you can withdraw money from an ATM. The amount of money you can withdraw is equivalent to the fund you have in your PayMaya account.

Articles Sources

- Manila Bulletin https://mb.com.ph/….

- Maya https://www.maya.ph/

- Esquiremag https://www.esquiremag.ph/…

Digido Reviews

-

JayWow! You save my life Digido. Very easy and very fast approval. Thank you again Digido 🥰😍🤗😍🤗5

JayWow! You save my life Digido. Very easy and very fast approval. Thank you again Digido 🥰😍🤗😍🤗5 -

Marilyn MasaltaThis is reliable app for emergency needs with zero interest within 7days super unique and rare just to pay on time no problem at all.Thumbs up 100%5

Marilyn MasaltaThis is reliable app for emergency needs with zero interest within 7days super unique and rare just to pay on time no problem at all.Thumbs up 100%5 -

JerickThanks for fast approval of my 1st loan.. iIwill definitely recommend this to my friends and workmates.5

JerickThanks for fast approval of my 1st loan.. iIwill definitely recommend this to my friends and workmates.5 -

AllanVery nice loan app. I've using this for several times and I have no problem at all. I got loan amount increase as I pay on time and also up to 30 days payment terms. Fast cash transfer in seconds. Just pay on time guys and everything's ok🙂👍4

AllanVery nice loan app. I've using this for several times and I have no problem at all. I got loan amount increase as I pay on time and also up to 30 days payment terms. Fast cash transfer in seconds. Just pay on time guys and everything's ok🙂👍4 -

FiaGreat app. Kinda low interest. Easy to apply, Fast and no hassle. Thank you Digido.4

FiaGreat app. Kinda low interest. Easy to apply, Fast and no hassle. Thank you Digido.4